Crypto became a surprising “safe haven” during the banking sector collapse of March, but the U.S. Securities and Exchange Commission (SEC) is making quick work to keep the traditional world of finance in charge.

As of this morning, the SEC has sued Coinbase (COIN) – one of the leading cryptocurrency exchanges in the world – alleging that the company was acting as an unregistered broker and exchange.

Today we charged Coinbase, Inc. with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency and for failing to register the offer and sale of its crypto asset staking-as-a-service program.https://t.co/XPG2gDkxtV pic.twitter.com/hCdVMw8B2v

— U.S. Securities and Exchange Commission (@SECGov) June 6, 2023

The move is ironic and hypocritical, to say the least.

This is a publicly-traded company we’re talking about. Its financial statements are audited by a Big Four accounting firm.

Heck, the SEC approved Coinbase’s IPO based on the same business model just two years ago.

And Coinbase CEO Brian Armstrong made sure he reiterated that argument in his response to the SEC this morning.

Regarding the SEC complaint against us today, we're proud to represent the industry in court to finally get some clarity around crypto rules.

— Brian Armstrong 🛡️ (@brian_armstrong) June 6, 2023

Remember:

1. The SEC reviewed our business and allowed us to become a public company in 2021.

2. There is no path to "come in and…

Remember: The SEC issued a notice to Coinbase back in March letting the company know some sort of action was coming.

We didn’t know what the notice said. But we knew the SEC was breathing down Coinbase’s neck.

And Armstrong has been preparing for one heck of a legal battle.

But the fact remains that this news has investors running scared: COIN shares have dropped as much as 20% since market close yesterday.

Those of you who’ve been following Derby City Daily closely know we’ve been bullish on Coinbase for a while.

Here’s where this leaves us now…

The Irony of the SEC’s Actions

The SEC’s actions against Coinbase come at a time when the traditional banking sector is under significant strain from its epic meltdown earlier this year.

Consumer trust in large institutions was already faltering: In 2022, just 27% of Americans reported having a great deal or quite a lot of confidence in banks compared to 33% in 2021 and 38% in 2020, according to Gallup poll results.

Then, Silicon Valley Bank went down in March, Signature Bank (SBNY) got dragged down with it, and all-out turmoil ensued with a wave of bank closures across the U.S.

That crisis highlighted the vulnerability of the traditional banking system, prompting crypto industry experts to advocate for decentralized financial infrastructure as a more secure and reliable alternative.

We watched as mentions of banking withdrawals skyrocketed in the last quarter. Heck, they’re still up 71% year-over-year.

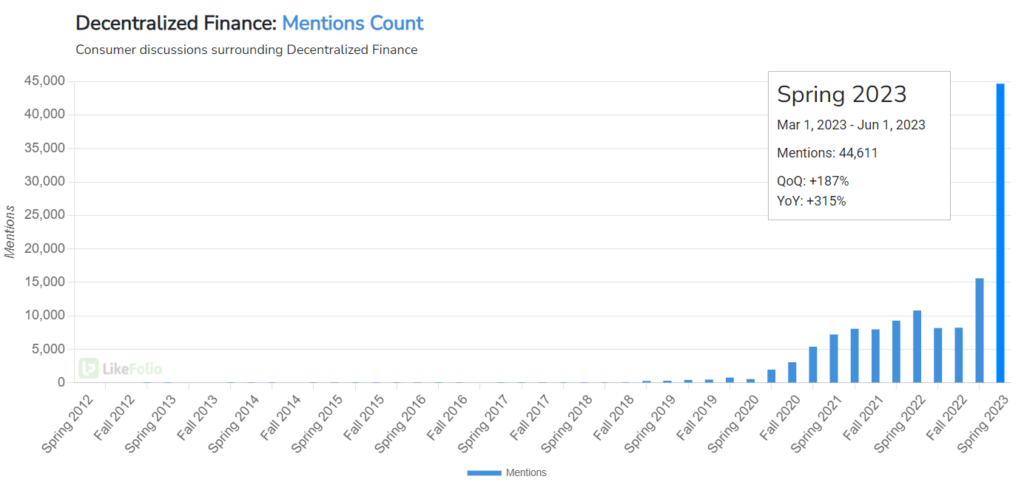

At the same time, social media chatter around decentralized finance (DeFi) shot higher, faster, as crypto became the flight to safety in a stunning role reversal.

