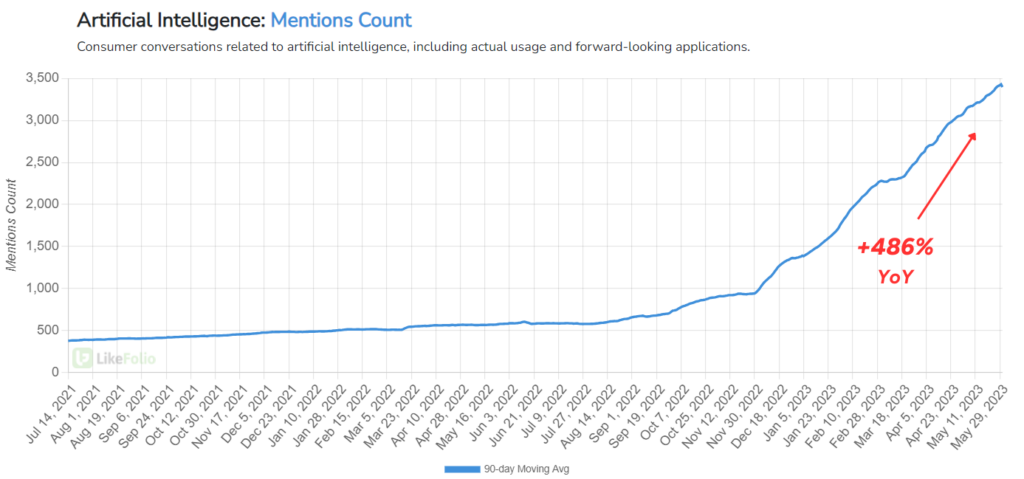

We’ve never seen a trend catch fire with consumers like artificial intelligence (AI) has in the last few months.

And that’s opened up a generational wealth opportunity.

According to our proprietary LikeFolio data, talk about AI and its potential has soared a staggering 486% year-over-year. And this drumbeat of buzz has been racing along for months.

As fast as AI has been cruising, there’s one company that’s in high gear in the express lane – and leading the pack.

I’m talking, of course, about everything-can-be-done-with-chips innovator Nvidia (NVDA).

Nvidia’s stock price has doubled since we first spotlighted the opportunity here in Derby City Daily. I hope you took full advantage.

Since the start of the year, NVDA shares have skyrocketed an incredible 209%.

A little context is needed here.

If you figure that the stock market returns an average of 10% a year, we’re talking about more than 20 years of gains, in seven months, from a single stock.

Those incredible gains were ignited by the high expectations for Nvidia’s AI prowess.

And it’s no wonder: Nvidia boosted quarterly revenue guidance by a virtually unheard-of 50% as part of its just-delivered earnings report, with a glowing statement from CEO Jensen Huang: “We are significantly increasing our supply to meet surging demand for them.”

One analyst dubbed it “guidance for the ages.”

But more recent signals are hinting that this burst of AI exuberance could be losing steam.

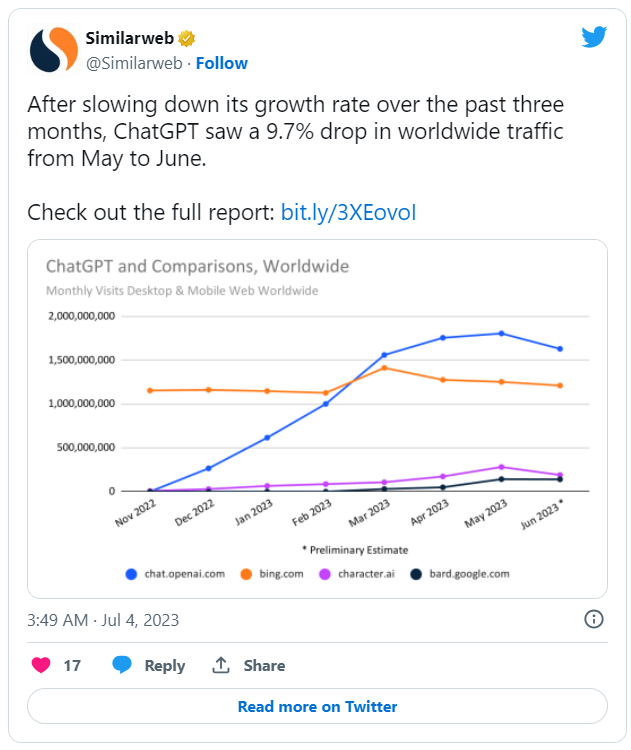

It started when, after a period of rapid popularity gain, AI giant ChatGPT saw its first-ever user decline between May and June, according to data from internet analytics firm Similarweb (SMWB).

