“We’ve talked about 2024 as the year of monetization, and we’re delivering on that ambition,” Spotify (SPOT) CEO Daniel Ek said on the company’s last earnings call.

For consumers, that means music streaming on Spotify is about to get more expensive.

Starting next month, U.S. subscribers will see the cost of their monthly subscriptions jump from:

- $10.99 to $11.99 for Individual

- $14.99 to $16.99 for Duo

- $16.99 to $19.99 for Family

With these price hikes, Ek is looking to boost revenue and fund product innovation.

Wall Street celebrated the news, pushing Spotify shares more than 5% higher on Monday, adding to the stock’s 100%-plus rally over the past year – and sending SPOT to a new 52-week high just this morning.

We’re celebrating, too.

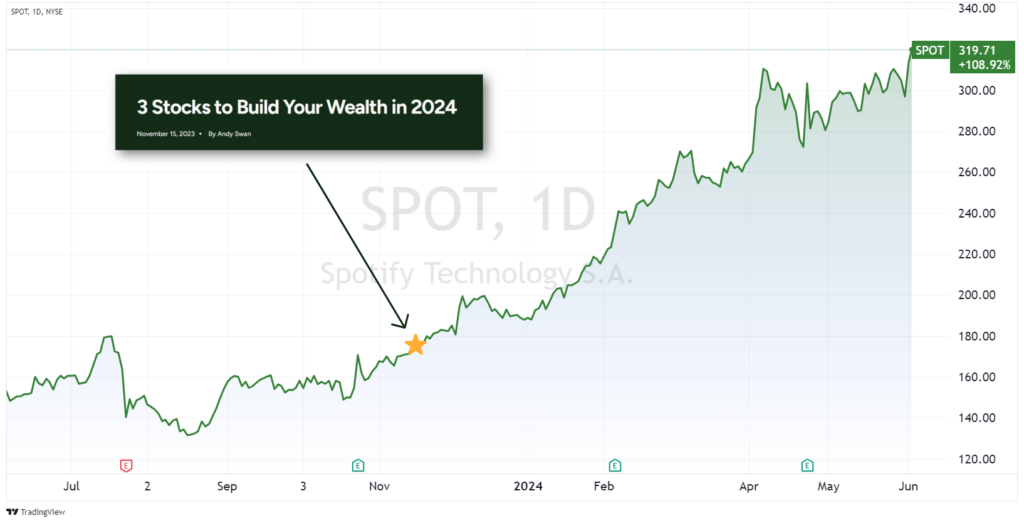

Thanks to LikeFolio’s consumer insights, you saw the profit potential budding in SPOT early on, when we named it a top stock to build your wealth in 2024 right here in Derby City Daily.

Boy, has that call paid off.

Those of you who followed that recommendation are sitting pretty right now with an +84% gain in less than seven months. Congratulations. 🎉

But this will be the second price increase consumers have had to withstand from Spotify in one year. And as we know, persistent inflation is still taking its toll on certain discretionary spend.

Could a more costly subscription put Spotify demand at risk?

Spotify Flexes Its Pricing Power

Not according to our data, which suggests Spotify has plenty of pricing power.

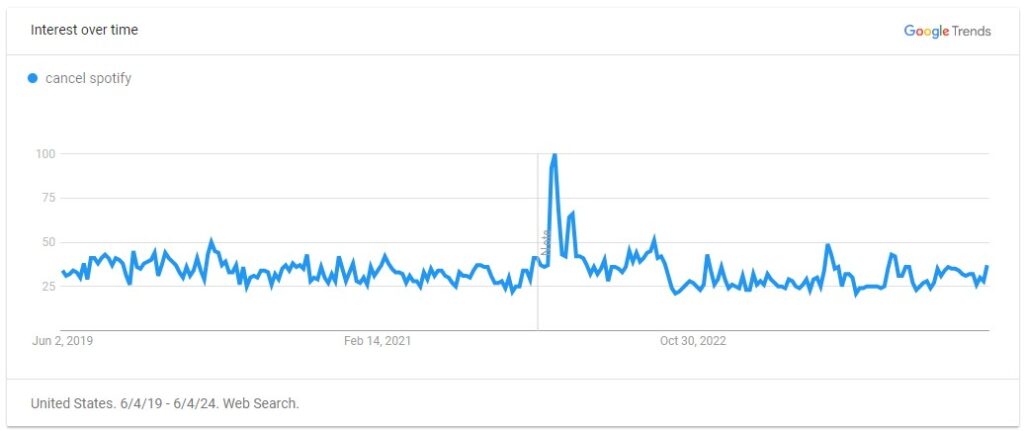

For one, “Cancel Spotify” searches are at multi-year lows right now…

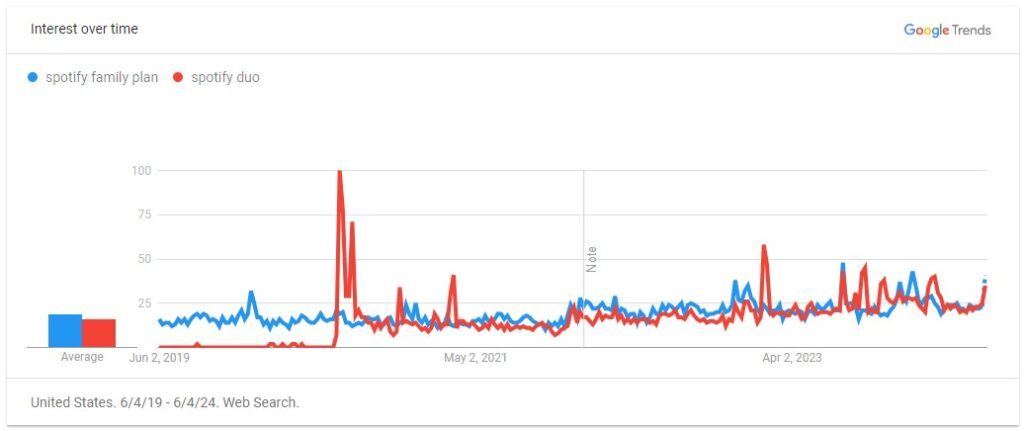

While queries for Spotify’s Family and Duo plans are on the rise:

