From rushed weekday mornings to lazy Sunday brunches, cereal has been a delightfully crunchy morning companion since our youth.

Whether your go-to choice was Lucky Charms with its multi-colored marshmallows, Cinnamon Toast Crunch with the leftover milk turning into “cinnamon-flavored liquid gold,” or fiber-filled Cheerios, there is something out there for everyone.

And with the breakfast titan General Mills (GIS) reporting earnings today, I wanted to take a step back and show how this seemingly simple meal became a $22 billion industry…

The Rise (and Fall) of Cereal

Cereal wasn’t born in a bustling city or a fancy food lab. Instead, it sprouted in the most unlikely of places, thanks to a pair of brothers with a vision. (Something my brother Landon and I can relate to.)

Meet the Kelloggs: John Harvey and Will Keith, two brothers running a health resort in Battle Creek, Michigan, with a lifestyle that would make even the most dedicated health nuts of today raise an eyebrow. (Think vegetarianism, zero alcohol, and a big no-no to our beloved caffeine fixes.)

As the head honcho of the Battle Creek Sanitarium, John Harvey was on a mission to reform America’s eating habits. But let’s face it, his diet plan was a bit… bland. So, in a bid to add some flavor to their patients’ plates, the Kellogg trio (including John’s wife, Ella) began tinkering with recipes.

One night, while attempting to manufacture this digestible bread variant, they accidentally created wheat flakes… And the world’s first flaked cereal product was born.

Business-savvy brother Will was able to package and market this creation as the iconic Kellogg’s (K) Corn Flakes we all know today.

Consumers enjoyed the convenience and long shelf life of this breakfast staple for decades.

It turned breakfast from a rushed endeavor to cook food before racing off to work and school to families actually being able to sit and spend time together at the table, establishing breakfast as “the most important meal of the day.”

A century later, many of us still value time-saving food options. But cereal has morphed into more of a dessert than a breakfast food – with loads of sugar, chocolate, and ingredients most people can’t even pronounce jammed into each bite.

And consumers are, well… over it.

Sugary, carb-packed cereals are being swapped for nutrient-rich breakfasts and healthier on-the-go breakfast options.

And as America’s appetite shifts, cereal titans like Kellogg’s, General Mills, and Post Holdings (POST) are having to make radical moves to keep up.

I’ll show you how these players are adapting – for better or worse – and what to make of General Mills after its just-released earnings report…

🥣 Stock No. 1: Kellogg’s (K)

Top-selling cereal: Frosted Flakes. Boxes of Frosted Flakes sold to date: 132.3 million.

Starting in 1969, Kellogg’s saw an opportunity to branch out into other consumer packaged goods products – eventually solidifying its place in the snack aisle in 2001 with a $3.87 billion acquisition of the Keebler Company.

Today, snacks make up the majority of the “OG” cereal maker’s net sales.

And with cereal on the decline, Kellogg’s has big plans to spin off its North American cereal division into a new company named WK Kellogg’s (in honor of Will Keith).

The move will allow Kellogg to focus on its snacking segment, including brands like Pringles and Cheez-It, under a new name, Kellanova.

Once the spinoff is made official by the end this year, WK Kellogg will trade on the New York Stock Exchange (NYSE) under its own stock ticker, KLG.

General Mills and Post, on the other hand, are leaning into another growing market that could make all the difference in the long term.

🥣 Stock No. 2: General Mills (GIS)

Top-selling cereal: Cheerios. Boxes of Cheerios sold to date: 139.1 million.

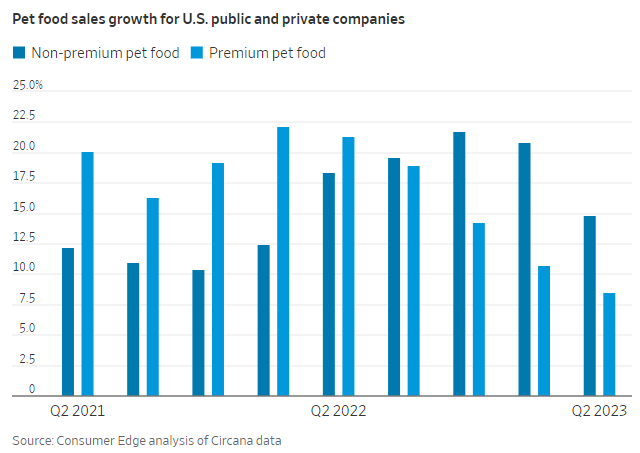

General Mills acquired premium pet food brand, Blue Buffalo, in 2018 as part of a bold bid to reshape its product portfolio with a Pet Segment. The move immediately made General Mills the leader in the growing Wholesome Natural pet foods category.

And with one in five households adding a pet to their families during the pandemic, that move quickly proved lucrative.

In 2022, the Pet Segment brought in $2.3 billion in revenue for General Mills, reflecting a 30% year-over-year uptick as it expanded its pet food offerings with acquisitions of Nudges, True Chews, and Top Chews treat brands.

