“The battlefield is a scene of constant chaos. The winner will be the one who controls that chaos, both his own and the enemies.” – Napoleon Bonaparte

Consumer trust in large institutions is faltering.

It’s not a surprise.

Hardworking, everyday Americans feel like they’ve been let down – over and over again – by our so-called leaders in Washington, by big corporations, by the news media, and more.

Gallup poll results show degrading confidence in institutions, including Congress, media, public schools, and organized religion.

Banks are the latest of the institutions to get a “no confidence” vote.

For example, in 2022, just 27% of Americans reported having a great deal or quite a lot of confidence in banks compared to 33% in 2021 and 38% in 2020.

And these feelings of angst – and betrayal – lead to action.

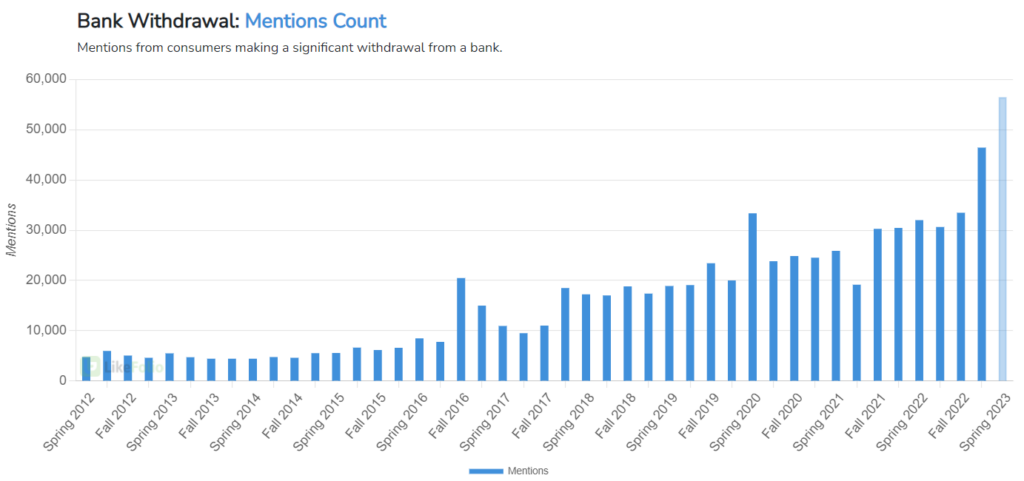

Here at LikeFolio, we’ve seen a surge in consumer mention volume related to the failure of small- to mid-size banks in 2023.

Check out how mentions of banking withdrawals skyrocketed in the last quarter, currently up 81% year-over-year:

Here’s where things get interesting, though.

Because, as Napoleon once said, chaos absolutely leads to opportunity.

Even with the banking crisis.

We can show you how, why – as well as the opportunities that crisis has spotlighted – right here…

Crypto’s Stunning Role Reversal

When banks started collapsing, Bitcoin (BTC) roared back from the doldrums and shot upwards of $30,000.

But it happened so fast that most folks didn’t have a chance to fully process what was happening.

Banks, which have been around 1,800 BC, have traditionally been viewed as a super-safe haven for cash.

But with the crisis, that view suddenly changed.

Banks were now risky.

And in one of those ironic market moves, a digital asset that was created less than 15 years ago was suddenly viewed as a safer option.

So we witnessed a “flight to safety,” from banks and into cryptocurrencies.

Ironic… but maybe not as bizarre as it sounds since cryptos are:

- Immune to being frozen and seized…

- Censorship resistant…

- Permissionless…

- And decentralized.

Viewed through that lens, it makes sense that the flaws of the banking sector gave consumers and businesses a better-by-comparison view of crypto.

