Earning reports are our bread and butter when it comes to making money – but there’s another event from Apple (AAPL) that we’re watching like a hawk this week.

Its Worldwide Developers Conference (WWDC).

Heading into today’s kickoff, the rumor mill was swirling that Apple could unveil a new VR (virtual reality) headset.

It did: The Apple Vision Pro.

Consumers can get their hands on one of the ski mask-looking devices starting early next year – if they’re willing to shell out a hefty 3,499 bucks.

The Vision Pro skews more heavily into augmented reality (AR) than it does VR, as rumored. AR uses a real-world backdrop “augmented” with virtual components (think Pokémon GO) while VR uses a purely virtual environment. But consumers will be able to switch between AR and VR relatively easily while using the device.

The Vision Pro marks the first major product announcement since the Apple Watch in 2015.

And AAPL shares were already surging to all-time highs today on nothing but rumors of its launch.

The unveiling of the rumored VR headset was a kind of “make-or-break” situation for Apple.

Its last earnings report was a mixed bag: Shares rose slightly (just 2%) on better-than-anticipated iPhone sales, which came even as the smartphone industry overall contracted about 15%. That proved to investors that Apple still has its key edge over the competition.

But overall sales dropped for the second-consecutive quarter (revenue was down 3% year-over-year) while Mac, iPad, and services underperformed.

And looking ahead, LikeFolio demand data for Apple continues to weaken.

Meaning: Apple needed to shake things up and inject new life into its product lineup if it wants to keep up in this evolving tech landscape.

But was the Vision Pro we saw today enough to keep Apple’s stock climbing?

Today, I’ll show you just how pivotal of a moment this is for the iconic tech company…

Weakening Demand for Apple Products

According to LikeFolio’s forward-looking data, Mac demand continues to underperform alongside other “non-essential” high-ticket items like the iPad and Airpods.

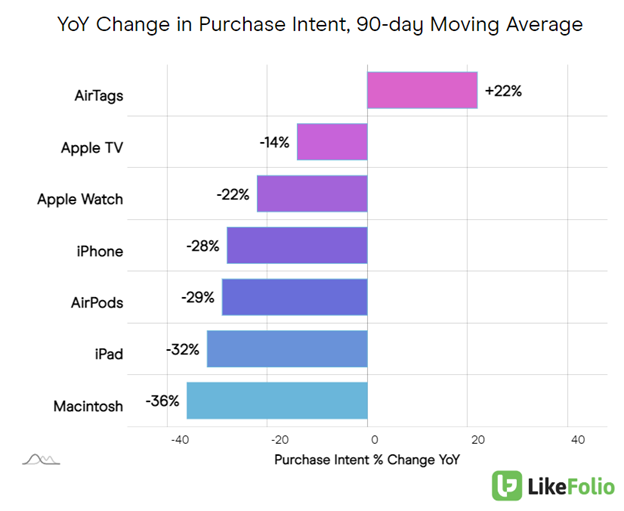

You can see the slide in Purchase Intent mentions on a year-over-year basis in the chart below, with Mac losing 36%, iPad losing 32%, and AirPods losing 29%:

Even the iPhone is losing some steam, with Purchase Intent sliding by 28%.

Apple’s current Earnings Score is neutral but does lean bearish at -12.

Its long-term score, which is calculated using a similar method but reflects momentum on a longer-term scale, is also on the verge at -20.

Apple demand collectively has slipped compared to last quarter – down 23% year-over-year vs. 11%.

As economic tightening puts the squeeze on consumer budgets, even Apple isn’t immune to the effects.

If Apple’s Vision Pro doesn’t deliver the excitement investors are craving during WWDC this week, a pull-back could be in store for AAPL shares.

My brother and LikeFolio co-founder Landon Swan joined the guys over at the TD Ameritrade Network as AAPL shares hit all-time highs today to discuss the data in-depth.

I encourage you to watch that coverage here:

Before You Go: Earnings Surprises on Deck This Week

In addition to keeping Apple on your watchlist, Week 8 of earnings season features 18 big names set to report their quarterly numbers, including:

- Academy Sports (ASO)

- Smuckers (SJM)

- Lovesac (LOVE)

- Campbell Soup (CPB)

- Stitch Fix (SFIX)

- Dave & Busters (PLAY)

At a high level, here are the big themes to watch:

- Consumers trading down to cheaper options at the grocery store could potentially impact well-known brands like SJM and CPB

- Discretionary spending still looks weak, which could spell trouble for PLAY, LOVE, and SFIX.

- On the flipside, we’ve recorded relative strength in consumer demand at Academy Sports. Is the stock’s recent pull-back overdone?

Earnings Season Pass members can access the full 2023 Q2 Week 8 breakdown here.

Not yet a member? Click here to learn how to join today and gain access to this week’s hottest trading opportunities.

Andy Swan

Founder, LikeFolio