Wall Street has turned against Tesla (TSLA).

Many are wondering if the company could lose money at some point in 2024.

Shares are down nearly 30% year to date.

Tesla’s Q4 earnings missed Wall Street expectations. The company projected slower automotive sales growth for 2024, leading to a significant 12% drop in its stock price – the worst single-day performance in over a year.

Despite Tesla’s ongoing efforts to ramp up production, such as the Cybertruck launch, increased costs and vague future sales guidance have analysts lowering their price targets, while concerns over future profitability and market performance abound.

That’s only been compounded by fears over tepid electric vehicle (EV) demand, strong hybrid momentum, and large dumps from fleets like Hertz (HTZ).

Adding fuel to the fire, up-and-comer Rivian (RIVN) just released its new R3 and R3X crossovers (and priced its R2 at $45,000 – when it finally hits the road in 2026).

The chorus of Tesla bears is growing louder.

But we say TSLA is playing the long game…

The Bullish Case for Tesla

- Tesla’s price cuts have wounded the competition.

Ford Motor Co. (F) appears to be taking a page from Tesla’s book, slashing the price of its Mustang Mach-E by more than $8,000 to drum up demand.

Mach-E sales dropped significantly in January. This places the cost of its vehicle around $48,000.

Tesla’s comparable vehicle, the Model Y, starts at $42,000 and qualifies for the federal tax credits that the Mach-E does not due to its reliance on Chinese suppliers.

- Tesla continues to captivate consumer interest.

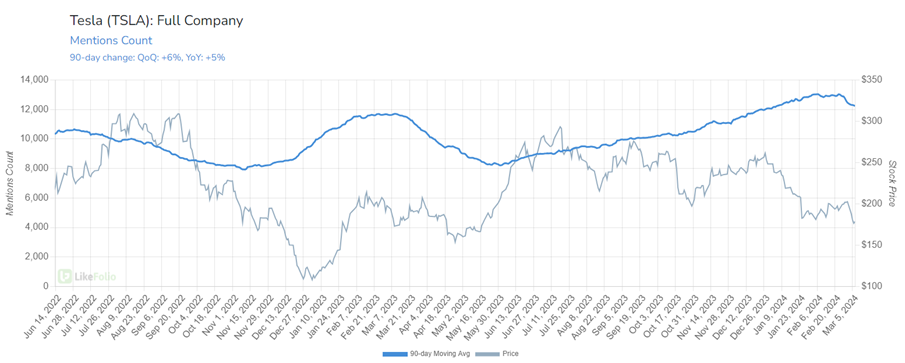

TSLA buzz is up 5% year over year, and web visits have increased at an even larger clip: +19% year over year.

This greatly contrasts with other major players like Ford with declining traffic and buzz (F mention volume is down 16% YoY, while GM is down 17%).

For TSLA, growing mentions and web visits are positive indicators of future demand, especially as Consumer Happiness levels hold steady near 60% positive.

- The Cybertuck is generating significant buzz (+266% YoY).

And tweets look positive. Check out this Cybertruck with a metallic wrap that’s out of this world:

Users are also putting the futuristic truck to the test versus other big daddies like the Chevy Silverado 2500 – and it’s not even close.

Cybertruck defeats a Chevy Silverado 2500 like it’s nothing. @tesla @cybertruck pic.twitter.com/AzX5sHTXVE

— Tesla Owners Silicon Valley (@teslaownersSV) March 8, 2024

Tesla has proven it can produce the highest-quality vehicles around when it comes to comfort and performance.

Bottom line: While EV demand may be cooling as gas prices are forced lower during election season, we actually see Tesla as the big winner when it comes to all vehicle manufacturers, not just EVs.

Seize the opportunity to pick up shares at a discount. Buy the dips.

This is one of our favorite long positions.

Some of our most lucrative wins have come from spotting “oversold” or undervalued stocks and issuing trades before they inevitably rebound and rocket higher. This is how we led our MegaTrends subscribers to:

- Meta Platforms (META) in September 2022 for under $150/share

- Coinbase (COIN) in May 2023 for under $60/share

- Nvidia (NVDA) in September 2022 for under $130/share (and again in January 2023 for just $173/share)

Needless to say, those stocks have gone on to deliver eye-watering gains – soaring 233%, 342%, and 601%, respectively. And they’re just a taste of what’s coming next.

We see what Wall Street can’t. We play the long game. And we beat the market.

Here’s how you can join us for the next big trade.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. Tesla is one of those polarizing stocks. Most folks either love it – or hate it. Which side do you stand on? Are you a fan of Tesla? Do you share our long-term vision that Tesla could be the winner of all the automakers? We’d love to hear your thoughts. Shoot us an email at [email protected]. 📧

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Celsius Is the Winner That Keeps on Winning

Here’s why we think this quadruple-your-money winner still has gas in the tank…

NVDA Who? This AI Chip Maker Could Surge in 2024

Wall Street is still underestimating this name, but we see a massive opportunity…