Monster Energy (MNST) is an “OG” of the beverage space with roots dating all the way back to 1935. It started as Hansen Natural, a small juice company run by Hubert Hansen and his three sons.

It wasn’t until 2002 that Hansen’s launched its now-namesake product, Monster Energy: a sugary, chemical-fueled energy drink wrapped in a grungy package.

Monster built a brand around appealing to folks who need concentration and an extra energy boost – like high-octane athletes, gamers, and college students.

The brand has sponsored motocross, wakeboarding, and drag racing events, as well as e-sports gaming tournaments.

Heck, even Tiger Woods has been seen sporting a Monster Energy bag.

NASCAR’s premier race series was called the Monster Energy NASCAR Cup Series from 2017 to 2019.

With all that exposure, it’s no wonder Monster Energy quickly became Hansen’s top revenue generator. By 2012, the company decided to go all-in on energy drinks by selling the rest of its business to Coca-Cola (KO) and changing its name to Monster Beverage Corp.

But even as one of the largest beverage players in the LikeFolio universe, Monster now finds itself in an unusual position as the underdog.

That’s because the company faces stiff competition from up-and-coming Celsius (CELH), a brand successfully tapping into emerging consumer trends with a healthier alternative to Monster and Red Bull’s sugary offerings.

We’ve been tracking Celsius and its meteoric rise closely, recommending several bullish entry points on the stock over the years.

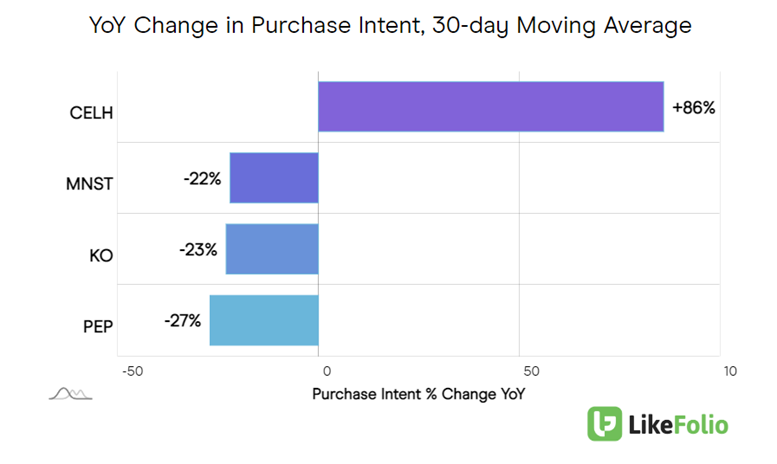

Compared to its competitors, Celsius demand is surging – up a staggering 86% year-over-year as of this writing:

Its share price is rocketing even higher: gaining 150% over the same period.

Celsius differentiated itself from the competition by leaning into consumer wellness trends, a strategy that clearly resonated with consumers and unlocked tremendous growth.

Celsius shares hit an all-time high last week.

And Monster is taking notes…

Learning from the Competition

Monster is throwing its hat in the “better-for-you” beverage ring with a fresh product lineup that includes an iconic product that won the hearts of music fans two decades ago.

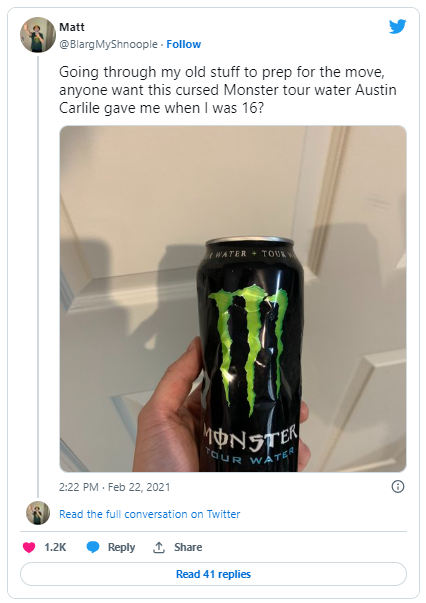

The same Monster Tour Water that was originally only available to entertainers at the 2003 Vans Warped Tour is now available to the public.

The product is just canned water that looks like a Monster Energy drink. But it became a sort of cultural flashpoint, only available at special events – and to the talent playing them.

And social media is going crazy for it.

Packaged in aluminum cans with vintage graphics, the re-release of Monster Tour Water represents more than just a nostalgic “throwback.”

