In America, consumer spending drives nearly 70% of everything that happens in our economy. And that makes consumers a powerful force when it comes to investing.

Consumer spending is like one big election, where wallet-based voting takes place each and every day. That voting separates the winners and the losers – with products and services and with the companies that sell them.

And because a product that’s a big hit can do wonders for a company’s sales, understanding where consumer interest is hot (and where it’s not) gives you an enormous edge as an investor.

At LikeFolio, we understand the singular power of the consumer better than most.

A decade ago, my brother Landon and I realized that:

- Consumers enthusiastically share the brands they purchased on social media…

- We could use that data to forecast the sales of the companies that own those brands…

- And those sales forecasts can be used to make big-profit stock picks.

We built a data engine powerful enough to capture those insights on a massive scale with direct access to the firehose of social media data being created every minute of every day – through X (formerly Twitter), Reddit, Google, and more.

We figured out how to distill those millions of datapoints into predictive metrics like Purchase Intent (demand), Consumer Happiness (sentiment), and macro trends with an advanced algorithm.

Even secured an endorsement from Georgetown University, which studied our technology and found it could “predict” future outcomes.

It’s a powerful system that works with remarkable accuracy, leading our followers to double-, triple-, heck, even quadruple-your-money winners like:

- Crocs (CROX) in 2020 for 213% gains…

- Celsius Holdings (CELH) in 2021 for a 327% profit…

- Etsy (ETSY) in 2022 for a 337% windfall…

- WW International (WW) in 2023 for a 174% return…

And today, we’ll use it to deliver YOUR next big winner with the three fresh picks we’ve identified to help build your wealth in 2024.

Each of these names hits the mark on our stock-picking strategy:

- The company is capitalizing on at least one major macro trend with a sustainable long-term growth trajectory.

- The stock has shown proven profit potential in 2023, with plenty of room to run in 2024.

- And LikeFolio data shows continued positive momentum in one or more key metrics (consumer demand, buzz, sentiment, website traffic).

An all-in-one finance app getting a boost from student loan repayments…

An online sports betting platform whose demand soars each time a new state passes legislation…

And an AI-powered music streamer winning over consumers in droves.

Meet the three stocks that could build your wealth in 2024 – and beyond…

The One-Stop Fintech “Super App”

SoFi Technologies (SOFI)

Key Points

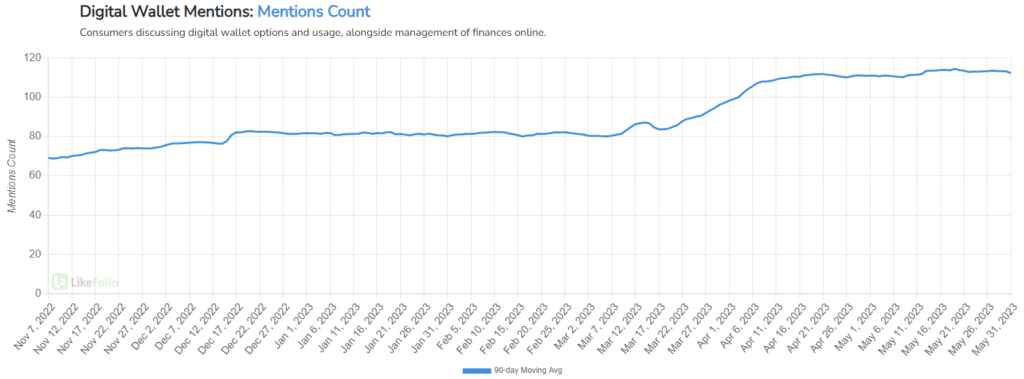

- Trend Watch: Digital Wallet Mentions +13% YoY

- Stock Performance: +61% YTD*

- Consumer Insights: 75% Consumer Happiness

*As of November 14, 2023

SoFi Technologies (SOFI) started in 2011 as a pilot loan program on a college campus.

Looking for a more affordable way to finance college educations, Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady recruited 40 Stanford University alumni to pool together a $2 million loan, which was then split between 100 students.

