This will be a decisive week for the markets that could shape the investing landscape for the rest of 2023 – and it all comes down to what happens Wednesday afternoon.

That’s when the Federal Reserve will announce its decision about whether or not it plans to hike interest rates on the heels of bank failures and bailouts.

It’s a tough spot to be in:

- If the Fed doesn’t raise rates, inflation could get worse… And that’s bad.

- If the Fed does raise rates, more banks could find themselves holding underwater treasury notes… And put further strain on a very fragile banking system.

Ultimately, we think the Fed will raise rates by a token 25 basis points – if only just to show it can’t be pushed around by markets – and likely signal it’s done with rate hikes until inflation starts to rear its ugly head again.

Either way, Wednesday’s decision will have a dramatic impact on stock prices…

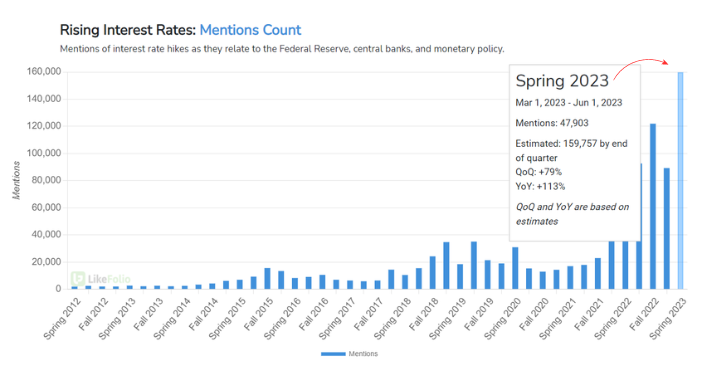

Especially as consumer buzz around rising interest rates continues to escalate:

But before that volatility-inducing decision rocks the markets, you can look forward to a few key earnings releases to shake things up – and create potential profit opportunities.

Here are the top companies set to report earnings between now and then…

Earnings on Tap This Week 📈

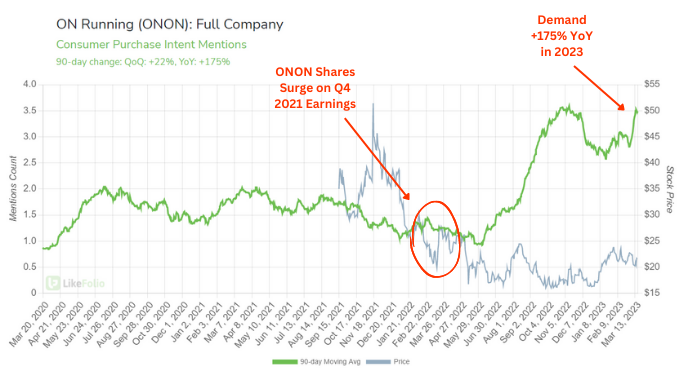

Favorite shoemaker of runners around the world, ON Running (ONON), reports its Q4 2022 numbers on Tuesday. The company is looking to put up its first positive earnings week since surging nearly 40% during this same period last year. The difference now is that LikeFolio data shows ON demand racing 175% higher year-over-year (YoY):

→ Our very own VP of Research, Megan Brantley, featured ONON as her top stock pick for 2023. Find out why you should be bullish on ONON too in this quick video.

Nike (NKE) reports Tuesday after the market closes. And unlike competitor ON, things are not looking good for this classic athletic apparel brand. Our data shows signs of deteriorating demand as wallets get thin: Nike Purchase Intent (PI) Mentions are down 26% YoY and 21% quarter-over-quarter (QoQ).

GameStop (GME) also reports Tuesday after market close for an expected +/- 12.8% move on earnings. Buzz is way down for the video game retailer, dropping 33% from last year along with its share price (down 26%).

The surprise this week could be online pet retailer, Chewy (CHWY), which reports after the market close on Wednesday – amid whatever fallout commences from the Fed’s interest rate decision. Three of its last four earnings moves have been larger than 10% and short sellers have piled into bearish bets against this company. Any surprise to the upside could get explosive.

Bottom line: Be cautious with any positions going into the Fed decision on Wednesday – there’s always another trading day to establish positions with more information.

In the meantime, fasten your seatbelts for another turbulent week, folks.

Until next time,

Andy Swan

Co-Founder

Continued Reading: Inflation Is Down, Bitcoin Is Up, and One of My Favorite Stocks Is Reaping the Benefits

Bitcoin (BTC) is thriving in the face of centralized banking failures. Since I wrote to you last week, the BTC price has gained another 17%. And one of my favorite stocks is gaining right along with it (I‘ll show you which right here).