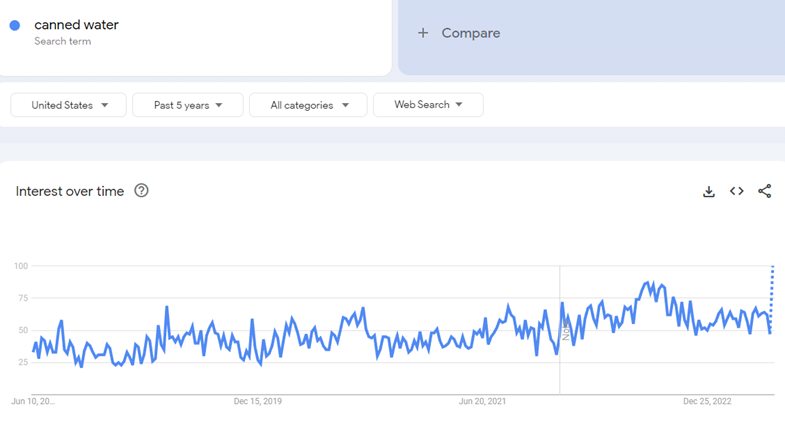

It’s a nod to the growing consumer interest in canned water as an alternative to alcohol and energy drinks – a trend that is on pace for multi-year highs.

Let me show you why this “throwback” could be just the comeback Monster needed…

Canned Water Is Having a Moment

Canned water might sound strange, but consumers are latching onto the trend for several good reasons…

- Sustainability

Aluminum cans are more environmentally friendly than plastic bottles. It appeals to environmentally conscious consumers by touting the can as “infinitely recyclable” and using 73% of recycled aluminum.

- Taste

Some consumers believe that water stored in aluminum cans tastes fresher and cleaner than water stored in plastic bottles, which can sometimes impart a plastic taste.

- Novelty and Aesthetics

The novelty of drinking water from a can, along with the often sleek and attractive design of the cans, can make the experience more enjoyable for some consumers. This is particularly true for brands that use eye-catching designs and branding, like Monster with its Warped Tour callback. The eye-catching graphics and celebrity spokespeople, like Travis Barker, don’t hurt, either.

- Health

Cans do not contain BPA, a chemical often found in plastic bottles that some research suggests may have harmful effects on health.

- Social Settings

You’ll find canned water at sporting events, concert venues, and other social settings where canned beer or soda might be consumed. Having water in a similar and attractive form can be more appealing and socially comfortable than drinking from a plastic bottle.

Beyond Sugary Energy Drinks

Monster Energy’s strategy is clear: It’s listening to consumers and opening up its product line-up beyond traditional energy drinks.

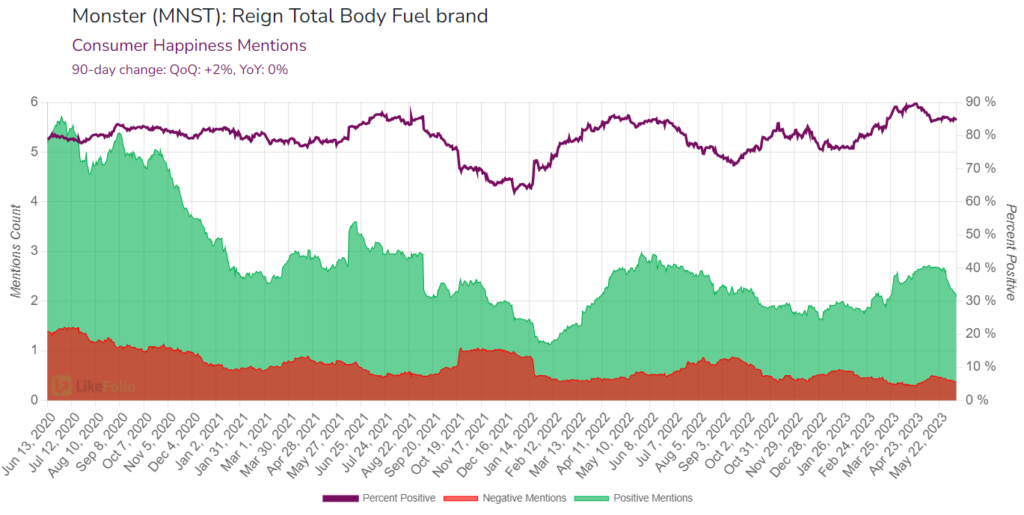

The company launched a sugar-free alternative, Monster Energy Zero Sugar, in January, along with a spin-off “total wellness energy drink” called Reign Storm (which it owns a stake in) to further cater to the wellness-focused consumer.

So far, consumers seem to love the Reign Total Body Fuel brand. Consumer Happiness levels are up 2% quarter-over-quarter to over 85%:

Looking Ahead: Is Audience Base Expansion Possible?

As it stands, Monster Energy is losing some momentum among consumers. Demand is trending lower on a year-over-year basis and the competition heating up.

Whether Monster’s new product launches and segment expansions can re-ignite audience growth and demand remains to be seen.

MNST shares are trading near all-time highs. If Monster fails to expand its base and loses market share to competitors, the stock may be getting a bit ahead of itself.

The company may also prove successful in establishing itself among a wider audience with its new beverages, propelling the stock even higher.

We’ll be tracking in real time to see which way consumers move the needle on Monster – so stay tuned…

In the meantime, be sure to check out our most recent coverage on Celsius right here.

Until next time,

Andy Swan

Founder, LikeFolio