The best scene from Aaron Sorkin’s 2011 flick about the birth of Facebook, The Social Network, has to go to Justin Timberlake.

Portraying Sean Parker, the founder of the disruptive free music service Napster, Timberlake tells Facebook founders Mark Zuckerberg and Eduardo Saverin to think bigger about their business because “a million dollars isn’t cool.”

“You know what’s cool?” Timberlake rhetorically asks.

“You?” a non-too-enthralled Saverin snaps back.

Timberlake smirks and delivers the knockout punch: “A billion dollars.”

In Meta Platforms’ (META) relentless pursuit of digital dominance, even a billion dollars now looks like pennies.

The company raked in $32 billion in revenue last quarter…

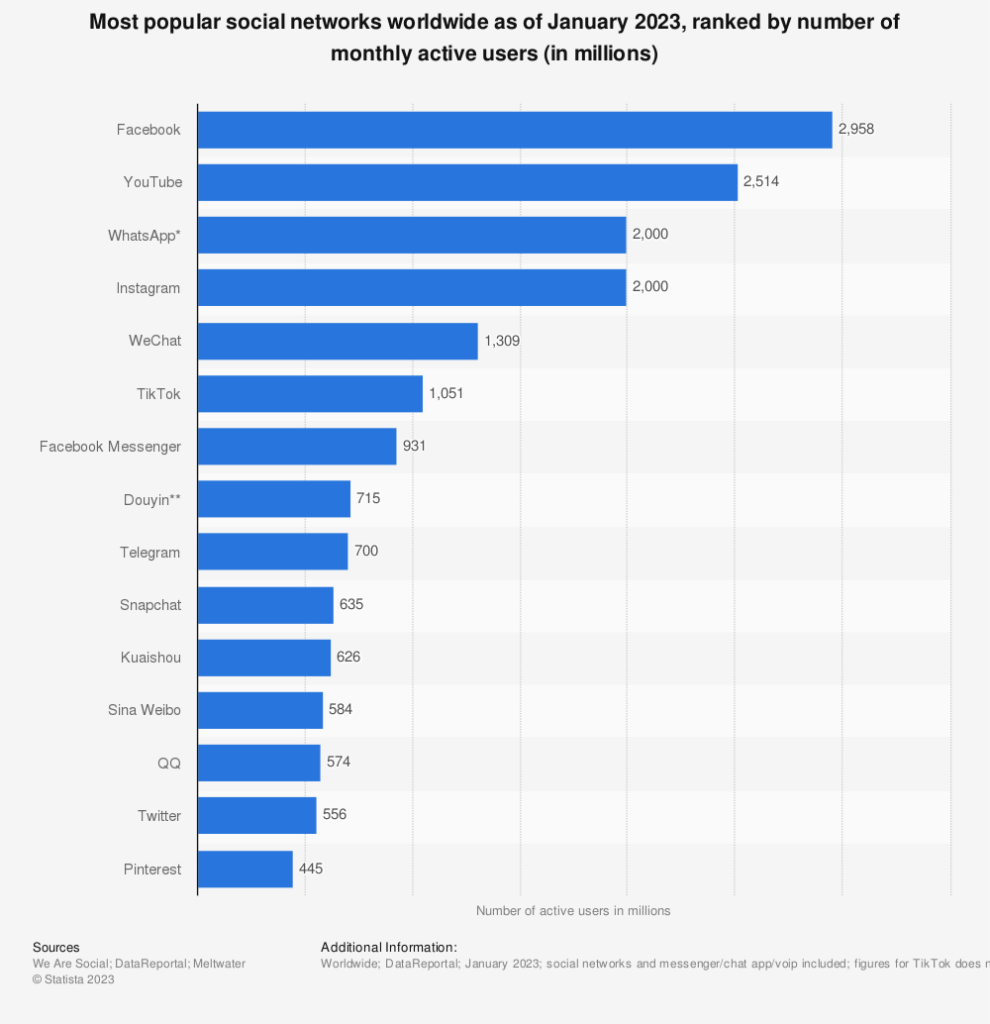

Claims three of the world’s top-five most popular social media networks with WhatsApp and Instagram now on its roster…

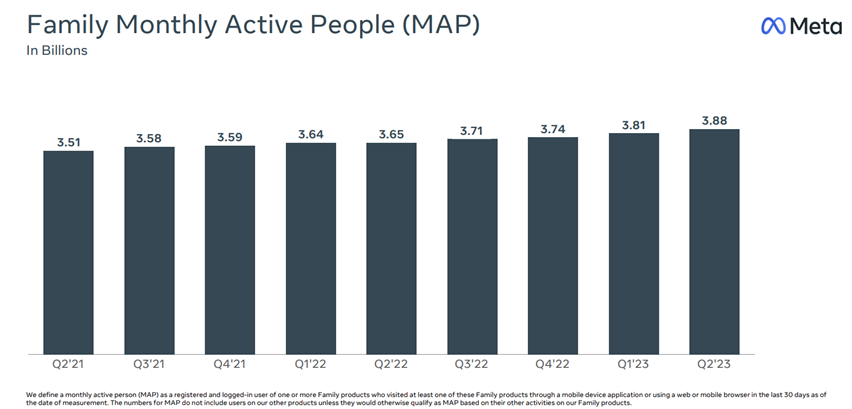

And boasts 3.88 billion monthly active users across its family of platforms.

