Nike (NKE) is stumbling, and we saw it coming long before Wall Street caught wind.

The signs were there, clear as day, in the data we track daily. Nike’s iconic brand isn’t enough to save it from the steep decline it’s now facing.

The company’s latest earnings disaster was no surprise to us at LikeFolio. In fact, we’ve been ringing the alarm bell for months, and now the market is finally catching up.

Let’s be clear – Nike’s troubles aren’t just a blip. This is a company facing systemic issues. From weakening demand in key markets like China to a crumbling direct-to-consumer strategy, Nike is slipping fast.

The decline is far from over.

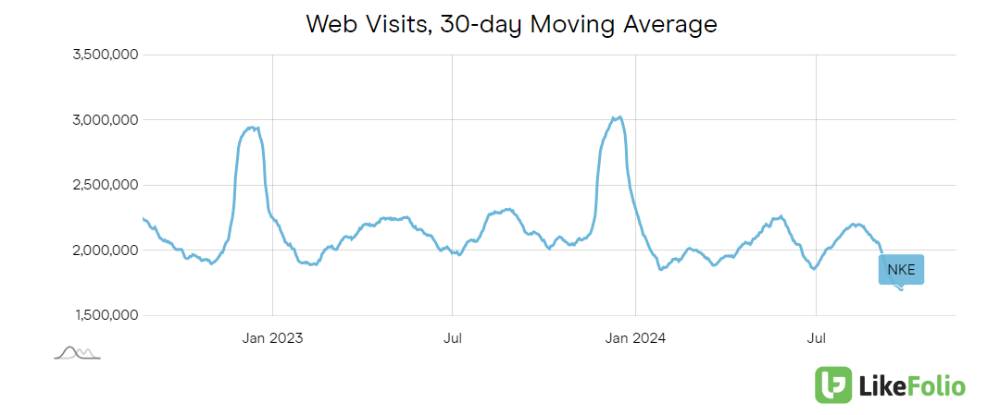

Just look at the 22% drop in web traffic year over year compared to the modest 7% decline we tracked a quarter ago:

The numbers don’t lie. Nike’s once-unshakable connection with consumers is deteriorating rapidly.

The Decline of Nike (That We Saw Coming)

Nike’s strategic missteps are compounding its problems. The company has overextended itself, trying to dominate every corner of the market while failing to innovate where it matters most.

Its reliance on classic franchises like Air Force 1 is fading, while the once-buzzed-about direct-to-consumer model is now losing steam. The situation with its Converse brand, where revenues slid 18% year over year, only adds to the grim outlook.

But it’s the changing of the guard that’s the real story here.

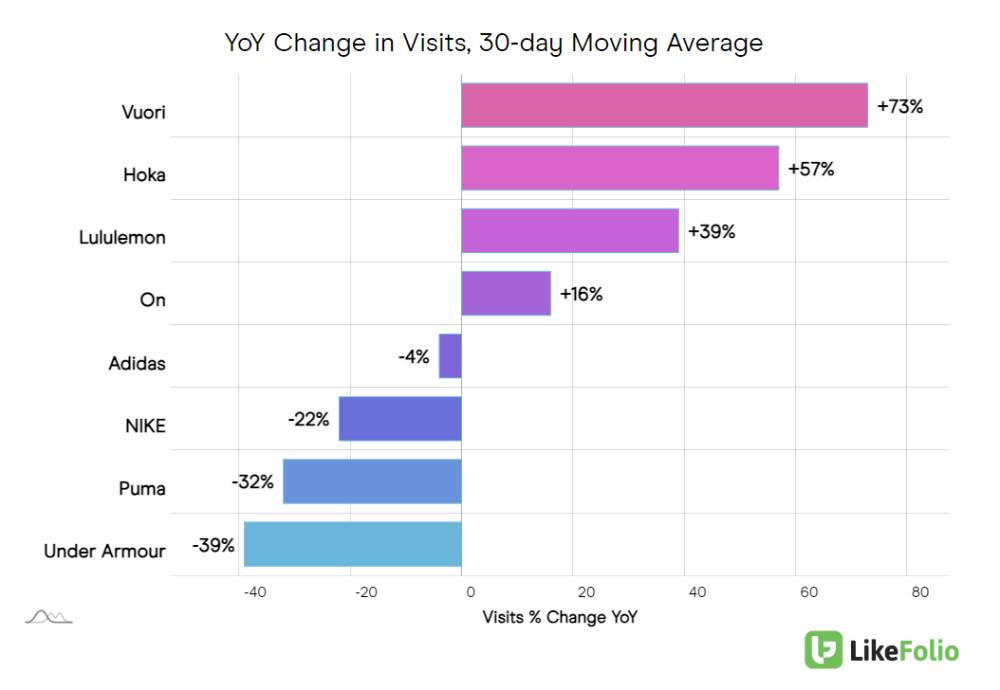

The new favorite brands on Main Street, names like Vuori, Hoka (DECK), and Lululemon (LULU), are taking the lead as Nike struggles to keep pace. While Nike flounders, Vuori has seen a staggering 73% increase in web traffic year over year:

Hoka is surging with 57% growth, and Lululemon continues its dominance in the high-end athleisure market with 39% gains in website visits.

Vuori specializes in performance apparel from joggers to leggings to tees; while not publicly-traded, it’s certainly stealing market share in the lifestyle space. Deckers Outdoor-owned Hoka pushed the boundaries of what running shoes could be with a bold design that’s garnered a loyal fanbase of athletes and celebrities alike. And Lululemon, need we say more? The luxury athleisurewear specialist has become a staple of American fitness culture, with recently expanded footwear offerings putting it in direct competition with Nike.

In an effort to keep up, Nike is trying to pin its hopes on product innovations, including a new Pegasus Premium running shoe that uses its “Air” technology to contour the natural shape of the foot – set to be available in 2025.

The problem is, Nike is already fighting a losing battle.

The tide is shifting in favor of smaller, more nimble brands that understand what today’s consumers want – premium, niche products that align with their lifestyle.

Nike’s once-dominant lifestyle segment is getting trounced as jeans and retro styles make a comeback, leaving Nike stuck in the middle of a cultural shift.

Wall Street analysts were still clinging to the old narrative, but the data didn’t lie. Nike’s dominance is fading, and we’re watching the rise of a new era in the athletic and lifestyle markets.

The competitors that were once in Nike’s shadow – Vuori, Hoka, Lululemon – are now outshining it.

So What’s Next?

If Nike’s struggles continue – and we believe they will – it’s going to be a long road back to relevance. Meanwhile, brands like Vuori and Hoka are positioned to capitalize on this shift, leading the next generation of “it brands” in the market.

LikeFolio is bullish on these smaller players. The growth trajectory is clear, and as Nike continues to falter, the gap is only going to widen.

This isn’t just a hiccup for Nike. It’s the beginning of a new landscape in the athletic and lifestyle industry. Those who get in early on this trend are going to ride the wave of these rising stars.

The old guard is falling. The new guard is here.

Make no mistake: Nike’s decline is just beginning, and the opportunities for its competitors are heating up.

I know because the same system that helped us avoid Nike’s losses delivered a 147% gain on running shoe competitor On Holding (ONON)… and it’s currently analyzing millions of consumer data points to identify our next breakout winner.

Find out how you can get in on the next triple-digit profit opportunity with us.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

CrowdStrike Disaster Creates Opportunity for One Alternative Stock

The cybersecurity market is ripe for disruption – and this stock could be first in line to benefit…

PayPal’s Turnaround Story Is Finally Underway

Strategic partnerships put PayPal in the fast lane… See the data that has us feeling bullish.