The pilot was a success.

By 2012, SoFi became the first company to refinance federal and private student loans…

By 2014, it launched a mortgage division.

By 2015, it was offering personal loans – and had become the first fintech company based in the United States to receive a $1 billion funding round…

And by 2020, it was celebrating 1 million members.

SoFi’s journey, while characterized by “firsts,” hasn’t been without setbacks.

The COVID-era freeze on student loan payments gutted a key segment of SoFi’s business. Quarterly revenue from its student loan unit tanked from $2.4 billion pre-pandemic to a meager $525 million in the first quarter of this year.

Its stock price was slashed by more than half.

But as history has shown, SoFi knows how to innovate… and how to evolve with the times.

Trend Watch: Mobile Banking Now a Must-Have

Mobile banking apps have become a “must-have” money management tool – especially for the younger generations. Consumer conversations around digital wallet options have spiked 13% year over year.

A recent FinTech survey confirms this trend’s staying power:

📱 69% of consumers used digital wallets for payments over the last year.

And SoFi is doing it better than most.

With a market cap of just $7 billion, the company is relatively small compared to its fintech (“financial tech”) peers: PayPal (PYPL) at $61 billion, Block (SQ) at $33 billion…

Stack it up against a more traditional banking player like American Express (AXP) with its $112 billion market cap, and SoFi looks downright tiny.

Thing is, SoFi found a unique niche that sets it apart from those larger competitors: it’s a true “one-stop” financial services “Super App” where customers can manage multiple accounts, including loans, credit cards, mortgages, and more.

The SoFi Relay mobile dashboard gives members a convenient way to view everything going on with their finances in one spot. And competitive interest rates, strong customer service, and highly accessible CEO Anthony Noto are attracting a large, loyal following.

SoFi’s all-in-one app also allows users to trade Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Polkadot (DOT), Dogecoin (DOGE), and more top cryptocurrencies 24/7.

That’s huge, considering the surging consumer interest we’re seeing in crypto and DeFi:

- DeFi Mentions +323% YoY

- Blockchain Technology Mentions +69% YoY

- Trading Crypto Mentions +42% YoY

It’s not just us noting significant growth.

According to a SoFi Investor survey, 85% of investors planned to change how they invest in 2023, with notably strong interest in crypto among younger generations.

Not only was crypto the most common non-stock investment in 2022, but the most common regret that year was not buying crypto at lower prices.

As the DeFi “mega” trend continues to gain steam, SoFi will be perfectly positioned to benefit.

Consumer Insights: Happy Customers Abound

🔑 SoFi has garnered an enthusiastic customer base with a Consumer Happiness level of over 75%.

Even as demand for competing services declined this summer, SOFI Purchase Intent mentions – consumers talking about opening a SoFi banking, lending, credit card, insurance, or investment account – remained elevated by 4% on a quarter-over-quarter basis.

Now, buzz around SoFi is up 16% year-over-year…

…while web visits are up by an impressive 63% year-over-year.

And this momentum has translated to real growth for SoFi in 2023. In the third quarter:

- Revenue soared 27% year-over-year to $531 million for a new record…

- Membership grew 47% year-over-year, bringing its total tally to 6.9 million…

- Adjusted EBITDA saw a 121% boost from the year prior to $98 million…

- And student loan originations doubled compared to the same period last year.

With the debt ceiling deal in Washington ending the three-years-and-counting freeze on student loan payments, SoFi has a clear runway to ramp up its bottom line even further.

SoFi is an exciting company – one our system flagged as a buy back in May, when shares were trading under $5. The stock has gained more than 50% since then, giving our paid-up MegaTrends members an early lead.

But strengthening LikeFolio data – and a pullback to under $8 a share – leads us to believe the SOFI profits are only just getting started.

The Online Sports Betting Titan

DraftKings (DKNG)

Key Points

- Trend Watch: Sports Betting Mentions +10% YoY

- Stock Performance: +235% YTD*

- Consumer Insights: Buzz +66% QoQ

*As of November 14, 2023

In the heart of the Bluegrass state, betting on the Kentucky Derby is more than just a gamble — it’s a tradition.