With Zuckerberg still at the helm, Meta’s making increasingly ambitious moves here in 2023.

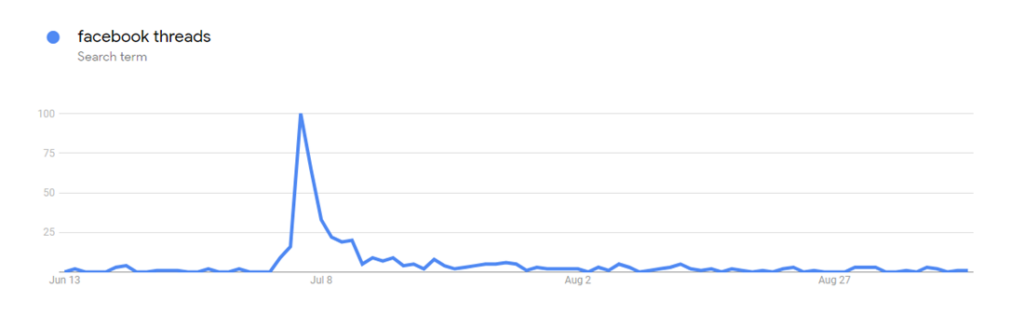

The company took a direct shot at X’s throne (formerly known as Twitter) with the July launch of Threads. The text-based version of Instagram saw 70 million downloads one day into its debut.

And its Quest 3 VR headsets are set to hit the market next week – September 27 – just in time for the holiday shopping season.

It’s already been a rewarding year for META investors. The stock returned 138% in the first half of the year, making it one of the best-performing S&P 500 stocks for that period – second only to Nvidia’s (NVDA) tough-to-beat 190%.

With the much-anticipated headset launch right around the corner, we’re putting our LikeFolio “edge” to work to cut through the hype and find out if Meta’s gaining real-world traction with its major products and services.

Join us in taking a peek inside Meta’s digital empire today to see what’s actually resonating with users… and what’s falling flat…

📝 Editor’s Note: Hey, it’s Landon Swan with a quick note before you jump into today’s issue of Derby City Daily…

META and NVDA were two opportunities our predictive stock-picking algorithm targeted as buys last September for 100%-plus and 240% gains. And I’m here to tell you: It’s not too late for you to get in on this next round of profits. Because five stocks are now signaling even bigger 1,000% growth potential over the next few years. I’ll show you more here.

Threads: A Fading Echo

Meant to be a text-based version of the wildly popular Instagram app and a direct competitor to Twitter, Threads burst onto the scene with promise.

But the initial fanfare seems to be waning…

Despite racking up an impressive 150 million downloads in just its second week, engagement quickly dwindled… dipping to just 10 million daily active users by August.

Adding insult to injury, the advertising world – wary of the fragmented social media landscape – held back their dollars, further stunting Threads’ growth potential.

