The official start of Spring kicked off on Monday and if you’re anything like me, you’re already itching to shake off the winter hibernation with some adventure outside the home.

Hiking, visiting the farmer’s market, and sipping a cocktail on the porch is more my style, but not everyone is looking to stay on dry land as the weather warms up.

In fact, this year, folks are going all-in on all-inclusive cruises.

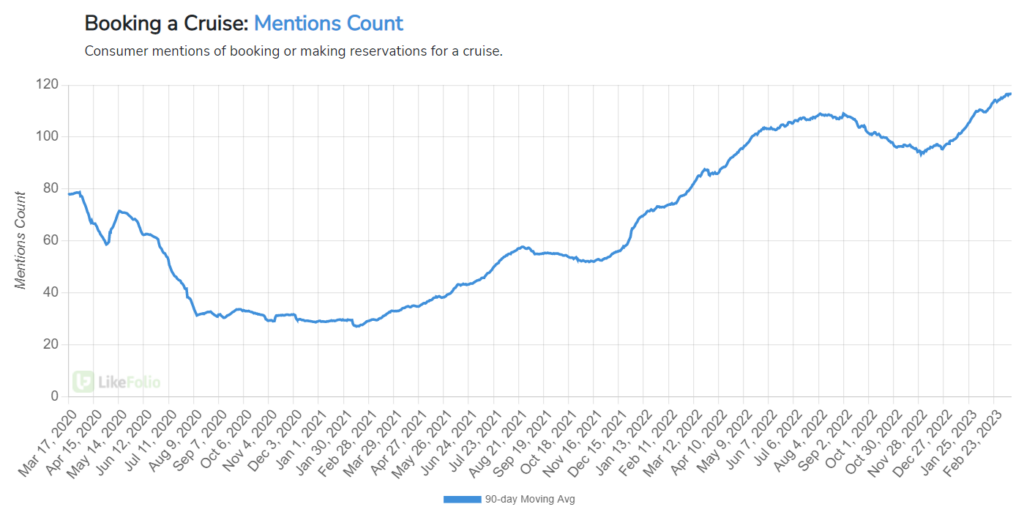

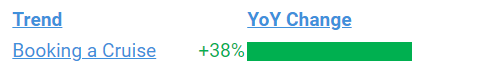

While social media mentions of booking a hotel are up 13%, chatter around booking a cruise is booming – trending 38% higher this year to exceed even pre-pandemic levels:

Cruises aren’t exactly known for being cheap but they are known for being all-inclusive – and that has become particularly desirable for consumers looking to save where they can.

Where there’s demand, there’s opportunity – and the top cruise lines are vying to capture consumers. But which cruise line is winning the battle?

Our consumer data paints a lucrative picture for the entire industry.

But there’s one cruise stock in particular that we want to put on your investing radar, as it could see price movement as soon as next week thanks to a key catalyst…

Cruises Aren’t Dead After All

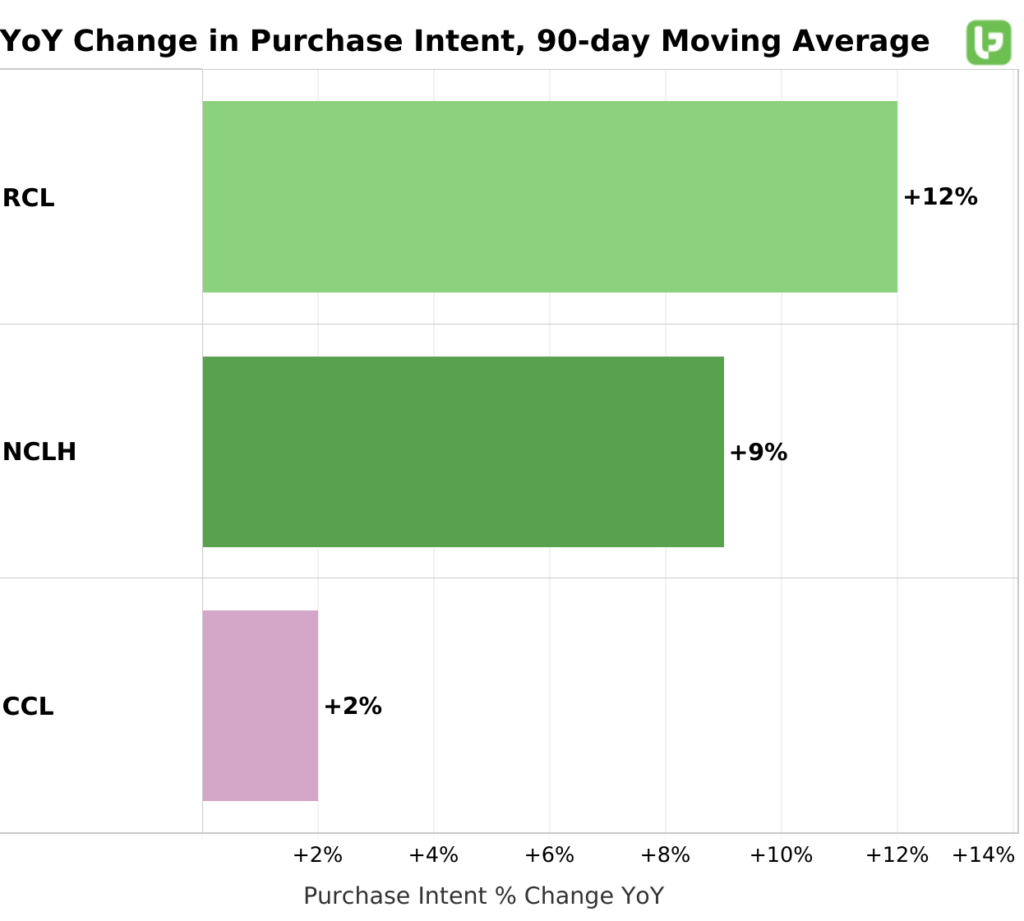

LikeFolio Consumer Purchase Intent (PI) data reveals strong growth for all major players in this space, including Royal Caribbean (RCL), Norwegian Cruise Line (NCLH), and Carnival (CCL):

These three cruise lines have been neck and neck when it comes to capturing consumer demand – just a few weeks ago, LikeFolio data showed NCLH leading in this category whereas now, RCL has the edge.