Yet placing a wager on any other sporting event was a no-go, at least legally.

But times have changed. And investors in the right sports betting stocks are set up for significant gains.

Our own Kentucky joined the ranks of states embracing the future this September when it legalized sports betting in person and online, bringing the tally to 37 states since the Supreme Court lifted the federal ban in 2018.

Even for a modest state like Kentucky, the financial impact could be dramatic. Projections suggest the state’s sports betting handle could touch a whopping $3.2 billion annually.

Nationwide, that impact is eye-popping: The gaming industry contributes $328.6 billion to the economy, according to a new study from the American Gaming Association.

And every time a new state comes online, that impact grows – opening up a brand-new revenue stream for an already lucrative sports betting market.

🎲 70% of Americans have tried their luck in some form of gambling in the past year.

The dice are rolling, and they’re rolling fast.

And for companies like DraftKings (DKNG) making those wagers possible and their investors, the profit potential could be massive…

Trend Watch: Sports Betting Legalization Catches Fire

In 2019, just 44% of sports bets were placed through regulated operators. In 2023, that number jumped to 77%, according to the American Gaming Association.

As the legalization of sports betting catches fire in the U.S., we’ve been keeping close tabs on the winners and losers, issuing a bullish MegaTrends report in June 2022 with four of the five players delivering massive wins:

- Light & Wonder (LNW): +82%

- Flutter Entertainment (PDYPF): +47%

- Churchill Downs (CHDN): +30%

- DraftKings (DKNG): +206%

- Penn Entertainment (PENN): -20%

(Want in on the next round of profits? Check this out.)

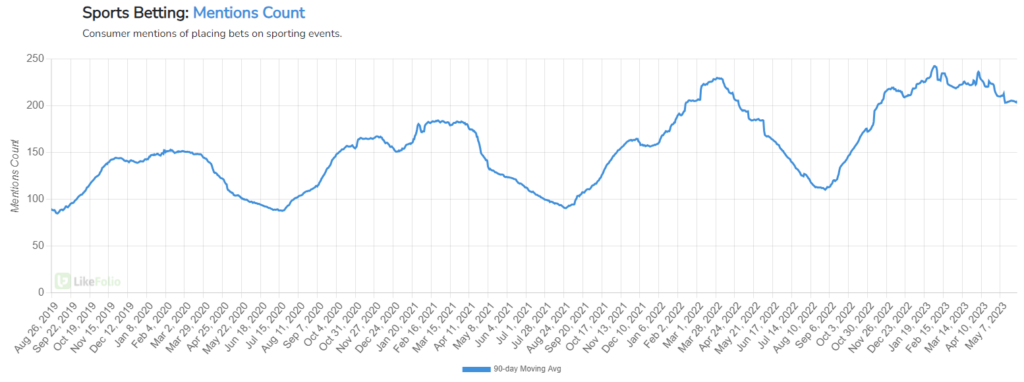

One thing we’ve noticed tracking our consumer data is that mentions of sports betting tend to reach new highs during one event in particular: The Super Bowl.

