When banks started collapsing, Bitcoin (BTC) roared back from the doldrums and shot upwards of $30,000.

But everything happened so fast that I don’t think most folks fully grasped the situation.

Banks were considered risky while cryptocurrencies were a flight to safety.

You read that right.

The banking sector, which has been around since 1,800 BC, was considered risky… And people felt putting their money in a digital asset that was created less than 15 years ago was more secure.

But when you think about the reasons why, it’s not as bizarre as it first sounds.

That’s because cryptocurrencies are:

- Immune to being frozen and seized…

- Censorship resistant…

- Permissionless…

- And decentralized.

With all that in mind, it makes sense that the flaws of the banking sector placed a positive spotlight on crypto, which has correlated to an uptick in social media chatter around people trading and investing in crypto.

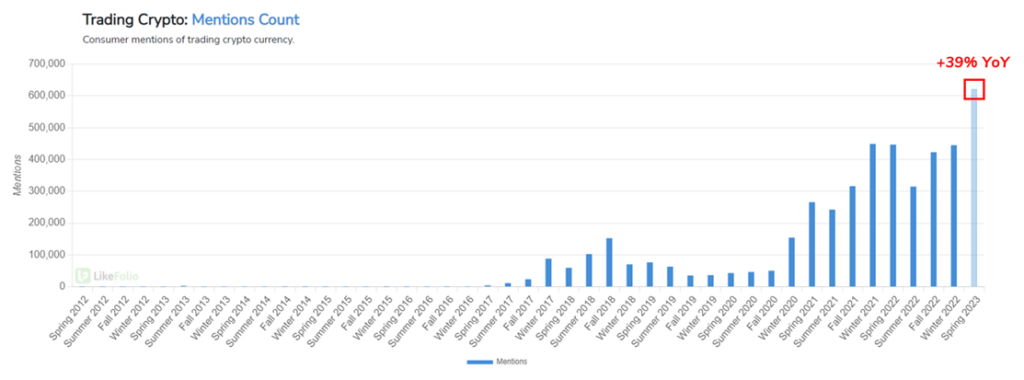

Year-over-year (YoY), mentions of trading crypto are up 39%:

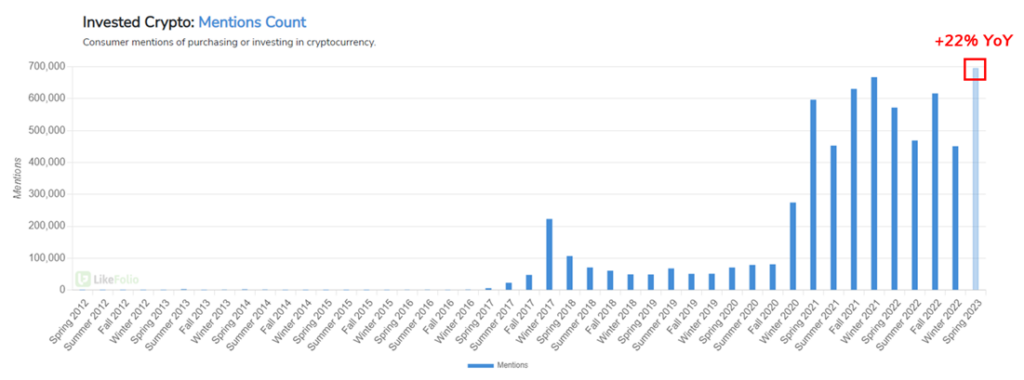

And mentions of investing in crypto are up 22%:

Here in Derby City Daily, we’ve been keeping close tabs on a surge in social media chatter around decentralized finance (DeFi).

And with cryptocurrencies and DeFi virtually inseparable, we expected that trend could quickly translate to an uptick in crypto demand – and it has.

💡 Because cryptocurrencies provide a secure and transparent way to store and transfer value without the need for a trusted third party or intermediary, they’re a natural fit for many DeFi use cases like peer-to-peer lending, decentralized exchanges, and other forms of financial transactions.