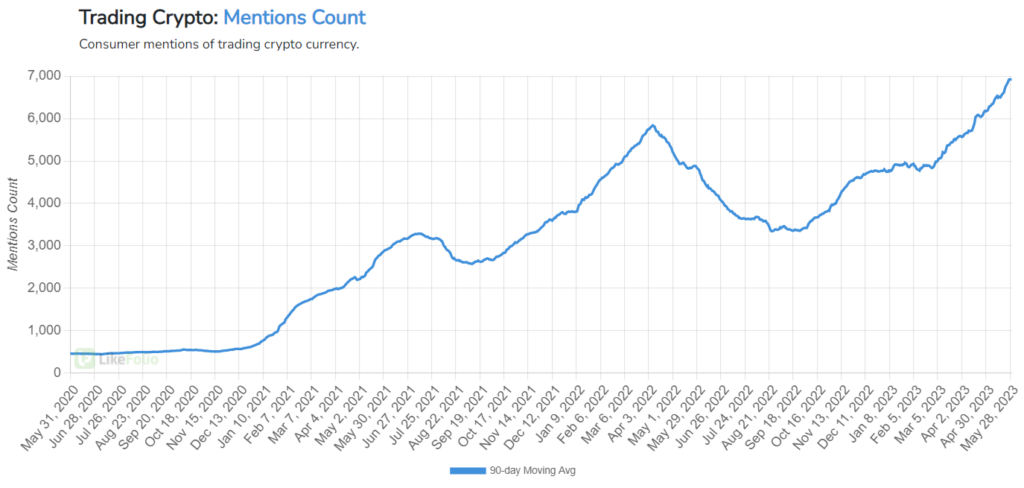

And that sentiment shift sparked an uptick in three segments where LikeFolio consumer trend data is experiencing a hefty year-over-year ramp-up in momentum.

We’re talking about:

- Decentralized Finance: +327%

- Cryptocurrency [Trading]: +44%

- Blockchain Technology: +70%

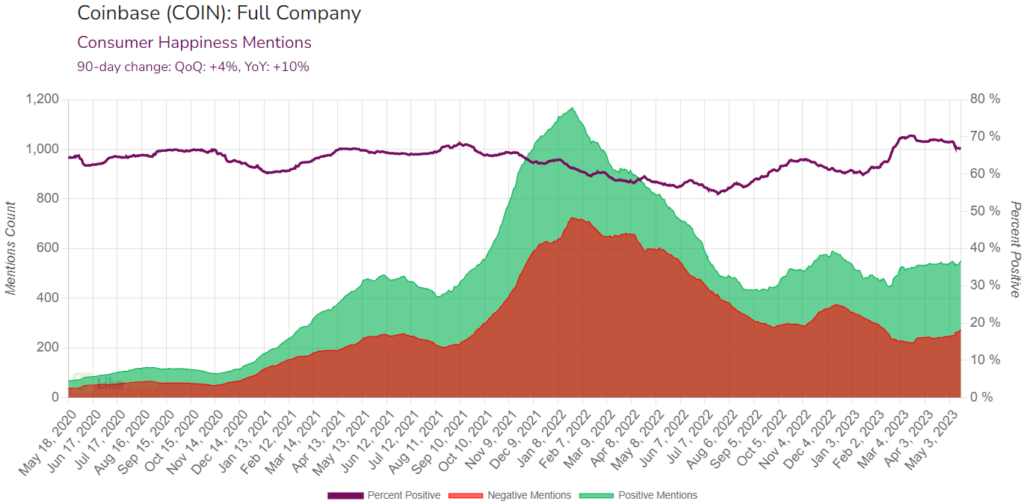

At the same time, our system has logged significant leaps in Consumer Happiness for one specific publicly-traded crypto exchange.

Add in renewed consumer interest in cryptocurrency, and we’re back to our premise: Even in chaos, there’s opportunity in this crypto-exchange play…

That company is Coinbase (COIN).

Why Coinbase Is a Clear Winner

As the world’s largest publicly traded cryptocurrency exchange, we believe Coinbase is positioned better than anyone to cash in on a crypto future.

The company provides the “infrastructure” that makes global cryptocurrency trading possible, including:

- Cryptocurrency accounts, digital tools, and educational resources for individual investors

- A crypto transaction marketplace for institutions

- And technology that helps developers build crypto-based apps that can accept crypto as payment.