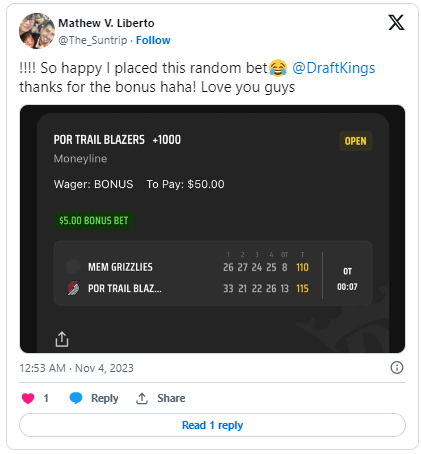

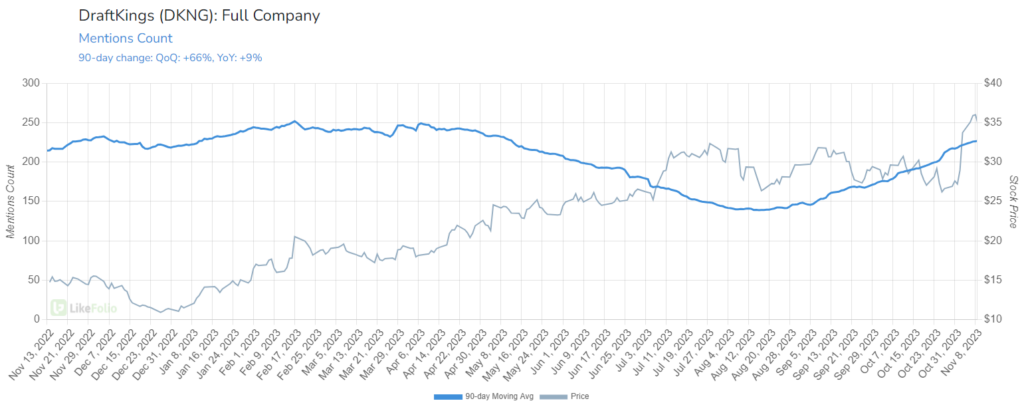

Take a look at the trend chart below, and you’ll see what we mean:

🏈 The NFL is the pinnacle for sports betting: In the 2022 season, the event raked in a record-breaking $60 billion in commercial gaming revenue.

While sports betting mentions are seasonal, the overall growth pace is still accelerating over time – pacing 10% higher year over year as of this writing.

And with each NFL season, mentions reach new all-time highs.

Online Players Dominate

These days, the vast majority of all U.S. sports betting volume is done online. Depending on the state, online bets make up anywhere from 70% to 90% of total wagers.

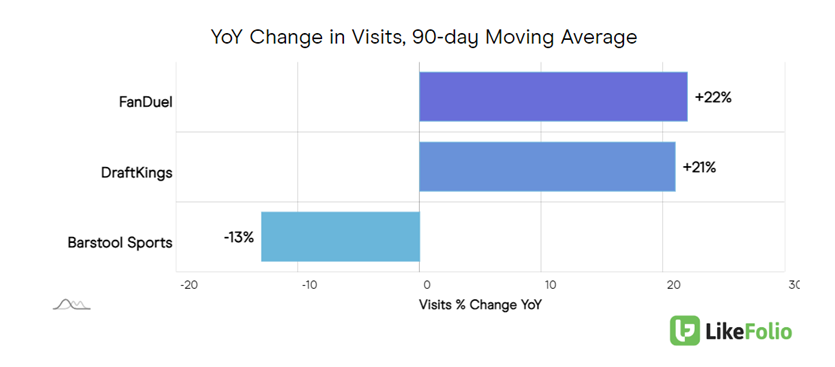

DraftKings and Flutter-owned FanDuel (PDYPF) lead the pack in the online arena, holding 32% and 45% of the market share, respectively, while other players like BetMGM, Caesars Sportsbook, and Barstool Sports trail behind.

