Between 2019 and 2023, the luxury industry thrived, growing nearly 30% during those four years, even in the face of a global pandemic and record inflation.

Retailers targeting “high-end” consumers stood resilient.

Brands like Abercrombie & Fitch (ANF) and Ralph Lauren (RL) surged back to life.

But Nike (NKE) and Lululemon (LULU) recently reported financial results that suggest bigger economic troubles could be on the horizon – not just for retail, but for the consumer in general, and perhaps even the overall economy.

Luxury Retailers Sound the Alarm

Nike’s latest report shows strong sales, especially in North America – which saw 3% sales growth to $5.07 billion for the quarter ended February 29, 2024.

But it’s not all good news.

The company is facing pressure on its profit margins, warning that revenue could shrink in the first half of FY25 – hinting at deeper issues like rising costs and economic uncertainty.

Even with a spike in demand, the struggle to maintain profitability is becoming apparent.

Lululemon, known for its high-end athletic wear, also sent a jolt through the market last week with a stark warning about falling profit margins and slowing sales in 2024.

The company otherwise delivered a strong quarter – net revenue grew 16% to $3.2 billion, comparable sales increased 12%, and gross profit was up 25% to $1.9 billion.

But now, even this retailer is feeling the pinch, facing the same challenges as others: excess stock and the need for more discounts.

“As you’ve heard from others in our industry, there has been a shift in the U.S. consumer behavior of late and we’re navigating what has been a slower start to the year in this market,” explained Calvin McDonald, CEO of Lululemon.

This shift is worrying because Lululemon has been a symbol of strength in the retail sector, catering to wealthier consumers.

LULU shares plummeted 19% from $478.84 as of market close on March 21 to a low of $387.11 on March 22, the day following the report.

The Bottom Line

These stories from Nike and Lululemon might be early signs of wider economic challenges. Both companies are staples in the retail world, and their struggles suggest that consumers across the board might be tightening their belts.

If these trends continue, we could be looking at a downturn that affects much more than just the retail sector.

Members, as always, will be the first to know when it’s time to take profits – and where the next big opportunities lie.

📊 Bonus Insight: Sizing up the Sneaker Competition

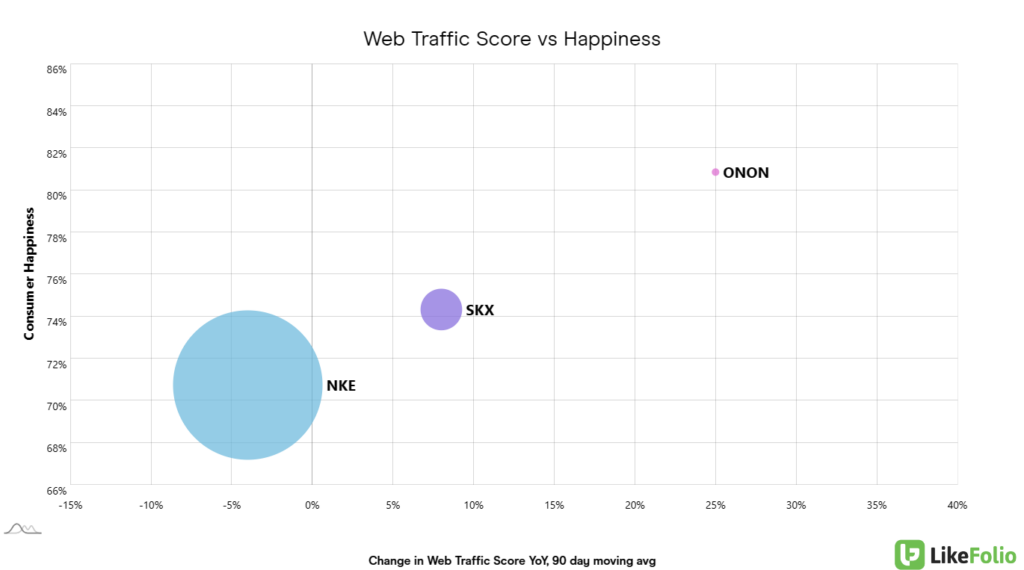

Here’s a powerful chart derived straight from the LikeFolio Data Engine: This Outlier Grid plots Consumer Happiness (higher is better) against web traffic growth (more right is more growth). Dot size represents volume of web traffic.

NKE’s dot might be the biggest, but ONON (On Holding) is the one to pay attention to here.

We love seeing small dots on the upper right corner of Outlier Grids because it means happy customers and fast demand growth from a small company – generally indicating a high-potential small-cap investment opportunity.

By the looks of it, ONON is in perfect position to steal market share.

Enjoy.

Until next time,

Andy Swan

Founder, LikeFolio

The Latest Free Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s hot this week…

4 Reasons Meta’s 400% Rally Isn’t Over

The narrative on Main Street has shifted in Meta’s favor – and paints a bullish picture from here…

What to Know About Reddit’s IPO: The Inside Scoop

Why the social media company’s public debut matters – and trading it from here…