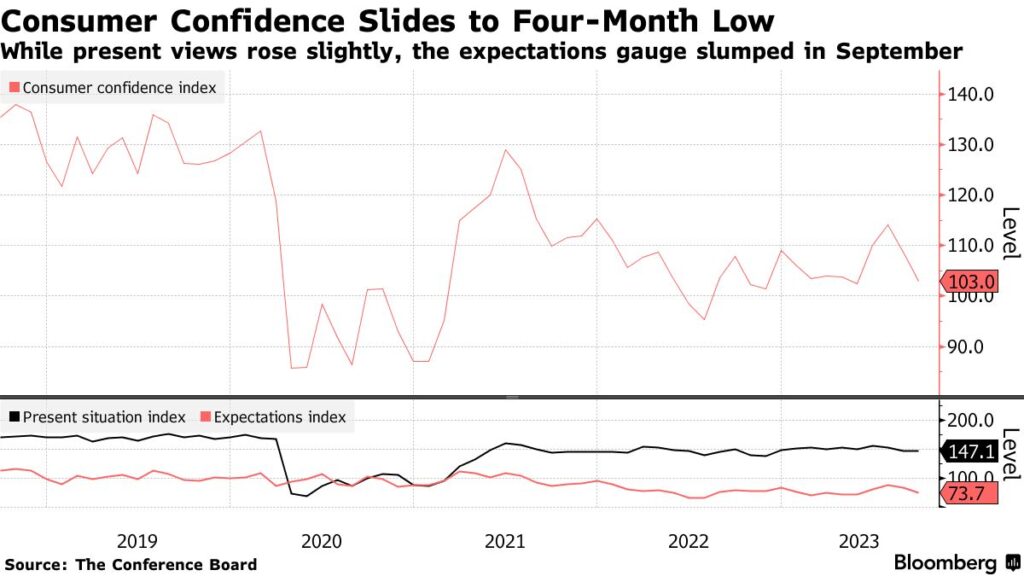

This just in: Consumer confidence in September sank to its lowest level in four months, according to the latest Conference Board survey.

For the everyday Americans surveyed, rising prices were still top of mind, with gas and food prices both chief concerns.

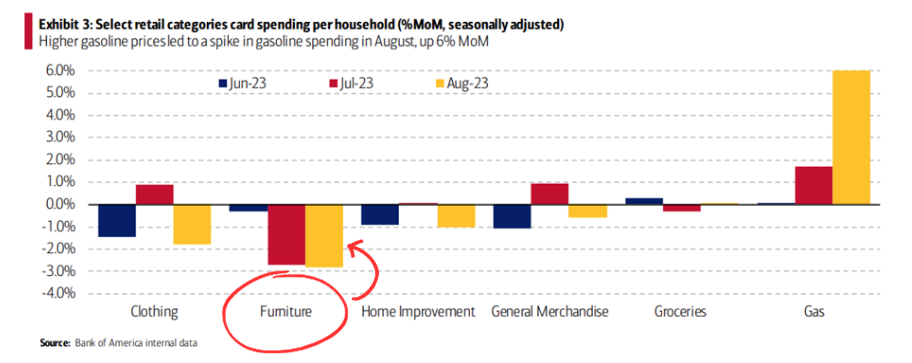

As lingering inflation eats away at the consumer psyche, Bank of America’s most recent “Consumer Checkpoint” report helps break down which sectors could be the hardest hit.

While spending in other categories like groceries remained relatively stable over the summer, furniture saw by far the biggest slowdown, as you can see from the chart below:

A typical 10-second analysis from a Wall Street “big shot” on the financial news outlet of your choice would see that data and tell the audience that a furniture retailer like Wayfair (W) now looks like it’s in trouble. Heck, shares are down nearly 5% since Friday.

But while they rely on retroactive data like this to drive their investment strategy, here at LikeFolio, we’re one step ahead.

Our real-time pulse on Main Street sentiment arms us with a more forward-looking view of the opportunity.

And right now, it’s painting a different picture for Wayfair – suggesting a potential lift higher when it reports earnings in November that may shock everyone – except for you.

Because armed with what we’re about to share, you can set yourself up for this potential profit play.

Take a look…

Why Wayfair Could Defy the Odds

- A Strong Back-to-School Showing

There’s been an overall decline in consumer spending on furniture and home improvement, but LikeFolio data indicates robust back-to-school spending.