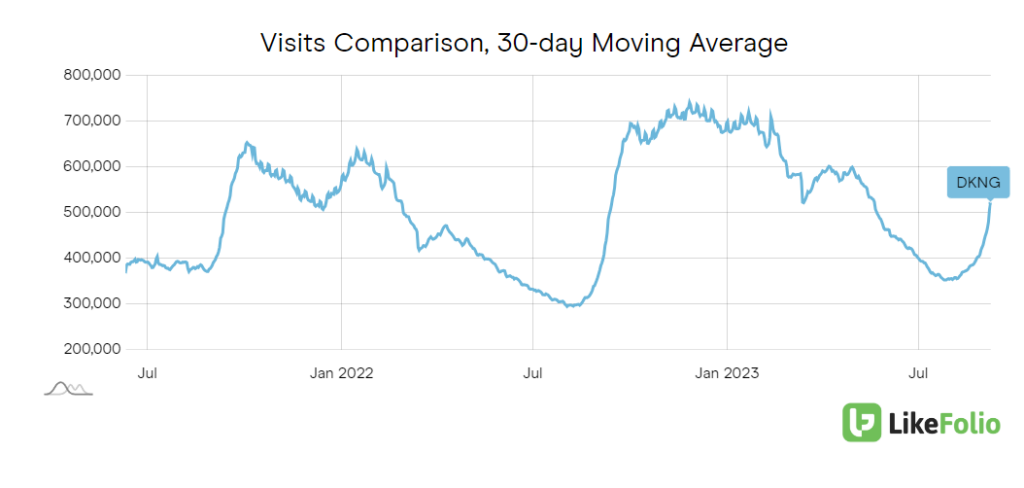

LikeFolio data shows DraftKings and FanDuel are in a fierce battle for web traffic, each growing visits by more than 20%, hinting at potential new users coming online.

💸 DraftKings saw $3.4 million in wagers during Maine’s first weekend of legal sports betting in November 2023.

With the highest Consumer Happiness level, we believe DKNG might just be the dark horse investors are looking for…

The online sports betting titan provides an integrated daily fantasy sports, sports betting, and iGaming platform where users get one account, one wallet, a centralized payment system, and responsible gaming controls.

To pregame for a historic Kentucky Derby this year, DraftKings launched its first-ever horse racing product, DK Horse, in collaboration with “OG” Derby track-turned-sports-betting company, Churchill Downs.

The standalone, DK Horse-branded app gives customers the ability to handicap races, wager, and stream videos of races all within their DK Horse account.

The partnership between DraftKings and Churchill Downs subsidiary, TwinSpires, aims to deliver an innovative, mobile customer experience, said Jason Robins, CEO and Chairman of the Board of DraftKings.

Leading up to the Kentucky Derby, we logged a 13% year-over-year increase in Purchase Intent mentions for DraftKings, proving interest in this new offering.

Consumer Insights: DraftKings Is a Fan Favorite

DraftKings buzz continues to gain traction in 2024.

🔑 DKNG mentions are up 66% on a quarter-over-quarter basis (and 9% year over year).

Thanks to LikeFolio’s X-ray view into web traffic, we also know DraftKings web visits are up by 22% year over year.

The company’s third-quarter earnings report, posted November 2, 2023, came in with stunning results:

- Monthly users (“unique players”) jumped 40% year over year to 2.3 million…

- Average revenue per user increased 14% year over year to $114…

- And revenue grew 57% year over year to $790 million.

It was a “best-case” scenario for DraftKings, leading the company to up its full-year revenue guidance from $3.46 billion to $3.54 billion to $3.67 billion to $3.72 billion, which would represent a 64% to 66% year-over-year surge.

In the rapidly growing sports betting arena, DraftKings has proven itself to be a formidable competitor.

The AI-Powered Streamer Beating Apple at Its Own Game

Spotify (SPOT)