But tough choices are being made this year as consumer wallets get tighter.

Earlier this month, General Mills leadership noted challenges as pet owners opt for cheaper or smaller-sized food options.

As a result, organic net sales for the company’s pet segment remained flat in the most recent quarter at $580 million – just as General Mills execs expected.

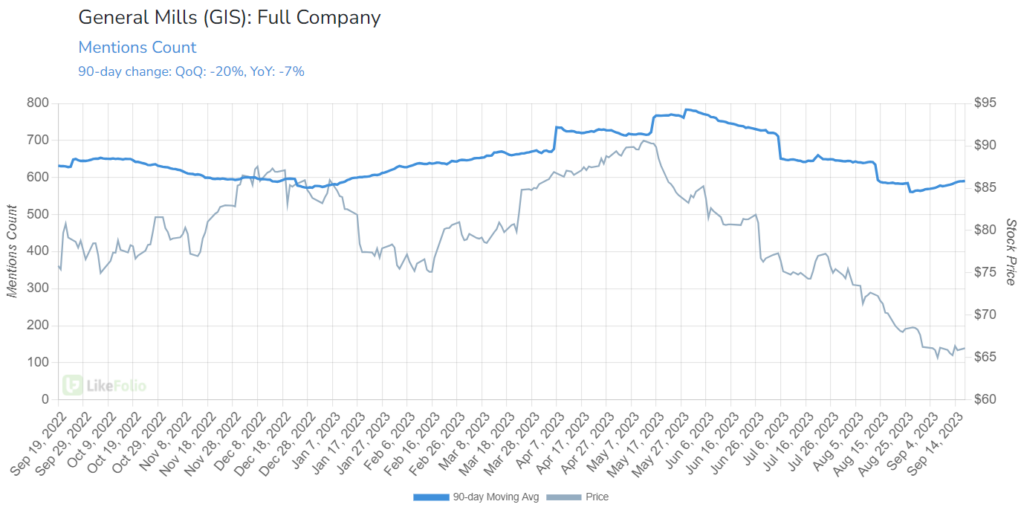

LikeFolio data confirms year-over-year softening for General Mills as a whole, at least on the consumer front. Mentions have slipped by as much as 7%.

Notably, though, folks seem happy with the Blue Buffalo brand – Consumer Happiness has grown by four points year-over-year to 75%.

The company’s CFO, Kofi Bruce, believes that the long-term trend will still favor premium pet food offerings as consumers often treat their pets like family.

🥣 Stock No. 3: Post Holdings (POST)

Top-selling cereal: Honey Bunches of Oats. Boxes of Honey Bunches of Oats sold to date: 111.3 million.

Post made a similar bet here in 2023 to help offset declines in its own cereal sales.

In April, the company completed its acquisition of a few key pet food brands from The J.M. Smucker Co. (SJM), including Rachael Ray Nutrish and Nature’s Recipe.

Those pet food sales added $275.3 million to its Post Consumer Brands segment in the third quarter. With only a couple months under its belt, we’re waiting to see the long-term impacts.

But a 2023 Bloomberg Intelligence report put the pet food market’s growth potential in perspective: By the end of the decade, the value of this global industry could zoom over 50% to $493 billion.

Post and General Mills are claiming their slice of that pie today.

As always, we’ll be keeping an eye on this sector and the developing changes to provide you with the best opportunities before everyone else realizes their potential.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. Cereal companies have zeroed in on the fact that it’s just not people that need breakfast – our furry friends need it, too. With pets being a $261 billion global industry, there’s a lot of money to be made. And not just in food…

There’s another slice of the market where demand is accelerating, with one tiny player in a fantastic position for growth.

I’m talking about a small-cap stock that our system recently flagged as a buy for MegaTrends subscribers. Website visits climbing 29% year-over-year and an industry-leading Consumer Happiness level of 80% earned it a very bullish Social Heat Score of 81.

We believe this stock has the potential to soar 500% over the next four years. And if you’re not yet a paid-up subscriber, we invite you to find out how you can get in on the opportunity today by clicking here.

Trending Now: Fall Favorites to Turn into 2024 Profits

To stay ahead of the investing curve for 2024, you need to know about these companies gaining serious traction with consumers in 2023…

No. 1

The Beloved Beauty Retailer on Discount

Consumers love the special discounts, free gifts, and early access they get from this beauty retailer so much that Consumer Happiness is up 10% year-over-year. We love it because its stock price looks like a steal right now… And we’re buying the dip.

No. 2

The “Undercover” AI Winner Under $3

Demand mentions for this company are currently surging 120% year-over-year. This undercover AI play has already doubled since it first hit our radar a few months back, but you can still grab shares for under $3 if you act fast… More here.

No. 3

The Comeback Kid Generating Buzz

As America heads back to school, fall fashion is top-of-mind. And one iconic brand is having a moment. Preppy is back in, buzz for this company’s classic threads is up by 56% year over year, and we see a comeback in the making… Check this out.