America has spoken: Donald J. Trump (R) will return to office in January.

And the market is having a field day.

Hopefully, you’ve been following along with our coverage here in Derby City Daily. Because all politics aside, I’ll bet you made some money in the market today – and that’s what we’re here for.

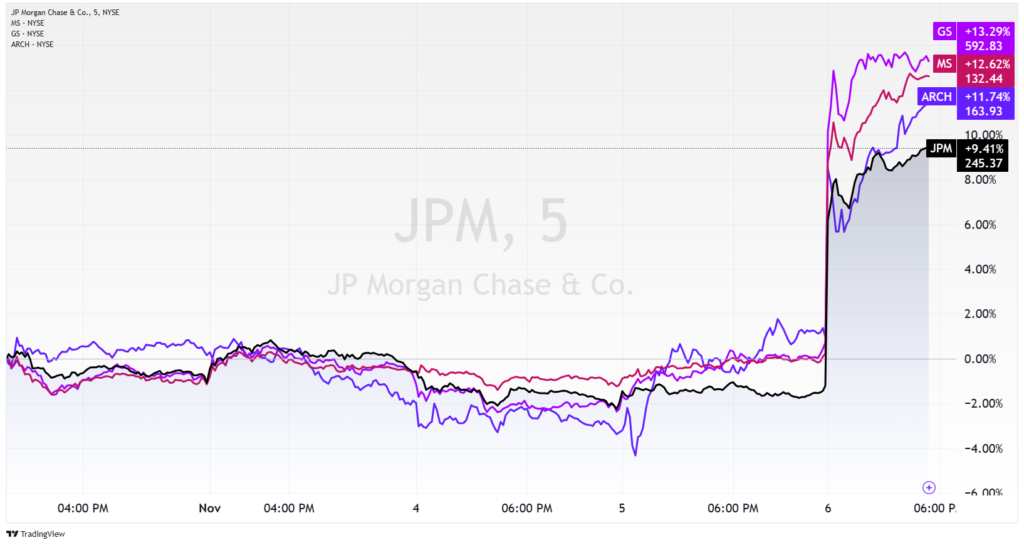

Remember those bank stocks we told you would likely rally on a second Trump term? They’re off to the races, just as we expected.

How about Tesla (TSLA)? In May, we showed you why CEO Elon Musk could sway this election. His role ended up being so critical to Trump’s victory that it could not only end the Biden-era federal investigations into Tesla, but also land Musk an influential position in the White House. Now, Tesla shares are zooming higher on renewed investor optimism.

And did you see Bitcoin’s (BTC) reaction? In July, we noted how Trump set the stage for Bitcoin’s next big breakout as he lent vocal support to the cryptocurrency, even going so far as to headline the 2024 Bitcoin Conference. This morning, Bitcoin soared to a new all-time high, cresting the $75,000 mark for the first time on a wave of euphoria.

Now that the dust has settled and the winner is certain, let’s regroup and see where the market stands today – and what investors can expect next.

Consider this your post-election cheat sheet…

LikeFolio’s Post-Election Cheat Sheet

First, we’ll break down the overall market reaction following Trump’s 2024 victory, and what it all means.