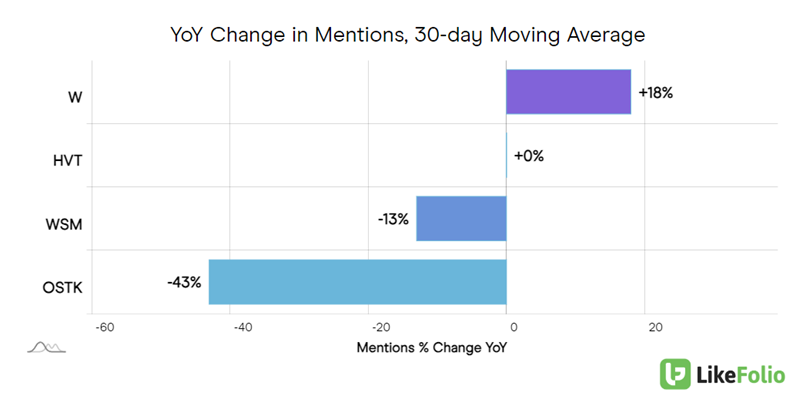

Wayfair mentions have surged by 18% year-over-year during this critical season as offers like The Surplus Sale, Closeout Deals, Open Box Deals, and 24-Hour Flash Deal Fridays appeal to price-sensitive consumers.

- A Superior Customer Experience

The Wayfair app helps put those deals in the palms of consumers – and fast and free shipping over $35 makes it easier than ever to hit “buy” on bulky furniture products.

The July launch of its AI-powered virtual room makeover app, “Decorify,” has further enhanced the consumer shopping experience.

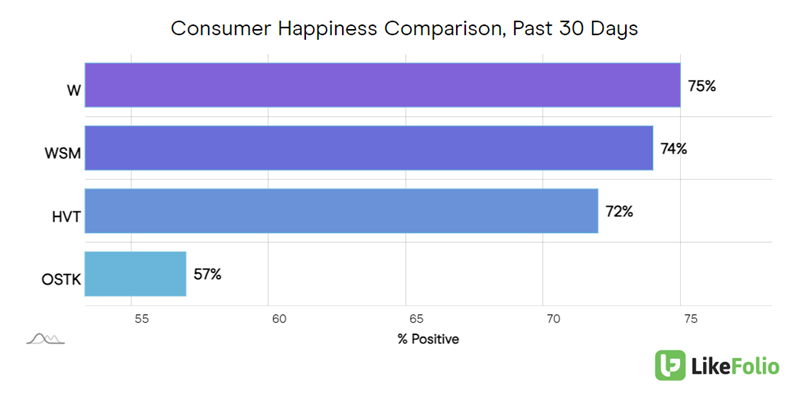

And these efforts are paying off in increasingly happy customers: At 75%, Wayfair leads the pack in overall Consumer Happiness levels.

A Lead Over the Competition

With major competitor Bed Bath & Beyond out of the picture, Wayfair is seizing the opportunity to gain market share.

Traffic to Wayfair.com notably ramped up following the closure of Bed Bath & Beyond stores and has been steadily rising since.

Compared to competitors like Haverty Furniture Companies (HVT), Overstock.com (OSTK), and Williams-Sonoma (WSM), who have seen mentions decline, Wayfair has the only positive buzz – recording 18% year-over-year mention growth.

- A Well-Timed Pullback

While the slowdown in spending on home furnishings mentioned earlier has fueled a recent downturn in the stock, we believe this only makes Wayfair that much more appealing.

Who doesn’t love a cheaper entry point for a stock?

Wayfair won’t report its next batch of earnings until later this fall – likely November. But with a lower bar, Wayfair is well positioned to surpass expectations – adding to the likelihood of an upside surprise.

For traders, our forward-looking data provides an early glimpse at a potentially favorable outlook with a bullish Earnings Score of +64.

🔥 New Bullish Alert for September 27, 2023 🔥

Our predictive stock-picking system just made one of its biggest moves yet – swinging one online marketplace’s Social Heat Score from a bearish 21 (sell) to a bullish 71 (buy), and issuing a time-sensitive opportunity alert for LikeFolio Investor subscribers. (Paid-up members: Access your alert here.)

After taking 50% profits from a short position on this same stock, that massive Social Heat Score move higher has us buying up shares for a shot at even bigger profits.

Go here now to find out how you can join for immediate access to this just-issued buy alert, along with over a dozen other open positions you can act on today.

Until next time,

Andy Swan

Founder, LikeFolio

Trending Now in Derby City Daily

Find out what’s hot with consumers (and what’s not), and how we’re playing those trends for our own profits this fall, with these free investor insights…

#AI, #unity, $U

AI Game Maker Sparks Outrage: The Bullish (and Bearish) Case

When consumers feel like corporations put profits ahead of users, the results can be disastrous. With Unity feeling the heat, just how concerned should you be about this otherwise bullish AI pick?

#olivegarden, #inflation, $DRI

Value Brands Give This Stock a Surprise Upside

Ruth’s Chris officially joined Darden’s other high-end banners like The Capital Grille in June. But LikeFolio data suggests it’s the value-driven brands like Olive Garden that are leading Darden’s growth of late…

#breakfast, #petfood, $GIS

Billion-Dollar Cereal Battles (3 Stocks to Watch)

Cereal has morphed into more of a dessert than a breakfast. And as America’s appetite shifts, cereal titans like Kellogg’s, General Mills, and Post are having to make radical moves to keep up…