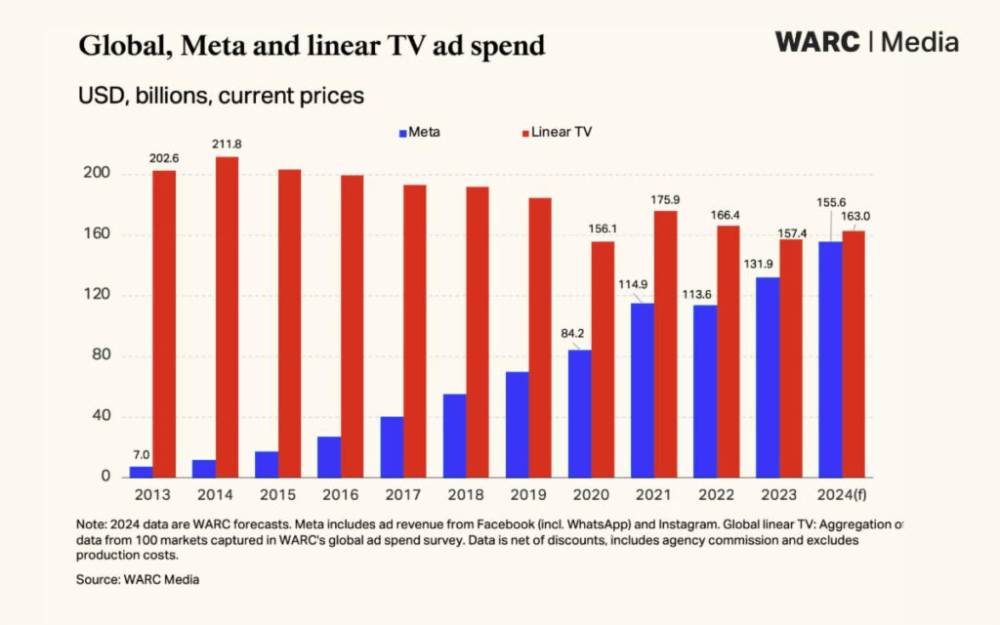

This chart is wild. Advertising spend on Meta Platforms (META) alone is about to overtake cumulative ad spend on linear TV, according to the latest analysis from WARC Media:

We’ve been pounding the table on the discrepancy in ad spend between OTT (over the top) streaming networks and linear (aka traditional) TV for years.

But other digital outlets are likely to benefit from ad dollars following eyeballs – and we’ll show you another top pick here today.

Other than META, this is the number-one platform that’s likely to benefit from shifting ad strategies…

Keep an Eye on This “Social Media” Stock

Pinterest (PINS) often gets lumped into the same social media category as META. But its social element is drastically different from Instagram, Facebook, Reels, and just about every other traditional “social media” stock out there.

A better classification would be an online ads catalogue, designed to serve up ideas – and of course, products – that consumers might be interested in.

At face value, this means Pinterest’s value proposition is very different from its largest ad dollar competitor (Meta).

It’s less intrusive.

More than half of Pinterest users view Pinterest as a place to shop. Heck, 85% of weekly U.S. “pinners” have made a purchase straight from a brand they saw on Pinterest.

And it’s gaining traction with consumers – especially the younger generations, Pinterest’s fastest-growing (and most engaged) demographic.

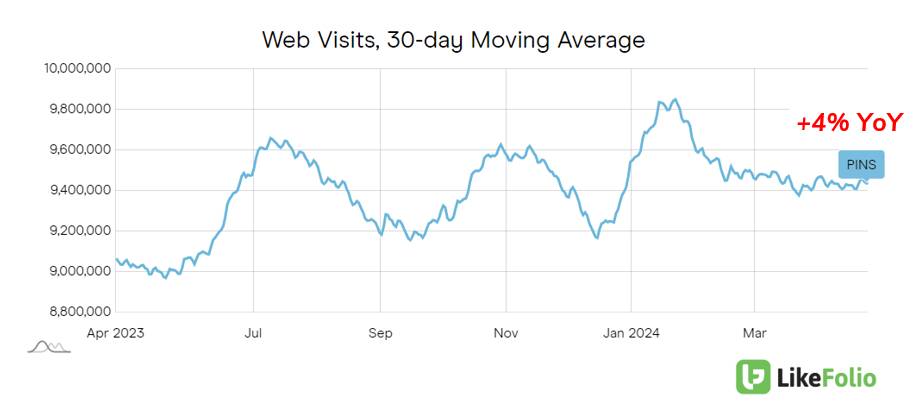

Web visits are climbing 4% year over year, which means more eyeballs hitting its shoppable posts:

And Q1 earnings proved it.

