Costco (COST) has proven time and time again that its no-frills business model appeals to both consumers and investors.

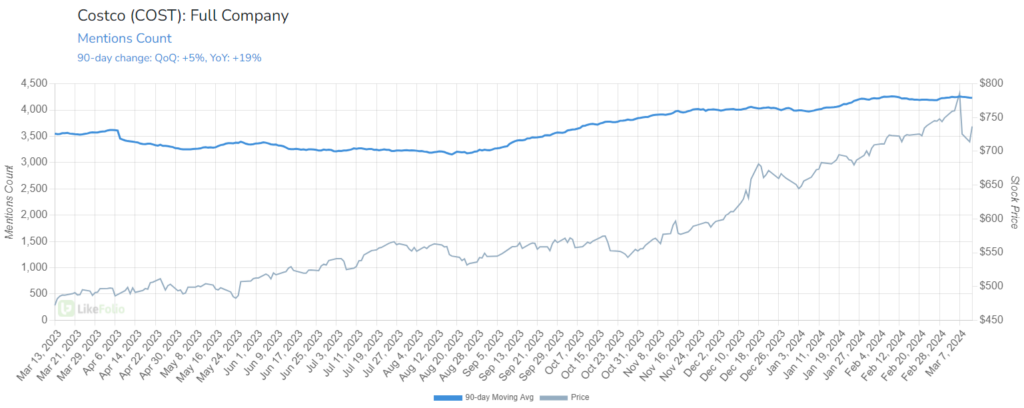

The bulk retailer, famous for its “inflation-proof” $1.50 hot dog combo and unique product offerings, is surging on LikeFolio’s consumer front:

And just last week, shares soared to new all-time highs – closing at $785.59 on March 7, 2024.

The warehouse retailer was looking stronger than ever heading into its quarterly earnings report.

But despite handily topping earnings estimates for the second quarter, recording earnings per share (EPS) of $3.92 compared to the expected $3.62, Costco just missed on revenue at $58.44 billion (+5.75% YoY). Wall Street was expecting $59.16 billion.

Shares are now down more than 6% from last week’s highs.

And the question remains whether Costco will increase membership fees as it welcomes a new CFO at the end of this week.

We’re not worried.

Costco Is Crushing It

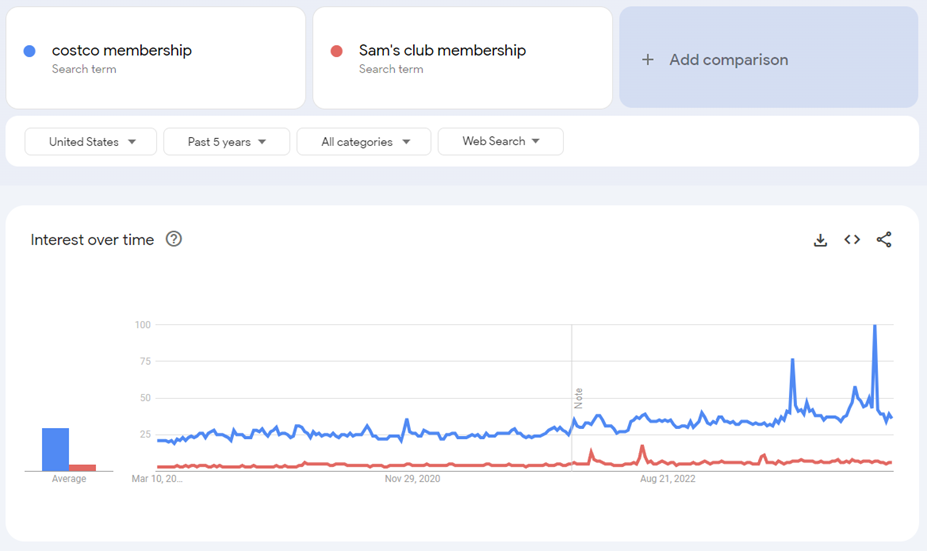

Mentions are up 19% and accelerating as Google searches for its membership power higher, easily beating its next-closest competitor, Sam’s Club (WMT).

And e-commerce is showing signs of ramping.

Despite its revenue miss last quarter, Costco logged a significant 18.4% year-over-year surge in e-commerce sales, marking a robust start to the year.

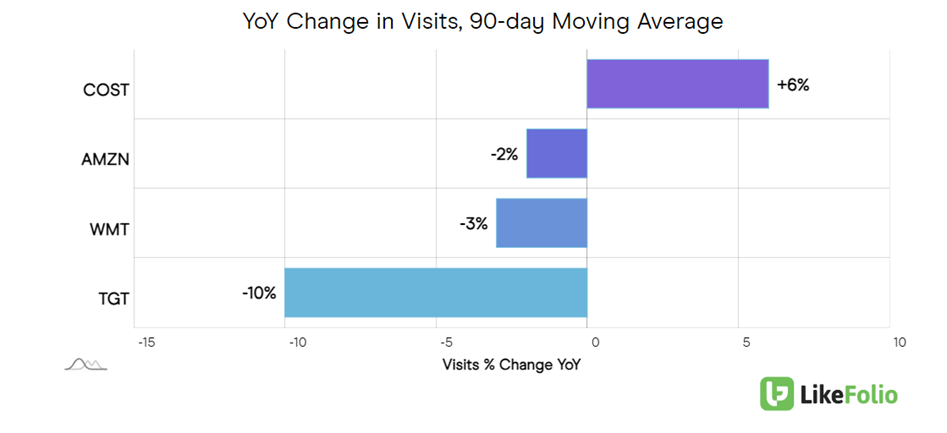

LikeFolio data confirms Costco is catching up to other retailers with more established e-commerce channels, including Amazon.com (AMZN) and Target (TGT):