Coinbase’s exchange platform offers trading in hundreds of different cryptocurrencies with $130 billion in assets on its platform.

And because it collects a percentage on each transaction, Coinbase’s performance is directly tied to interest in Bitcoin and Ethereum (ETH). And the renewed interest in crypto here in 2023 bodes well for its bottom line.

More Folks Buying BTC and ETH = More Revenue for Coinbase

LikeFolio data shows that consumer mentions of cryptocurrency trading are rising again – surging 44% on a year-over-year basis:

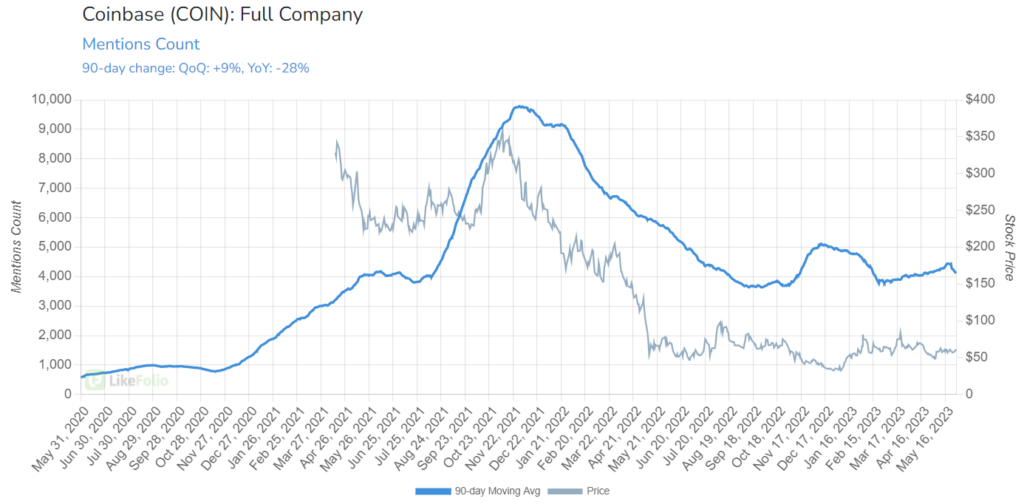

In the company’s last report, consumer and institutional trading volume dropped on a year-over-year basis.

Coinbase Purchase Intent (demand) dropped with it, as seen in the chart below.

However, the company handily beat earnings and revenue expectations, driven partially by unexpected strength in subscription and services revenue.

The stock rose 18% on May 5, the day after earnings were released.

And Coinbase mention volume is now gaining steam in the second quarter of 2023, gaining 9% quarter-over-quarter:

Consumer Sentiment Is Best of Breed

The impact of the banking disaster earlier this year has turned Coinbase into a sort of “safe haven” for investors.

Coinbase is the only crypto exchange of its kind that’s publicly traded. And because its financial statements are audited by a Big Four accounting firm, it provides a level of transparency that no other crypto exchange is able to.

That transparency and accountability have translated to a 10% year-over-year boost to Coinbase’s Consumer Happiness:

Consumers increasingly report trust in the company, citing its regulation, compliance, and security protocols as main drivers of positive sentiment.

In addition, the company’s user-friendly interface makes it easy to attract first-time crypto buyers – and to keep the customers it already has.