PINS shares surged following a boost in its top line: Revenue increased 23% year over year to $740 million.

Monthly active users (MAUs) saw 12% year-over-year growth, primarily fueled by international markets, where MAUs rose by 10% in Europe and 16% elsewhere. This growth outpaced the more modest 3% increase in the U.S. and Canada.

While user expansion is vital, Pinterest’s primary focus is on effectively monetizing its user base. The company made notable progress in this area during the first quarter, with average revenue per user (ARPU) rising by 11% year over year to $1.46.

Particularly noteworthy was the 19% surge in ARPU in the U.S. and Canada – the company is obviously getting a piece of the shifting ad dollars pie.

And it still has room for improvement. While ARPU in the U.S. is $6.05, ARPU in Europe is under a dollar ($0.86) and barely over a dime for the rest of the world ($0.11). If Pinterest can crank here, shares are likely to soar even higher.

The company’s strategic partnerships may help down the road.

Pinterest aims to amplify its monetization efforts by leveraging Amazon.com (AMZN) ads to enhance shoppable content and utilizing Google’s (GOOGL) expertise in international markets.

It’s also leveraging artificial intelligence (AI) to deliver hyper-personalized content with remarkable success.

“Thanks to our investments in AI and shoppability, we’re driving even greater returns for advertisers and gaining access to performance budgets,” CEO Bill Ready called out in the company’s recent Q1 earnings release.

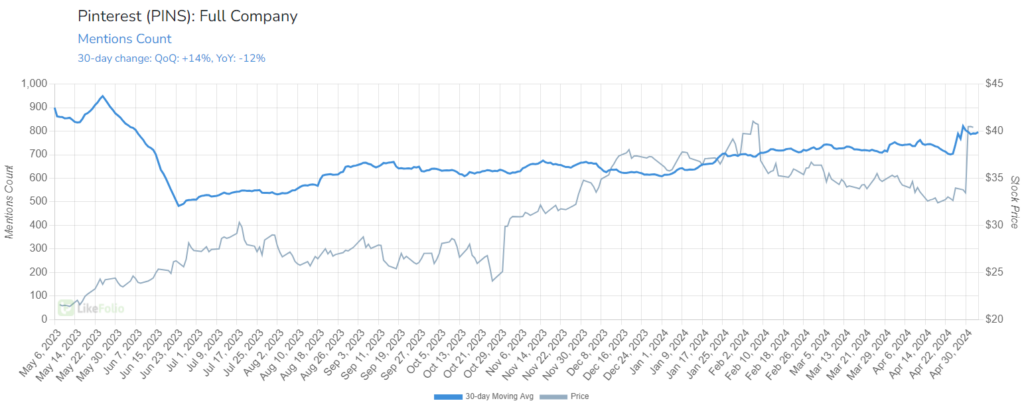

PINS has zoomed nearly 50% since we first featured this “misunderstood moneymaker” in Derby City Daily – and we still see tremendous potential for upside.

Now, if you’re looking for that next AI stock to pop, look no further than right here for a $5 AI play with outstanding profit potential. To be clear, this is a “moonshot” type of opportunity – meaning it could go to zero. But if it can execute like we think it can, it could just as easily rocket.

And sooner than you might think… Because the company I’m talking about is due to report earnings later this week. Check it out here before it’s too late.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

It’s Disney and Netflix Vs. Every Other Streamer

In the streaming wars, two tiers have emerged – and the ultimate “winner” could come down to this…

SoFi Now Faces the Ultimate Loyalty Test

Investors are split over the future of this company. Where do you stand?