Key Points

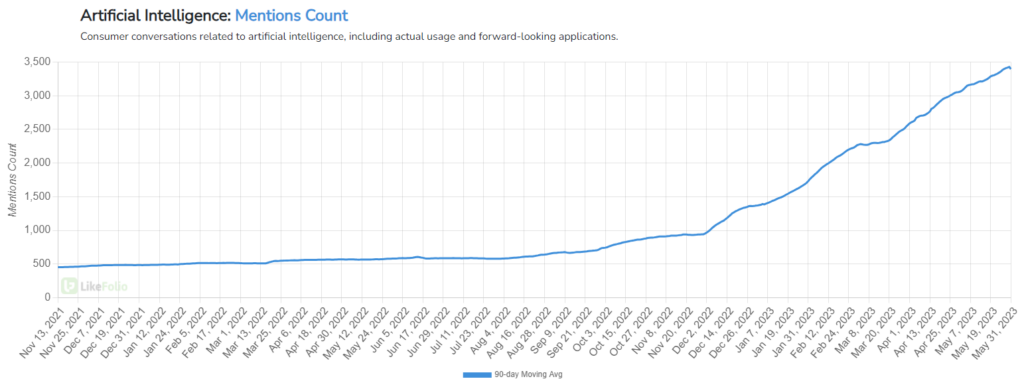

- Trend Watch: Artificial Intelligence +486% YoY

- Stock Performance: +113% YTD*

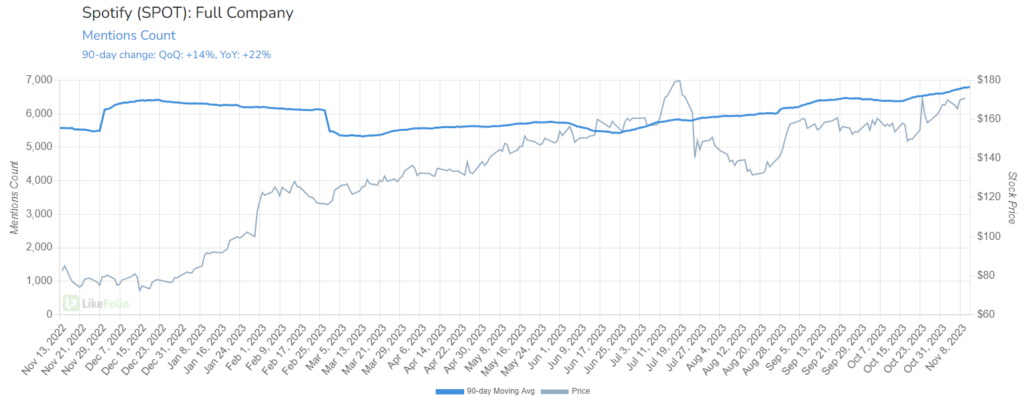

- Consumer Insights: Buzz +22% YoY

*As of November 14, 2023

Apple (AAPL) has always been ahead of the curve in the music industry, releasing its first-generation iPod 20 years ago – a heavy silver device that could fit 1,000 songs in the palm of your hand, the most of any other MP3 player on the market at that time.

Fast forward to today, and you can now access over 100 million songs through Apple Music – no bulky hardware required.

But the next evolution in music is now underway with artificial intelligence (AI).

AI is enabling algorithmically generated music, curated perfectly to sync with our moods, activities, or own playlists.

And when it comes to AI-powered listening, Spotify (SPOT) is starting to beat Apple at its own game…

