The problems with our debt ceiling haven’t been solved – the proverbial “kicking a can” of issues is just being pushed further down the road.

And as the recent deal does little to slow the massive buildup of federal debt, one asset is starting to emerge as a beacon of stability – Bitcoin (BTC).

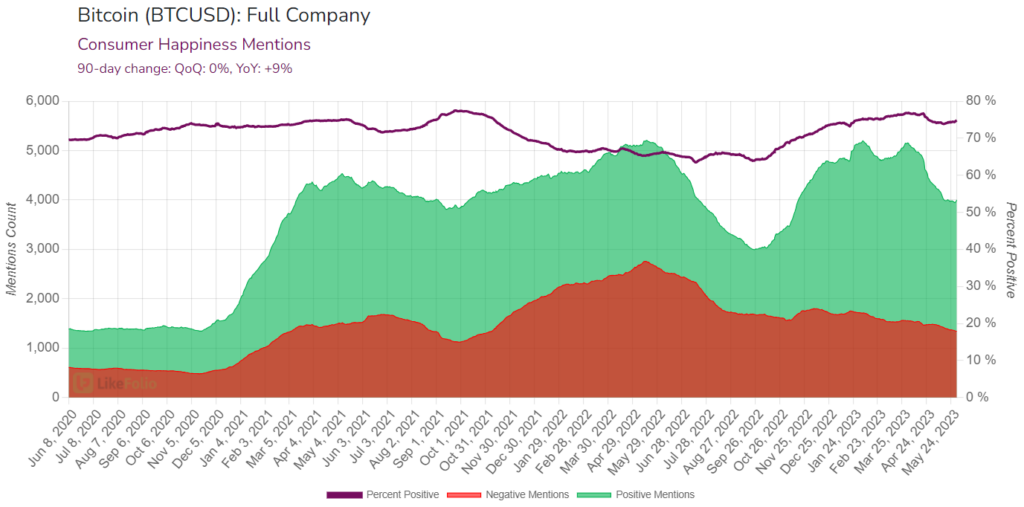

We’re already seeing Consumer Happiness mentions of Bitcoin increasing over the last year, which could have some correlation – among other things – to people getting sick of the political posturing in Washington wrapping the stock market in uncertainty.

But I know what you’re thinking, “Andy, aren’t Bitcoin prices all over the place? Isn’t crypto volatile? Aren’t there lawsuits against crypto exchanges right now?”

Yes.

Compared to stock prices, it does take a little bit of extra grit to ride out waves of volatility as a crypto investor.

But Bitcoin’s capped supply and immunity to inflationary pressures make it a compelling long-term investment and store of value. That’s important to know, as the debt deal failed to address the growing revenue shortfall and the increasing spending on health and retirement for the aging population.

That could all continue to lead to high levels of inflation and a devaluation of the U.S. dollar.

So, despite the near-term turbulence in the adoption of crypto, especially among institutional investors, we remain bullish on Bitcoin.

🔥 Hot Take: We’re setting a price target of a whopping $250,000 by 2028. Currently, the price of Bitcoin is hovering between $25,000 and $27,000. 🔥

Here are four reasons why we think this price target is realistic…

Reason No. 1: Hedge Against Inflation

Even though inflation may be “cooling,” ask yourself if your grocery bill or going out to eat looks any cheaper.

The Federal Reserve is still well below its target inflation rate of 2%. And it’s going to be a longer fight to get it under control than they would like to lead on.

In other words, inflation is going to stay “sticky.”

As more people realize this and see more fiscal instability play out, the demand for cryptocurrencies – especially for Bitcoin as the most well-known crypto – is only going to grow.