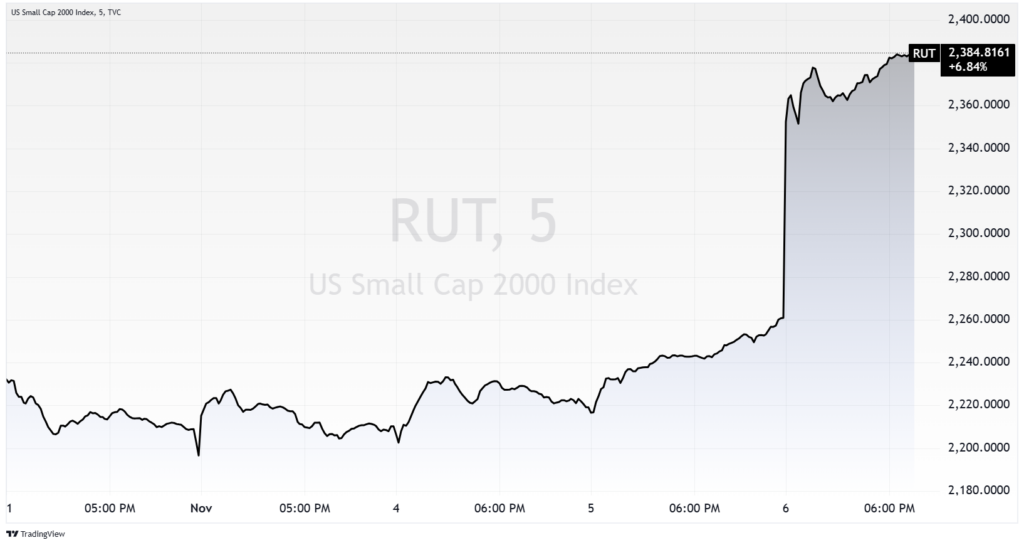

📈 Stock Market Surge

Financial markets surged following Trump’s projected win, with S&P 500 and Dow Jones futures both gaining over 2%. Small-cap stocks, tracked by the Russell 2000 Index (RUT), jumped an even larger 5%. (This was one of our top election sectors to watch.)

Investors are anticipating business-friendly policies, potential tax cuts, and deregulation that could drive economic growth and lift corporate earnings.

📈 Rising Treasury Yields

U.S. government bond yields rose as investors prepared for increased government spending and potential tax cuts, which could lead to higher inflation and larger government debt. This movement suggests inflationary concerns and a potential increase in borrowing costs.

📈 Currency Strength

The U.S. dollar (USD) appreciated against several major currencies due to expectations of stronger economic growth and potentially higher interest rates under Trump’s administration.

📈 Crypto Boom

Bitcoin surged to new highs, driven by market optimism about the potential for lighter regulatory oversight under Trump’s leadership, just as we predicted. Investors are speculating that the administration will create a friendlier regulatory environment for digital assets, spurring further growth and adoption.

📈 Tech Stocks Rise

Technology companies, including major names like Tesla (as you saw) and Nvidia (NVDA), posted significant gains as markets anticipated supportive policies fostering innovation and expansion in the tech industry.

- Nvidia’s Growth Potential: NVDA stock is up 3% on the strength of its artificial intelligence (AI) and semiconductor offerings, especially in the wake of a Trump administration that wants to continue growing chip manufacturing here in the U.S.

- Tesla’s Ongoing Momentum: Tesla shares surged even higher, up 13%, reflecting expectations of policy support for U.S. manufacturing and potential tariffs on Chinese electric vehicles (EVs). Trump’s victory could also streamline regulatory approval of Tesla’s autonomous driving technology, which is an enormous catalyst for the company’s growth prospects and long-term valuation.

- Alphabet’s Brightened Prospects: Alphabet Inc. (GOOGL), Google’s parent company, saw its stock rise by about 3.5% this morning. This uptick comes as investors grow optimistic about a potential easing of antitrust pressures under the new administration, which may lead to a more favorable regulatory environment for the company.

What Comes Next

Now, to address that all-important question of what comes next?

Looking ahead, we remain extremely bullish on companies like Tesla, which stand to benefit tremendously from friendlier policies at large, as well as Bitcoin and crypto-adjacent names.

We’re also expecting tariffs to spur big moves – to the upside and downside – as policy is defined and enacted.

During his previous term, Trump imposed tariffs on Chinese goods to address trade imbalances and protect domestic industries. Businesses should prepare for potential tariff increases on imports, especially from China, as Trump has indicated a willingness to reignite economic pressure to support U.S. manufacturing and reduce reliance on foreign goods.

This could impact supply chains, increase costs for imported components, and potentially drive companies to reconsider their sourcing strategies and domestic production capabilities. Industries with global exposure may face higher operational costs but could also benefit from incentives aimed at reshoring production.

The Bottom Line

Phew. The election uncertainty is finally behind us – and overall, investors came out on top. Markets have responded positively to expectations of pro-business policies under Trump’s administration.

Tech leaders like Nvidia, Tesla, and Google stand to gain from regulatory shifts, while the crypto market remains hopeful for reduced restrictions.

Investors should expect some near-term volatility as the market shakes out what will be a dramatic news cycle. Buy the rumor, sell the news, right?

Remain risk defined, and we will keep hunting for opportunities as they unfold.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Two Energy Drink Plays Banking on an Earnings Jolt

Can Celsius and Monster recover their all-star status? One of these stocks looks ready to burst…

Digital Ad Spend SNAPs Back: 3 Big Winners

See which rising stars are leading a digital ad comeback – and what’s driving these outsized gains…