Costco is a Main Street mainstay for a reason…

And it’s not just the hot dogs.

The 8 Things Costco Does Oh-So-Well

Costco provides incredible value to a growing number of consumers using some of the best tricks in the book:

No. 1: Membership Model

A pivotal aspect of Costco’s strategy is its membership model, which creates a steady revenue stream, even in the face of macroeconomic pressures like inflation. Members pay an annual fee, which significantly contributes to Costco’s operating profits. This model encourages customer loyalty and frequent shopping trips as Costco’s 130 million card-holding members seek to maximize the value of their membership.

No. 2: Cost Leadership and High-Quality Items

Costco’s core strategy revolves around offering its members high-quality goods and services at the lowest possible prices: coffee from Starbucks, or jellybeans from Jelly Belly. It does this by maintaining a cost leadership strategy while focusing on selling a limited selection of products in bulk. This approach ensures that despite low profit margins, the company benefits from high sales volumes.

No. 3: High Inventory Turnover

By focusing on a limited selection of items, Costco not only ensures high sales volumes but also fast inventory turnover. The company employs cross-docking and single-step distribution channels to efficiently move merchandise from manufacturers to warehouses, reducing inventory management costs.

No. 4: Ancillary Businesses

Costco leverages its tight-margin merchandise by offering expanded products and services, such as gas stations and pharmacies, to encourage members to spend more during their visits.

No. 5: Efficient Inventory Management and Warehouse Design

The use of warehouse-style stores serves dual purposes as both retail and storage spaces, enabling Costco to minimize storage space costs. The company’s logistics are further optimized through cross-docking, which reduces handling times and costs.

No. 6: Liberal Return Policy

Costco’s generous return policy, which allows customers to return almost anything at any time, reduces the perceived risk of making bulk purchases. This policy is integral to encouraging customers to try new products – and customer retention.

Example: Customer Jackie Nguyen returned a 3-year-old sofa recently for a full refund, simply because she “didn’t like it anymore!”

No. 7: Targeting Affluent Suburban Homeowners

Costco strategically targets relatively wealthy, college-educated customers who understand the value of buying in bulk. This demographic is more likely to have the means to purchase and store large quantities of goods.

No. 8: Marketing and Promotion Strategies

Interestingly, Costco spends very little on advertising, relying instead on word-of-mouth and the inherent value proposition of its membership model to attract and retain customers. The company’s sky-high member renewal rates (90%) are proof.

The Membership Dilemma: To Hike or Not to Hike?

Costco’s business model offers comparatively few products, each sold in only one oversized package. How does this business model work? It lowers costs that are passed on to the consumer as Costco negotiates with its vendors on huge orders. There’s no need for the company to worry about storage, as the goods are sold directly out of its warehouse-like showroom.

With perks like vision care, insurance, steep travel bargains (a $500 Southwest Airlines gift card recently retailed for $430 at Costco), discounted gift cards, and more, it would stand to reason that a membership would cost a pretty penny. But the basic consumer membership has held strong at $60 annually since 2017.

It’s the company’s bread and butter and could add significantly to the bottom line – membership fees generated a supersized $4.6 billion for Costco in 2023 alone, comprising an incredible 70% of Costco’s profits.

While a new CFO might usher in higher membership fees, that likely won’t put a dent in potential customers seeking new memberships. The perks are simply too lucrative.

Bottom line: We’re bullish on COST for the long haul – and buyers of any near-term dips. Be on the lookout for the next earnings report to see how investors react to any membership cost adjustment… that development may mark our next opportunity.

We love a “Steady Eddie” stock like Costco; MegaTrends subscribers are up a solid 42% on COST in two years – even after its post-earnings dip.

But there’s always room in our portfolio for a riskier kind of bet – a moonshot. I’m talking about the kind of stock trading for just a few bucks, but that has the potential to skyrocket.

Our system has picked up on a “moonshot” riding the hottest investing trend of the decade: artificial intelligence (AI).

At less than $2 a share, this name is still flying under Wall Street’s radar. But it won’t be for long, based on what we’re seeing at LikeFolio…

Which means you need to see this.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Tesla Is Playing the Long Game. You Should, Too.

Wall Street has turned against the EV king. Here’s how to make Tesla’s loss your gain…

Celsius Is the Winner That Keeps on Winning

Here’s why we think this quadruple-your-money winner still has gas in the tank…