Deckers Outdoor Corp.’s (DECK) pride and joy – the infamous “Ugg” boot – was the hottest shoe of the 2023 winter season.

Ugg achieved its first-ever billion-dollar quarter in Q3, driven by a 20% surge in direct-to-consumer (DTC) revenue that accounted for 62% of the brand’s total revenue.

But as peak season for Uggs cools off – sheepskin boots are unquestionably a cold-weather accessory – DECK showcases another rising star in its portfolio…

We’re talking about Hoka, the highly touted and extremely comfortable running shoe brand (one we’ve covered here before).

Out with the Ugg, in with the Hoka

Since we introduced you to Hoka’s origin story last June, this “ugly” shoe brand has only gained momentum. (And DECK stock? It’s gained nearly 90%.)

Hoka is successfully attracting new customers and maintaining loyalty among existing ones, recording a 50% increase in new international customer acquisitions and a 27% increase domestically in the most recent quarter. It also saw an impressive 55% rise in customer retention internationally and a 33% increase in the U.S.

LikeFolio data suggests this all-star brand may just be getting started.

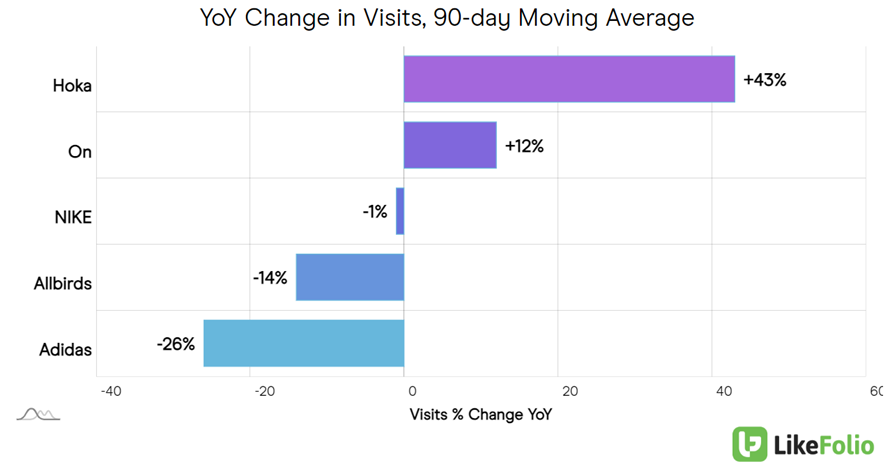

Hoka web visits have increased by 43% year over year, the highest rate of traffic growth for any athletic shoe in our universe.

The introduction of new products like the Cielo X1, a high-performance running shoe, and lifestyle-oriented offerings including apparel, are bolstering consumer demand.

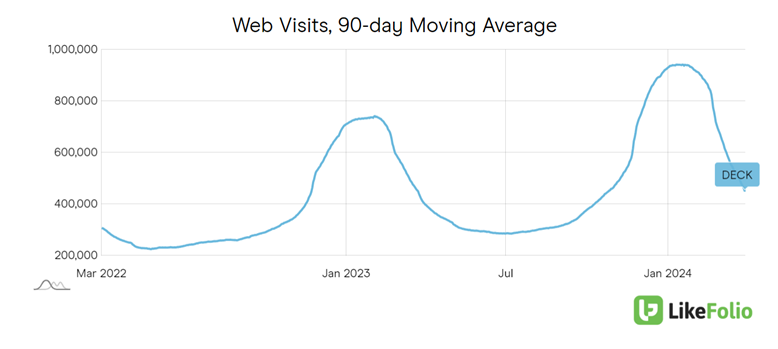

As the Ugg brand loses steam in the warmer months, Hoka’s digital traffic growth is helping to keep Deckers’ overall web visits trending in a positive direction.

Collectively, DECK web visits are up by 12% year over year:

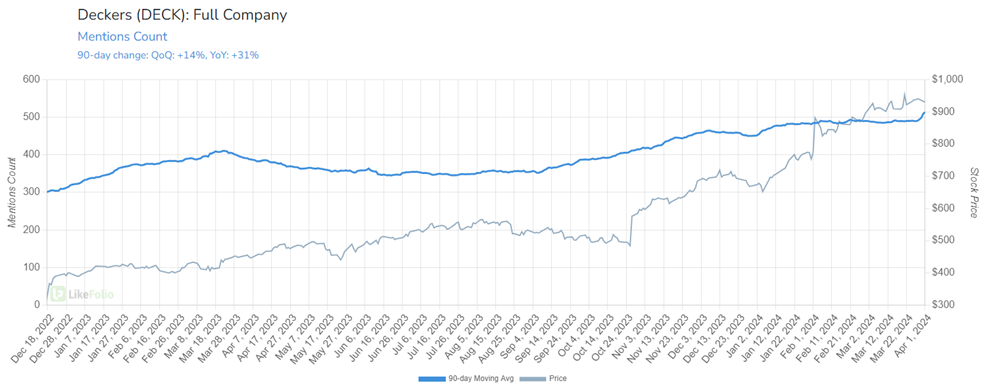

On a company level, DECK mentions are also positive, climbing 31% on a year-over-year basis, driven recently by – you guessed it – Hoka.

Last quarter, DECK’s revenue growth at large was impressive, especially considering its healthy split of in-store versus e-commerce sales. Total company revenue increased 16% to $1.56 billion, with DTC revenue gaining 23%, making up 55% of that total haul.

But boy, is the bar high…

Earnings on DECK

As the company’s stock price rises, so do expectations… and DECK shares have nearly doubled over the last year.

When it comes to earnings, even a stock like DECK with everything going for it can stumble on the slightest disappointment. So far, Hoka appears to be holding DECK’s head above water, but any slowdown could spook the market.

We’ll be keeping a close eye on this one heading into its next earnings event – and when the time comes for DECK to report in June, our proprietary “emotion mapping” technology will show us just how to play it.

Because the beauty of earnings trading with our system is, you’ll always know which way the stock is likely to move. And whether that’s up, down, or sideways, you’ll always go in armed with the best way to trade.

I’ll show you how it works here.

Then, you’ll have all the information you need to decide for yourself whether you want to play along.

Stay tuned for DECK’s next earnings release. We’ll have plenty of earnings opportunities to keep us busy – and making money – until then.

Until next time,

Andy Swan

Founder, LikeFolio

The Latest Free Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s hot this week…

How to Play the Small-Cap Revival (3 Top Picks)

Small caps are due for a serious resurgence. Here’s how you can play along…

Airline Loyalty Shift: See Who’s on Top Now

Two airlines look primed for a comeback amid a massive industry shift…