One look at the LikeFolio chart of interest in decentralized finance underscores the growing interest in DeFi amid the failures of traditional banks.

At LikeFolio, we’ve been closely monitoring these developments in real time. Here’s what we’re seeing…

LikeFolio’s Data Insights Amid the Chaos

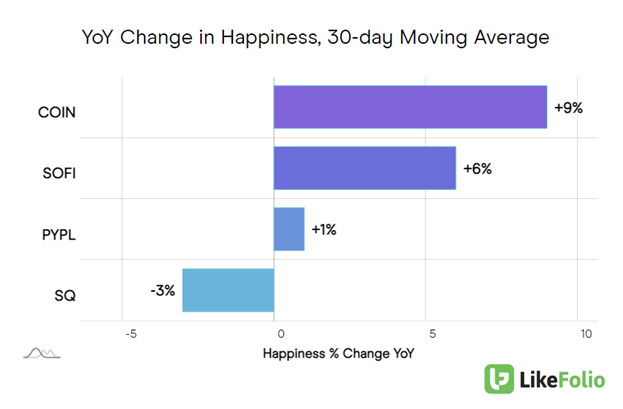

Our consumer data shows that while Coinbase demand is down – Purchase Intent mentions have slid approximately 30% year-over-year – positive sentiment around the exchange is soaring.

Coinbase Consumer Happiness levels have risen by an impressive nine points over the past year to 66% positive.

This suggests that despite the regulatory headwinds, users who are already on the platform are generally satisfied with their experience.

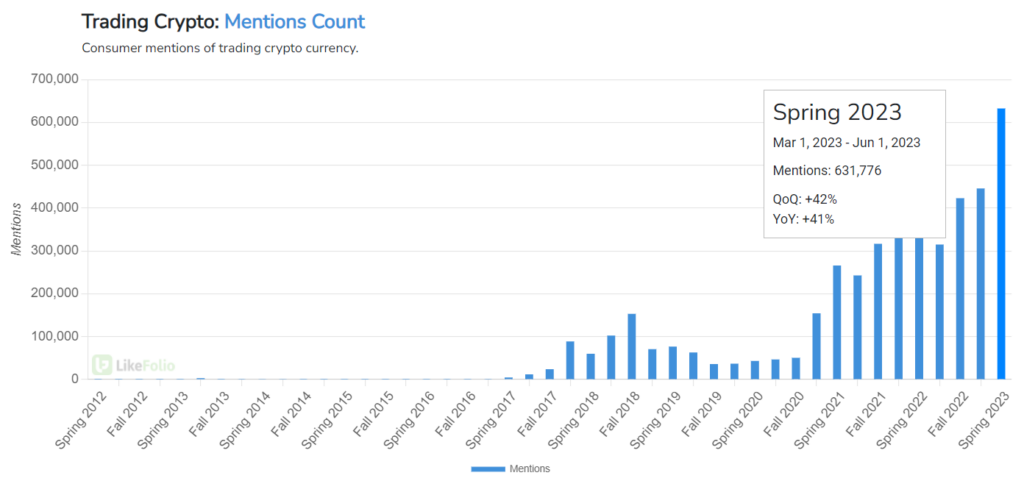

And despite a decrease in overall investment in crypto, the trend of trading cryptocurrency has increased by 41% year-over-year.

Proof that while fewer people may be entering the crypto market as new investors, those who are already involved are becoming more active in trading.

The Silver Lining: Increased Regulation Can Create Moats

While the SEC’s lawsuit against Coinbase may seem like a setback, history has shown that increased regulation can actually create moats of invulnerability for established players.

A prime example of this is Microsoft’s (MSFT) antitrust lawsuit in the late 1990s. Despite the initial pain, Microsoft emerged stronger and more dominant, partly due to the barriers to entry the lawsuit created for potential competitors.

In the case of Coinbase, the SEC’s actions could similarly create a moat.

By navigating these regulatory challenges, Coinbase could solidify its position in the market, making it harder for new entrants to compete.

Looking Ahead: A Bullish Outlook on Coinbase

Despite the current regulatory challenges, we remain bullish on Coinbase in the long term.

The company’s ability to navigate these issues, combined with the growing interest in DeFi and crypto trading, positions it well for future growth.

In these turbulent times, LikeFolio’s data and insights provide a beacon of clarity. By closely monitoring consumer sentiment and market trends, we can navigate the chaos and uncover opportunities in the rapidly evolving world of finance.

Andy Swan

Founder, LikeFolio