Trend Watch: Harnessing the Power of AI

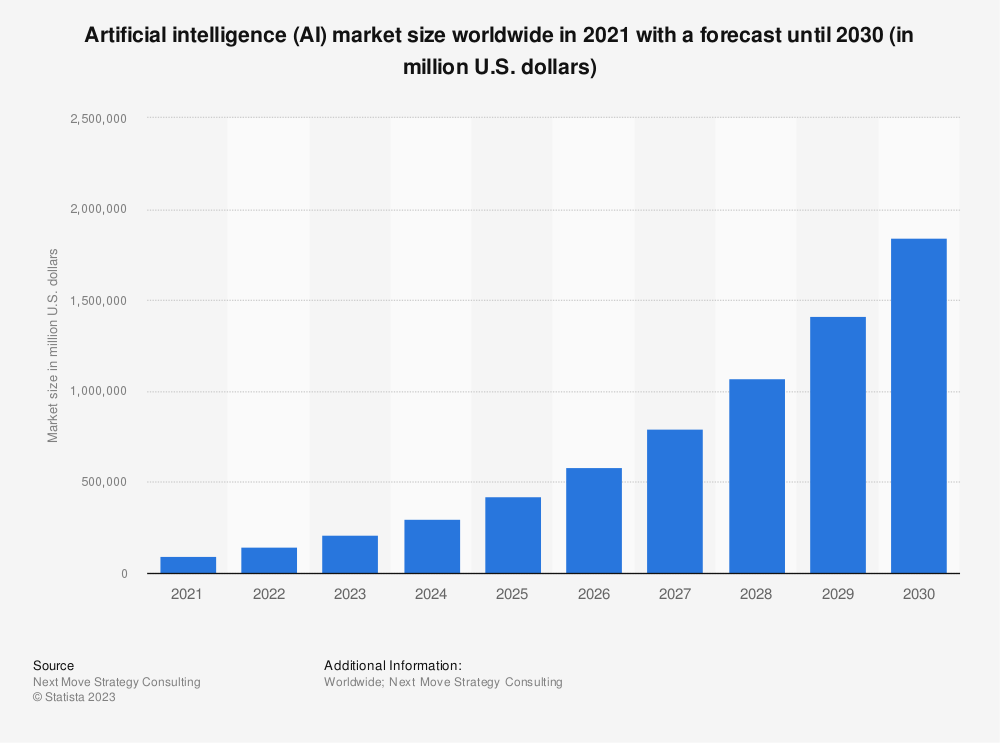

As investors, the opportunity in AI is clear as day. The global AI market is already valued at nearly $100 billion – and is expected to grow to 20x its current size, hitting $2 trillion by 2030.

And when ChatGPT made AI “real” for everyday folks at the end of 2022, global conversations around artificial intelligence started buzzing off the charts – rocketing 486% year over year.

Spotify was already ahead of the curve here with its innovative AI-powered features that are winning over consumers in droves.

- Breaking Language Barriers with AI-Powered Podcasts

With Spotify’s Voice Translation pilot, which launched in September 2023, it’s not about translating podcasts word-for-word with some robotic-sounding voiceover. It’s about the unique essence and style of the podcaster on the other end.

By collaborating with renowned podcasters and leveraging OpenAI’s voice generation tech, Spotify offers listeners a genuine experience that transcends traditional dubbing methods.

Imagine listening to your favorite podcast in Spanish, French, or German without losing the original podcaster’s unique flair.

- Revolutionizing Audio Ads with AI

Spotify wants to make it easier and more cost-effective for advertisers to leverage its platform – and pour money into its ad-supported tier bucket – with AI-generated audio ads.

CEO Daniel Ek explained it like this: “By using generative AI and our tools here… instead of having one ad, you can imagine having thousands and tested across the Spotify networks, things that you could easily do today using text but you haven’t been able to do over video or in audio.”

With the potential to produce thousands of ad variations, Spotify’s AI-driven approach could redefine audio advertising.

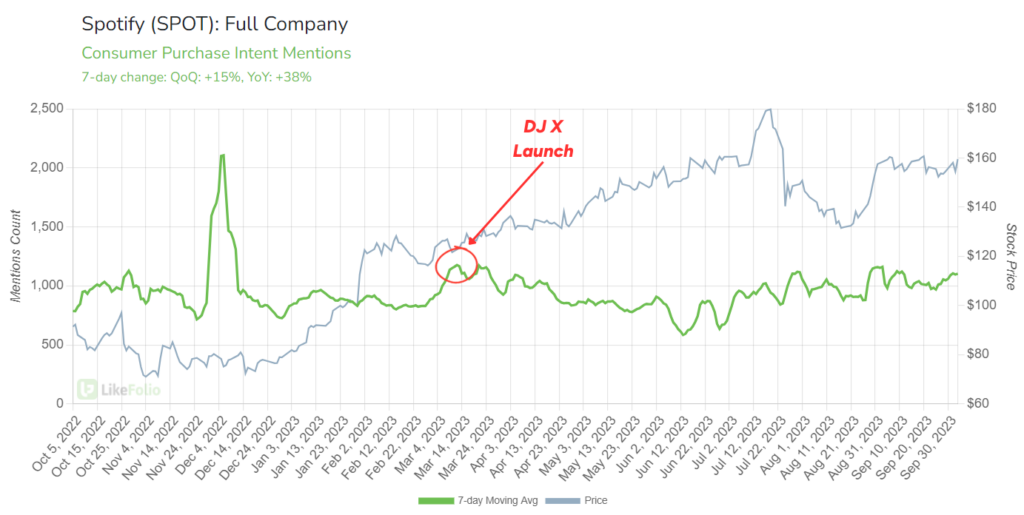

- DJ X, Your Personal AI Music Guide

Spotify’s AI-powered DJ named Xavier (or “X” for short) is an AI marvel that queues up personalized tracks tailored to your tastes, with real-sounding – and oddly insightful – voice commentary peppered in between.