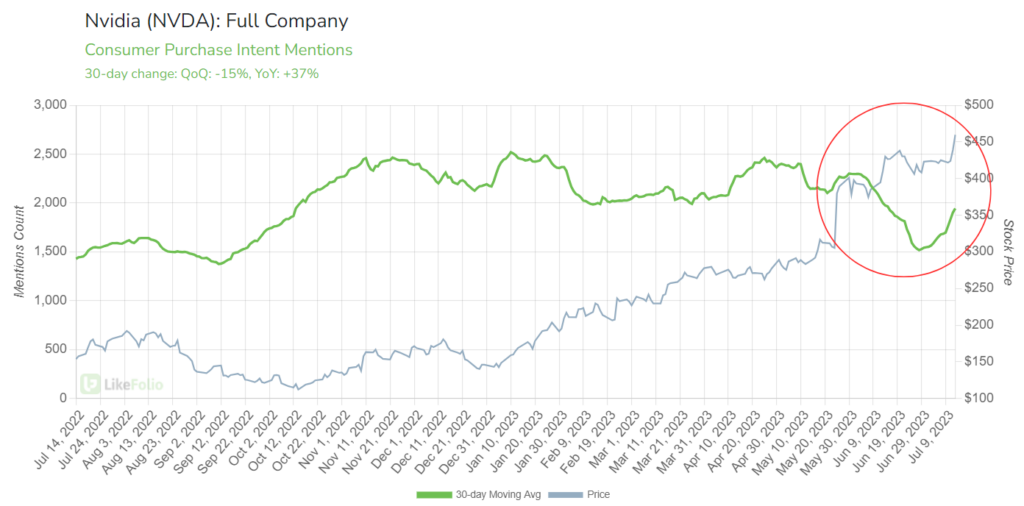

And, for Nvidia, LikeFolio data now reveals a 15% quarter-over-quarter drop in Purchase Intent mentions, our consumer-facing demand metric.

Make no mistake: The fascination with AI is still strong. And we’re long-term bulls on both the broader AI industry and NVDA.

But this recent downturn in demand may be telling us that Nvidia’s shares could be in for a near-term stumble.

In fact, we believe Nvidia’s shares could drop back as much as 15% in the short term.

That might not sound like “good” news if you’re an NVDA investor.

But trust me, it is when you’re taking a long view.

And I’ll show you why…

NVDA: Where We’re Buying

While we might witness a short-term dip in NVDA’s stock price, the long-term forecast remains robust.

Nvidia is a clear front-runner among chipmakers for AI applications, having tinkered with artificial intelligence applications for decades.

Its chips and graphics cards can already be found behind some of the world’s most profound AI tech. We’re talking scientific breakthroughs like the James Webb Space Telescope and rapid DNA sequencing, made possible by Nvidia.

It blazed the trail for GPU-accelerated computing with a novel approach where the GPU takes on many of the intricate tasks typically handled by the CPU, making everything from AI to autonomous vehicles possible.

All this has positioned Nvidia as a vital player in the AI arena, with specialized technology equipped to manage the colossal amounts of data and computations needed for machine learning and neural networks.

There’s no denying it: Nvidia is a superb long-term investment opportunity.

If anything, a pullback in NVDA’s stock price could be your gateway to investing in a leader in the AI revolution.

We love NVDA stock at $400. Heck, $350? Even better.

That’s where we’ll be buying.

The firm’s dominance in AI, its trailblazing technology, and the escalating demand for AI applications make it a robust candidate for continued growth.

Stay tuned to this space.

The long-term prospects remain incredibly promising.

And look, if you feel like you missed out on Nvidia’s meteoric rise, and you don’t want to wait around for a pullback, there are smaller players out there ready to breakout…

If you know where to look.

In fact, our system helped us spot what we believe could be one of the biggest undercover AI opportunities of the decade.

The stock has more than doubled since it first hit our radar.

But with AI tailwinds at its back, this $2 stock is only just getting started.

Until next time,

Andy Swan

Founder, LikeFolio