Cruise line share prices have seen big movement on Wall Street, too.

In February, Norwegian Cruise Line and Royal Caribbean both reported their Q4 and full-year 2022 earnings results to very different investor reactions:

📈 Royal Caribbean exceeded earnings-per-share (EPS) expectations and saw its share price pop nearly 10% immediately following the Feb. 7 report.

📉 But a few weeks later, despite beating revenue forecasts in its Q4 earnings report, a wider-than-expected loss was enough to send Norwegian Cruise Line shares sinking 12%… And take RCL and CCL down, too.

| STOCK | PEAK GAINS 2023 | YTD GAINS 2023 |

|---|---|---|

| RCL | +50.97% (Feb. 9) | +25.25% |

| NCLH | +44.96% (Feb. 15) | +1.76% |

| CCL | +53.16% (Feb. 7) | +8.62% |

And the drama isn’t over yet…

Just yesterday, Norwegian Cruise Line appointed a new CEO, Harry J. Sommer, as Frank J. Del Rio announced plans to retire – and NCLH shares are now trading 5% higher as of this writing.

But it’s all eyes on Carnival now heading into a key earnings report on Monday (March 28).

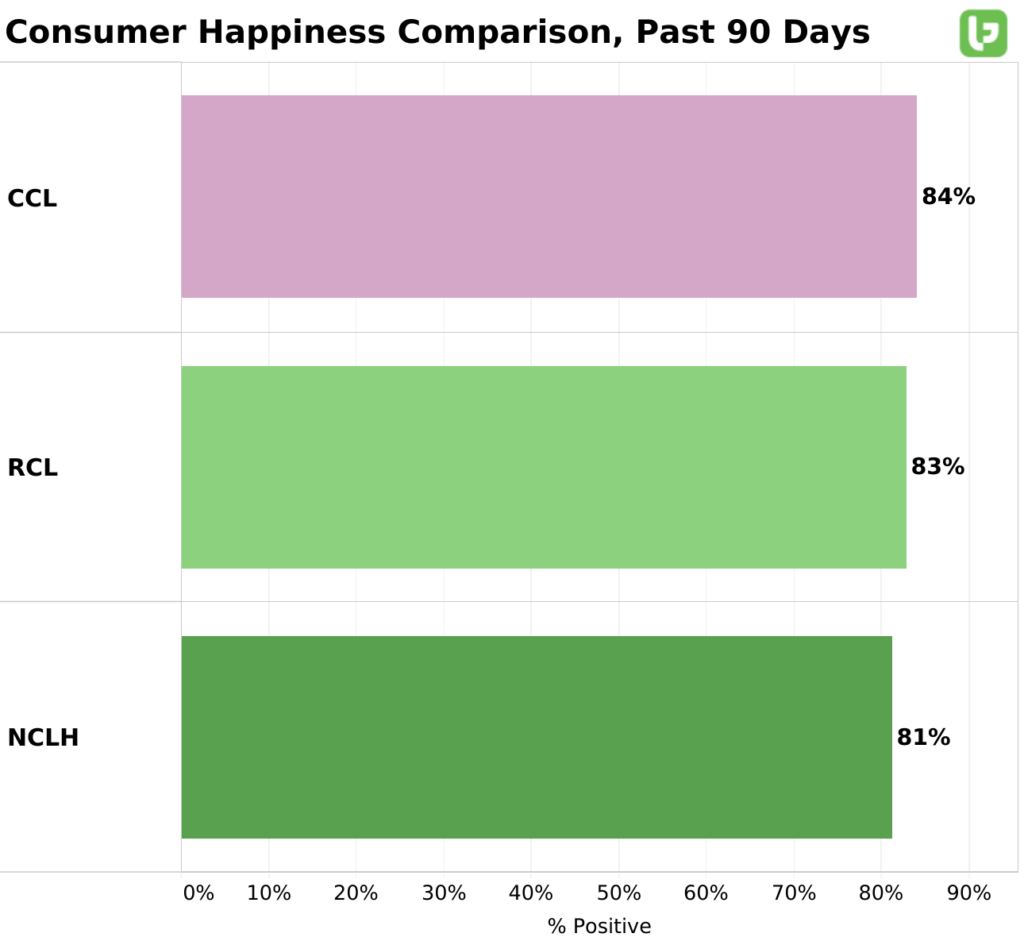

Investors are waiting to hear how CCL managed expenses compared to its peers. And while it may not be seeing the same level of demand growth as Royal Caribbean and Norwegian Cruise Line, Carnival does have an ace with the highest Consumer Happiness levels of the bunch:

Buzz around CCL is ticking higher, too – up 15% from the year prior and growing faster than either of its competitors.

Bottom line: With such robust consumer demand for cruises, each of these companies is positioned for long-term growth.

As for the winner – well, that will be determined by which company can control costs the best.

Put this space on your moneymaking watchlist if you haven’t already.

Until next time,

Andy Swan

Co-Founder

Must-Read for March 21: What to Know Before Wednesday’s Big Fed Verdict

This will be a decisive week for the markets that could shape the investing landscape for the rest of 2023 – and it all comes down to what happens Wednesday afternoon. Here’s what you need to know heading into the big day.