When the feature first launched in late February, we saw “spotify dj” searches surge through the roof. Purchase Intent – aka consumers talking about spending real money with Spotify – spiked, too.

Users are loving it, with many dedicating a significant chunk of their listening time to this feature.

- Delivering the Future of Audiobooks with AI Narration

Demand for audiobooks is on the rise: The global audiobooks market is on track to reach $35 billion by 2030 after a decade of double-digit percentage growth.

🎧 72% of 18- to 34-year-olds listen to audiobooks, according to a new survey, citing relaxation and comfort as their top reasons.

While producing an audiobook with a human voice can take weeks and cost publishers thousands of dollars, Spotify’s text-to-speech synthesis system can deliver lifelike speech, complete with emotions and varied tones for natural-sounding audiobook narration.

AI could very well be Spotify’s ticket to dominating this market, giving competitors like Apple a run for their money.

And more folks than ever are tuning in: As of November 2023, Spotify Premium customers in the U.S. can access to over 200,000 audiobooks and 15 hours of listening per month at no additional cost.

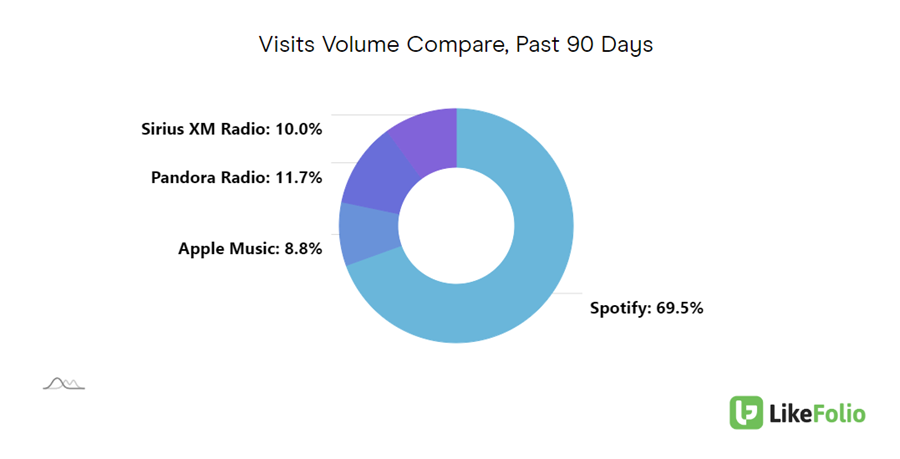

Consumer Insights: Spotify Leads the Pack

Spotify is leading the pack in the LikeFolio universe in terms of mention volume and overall levels of web traffic. Check out how it stacks up against competitors like Apple Music, Sirius XM Radio, and Pandora Radio:

🔑 Spotify handily dominates competitors with 69.5% of website volume.

And mentions continue to grow 22% on a year-over-year basis, supporting the stock’s run higher in 2023.

Spotify shares surged 10% on its third-quarter earnings report in October 2023. Among the highlights:

- Total monthly active users soared 26% year-over-year to 574 million…

- Premium subscribers grew 16% year-over-year to 226 million…

- Revenue ticked 17% higher year-over-year…

- And gross profit improved 18% year-over-year.

With its consumer-centric approach and technological advancements, we believe Spotify’s growth trajectory is just getting started. And this AI-driven innovation could be the tune that keeps its stock dancing to new highs.

The Bottom Line

In this special report, we spotlighted three stocks poised to deliver profits in 2024:

- SoFi Technologies (SOFI), the fintech “Super App” that’s already a favorite among consumers, and with student loan revenue ramping back up, this company has a clear runway for growth.

- DraftKings (DKNG), the online sports betting titan – every time a new state legalizes sports betting, it has a brand-new revenue stream to capitalize on.

- And Spotify (SPOT), the music streamer that’s cracked the code on AI-powered listening – and consumers can’t get enough.

With soaring LikeFolio metrics and a proven track record of delivering profits, these could be some of the best bets you make all year.