Running a business. Driving the kids around town. Running some errands.

If you’re like me, this is your daily Ironman.

For Norway’s Gustav Iden, the 2022 Ironman World Championship in Hawaii was the real deal. He crushed the all-time course record and ran a record 2:36:15 marathon.

A few days prior, he signed on as On Holding’s (ONON) latest superstar athlete.

The Swiss running shoe company couldn’t have scripted it any better. Iden’s victory brought instant credibility to a brand that is red-hot among avid runners worldwide.

And that victory was just the start for the Zurich-based shoemaker.

Today, ONON is giving even a giant like Nike (NKE) a run for its money. The niche, high-end brand is winning over major athletes and consumers alike with its high-quality running shoes, unique aesthetic, and Olympic-caliber performance enhancements.

Many of you reading this today have your own special connection to ONON. I know I do.

In our very first issue of Derby City Daily, on February 27, 2023, it was one of three stocks we named as the best bets you could make at the time, alongside Nvidia (NVDA) and The Trade Desk (TTD).

I’m thrilled to report that ONON has gained more than 70% since then. (NVDA and TTD have performed exceptionally well, too.)

There’s more fantastic news for ONON shareholders: With the Summer Olympics on the horizon, this “LikeFolio All-Star” has even more potential for growth…

The Athletes’ Choice

On is proving to be more than a fleeting fashion trend. Athletes aren’t just sporting the cloud-like kicks – they’re winning in them, over and over again.

In April, Hellen Obiri won the Boston Marathon for the second consecutive year, the first woman to do so in two decades, while wearing On gear from head to toe (both times). This includes a groundbreaking new footwear technology that On plans to unveil in Paris this summer – on an Olympic world stage.

The company is set to expand its market in France, opening its second Paris store ahead of the Summer Olympics and showcasing its offerings through individual athletes.

Its roster of Olympians includes Team USA Track & Field superstar Yared Nuguse, from our very own Louisville, KY, and World No. 1 Iga Świątek, competing for Switzerland and favorite to win the women’s tennis singles gold.

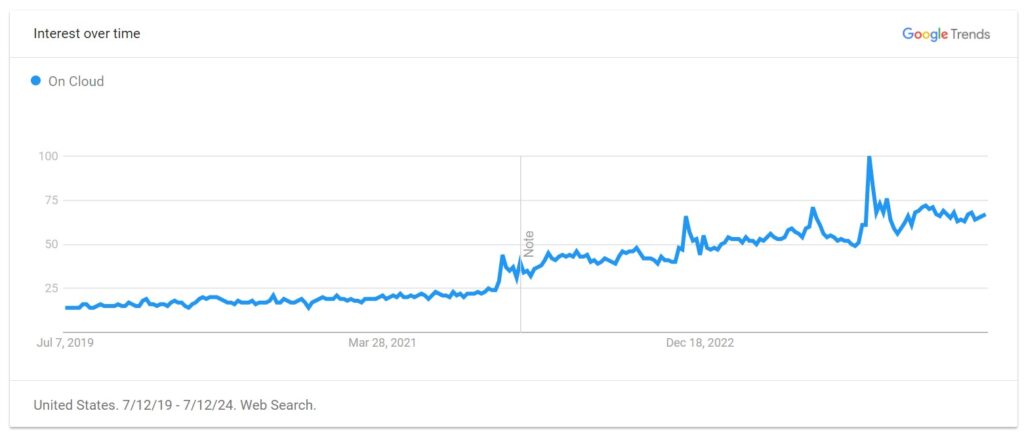

Search activity around On Cloud is already picking up significantly…

And with two in five U.S. adults expected to tune into this year’s games, which run July 26 to August 11, On’s audience is about to get a whole lot bigger.

In It for the Long Haul

It’s not just an Olympics boost that has us excited about ONON. We like this stock for the long term – namely, because the company is strategically targeting the next generation of spenders.

During its latest earnings call, On emphasized its disciplined strategy of selecting the right partners and maintaining a focused footprint, with an emphasis on performance and young consumers.

