As the world becomes increasingly enamored with quick fixes and magic pills…

And the hot new product consumers are clamoring for are weight-loss drugs that can slim you down without all the work of diet and exercise…

Another kind of “weight-loss” stock has caught our eye – well ahead of the New Year’s resolution rush.

There’s no denying the profit potential in “magic pill” weight-loss drugs like Wegovy, Ozempic, and Mounjaro.

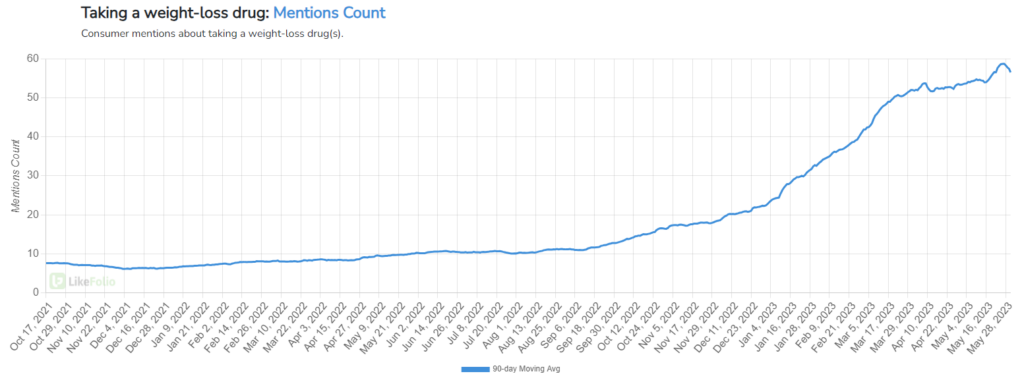

As a trend, mentions of taking a weight-loss drug have soared 464% year-over-year here in 2023, while those individual names I mentioned are seeing quadruple-digit traction.

New research from Goldman Sachs estimates that by 2030, a whopping 15 million American adults could be taking one of those weight-loss drugs. And its projected market value? $100 billion.

Here at LikeFolio, we were early to this “mega” trend with profit plays like WW International (WW) resulting in 175% gains for our LikeFolio Investor subscribers. (Want in on the next big winner? Click here.)

But we’re not about to stop there.

Not when there are so many other ways to play this weight loss “mega” trend.

Our data engine was built to keep us one step ahead of the rest of the market with real-time insights straight from the group that matters most: The consumers whose spending drives nearly 70% of everything that happens in our economy.

We’ve already got our sights set on what comes next.

And amid all the buzz surrounding and the latest weight-loss drugs, our data suggests the market is overlooking a golden opportunity with this tried-and-true “weight-loss” classic…

