One can + one contest + one TikTok account = Major backlash and financial fallout.

When Dylan Mulvaney, a transgender influencer with 10 million followers, hit TikTok to promote Bud Light’s March Madness contest and show off a tallboy can with her face on it…

The reaction was swift.

Sales slumped: Anheuser-Busch InBev (BUD) took a 10% hit that quarter…

Two executives took a leave of absence…

And in June, Constellation Brands’ (STZ) Modelo Especial, unseated Bud Light to become the bestselling beer in the U.S.

It’s been about six months since we first reported on the Bud Light meltdown, and BUD is slowly clawing its way back up as its other brands, like Michelob Ultra, Stella Artois, and craft brews pick up the slack.

We at LikeFolio have been keeping our ears to the ground, listening to consumers, and analyzing the data to understand the real impact on purchasing behavior.

Was the King of Beers able to withstand the heat, or will another beverage company rise to the top?

The data is pointing to a new brew: See what’s on tap…

The Big Winner of the Bud Light Meltdown

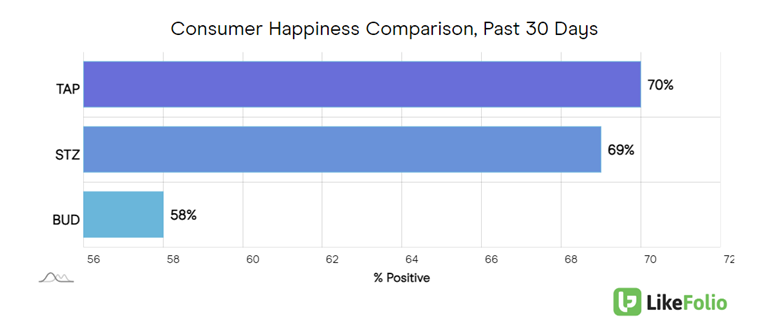

Our latest Consumer Happiness chart paints a clear picture of where these beer brands stand.

BUD’s overall sentiment has plummeted to a dismal 58% positive, a significant drop from its pre-controversy high of 76%. This is historically low for an alcohol brand, and it’s evident that the controversy may have left a lasting mark.

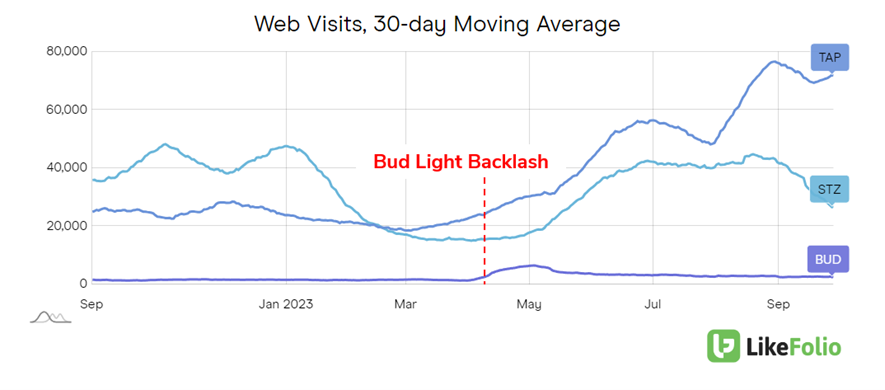

Interestingly, web visits indicate a massive shift towards Molson Coors Beverage Company (TAP), specifically Coors. While both STZ and TAP saw an initial bump post-controversy, TAP’s momentum is undeniable.

Top brass at TAP believe the bump is here to stay.

At its corporate Strategy Day on October 3, CEO Gavin Hattersley said:

“We’re now more than six months into it and we feel very confident based on all the data we’ve seen that this is a permanent shift.”

The company’s web visits have skyrocketed by over 130% year-over-year.

This surge, combined with a high Happiness rating, suggests that many consumers have permanently switched allegiances.

Breaking Down the Brands

So how are we playing each of these names from here?

Each name is ranked according to consumer momentum. Unsurprisingly, we’ll kick it off with Molson Coors…

Molson Coors Beverage Company (TAP): Bullish

Overview: TAP is a major multinational brewer, slightly smaller than BUD, offering a mix of traditional and modern beverages.

Top Brands: Coors Light, Miller Lite, Blue Moon Belgian White, and more.

Growth Drivers: Significant growth in core brands, especially Coors Light and Miller Lite. Their “Made to Chill” campaign and a diversified marketing approach have been game-changers.

LikeFolio’s Take: TAP has a golden opportunity to capture a significant portion of light beer drinkers. Our data supports a bullish outlook for the brand.

Constellation Brands (STZ): Neutral

Overview: STZ is known for its premium beer and wine brands and has diversified by investing in the cannabis industry. It currently has a 38.6% stake in Canadian cannabis giant, Canopy Growth (CGC).

Top Brands: Corona Extra, Modelo Especial, Pacifico, Robert Mondavi, Kim Crawford, and more.

Growth Drivers: Strong growth in their beer business, with a focus on high-end Mexican beer brands. Modelo took the crown for bestselling beer in the Bud Light fallout. Constellation recently reported double-digit sales growth in its beer business during its second-quarter earnings call and raised its 2024 guidance.

LikeFolio’s Take: While Mexican beer is trending, our metrics suggest a slowdown in growth for STZ. Its wine and liquor divisions aren’t doing as well as the beer side.

Anheuser-Busch InBev (BUD): Neutral

Overview: BUD is the world’s largest brewer with a vast portfolio and a global expansion strategy.

Top Brands: Budweiser, Bud Light, Stella Artois, and more.

Growth Drivers: Brand portfolio strength, global footprint, and a focus on long-term investments.

LikeFolio Take: BUD has a long road to recovery. However, its global presence and recent financial performance indicate the potential for a comeback.

The Final Pour

While BUD and STZ are under the microscope, TAP is the one to watch. The market might be underestimating its potential, and we’re excited to see how this beer battle unfolds.

But in the meantime, we can show you another big beverage winner with proven 327% moneymaking potential right here.

Cheers. 🍻

Until next time,

Andy Swan

Founder, LikeFolio

On Tap from Derby City Insights: AI Opportunities Worth Raising a Glass to

The AI-Powered Streamer Beating Apple at Its Own Game

Each time this Apple competitor rolls out a new AI-powered feature, consumer buzz rockets off the charts. Check out how this streamer cracked the code…

This Microcap Could Be the No. 1 AI Pick of the Decade

If you missed the meteoric rise of Nvidia, you don’t have to get caught on the sidelines again thanks to a tiny, little-known microcap that could soar even higher…

AI Game Maker Sparks Outrage: The Bullish (and Bearish) Case

With AI momentum as a profit booster, this stock was looking like a clear winner before its latest update sparked outrage. Here’s how we’re playing it now…