When consumers feel like corporations put profits ahead of providing a positive user experience, the results can be disastrous.

For example, Snap (SNAP) rolled out a massive redesign to its Snapchat app in 2018 that was so despised, it nearly took down the company.

“With almost 80% of Snapchat mentions turning negative in an ever-increasing volume of mentions, it’s clear that Snapchat users are livid with the changes,” I wrote in a special report for Forbes at the time, noting the unique severity of the backlash.

The update, which moved Snapchat’s “Discovery” section front and center to emphasize its sponsored content, was supposed to help Snap draw more revenue per user.

Instead, it infuriated users to the point of mass exodus – driving them to ditch Snapchat for Instagram Stories in droves, and ultimately, sinking SNAP from $19 to $6 by the end of 2018.

I can’t help but feel that same sense of déjà vu with the seething reaction to Unity Software’s (U) newest update.

The video game developer introduced a major departure to its pricing model earlier this month that’s not going down so well with users.

And LikeFolio is recording an eerily familiar pattern in our real-time consumer insights…

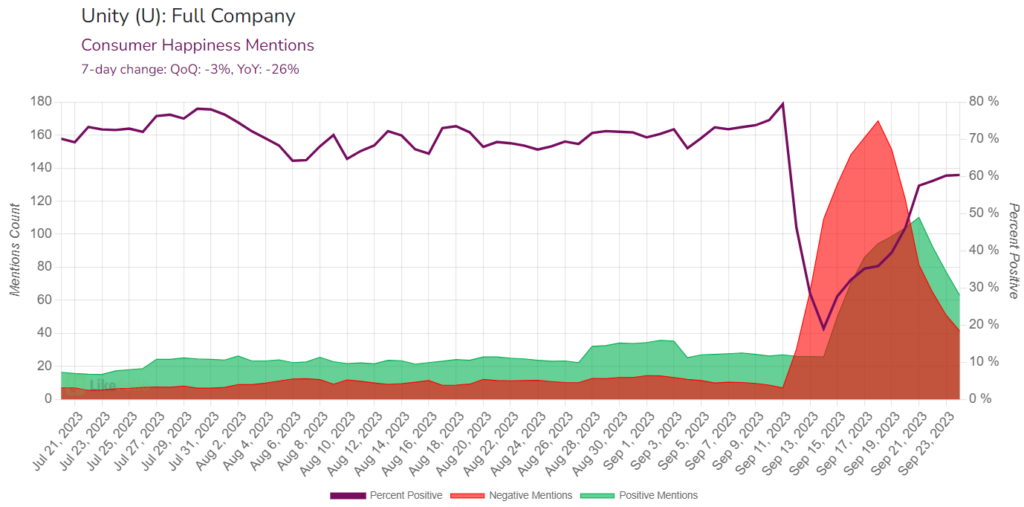

- Unity sentiment plunged from 80% positive to 19% positive in a matter of days.

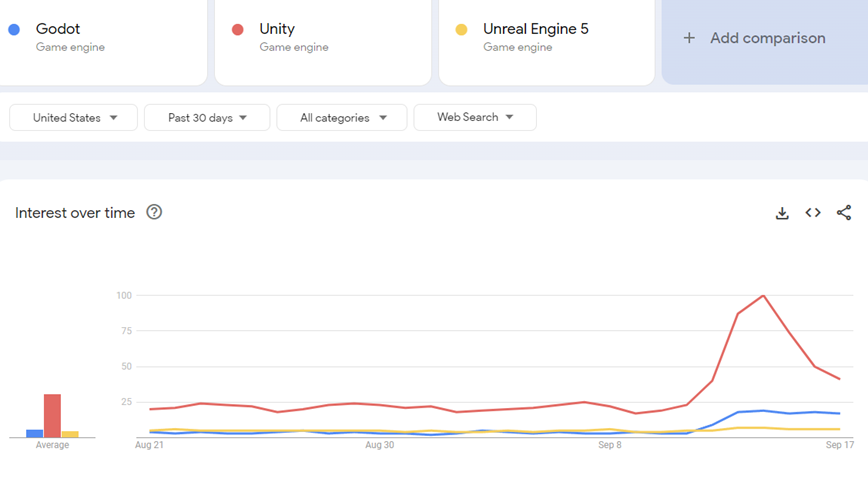

- “Unity alternative” searches surged upon the company’s announcement.

