MicroStrategy (MSTR) daylights as an enterprise software provider, helping users create visualizations, customize apps, and embed data analytics directly into workflows.

But make no mistake, MSTR is not your average tech stock.

It’s really a prolific investor in Bitcoin (BTC) and a visionary architect of its future.

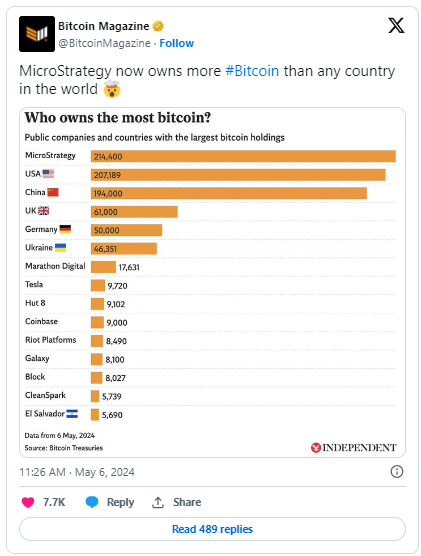

See, MicroStrategy began aggressively accumulating Bitcoin in 2020 as part of its corporate treasury reserve policy. It now owns about 1% of all bitcoins in existence, which is more than any publicly traded company or country in the world.

This strategic maneuver positions MicroStrategy as a pivotal player in the digital asset revolution.

We’re not just bullish on Bitcoin; we see it as the dawn of a new era in finance, and MicroStrategy should be on the radar for those looking to capitalize on this unprecedented opportunity.

A Leveraged Play with Unmatched Upside

Think of MicroStrategy as holding an in-the-money call option on Bitcoin.

As Bitcoin’s value climbs, the intrinsic value of MicroStrategy’s holdings could skyrocket, delivering outsized returns.

This is not merely speculative; it’s a calculated bet on a digital asset that continues to demonstrate resilience and growing acceptance among institutions and investors alike.

But MicroStrategy’s strategy goes beyond passive holding.

The company is doubling down, leveraging its capital structure to acquire more Bitcoin as prices rise.

It’s an aggressive acquisition tactic that amplifies its exposure and potential upside, mirroring a reinvestment strategy that is common in high-stakes trading but rarely seen in corporate treasury management.

Pioneering New Frontiers in the Bitcoin Ecosystem

Beyond accumulation, MicroStrategy is poised to transform its Bitcoin holdings into a broader technological venture.

The company is uniquely positioned to pivot toward becoming a technology and service provider within the Bitcoin ecosystem. This could involve:

- Blockchain Analytics

Developing tools and services that leverage its vast Bitcoin holdings to provide analytics and insights, much like how big data companies analyze consumer information.

- Financial Services for Bitcoin

Offering new financial products that could range from Bitcoin-backed loans to futures contracts or ETFs (exchange-traded funds), providing new liquidity options and leveraging its holdings to backstop these financial instruments.

- Consulting and Strategy Services

Leveraging its first-mover advantage and the extensive experience of its leadership, MicroStrategy could offer consulting services to other enterprises looking to enter the Bitcoin space or develop their cryptocurrency strategies.

The Road to Enhanced Operational Profitability

These new ventures could open up substantial revenue streams for MicroStrategy, driving both top-line growth and bottom-line profitability.

With the global financial landscape increasingly conducive to cryptocurrencies, MicroStrategy’s forward-thinking approach might just set a new standard for corporate investment and innovation in the digital age.

For investors, this means a chance to be part of a company that is not only exposed to the potential exponential growth of Bitcoin but could lead the charge in defining the business models that will harness this growth.

MSTR is perhaps the purest Bitcoin play outside of the currency itself.

But what if you could harness the profit power of crypto AND artificial intelligence (AI) in one investment? According to this Bitcoin pioneer, you absolutely can – with this $11 AI coin.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Beyond Meta: The Next Platform Winning Eyeballs – and Ad Dollars

These stocks are the most likely to benefit from ad dollars following eyeballs…

It’s Disney and Netflix Vs. Every Other Streamer

In the streaming wars, two tiers have emerged – and the ultimate “winner” could come down to this…