Web visits are improving, too. Spotify U.S. traffic is down 3% year over year, moderating from a 9% decline a month ago.

And it’s easy to see why.

AI Done Right

Spotify’s ability to harness artificial intelligence (AI) into features consumers love, like its AI DJ Xavier, has been central to its success thus far. This company is keeping consumers hooked with ultra-personalized playlists and listening experiences they simply can’t find anywhere else.

The latest AI feature winning over consumers is AI Playlist, which will generate a fully customized playlist from a simple phrase. (Ask for: “A playlist that puts me in a good mood while I get ready for work” or “yacht rock for a sunset cruise.”)

It’s still in beta mode and only available to users in the U.K. and Australia so far – so this won’t have an impact on Spotify’s pricing power in the U.S. just yet. But American listeners will get their hands on it soon enough. (We can’t wait.)

We’re still in the early innings of the AI revolution, where few companies have yet to crack the code on AI-powered features consumers actually love using. Spotify is a rarity here.

As the company delivers real value with AI – and not just hype – it’s also proving it can successfully streamline operations and cut costs.

A Case Study in Cost Cutting

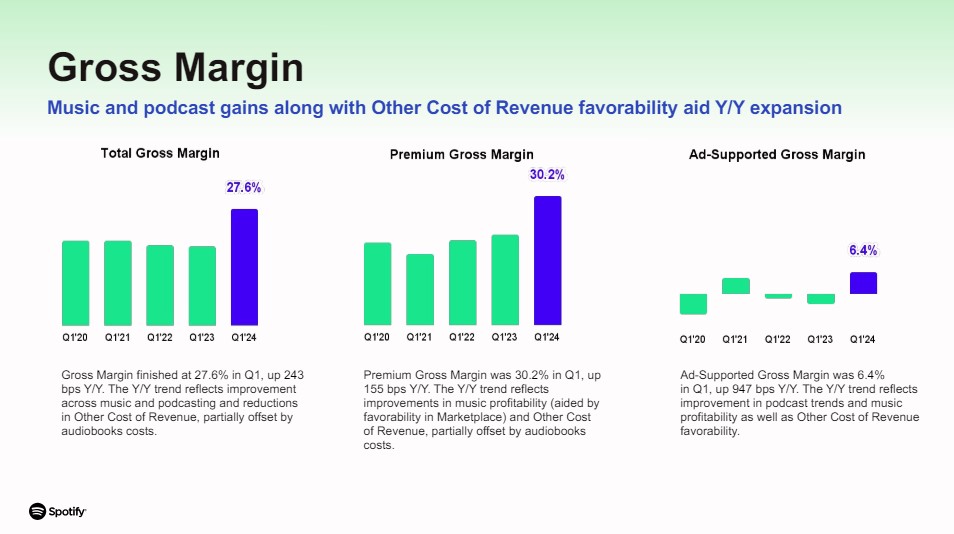

Spotify laid off more than a quarter of its workforce and scaled back its podcast ambitions despite re-signing Joe Rogan. These efforts improved profitability and margin performance.

For the first quarter, Spotify earned 97 euro cents per share, beating the expected 65 euro cents. (Remember, this company is based out of Sweden.) Revenue also exceeded estimates, reaching €3.64 billion compared to the consensus €3.61 billion.

And while monthly active users (MAUs) came in at 615 million, slightly below the 618 million expected, it didn’t matter: SPOT surged more than 10% on the report.

In the coming quarter, Spotify expects to add 16 million net new MAUs, which would bring its total tally to 631 million. The company also anticipates an improved gross margin of 28.1%, thanks to cost reductions and operational efficiencies.

What Comes Next: July

We’ve got a close eye on web visits and cancelation mentions moving forward to see if there is any fallout from these price hikes come July. If web visits continue to improve and cancelation mentions stay low, then Spotify will have a clear runway.

But there’s a much more critical situation taking shape between now and July that you need to be ready for…

The same Data Engine that revealed the Spotify opportunity has tipped us off to shocking proof that Elon Musk could change the course of the 2024 U.S. presidential election.

With direct access to 𝕏’s firehose of social data, I can show you evidence that Musk intends to avenge President Biden’s ongoing federal scrutiny into his companies and technologies as soon as July 18 – potentially even costing him the White House.

Most folks will never see this coming.

But YOU can prepare and profit from the election fallout with these five specific money moves.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

This Kentucky Derby Stock Is Worth a Bet in 2024

Here’s why Churchill Downs is set to have its best year yet. Plus: What the Trump verdict means for investors…

The Man Who Sent NVDA to $1,100 Could Sway the Election

Elon Musk’s next power play? Costing Biden re-election…