A Classic Fitness Play Amid Weight-Loss Drug Hype

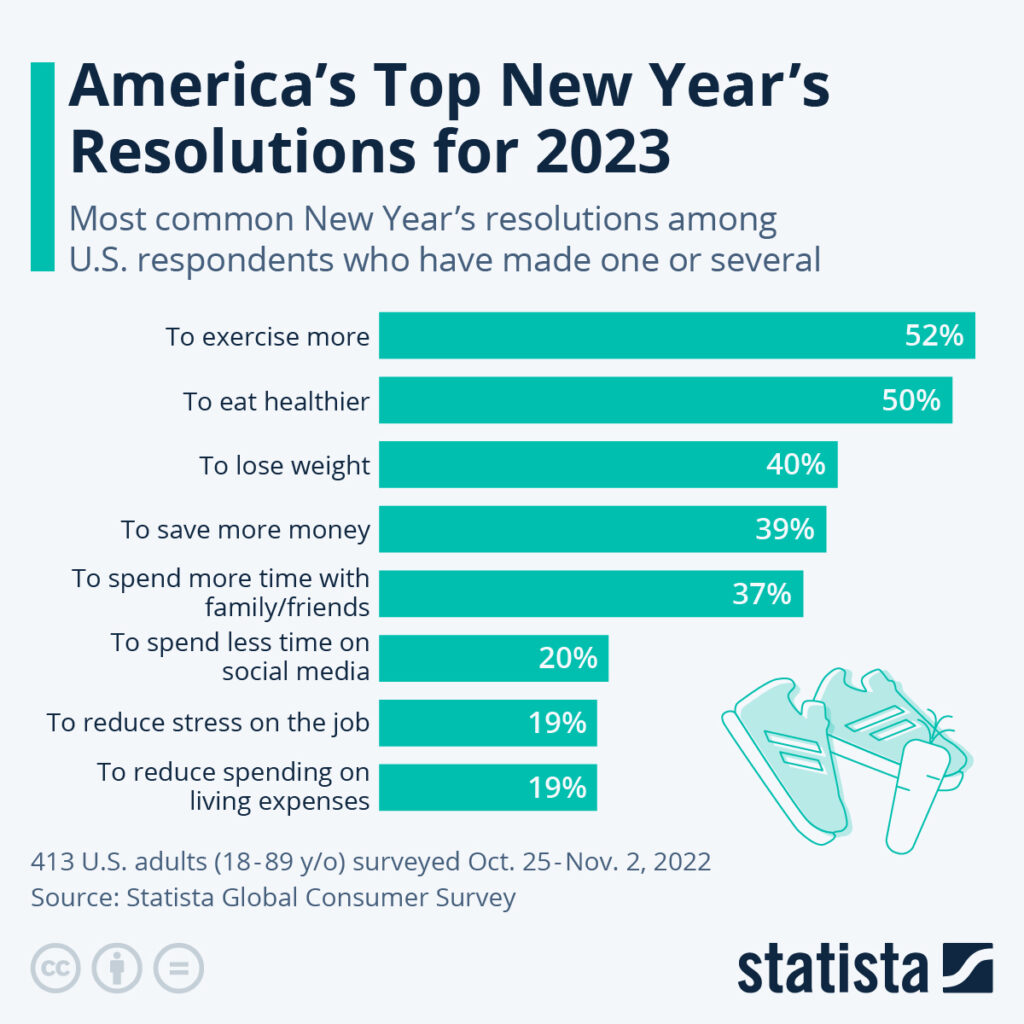

Exercising more frequently ranks at the very top of America’s New Year’s resolution list.

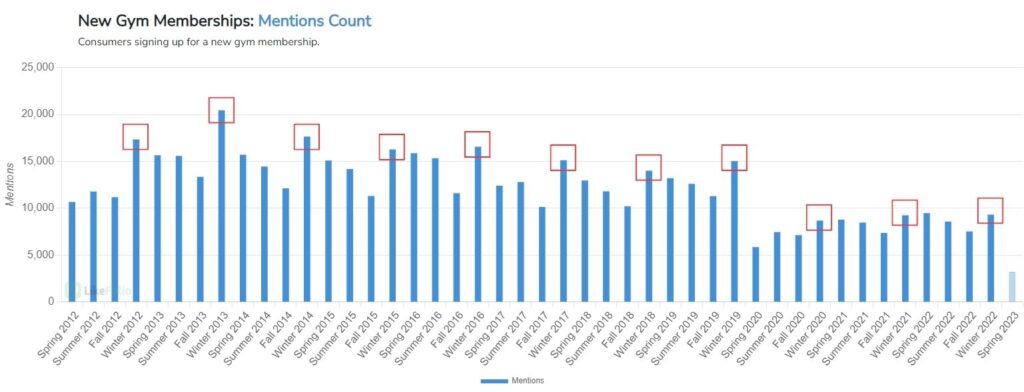

And every year, like clockwork, we see that New Year’s resolution bump play out in LikeFolio trend data as mentions of signing up for a new gym membership peak in the winter months.

Because fitness trends are highly seasonal, when we see a company defying those odds with an off-season spike in consumer momentum, we take notice.

And that’s exactly what’s happening with Planet Fitness (PLNT), the household fitness name known for its flexible, “no frills,” easy-to-cancel – and shockingly cheap – membership options.

