Election Day 2024 is just 12 days away – and the consequences are weighing heavily on America’s psyche.

An overwhelming majority of Americans (79%) are feeling anxious about the potential outcome, according to a recent LifeStance survey. For a whopping 57% of those respondents, the election is something they’re thinking about daily; for 21% of them, the anxiety is significant.

It’s easy to see why. Whether it’s Donald Trump (R) or Kamala Harris (D) heading up our country come January, this presidential election could impact every corner of our lives, from how we access basic health care to how much money is in our retirement accounts and everything in between.

For us investors, the stakes feel even higher as uncertainty translates to volatility in the markets.

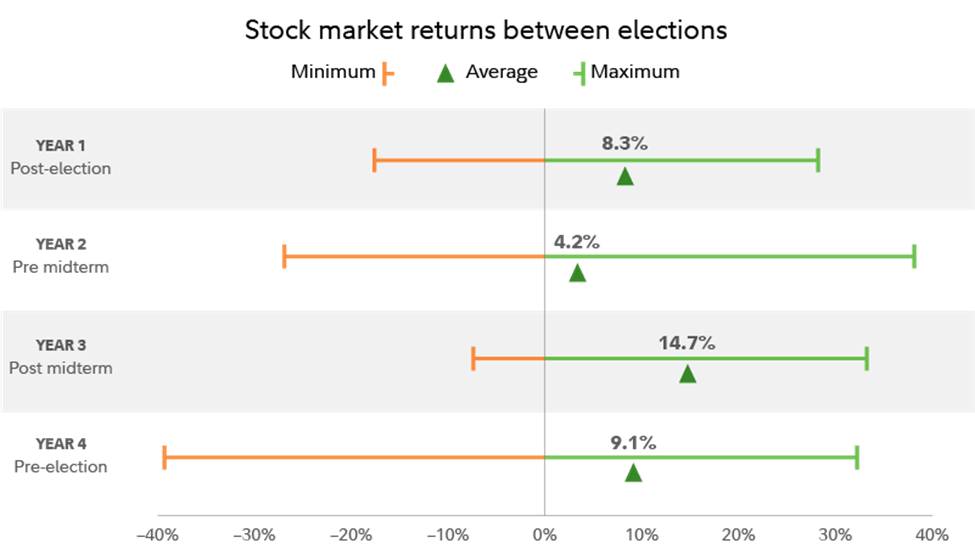

Going back to 1950, U.S. stocks have gained an average of 9% in election years – but sector-specific reactions can be much more pronounced, depending on the anticipated policy changes of the incoming administration.

And that can have serious implications for your portfolio.

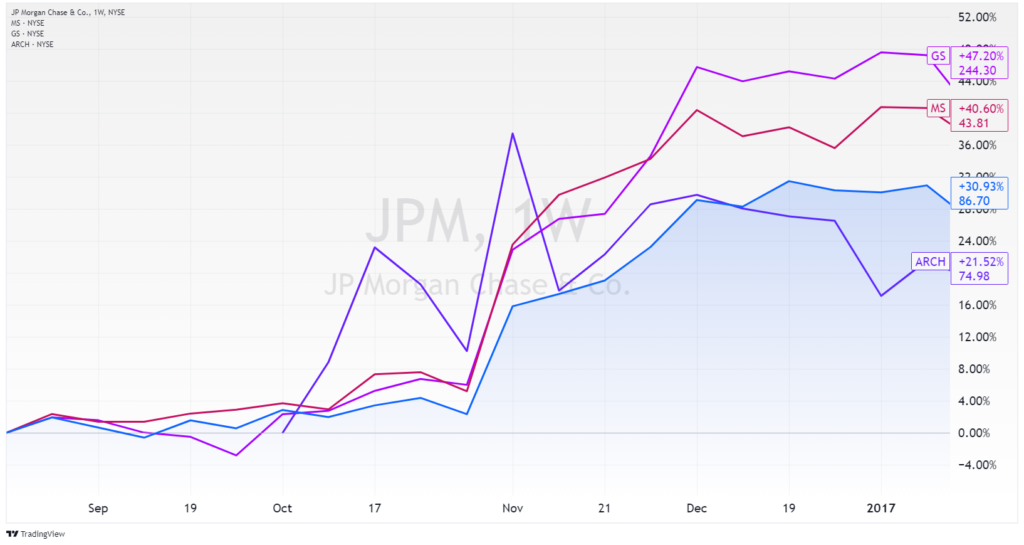

For example, after Trump’s 2016 victory, financial stocks surged over 30%, while energy names soared in response to promises of deregulation.