Reason No. 2: Security

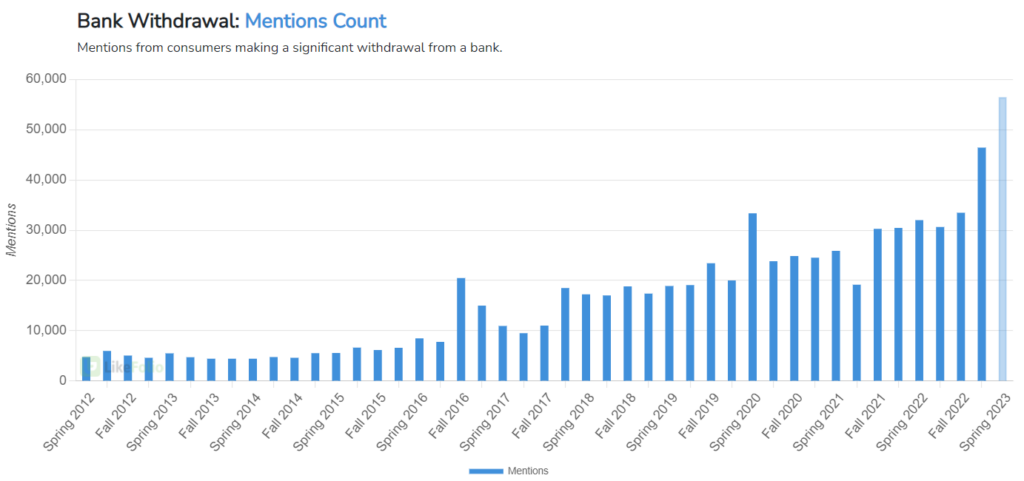

With the banking collapses in March, we were all reminded the hard way that stashing your money in a bank isn’t always a true security blanket.

Even for folks who didn’t have money at the banks that failed, it was still enough to cause a 65% year-over-year change in “Bank Withdrawal” mentions.

Bitcoin is by no means perfect, but it can still serve as a safer alternative than the traditional banking system.

At least with crypto, as long as you take the proper precautions of keeping it safe through things like a hardware wallet, you will have access to YOUR funds – 24 hours a day… seven days a week.

And with a study finding 186 more banks in the United States at risk of collapse, people are not going to keep sticking around with the traditional finance system and hope their hard-earned money is safe.

Reason No. 3: Growing Interest in DeFi

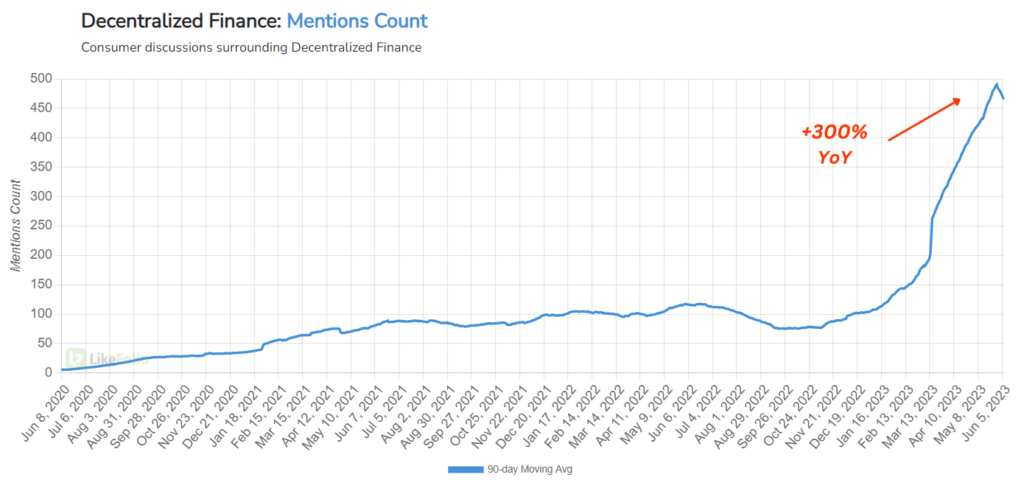

Much like the security aspect of Bitcoin – being based on a “trustless” system that doesn’t have humans involved to screw things up through incompetence or greed – people are starting to appreciate the “decentralization” aspect of crypto and what it could provide.

You can conduct peer-to-peer transactions without waiting days from an intermediary like you may have to for a wire transfer.

In broad strokes, DeFi is emerging as a cheaper, faster, and permissionless way to handle transactions.

And social media chatter around its potential is surging: +300% year-over-year as I write this, according to LikeFolio data.

Reason No. 4: Resilience Amid Regulatory Challenges

Bitcoin has shown resilience in the face of regulatory challenges in the past.

For instance, in September 2021, Bitcoin faced a significant regulatory challenge when China announced a blanket ban on all crypto transactions and mining, causing a considerable drop in Bitcoin’s price.

However, over the next few months, it gradually regained its value and even surged to new heights – hitting its all-time high of $69,044.77 on November 10, 2021.

By December 2021, Bitcoin’s price had risen significantly, marking a recovery and growth despite the regulatory pressures.

Bottom line: As a hedge against inflation, a security asset, growing interest in DeFi, and resilience against regulatory challenges, investors with a long-term outlook could be in line for a nice profit opportunity from Bitcoin.

🔥 Hot Take Reminder: We’re setting a price target of a whopping $250,000 by 2028. Currently, the price of Bitcoin is hovering between $25,000 and $27,000. 🔥

Until next time,

Andy Swan

Founder, LikeFolio