- And Unity’s stock price has taken a 20% hit in the days since.

The thing is: Before this, Unity was a favorite among game developers with one of the highest Consumer Happiness scores in the LikeFolio universe (92% at one point). And with artificial intelligence (AI) momentum in play as a profit booster, this stock was looking like a clear winner.

Now, the burning question is: Could Unity be headed for a Snapchat-style crash and burn in the stock market?

Or, did this 8% stock price drop in the last five days create an attractive entry point?

We’ll unpack what’s really going on with Unity and where we go from here.

Here’s the full story…

Unpacking Unity’s User Revolt

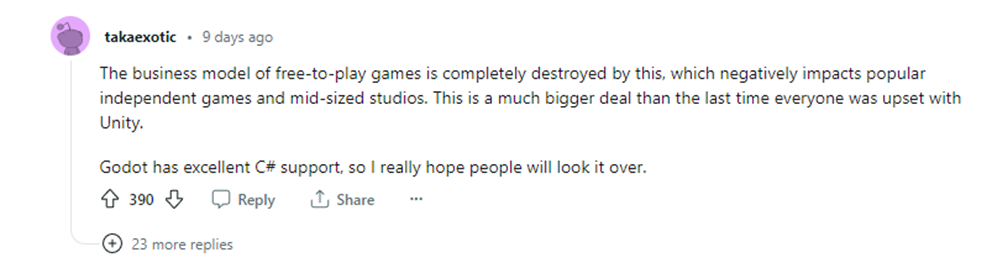

On September 12, Unity published a seemingly tepid blog post titled “Unity plan pricing and packaging updates,” that ignited a firestorm in the video game community.

“Effective January 1, 2024, we will introduce a new Unity Runtime Fee that’s based on game installs,” the post read, going on to explain an entirely new pricing model for its Unity Engine – a foundational software for many popular games like “Pokémon Go.”

Previously, the Unity Engine was available for free and sustained by higher-tier subscription services and an integrated ad platform.

But starting next year, developers who utilize Unity’s free tier for game creation would be charged 20 cents for each download and installation of their game once it surpasses 200,000 downloads and accumulates $200,000 in revenue.

Unity’s affordability has been instrumental in the success of several hit titles, and many developers have expressed concerns that the proposed fee model would detrimentally impact game studios of varying scales and budgets.

Folks are worried this new model could easily be misused through a sort of “review bombing,” referring to the coordinated effort to flood games with negative reviews, often targeting games that feature progressive elements.

Rami Ismail, an influential game developer, highlighted that developers advocating for inclusivity and diversity are particularly vulnerable to such malicious tactics.

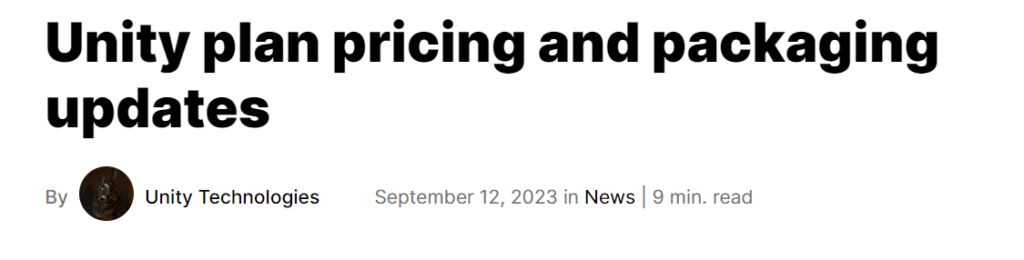

Unity responded to the outcry by clarifying certain aspects of its new model, stating that only the initial installation would incur a charge, and multiple reinstallations wouldn’t count towards the fee.

Games offered as part of subscription services, like Xbox Game Pass, would be exempt from these fees, but the distributors, such as Microsoft (MSFT), would bear the cost.

According to Unity exec Marc Whitten, only about 10% of Unity’s developers would be affected by the new fees, considering the set thresholds.

But the controversy was enough for Unity to make a complete 180 just a few days later, announcing on September 17 that it would revise the policy per user concerns.

By September 22, a revised version of the policy was announced in “An open letter to our community,” revealing that its Unity Personal plan would now remain free, among other adjustments.