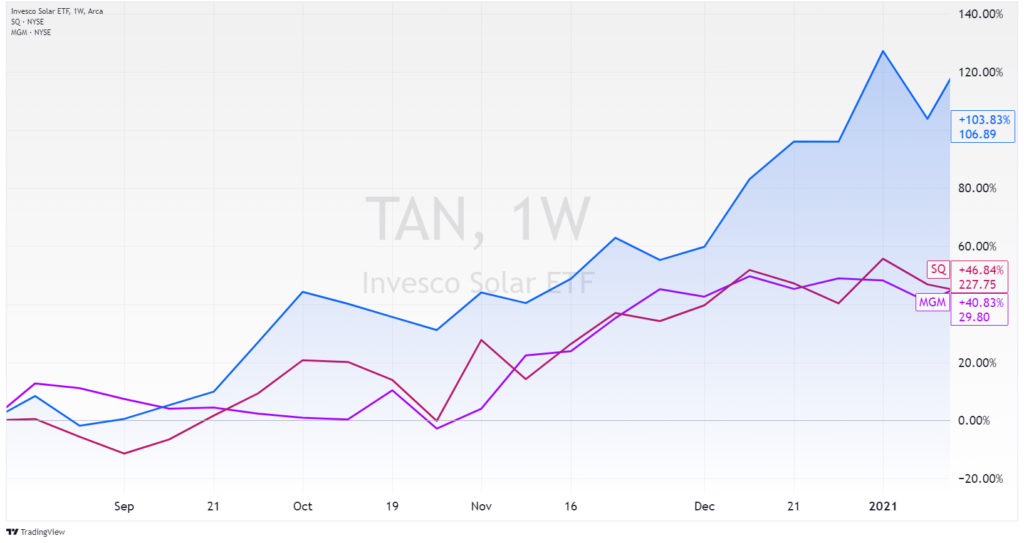

In contrast, after Biden’s 2020 win, clean energy and tech stocks took off. The Invesco Solar ETF (TAN) surged nearly 40%, while tech names like Block (SQ) and travel names like MGM Resorts (MGM) surged amid COVID-vaccine hopes.

With Trump and Harris vying for the presidency, the 2024 election is sure to create similar shifts across industries.

Unprepared investors risk falling victim to the election chaos. We’re here to make sure you’re not one of them.

Today, we’ll help you understand which stocks could benefit from proposed policy changes under either a Trump or Harris administration so you’ll be ready to embrace the chaos this election season.

🔴 4 Stocks to Watch for Trump

Some of the stocks below are commonly featured as major winners under a Trump administration, and for good reason. These energy, defense, and finance stocks clearly benefit from reduced regulation.

Trump Pick No. 1: Exxon Mobil (XOM)

Trump has consistently advocated for increased domestic energy production and fewer environmental regulations.

If elected, his administration would likely prioritize opening more federal land for oil and gas drilling. Exxon Mobil (XOM), one of the largest players in the oil industry, stands to benefit from such policies, with reduced regulatory hurdles enabling greater production capacity.

Traditional oil and gas players haven’t logged significant gains over the last month, so opportunity may still exist here for investors.

As a conservative energy stock that would really ONLY benefit under conservative leadership, Exxon could be due for an outsized bullish move if Trump is elected.

Trump Pick No. 2: JPMorgan Chase (JPM)

The financial sector has historically rallied under Republican leadership due to deregulatory policies. Trump’s administration previously rolled back provisions in the Dodd-Frank Act, making it easier for banks to expand.

Financial stocks, particularly large banks, are already gaining steam as investors anticipate deregulation and a more business-friendly environment under a potential Trump administration.

JPMorgan Chase (JPM), one of the largest U.S. banks, is an easy pick here that could see further gains if Trump pushes to reduce financial regulations once again.

Relaxed oversight would enable more mergers, faster approvals, and greater profitability for financial institutions.

Trump Pick No. 3: Palantir Technologies (PLTR)

Software specialist Palantir Technologies (PLTR) could benefit under Trump due to his hardline immigration policies, which rely on data analytics software for border control and enforcement through agencies like U.S. Immigration and Customs Enforcement (ICE).

Additionally, Trump’s focus on increasing national defense and military spending would create more demand for Palantir’s intelligence and defense services, further boosting the company’s government contracts.