The Muscle – and Data – Behind Planet Fitness

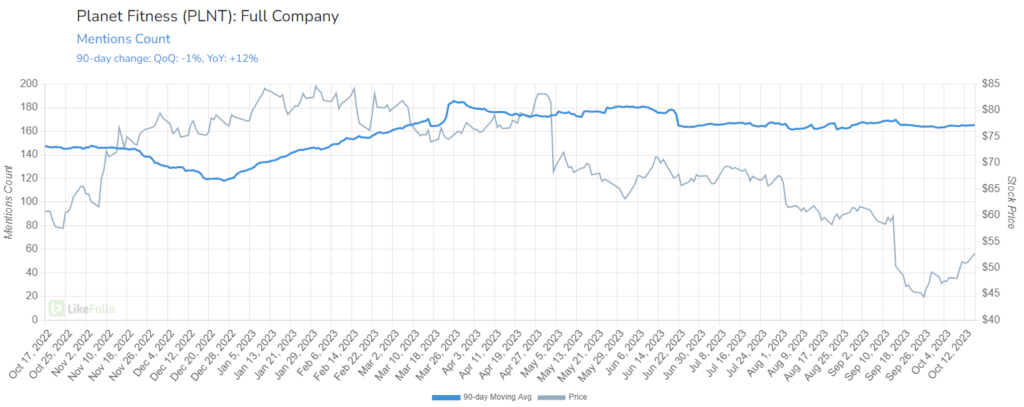

Despite not being in its peak season, Planet Fitness mentions have risen by 12% year-over-year.

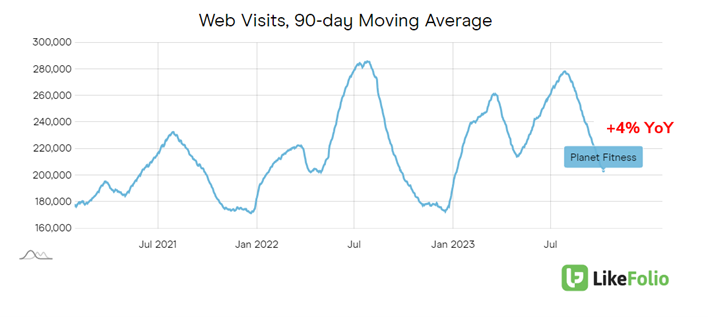

Web visits have followed suit, increasing by 4%, which is a lower off-season valley than last year.

This is a significant turnaround from a quarter ago when web traffic was trending in the opposite direction, down 7% year-over-year.

And the Consumer Happiness quotient? A stable 60% positive.

Last quarter’s performance further cements the brand’s resilience.

Revenue came in at $286.5 million, up nearly 28% from last year’s levels.

The company’s High School Summer Pass initiative – where teens can work out for free during their summer break – paid off in a Gen Z-led membership boost.

The idea is to build lifelong brand loyalty among younger generations. Nearly 3 million high schoolers signed up for the program this year.

Planet Fitness also saw 8.7% growth in same-store sales, 26 new store additions, and its eighth-straight quarter of lower year-over-year cancellation rates, proving it’s on an upward trajectory.

And its ambitious plan to invest $250 billion to tap into the vast non-gym-going population speaks to its long-term vision.

But that’s not why you’ll see Planet Fitness in the headlines today.

The Unexpected Leadership Shift

In September, the company announced the sudden departure of long-time CEO Chris Rondeau, who’d been at the helm since 2013.

The move left investors scratching their heads, and ultimately, led to a sharp decline in the company’s stock price.

PLNT shares lost 25% in value over the course of a week.

Craig Benson, former governor of New Hampshire and a seasoned member of the Planet Fitness board, is stepping in to fill the leadership void while the company hunts for a permanent CEO.

In the meantime, challenges around reduced equipment placements, rising construction costs, and the hunt for prime retail spaces are adding to the concerns.

It’s a pivotal moment in Planet Fitness’s corporate journey.

But the improving consumer metrics are hard to ignore.

Consumer Happiness, web visits, and a Gen Z membership surge are all putting muscle behind PLNT’s value, earning it a spot on our moneymaking watchlist.

Bottom line: With the stock price taking a nearly 30% hit over the past three months, we see potential brewing for those with a long-term investment horizon.

In a world chasing after the next big thing, sometimes it pays to bet on the proven classics.

We just triggered a buy alert on another one of those “proven classics” for our LikeFolio Investor subscribers amid doubling consumer demand mentions and industry-leading Consumer Happiness. And if you move quickly, you can still get in under our $90 target before its upcoming earnings catalyst. (Paid-up members: Find your latest Opportunity Alert here.)

Go here now to learn how you can get immediate access to that trade (and more).

Until next time,

Andy Swan

Founder, LikeFolio