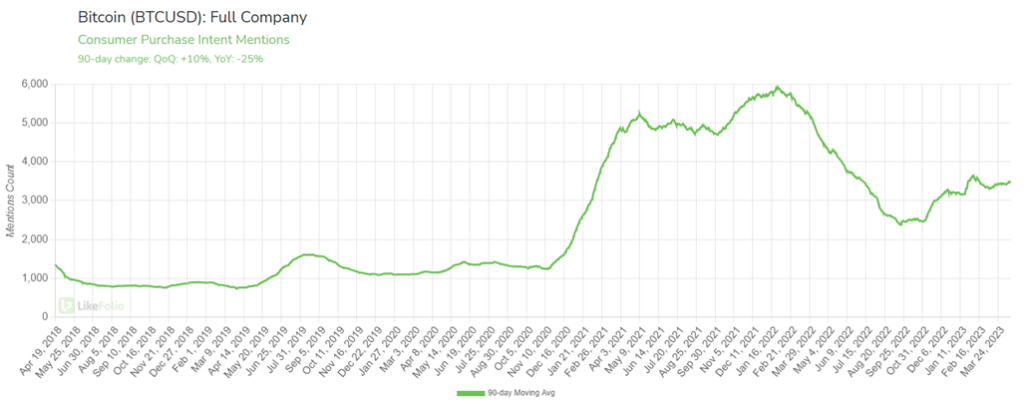

You can also see in the chart below how after cooling last summer, more people are now talking about buying or planning to buy Bitcoin, with BTC Consumer Purchase Intent (PI) Mentions increasing 10% quarter-over-quarter (QoQ):

But while Bitcoin has received most of the attention, there’s another crypto you need to put on your radar this week.

Because our real-time consumer data shows demand for this “little brother” crypto surging way past Bitcoin – and for good reason…

Ethereum (ETH) Upgrade Defies Expectations as Demand Goes Skyward

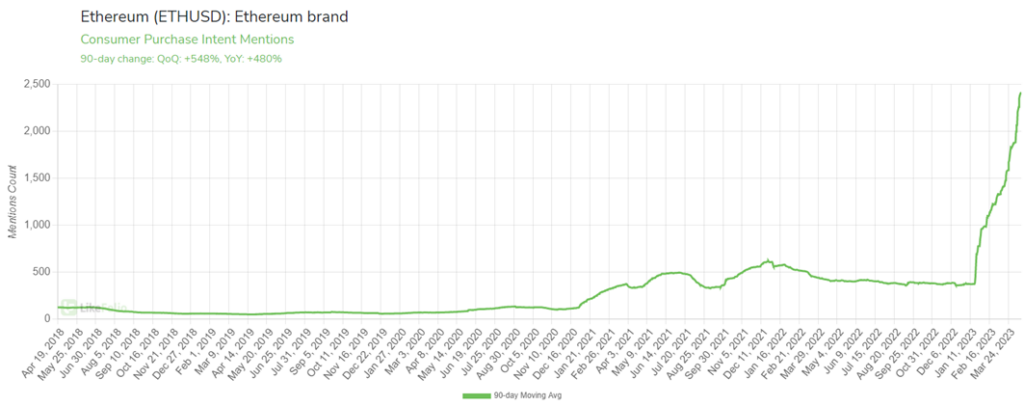

Take a look at the chart below:

Demand for the second-largest cryptocurrency by market cap, Ethereum (ETH), is blowing Bitcoin out of the water right now.

On a quarterly basis, Ethereum PI Mentions are up 548%.

And I’ll tell you why…

While Bitcoin is considered the “OG” crypto, Ethereum can be viewed as the more innovative little brother.

Ethereum allows for innovation in everything from finance to gaming, which has created a rise in NFTs (non-fungible tokens), DeFi, stablecoins, customized networks for organizations, and startup fundraising through initial coin offerings (ICOs), just to name a few examples.

There are still emerging use cases for Ethereum, which we can start to see in everything from real estate transactions to music royalties.

But concerns recently arose over Ethereum because of something called the Shapella upgrade, which is worth mentioning because many expected it to be a headwind that could send the price of ETH backward.

Ethereum’s Shapella upgrade is a complicated topic, so I’ll stick to the most important details investors need to know:

- The upgrade allowed investors to withdraw ETH that was previously locked up; some worried this would cause a flood of Ethereum to hit the market and start selling at lower prices.

- There were over 1 million Ethereum withdrawals in the first week after the upgrade; but ultimately, people started to “stake” their Ethereum more than they were withdrawing it. (You can think of staking like earning a dividend.)

- ETH staking volume reached 123,000 ETH on April 17, exceeding the withdrawal volume of 64,8000 for the first time since the upgrade.

All of this together suggests the risk of mass selling due to unlocked ETH has been mitigated.

In fact, in the days after the Shapella upgrade went live on April 12, the price of ETH soared 13% to hit $2,137 on April 16:

Despite near-term volatility in the crypto market at large, consumer sentiment is building for both Ethereum and Bitcoin.

And that bodes well for long-term investors.

Ready for more crypto coverage? Find out why crypto exchange Coinbase (COIN) is one of my favorite stocks for 2023.

Until next time,

Andy Swan

Co-Founder