This is great news for our MegaTrends members, who have already locked in a 105% profit on a bullish PLTR trade. (Go here to see how we spot triple-digit winners like PLTR ahead of the market.)

Each of these stocks is pretty well-known, so here’s an unexpected “wildcard” play that also stands to benefit under Trump…

🃏 Trump Wildcard Pick: Darden Restaurants (DRI)

Trump has proposed no taxes on tips for workers, which could be a huge boon for companies in the restaurant industry that rely heavily on tipped employees – like Darden Restaurants (DRI).

Darden, which owns Olive Garden, LongHorn Steakhouse, and other restaurant chains, could benefit from reduced tax burdens on its employees, potentially increasing worker retention and customer service quality.

Shares are trading flat year to date, which could be an appealing entry for long-term investors…

DRI is the kind of consumer-facing pick LikeFolio specializes in, so we’ll be keeping a close eye on our data for building momentum.

🔵 4 Stocks to Watch for Harris

Top Harris picks are centered around clean, renewable energy, but we’ve also identified a potential wildcard in the homebuilding sector that Wall Street may not see coming…

Harris Pick No. 1: Enphase Energy (ENPH)

Enphase Energy (ENPH), a leader in solar energy systems, could benefit from Harris’s plans to expand renewable energy tax credits and increase federal investments in solar infrastructure.

Enphase pioneered a semiconductor-based microinverter that converts energy at the individual solar module level – and its technology is considered one of the safest and smartest in the solar industry.

The company’s stock surged following Biden’s election but has struggled to gain meaningful traction so far in 2024. Similar policies under Harris could lead to another round of profits.

Harris Pick No. 2: Lucid Group (LCID)

Harris’s support for electric vehicle (EV) infrastructure would be a boon for EV manufacturers like Lucid Group (LCID).

Her administration would likely push for expanded charging networks and higher EV tax credits, driving demand for companies with strong EV exposure.

We cover tons of EV companies at LikeFolio – from the far-and-away favorite, Tesla (TSLA), to the up-and-coming Rivian (RIVN), to the traditional automakers like General Motors (GM) gaining EV market share.

What makes Lucid interesting is that it’s a relatively tiny player in this space. As you’ve learned here in Derby City Daily, small-caps are due for a resurgence – and tend to do particularly well in election years.

Harris Pick No. 3: Plug Power (PLUG)

As a leader in hydrogen fuel cell technology, Plug Power (PLUG) could thrive under Harris’s green energy policies.

Its “green hydrogen” is capable of powering EVs, but so far, it’s focused on larger-scale vehicles like commercial trucks and airplanes. Plug Power’s solutions also have promising industrial applications, including in data centers and manufacturing.

With an increased focus on renewable energy infrastructure and reducing carbon emissions, Plug Power’s hydrogen solutions could see heightened demand under Harris.

But fair warning: At $2 a share, PLUG is a moonshot bet that could just as easily go to zero.

🃏 Harris Wildcard Pick: Lennar Corp. (LEN)

Harris’s plan to expand tax credits for first-time homebuyers could lead to a housing boom, particularly in the entry-level market.

Lennar Corp. (LEN), one of the largest homebuilders in the U.S., would benefit from increased demand for affordable homes as buyers take advantage of federal tax incentives.

In addition, we’re looking at real estate revival as a major investing trend, powered by Federal Reserve rate cuts that could serve as an added tailwind for Lennar.

The Bottom Line

This watchlist is a great jumping-off point for navigating the 2024 election as an investor.

A Trump win would favor sectors like traditional energy, defense, and financials, while a Harris victory would benefit clean energy, electric vehicles, and health care.

But there are unexpected winners at hand, too – names like DRI and LEN that the market may not be playing yet.

Look for more election-year investing ideas in Friday’s issue of Derby City Daily, where we’ll cover three sectors poised for gains, no matter who comes out on top.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. In the meantime, we want to extend an invitation your way. Like us, our colleagues are experts at turning volatility into profits – and they’re sharing their own election investing plan here. It centers around an event that could trigger the day after the election. Not just a repeat of the contested election results of 2020 but something that could completely blindside unsuspecting investors and thrust the market into an unprecedented kind of chaos. Go here now to learn more.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

It’s GM Versus Ford in the EV Race for Second Place

Traditional automakers are playing catchup to Tesla – and one is in prime position…

Will Airbnb Be the Next Travel Stock to Surprise the Market?

A comeback attempt is underway – offering investors a glimmer of hope in an otherwise dour travel industry…