Spotify’s (SPOT) stock is on fire this year, up 81% and trading near all-time highs.

Investors are loving the way Spotify has grown its music streaming platform – us included.

Right now, its premium (aka paid subscriber) revenue growth is outpacing its ad-supported revenue growth: +22% year over year compared to +12% year over year, respectively.

Translation: Spotify users aren’t just hooked. They are willing to pay more per month for the premium experience.

(And ad spending may actually improve in the back half of this year, serving as an added tailwind.)

There’s just one problem…

Spotify’s music streaming platform has become so dominant in consumer mindshare that it’s got Apple (AAPL), the $3 trillion tech powerhouse, on the defensive.

Shocking, when you consider Apple has always been ahead of the curve in this realm, releasing the then-groundbreaking handheld iPod more than two decades ago…

But true.

Apple is actively inhibiting the Spotify user experience, leveraging the market it does command: the iPhone, a device more than half of Americans own.

Users will no longer be able to control the volume of connected devices playing Spotify with the physical volume buttons on the iPhone, for one.

Consumers also claim Spotify over-drains their iPhone batteries more than what they would expect for music streaming.

Clearly, Apple wants what Spotify has. But just how big of a threat does AAPL pose to SPOT’s throne?

Here’s what LikeFolio’s predictive insights say…

Can AAPL Catch SPOT?

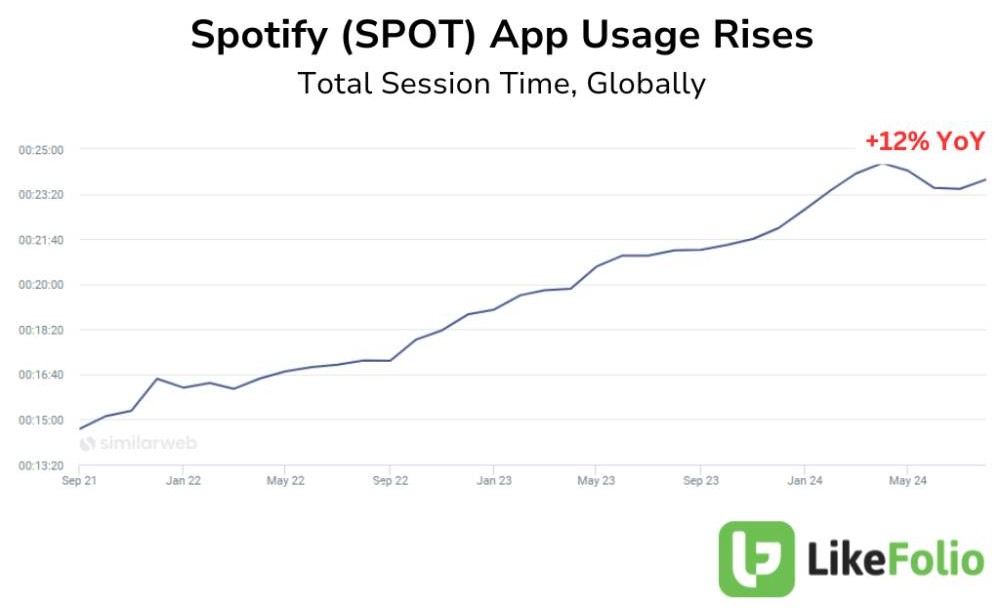

App engagement metrics prove the “stickiness” of Spotify’s platform. Total session time has ticked up substantially, gaining 12% year over year and averaging ~24 minutes per day per user.

Even with more consumers using Spotify’s app, Consumer Happiness levels have held strong – a rare feat. SPOT sentiment sits near our benchmark of 70% positive. Users are praising the streamer’s easy-to-use interface and always-right-on song recommendations.

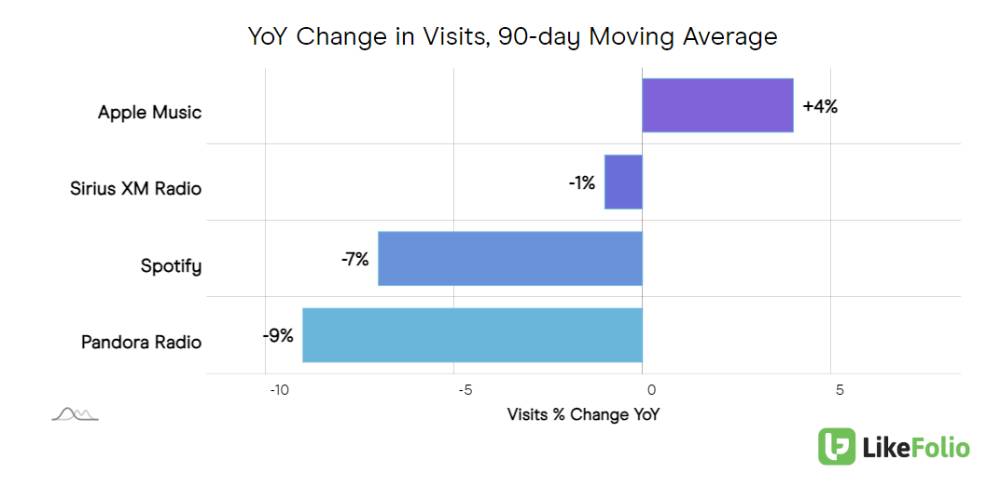

Apple Music is beating Spotify in new website traffic – visits are trending 4% higher year over year compared to Spotify’s 7% decline…

But AAPL still has a lot of ground to cover.

Because from a volume perspective – looking at the sheer number of web visits rather than growth – Apple Music comprises only 9% of consumer web traffic compared to Spotify’s 68%.

The Bullish – and Bearish – Case for SPOT

Looking ahead, investors in the bullish camp claim Spotify is just getting started.

As Spotify ushers in more premium subscribers and leverages artificial intelligence (AI) to cut costs and headcount, its net income is soaring. Spotify raked in $505 million over the last year, a significant reversal from its $776 million annual loss in 2023.

Its custom algorithm for each user is addictive, and it prides itself on a variety of subscription levels to fit different user segments, from students to families.

Bearish investors point out Spotify’s miss in Monthly Active Users (MAUs) last quarter, which reached 626 million, shy of the 631 million analysts were expecting due to “continued recalibration” of marketing activities. And its current valuation, they say, is too rich.

Our Take

We see Spotify as extremely sticky – who wants to transfer their entire music library and leave the platform they feel “knows them?”

Breakups are tough. But rest assured, Apple will be trying to make it as tempting as possible.

We will be monitoring for continued traction here. So far, we don’t see any major issues for SPOT but are on the lookout for signs of price sensitivity and churn from consumers.

You’ll be the first to know if we see any change.

For now, enjoy the 96%-and-counting gains SPOT has delivered since we named it a top stock to build your wealth in 2024, right here in Derby City Daily.

And be sure to check out our annual Apple Keynote Report released last week, if you haven’t already, to find out where AAPL stands with consumers after its iPhone 16 unveil – and where the stock could be headed next.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Fed Rate Cuts Could Turbocharge This Used Car Market Leader

LikeFolio data reveals a new leader in the trillion-dollar used car market ahead of the Fed’s critical interest rate decision…

Apple Keynote Report 2024: Will the iPhone 16 Deliver? Our Hot Take

See how consumers reacted to AAPL’s new lineup – and what our predictive insights mean for the stock’s trajectory…