In the heart of the Bluegrass state, betting on the Kentucky Derby is more than just a gamble — it’s a tradition.

Yet, placing a wager on any other sporting event was a no-go, at least legally.

But times have changed. And investors in the right sports betting stocks are set up for significant gains.

This week, Kentucky joined the ranks of states embracing the future, legalizing sports betting and taking the tally to 36 states.

The financial impact could be dramatic – even for a modest state like Kentucky. Projections suggest the state’s sports betting handle could touch a whopping $3.2 billion annually.

Kentuckians of legal age can now place bets in person, and starting September 28, they can take their wagers online – opening up a brand-new revenue stream for an already lucrative sports betting market…

And for the companies making those mobile wagers possible.

But here’s the game-changer: This move comes just as the NFL season kicks off.

The NFL isn’t just about touchdowns and Super Bowl rings. It’s a pinnacle for sports betting. Last season alone raked in a record-breaking $60 billion in commercial gaming revenue.

The league’s nod to gambling goes beyond a savvy business move – it reflects a broader societal shift.

Recent surveys show that over 70% of Americans have tried their luck in some form of gambling in the past year.

The dice are rolling, and they’re rolling fast.

And as the landscape of consumer behavior shifts, investors need to be one step ahead.

Here’s a look at the major players in the sports betting arena…

Investor’s Playbook: Betting on the Big Players

With our hometown finally in on the action, and football season officially underway, we put together a sort of “Investor’s Playbook” on sports betting stocks for our Derby City Daily readers.

The Online Titans: DraftKings (DKNG) and FanDuel (PDYPF)

In 2023, the vast majority of all U.S. sports betting volume is done online – depending on the state, online bets make up anywhere from 70% to 90% of total wagers.

DraftKings (DKNG) and FanDuel (PDYPF) lead the pack, holding 32% and 45% of the market share, respectively.

While other players like BetMGM, Caesars Sportsbook, and Barstool Sports are in the race, they’re trailing behind.

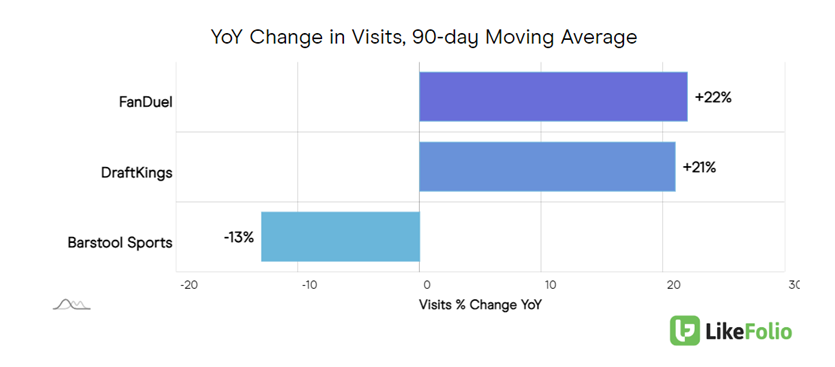

LikeFolio’s data paints an intriguing picture: DraftKings and FanDuel are in a fierce battle for web traffic, hinting at potential new users.

But with the highest Consumer Happiness level, DKNG might just be the dark horse investors are looking for.

Brick-and-Mortar Betting: PENN Entertainment (PENN) and Churchill Downs (CHDN)

While the online realm is buzzing, there’s still a charm in the old-school, in-person betting experience.

PENN Entertainment (PENN) and Churchill Downs (CHDN) offer the best of both worlds.

With a plethora of locations, from casinos to racetracks, these companies provide gamblers with a myriad of options. That omnichannel approach sets them apart from pure online players like DraftKings and FanDuel.

Even as online gaming surges, traditional gaming still holds the lion’s share of revenue. And as more states roll the dice on sports betting, companies like PENN and CHDN are poised to benefit.

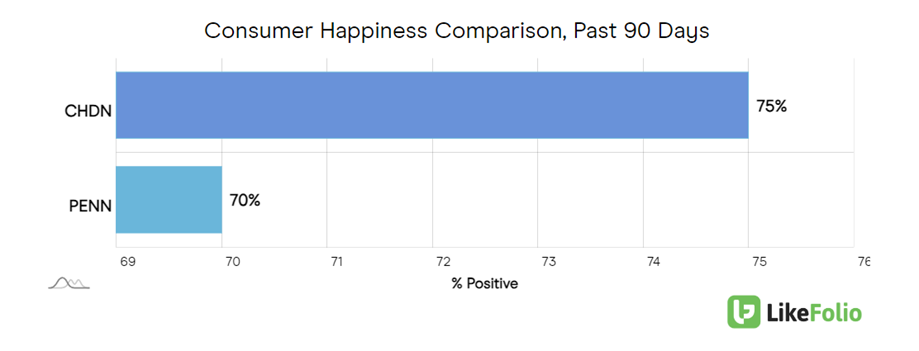

LikeFolio’s happiness stats give Churchill Downs a slight edge over PENN, making it a potential favorite for investors.

Final Whistle

The U.S. is placing its bets on sports betting. As cultural perceptions evolve and markets mature, the companies mentioned above might just hit the jackpot.

I’ve seen it before. Last June, our consumer insights machine triggered buy alerts on five gambling stocks when their Social Heat Scores flew above 70.

Four out of five of those picks have rocketed by double or triple-digits in the months since – with one zooming as much as 168%.

The thing is, only two dozen states had legalized sports betting at that time. Which means this industry is only just kicking into gear.

By 2027, we could be talking about a $14.4 billion industry – for online sports betting alone.

We’ve still got plenty of growth ahead… And the gains are only just getting started.

To learn more about how the Social Heat Score works, and how you can use it to target the best bets in sports betting stocks (and beyond), go here now.

Because the same system that flagged those winners is now targeting five under-the-radar AI stocks with even bigger upside potential.

Oh, and for our paid-up members: Keep your eyes peeled.

The next big wave in consumer demand might be closer than you think.

Until next time,

Andy Swan

Founder, LikeFolio

More Opportunities Worth Betting on from Derby City Insights

How a Winning Horse-Racing Bet Unlocked the Secret of Ten-Bagger Stocks

Find out how growing up on the racetrack ignited Andy and Landon Swan’s passion for trading – and inspired the top three stocks they’re betting on for 2023… Consider this the origin story.

This Could Be a $100 Stock in 2024 🔒

By 2027, the online sports betting industry alone could be worth $14.4 billion. But this gambling company is taking a different approach… One that could pay off big.

(LikeFolio Investor subscription required; to learn how you can join for immediate access, go here.)

3 Stocks That Could Triple This Year (Free Report)

Andy, Landon, and Megan share three companies that hit the mark on our “Trifecta” strategy so all our Derby City Daily readers have a shot at winning big this year… Full report.