But significant damage had already been done to Unity’s reputation – with many consumers questioning whether they can trust the company ever again.

The Bearish Case for Unity

Unity’s initial move to introduce a “Runtime Fee” signaled a potentially desperate move for revenue growth.

Worse still, significant insider selling by key company figures, including the CEO, just days before the announcement hints at a concerning lack of confidence in Unity’s future.

And its Apple (AAPL) collaboration – the same one that sent U shares soaring in June – could be in jeopardy.

After announcing Unity’s role in building spatial reality apps for the highly anticipated Vision Pro headset, Apple reportedly reduced its production orders, indicating a potential miscalculation of its market appeal.

These factors collectively raise concerns about Unity’s growth and stock trajectory.

But there’s another side to this story…

The Bullish Case for Unity

Unity is exploring new avenues for revenue with its new pricing model, which could ultimately lead to a more diversified and stable income, especially from high-performing games that achieve significant downloads and revenue.

By quickly pivoting its approach based on the outcry, Unity has proven it is willing to listen to developer feedback.

If Unity can effectively communicate the value and benefits of these changes to developers and offer added services or features, it might be able to turn the tide in its favor.

The good news is that the initial critics seem to be OK with the most recent revisions to the pricing structure…

And Consumer Happiness is already showing signs of a recovery, climbing back toward 60% as of this writing:

Better yet, even though there was a clear uptick in searches for competing platforms…

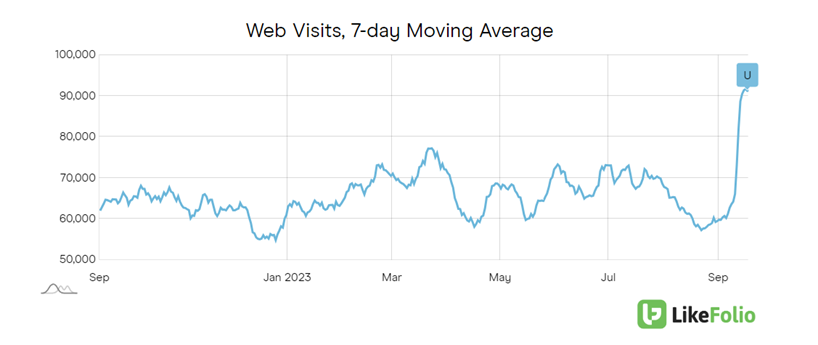

LikeFolio also recorded a spike in Unity web traffic during the same period:

This suggests a large swath of users are seeking additional information from Unity, versus writing the company off completely.

If buzz, sentiment, and web visits stabilize over the next two weeks, it could be a very bullish indicator that the company’s decision wasn’t enough to push users off the ledge – and that its quick pivot was successful damage control.

But if these metrics settle lower, it could signal trouble ahead.

It’s a risky bet right now, so we’ll be watching in real time and will provide an updated investing strategy for members when the dust settles.

While Unity sentiment recovers, I’ll leave you with an AI-powered company that consumers are loving: It boasts an impressive 80%-plus Consumer Happiness score, but folks aren’t just raving about this brand – they’re increasingly talking about spending their hard-earned cash, with demand mentions zooming 116% quarter-over-quarter as I write this. You can grab the details here.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Must-Watch AI Picks for 2024

With our consumer insights machine tuned to AI, there are plenty more opportunities to uncover with Derby City Insights. Check out three on our radar right now…

An AI Up-and-Comer Ready for Liftoff

With investors’ appetites whetted by Nvidia’s staggering 200%-plus rally, all eyes are on Arm’s recent AI IPO. But in the background, another AI stock is stirring – with LikeFolio data indicating it could be on the verge of a breakout… Check this one out.

Our Favorite Undercover AI Pick Under $5

Demand mentions for this company are accelerating 133% year-over-year right now as it rides the hottest investing trend of 2023. You can still grab shares for less than $3 apiece – but you have to act fast. This stock has already doubled since it first hit our radar… Learn more.

The Beaten-Down Stock Betting on AI

Whether it’s searching agreement libraries, extracting agreement details, or suggesting language edits based on best practices, the strides this company is making with AI could revolutionize the way business gets done. But is it enough to bring its shares back to life? Find out.