After a substantial chunk of failing First Republic Bank was sold to JPMorgan Chase (JPM), CEO Jamie Dimon offered reporters the sound bite that “the system is very, very sound.”

But with a birds-eye view into what people are saying on social media, our proprietary consumer insights data reveals folks on Main Street aren’t buying Dimon’s line.

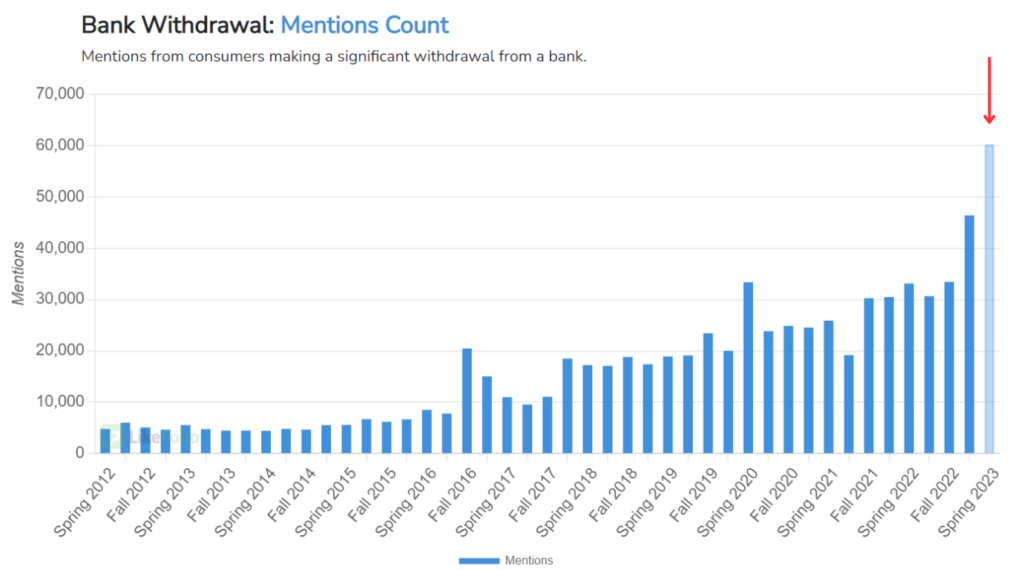

Over the past year, consumer mentions about making a significant bank withdrawal have skyrocketed 88% year-over-year and 53% quarter-over-quarter:

With three major bank failures in less than two months, it’s more of an “if” than a “when” as to when that next domino falls.

And that has folks focusing more on where their money will earn the best return and more on where that cash will stay safe…

Consumer Data Suggests Two Early Beneficiaries of the Banking Crisis

LikeFolio consumer demand data points to two early beneficiaries:

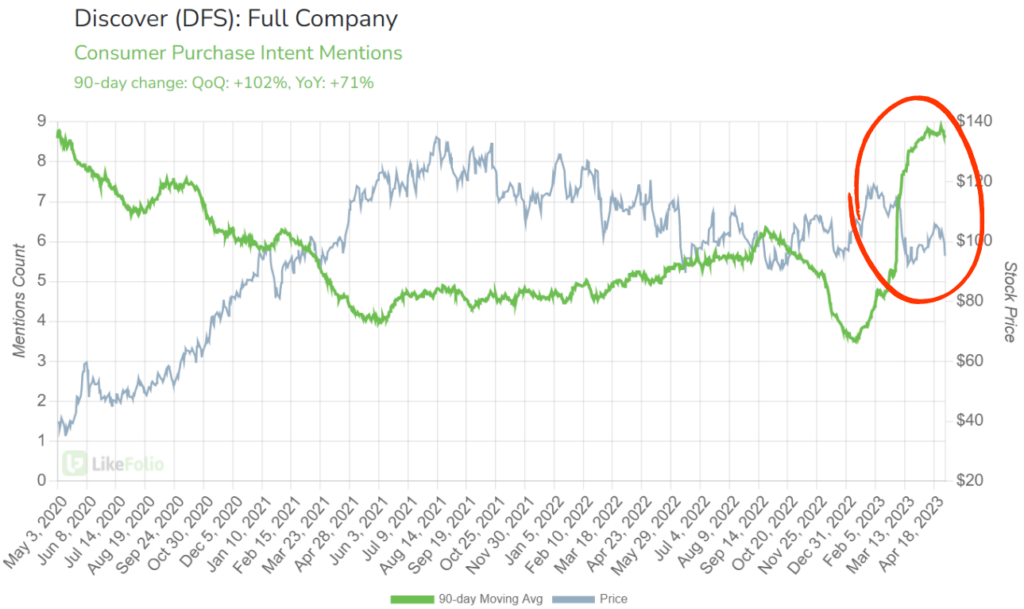

- Discover (DFS)