Key partners include Dick’s Sporting Goods (DKS) in the U.S. and online retailer Zalando in the Europe, Middle East, and Africa (EMEA) market.

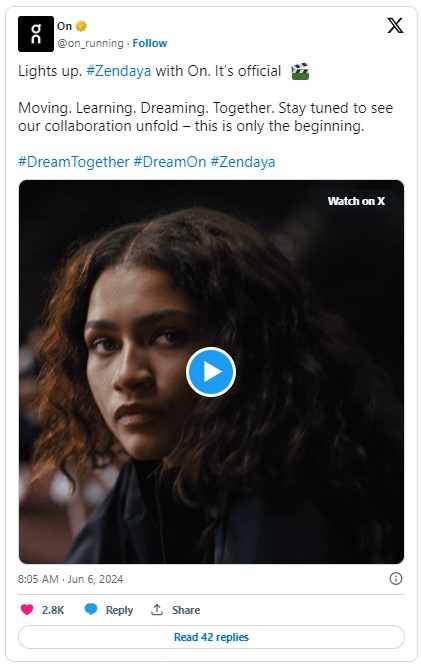

On also recently signed Gen Z darling, Zendaya, as a brand partner – a smart choice not just for her popularity with the younger crowd but for her recent blockbuster hit, Challengers, where she stars as a tennis coach.

This team-up comes as On launches its luxury apparel collection, gaining visibility through rising tennis stars like Świątek (mentioned earlier) and Ben Shelton.

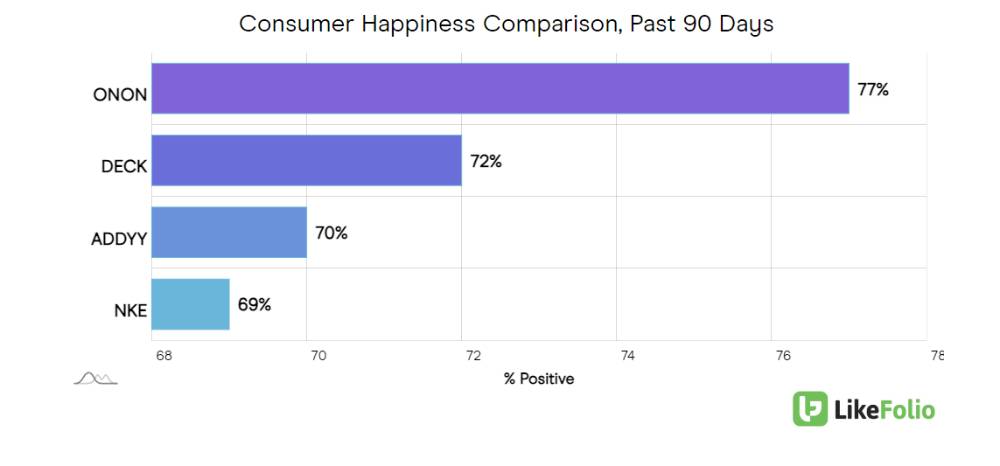

And LikeFolio data confirms that On is a top performer in the athletic footwear sector. Consumer Happiness currently stands at 77%, giving it a significant lead over competitors like NKE and Adidas (ADDYY):

What Comes Next for ONON

ONON shares skyrocketed in May following an impressive first-quarter earnings report. Earnings per share (EPS) more than doubled, revenue increased by over 20%, and direct-to-consumer sales surged nearly 40% year-over-year.

Effective inventory management and rising word-of-mouth endorsements from local running clubs are further strengthening the brand.

ONON’s next earnings report is due in August, and the stock has pulled back from its June highs. With the Olympics just days away, we believe this dip presents a prime accumulation opportunity for long-term investors to capitalize on the company’s lowered valuation and improved execution.

If you enjoyed this story, check out our recent coverage on Nike. I’ll show you how the once-dominant brand lost its “cool,” and a few more sneaker stocks to watch instead.

Until next time,

Andy Swan

Founder, LikeFolio