As consumers navigate through tighter budgets and an uncertain economy, one thing’s stayed constant: their appetite for memorable experiences.

A recent FinTech study confirms a striking trend, revealing more than half of consumers (51%) still prioritize experiences over other discretionary spending.

And in this experience economy, one company reigns supreme – providing the ultimate immersive experiences in its theme parks and through its streaming services.

The Walt Disney Company (DIS) drew more than 17 million folks to its flagship Magic Kingdom in 2022 alone. Another 16.88 million visitors flocked to its “OG” Disneyland in Anaheim that same year.

It’s no wonder Disney’s experiences division is the single biggest profit driver under its expanding umbrella. The company operates seven of the top 10 most-visited amusement parks in the world.

And with CEO Bob Iger back at the helm, Disney plans to “turbocharge” its parks profit engine with another $60 billion over the next decade.

It’s a bold move aimed at offsetting the more than $11 billion in streaming losses the company has racked up since launching Disney+ in 2019.

And spoiler alert: It’s working.

As Disney celebrates its 100th anniversary, LikeFolio data suggests its stock may not stay below $100 much longer…

Disney Parks: A Profit Engine in the Experience Economy

Under Iger, Disney plans to nearly double its parks’ capital expenditure to $60 billion over the next decade. This investment will fund new attractions and expansions, including significant developments in Florida and California, despite facing political challenges in Florida.

Disney also plans to expand its cruise line capacity by adding new ships.

The parks’ segment has shown consistent growth and profitability and was a standout in Disney’s fourth-quarter earnings beat this week.

Revenue growth for its Parks, Experiences, and Products grew 13% year-over-year for the second quarter in a row to $8.16 billion.

The growth was attributed to higher volumes and guest spending, reflecting the ongoing recovery and normalization of operations post-pandemic.

The segment benefited from increased attendance, occupied room nights, and cruise ship sailings… and data suggests this is likely to continue.

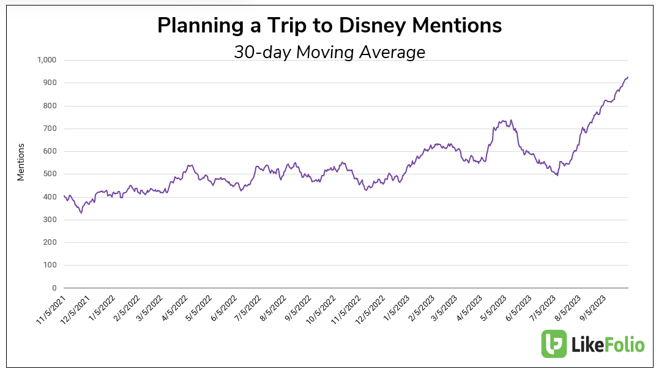

Consumer mentions of planning a trip to Walt Disney World or Disneyland have more than doubled over the past two years.

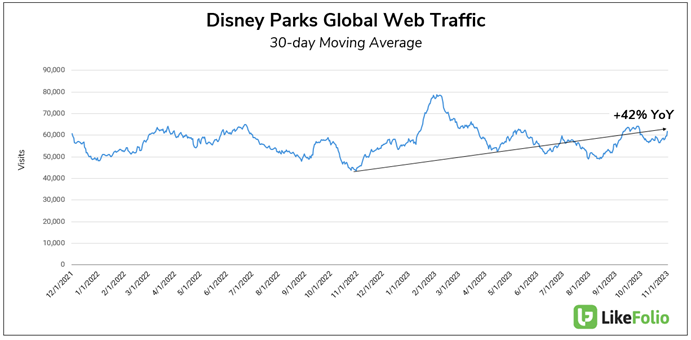

And despite rising ticket prices, the company’s vacation planning website has seen a significant 42% year-over-year uptick in visits, indicating a robust and ongoing demand for the unique joy that Disney parks provide.

Streaming Services: A Symphony of Satisfaction

Disney+ still isn’t profitable. But it’s getting back on track.

Compared to last year’s $1.5 billion loss, this quarter, Disney+ lost just $387 million. And subscribership grew more than expected, adding another 7 million for a total of 150.2 million users.

While this segment could continue to weigh on results in the near-term, we’re optimistic for the long-term.

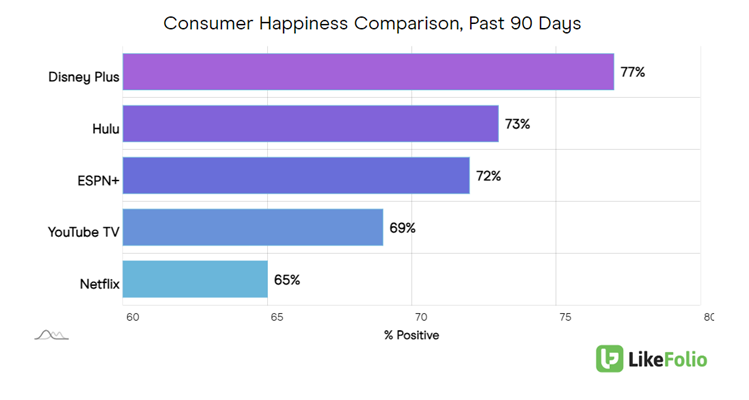

Disney’s streaming services rank notably high in Consumer Happiness, outshining peers with a comprehensive entertainment package that rivals traditional cable.

Consumers seemed to love recent releases like Haunted Mansion and are expressing excitement about new content like Goosebumps and The Marvels.

With Hulu officially under its belt as of last week, and big plans for ESPN, there’s plenty of room for growth here.

The Future of Disney’s Storytelling

Looking forward, Disney is sharpening its focus on the quality of its films and the efficiency of its streaming services.

Iger’s strategy to refine content and evaluate core services is a forward-thinking approach that aims to solidify Disney’s position as a premier entertainment provider.

With the stock trading at compelling levels, Disney’s commitment to delivering top-tier experiences makes it an attractive bet for investors who value the long-term appeal of this blue-chip company.

LikeFolio Investor subscribers got a head start on the Disney profits in October when our consumer insights machine triggered a bullish alert at $83.78 a share. The stock has gained nearly 8% in a matter of weeks – but we’re just getting started.

To find out how you can receive real-time profit alerts as soon as they’re released, watch this.

We’ve already got our sights set on the next big winner.

Until next time,

Andy Swan

Founder, LikeFolio

Up Next: Why We’re Still Thirsty for Celsius

Celsius Holdings (CELH) just reminded us why it may just be the best example of a LikeFolio All Star to date, popping more than 6% on earnings. Our consumer insights suggest there’s plenty more upside to come for this moneymaking machine…