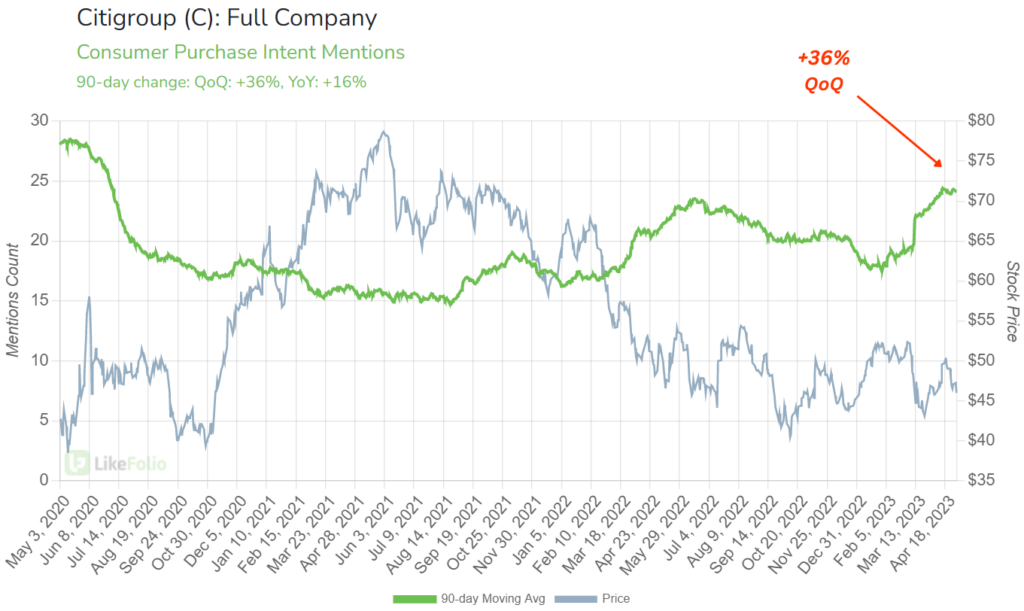

- Citigroup (C)

Our social media machine is picking up notable increases in Purchase Intent (PI) Mentions for these companies on a quarter-over-quarter basis (a shorter time horizon that’s particularly important considering the bank failures started in March).

For Discover, demand has rocketed 102%:

And Citigroup is logging a 36% increase over the same period:

From an investor perspective, both stocks have dropped this week. As I write this, Discover shares are down 8% since Monday and Citigroup shares are down 6%. But then again, the rest of the market took a similar hit amid uncertainty around the Federal Reserve’s interest rate decision.

From a consumer perspective, though, these companies are doing something right…

Let’s start with Discover.

Up until December 2022, Discover was offering a unique cash-back reward checking service, where customers earned 1% cash back on up to $3,000 in debit card purchases each month. It also has an online savings account with a 3.75% annual percentage yield (APY).

With these savings accounts, people also aren’t charged an account fee and there are no minimum balance requirements.

Plus, they are super easy to set up: You don’t need to visit a branch or other physical location – you just fill out a few forms, fund the account, and check your inbox for confirmation that the account is up and running.

Money goes where it is treated best, and earning money from your debit card purchases AND having a savings account with a 3.75% APY is attractive.

🍎 Apple (AAPL) launched its own savings account this week offering a 4.15% rate – attracting nearly $1 billion in deposits in the first four days. We’ll be keeping a close eye on our database to see how this impacts consumer demand.

Discover reported record deposit growth of 17% year-over-year for the first quarter of the year but missed on earnings-per-share (EPS) expectations due to higher operating costs from expanded marketing efforts and employee hiring.

For Citigroup, being one of the biggest global banks – with 200 million customers and operating in 160 countries – appears to be viewed as a pro for regular bank customers.

That makes sense, as folks want to feel assured that they can easily access their money and don’t have to stay up at night, worrying about their bank collapsing. And regional banks were the hardest hit.

Citigroup recently reported better-than-expected revenue for the first quarter of 2023, bringing in $21.4 billion to beat expectations of $19.99 billion.

Bottom line: Even though government and bank officials want to push the message that everything with banks is under control, we obviously can see people are not buying into that.

Folks are looking for spots to park their money with higher yields or looking for the safety of a large bank to hold their money.

Many are moving their money into another asset class entirely with cryptocurrency.

Until next time,

Andy Swan

Co-Founder