If I asked you what kind of company Tesla (TSLA) is, what would you say?

Is it an electric vehicle (EV) manufacturer? A car company? An artificial intelligence (AI) play?

Or something more?

Now, do me a favor and write down your answer as it stands right now. Better yet, open up a blank email to [email protected] and jot down your first thought – but don’t hit send (yet).

Because this is perhaps THE most important question investors need to ask themselves when approaching TSLA… especially after Tesla’s stock was downgraded to “Sell” on Friday.

Concerns that its Robotaxi unveiling event had been postponed from August to October sent the stock plummeting more than 8%, erasing about $100 billion in market value.

In an X post yesterday, CEO Elon Musk confirmed the delay, citing “an important design change to the front,” and explaining that the “extra time allows us to show off a few other things.”

Analysts are worried that the delay introduces “narrative risk,” potentially shaking investor confidence in Tesla’s long-term promises regarding its robotaxi future.

So today, I want to set the record straight.

Elon Musk ONLY thinks big. He wants things done right. And that kind of vision comes with a hefty payoff…

TSLA: The Big Bet on Robotics

When Musk first demoed his Tesla Bot in 2022, the project was met with the usual skepticism. But this wasn’t the “half-baked” idea critics thought at the time.

The humanoid robot is designed to handle repetitive and dangerous tasks, leveraging Tesla’s advancements in AI, neural networks, and computer vision technology. And it’s evolved by leaps and bounds in just two short years.

The latest iteration, Optimus Gen 2, debuted at the 2024 World Artificial Intelligence Conference in Shanghai. This new version features significant improvements, such as enhanced mobility, better dexterity, and faster walking capabilities. It is equipped with Tesla-designed actuators and sensors, allowing it to perform delicate tasks like picking up and boiling an egg.

We've built @Tesla_Optimus from the ground up – and it's already being tested in our factories pic.twitter.com/TDWZXeM74W

— Tesla (@Tesla) June 13, 2024

Optimus isn’t just some side project. Real-use cases are already being tested.

One of those uses is deploying Optimus robots in Tesla’s Gigafactories to assemble vehicles and batteries with precision and speed, allowing the company to increase production rates and lowering costs.

Tesla plans to start integrating these robots into its manufacturing processes by the end of 2024, with broader commercial availability targeted for 2025.

Musk has emphasized that Optimus has the potential to be a major revenue driver for Tesla, envisioning widespread adoption in both industrial settings and personal use. He predicts the demand for Optimus could be in the range of 10 to 20 billion units, potentially transforming Tesla into a multitrillion-dollar company.

The takeaway: Tesla’s venture into automation and robotics is a key part of its long-term strategy, with the potential to revolutionize entire industries and redefine the nature of work as we know it.

So, back to my earlier question…

Do you see Tesla as merely a car company? Or do you see it as a major disruptor in AI and robotics, like we do?

I’d love to hear what you think. Hit send on that email to [email protected] with your verdict.

TSLA: Here and Now

Now, many folks question whether projects like these are splitting Tesla’s focus away from its core competency: EVs.

But Musk is laser focused on making Tesla vehicles more accessible to the masses. And despite some speedbumps, that plan is on course.

In the second quarter, Tesla produced 410,831 vehicles and delivered 443,956 – a smaller-than-expected 5% decline as price cuts and incentives helped counteract cooling demand.

The company recently re-launched the rear-wheel drive variant of its Model 3 long-range vehicle, priced at $42,490, which is $5,000 less than the all-wheel drive version.

So it’s still making progress with more affordable models.

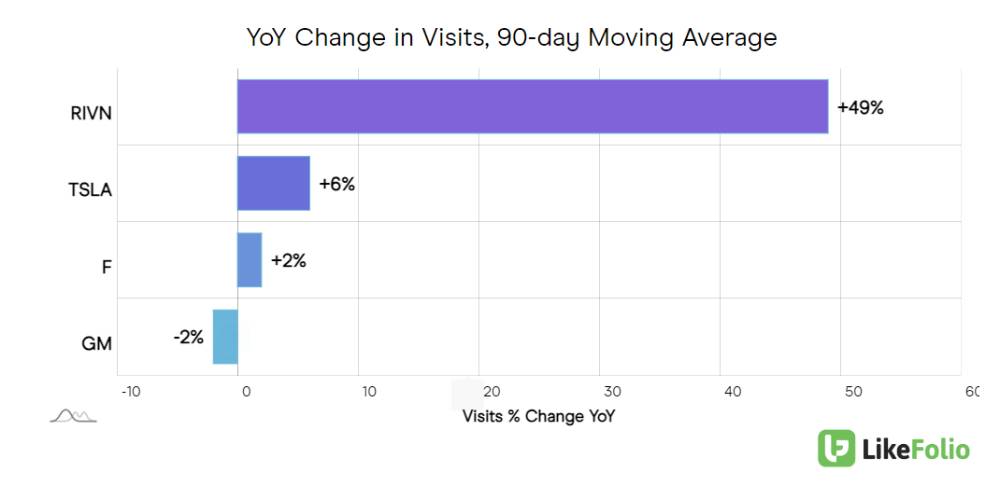

And LikeFolio data confirms consumer interest in Tesla vehicles remains high. Visits to the company’s website have increased by 6% year over year and an even larger 36% on a two-year stack.

We haven’t even scratched the surface of tremendous tailwinds propelling this name forward, including the implications of Tesla’s robotaxi and solar capabilities.

Bottom line: We aren’t betting against TSLA or its leader. And this is much, much more than just a car company.

From Tesla to SpaceX to PayPal (PYPL), Musk is a powerhouse of innovation – and profits. And if you think Optimus is impressive, you have to see this next project he’s working on.

It’s a wild AI experiment that’s been called a “medical miracle,” and it’s underway right now in Fremont, California.

Check out this boots-on-the-ground footage for the full story – straight from Elon’s headquarters.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. LikeFolio Investor subscribers – make sure you watch the important video update we sent out on TSLA earlier today if you haven’t already. That should be in your inbox now, as well as in the “Issues & Updates” section of your dashboard. Enjoy.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

ONON: An Olympic-Caliber Profit Play

This stock is gearing up for an Olympic boost – here’s how we’re playing it now…

It’s a Great Year for GOOGL: Should You Be Buying?

This tech stock is on a hot streak – and what comes next could be even bigger…