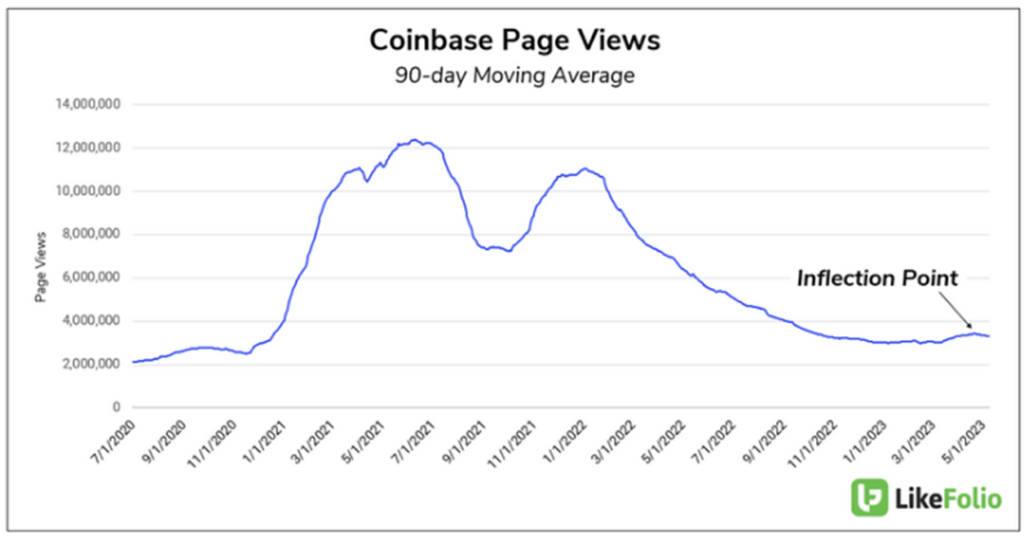

Page Views Reach Inflection Point

Here in the LikeFolio universe, page views are the most highly correlated metric to Coinbase revenue. In the last quarter, these views have reached an inflection point – and reversed a multi-year downward trend.

This is a metric that will be absolutely critical to Coinbase’s future success. So we’ll be watching these numbers very carefully from this point on.

What’s Next?

Look, we know there’s been a lot of bad news on the crypto stage. A bad macro narrative and such events as the Terra Luna crash and the FTX collapse helped Bitcoin lose more than 60% of its value last year.

But we also know that Coinbase has rebounded 80% so far here in 2023.

One of the big questions investors are asking is clear: Is crypto headed for another rally?

Bulls argue that network activity is on the rise, while the bears often cite looming regulatory hurdles.

It’s worth noting that over the last 14 years, the crypto industry has “died” hundreds of times. Bitcoin alone has experienced its own epitaph 474 times, according to 99Bitcoins.com.

Yet despite the constant predictions, crypto is still making folks money.

We continue to be bullish on Bitcoin here; Landon even named it one of his favorite opportunities for 2023.

Just remember that where there’s crypto, there’s volatility. And that makes Coinbase an inherently risky play.

For example, in April 2023 Coinbase sued the Securities and Exchange Commission, asking a federal judge to force the regulator to answer Coinbase’s July 2022 petition about whether existing rule-making processes for securities could be applied to the crypto industry.

The lawsuit followed a March SEC warning to Coinbase that enforcement action against the exchange may be forthcoming.

But that didn’t stop us from taking a big win in on Coinbase this earnings season: Earnings Season Pass members who followed our COIN trade were able to cash out for a 216% return.

One thing’s for sure: We plan to keep making money on Coinbase. And we’ll keep making our wins your wins.

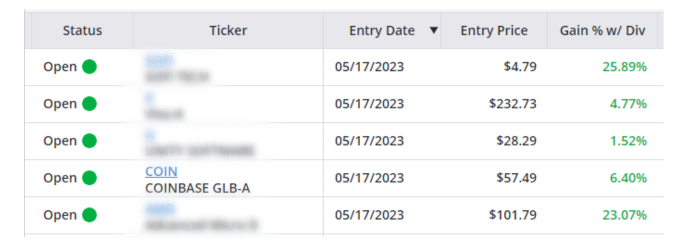

Coinbase was just one example of five opportunities featured in our May MegaTrends report – including three additional bullish ideas and one tantalizing bearish setup emerging for a company trading near multi-year highs.

Check out how those positions have performed in the span of just a couple of weeks:

See that 25.89%, our top performer? Tomorrow, I’ll reveal which stock that is and how you can get in on the action.

Until next time,

Andy Swan

Co-Founder