Instagram & Reels: Dancing to Success

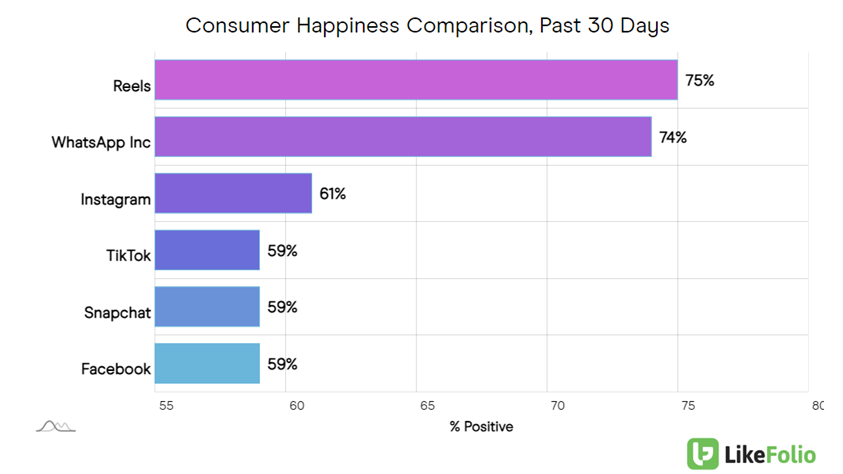

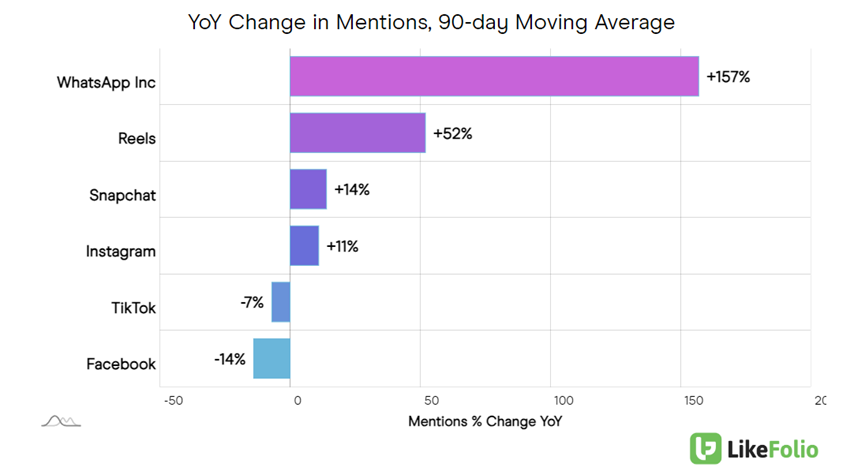

While Threads struggles to find its footing, Reels is grooving to a different beat. This Instagram (and Facebook) feature, designed to rival TikTok, is gaining traction.

According to LikeFolio consumer data, Instagram’s daily mentions have overtaken Facebook with 30% of the market share, nudging ahead of TikTok’s 27%.

A mere quarter ago, the tables were turned.

But it’s hard to beat a superior user experience.

Reels boasts a stellar 75% Consumer Happiness level, with Instagram trailing at 61%.

In comparison, Facebook, TikTok, and Snapchat are locked in a three-way tie at the bottom.

WhatsApp: The Global Messenger

While WhatsApp might not be the talk of the town in the U.S., its global footprint is expanding.

The introduction of WhatsApp Channels in Colombia and Singapore allows users to tune in to updates from celebrities and influencers – and so far, it’s been a hit.

The buzz growth around WhatsApp is undeniable at 157% year-over-year.

Meta plans to roll out this feature to 150 more countries, signaling its commitment to this private messaging platform.

But all isn’t rosy in Meta’s garden.

Reality Labs: A Virtual Setback

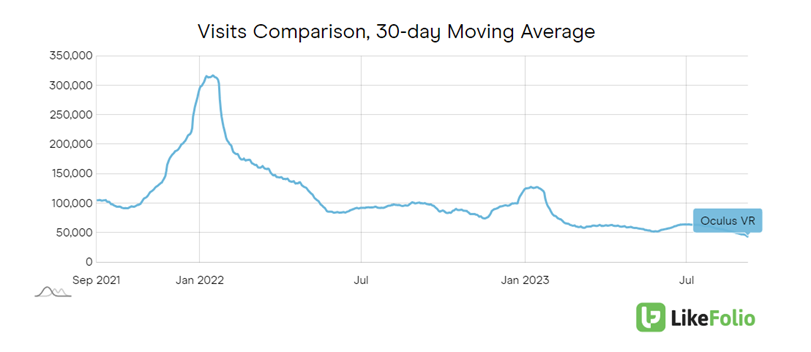

Meta’s Reality Labs segment, responsible for its virtual reality (VR) headsets, is facing an uphill battle in being a “must-have tech toy.”

With backdoor access to website data, we can tell consumer interest in products like the Oculus has plummeted. Web visits related to the Oculus VR have plunged by a staggering 56% year-over-year.

But the upcoming Quest 3 is Meta’s wildcard.

Priced just shy of $500 and set for a fall release, the holiday season will be the litmus test for its success or failure.

We’ll be watching for consumer feedback on the Quest 3 and keep our readers updated on any significant opportunities that arise.

Bottom line: LikeFolio data underscores the success of Instagram and WhatsApp in terms of consumer satisfaction and engagement. And the positive undertones from a rejuvenated ad market are increasingly hard to ignore. But between Threads’ lackluster performance and waning enthusiasm for VR headsets, we’re not jumping in just yet.

In the meantime, I want to make sure you saw this special video presentation where Landon and I take you behind the scenes of our stock-picking system and the $2 stock it’s targeting next.

Until next time,

Andy Swan

Founder, LikeFolio

More Stocks We’re Tracking in Derby City Daily: September 2023 Watchlist

$ARM, $AMD

With All Eyes on Arm, Another AI Stock Readies for Liftoff

September 15, 2023

We’re looking beyond the dazzle of the latest blockbuster IPO to another player that’s quietly verging on a breakout… Read now.

$GM, $TSLA

GM Is at a Crossroads. And This Next Move Is Make or Break.

September 13, 2023

Amid worker strikes, we explore whether GM is an emerging “EV play” that deserves a spot in your portfolio… Full story (free).

$DOCU

DocuSign Bets Big on AI: Will It Work?

September 12, 2023

DocuSign was a $300 stock in 2021. Now it’s barely reaching $50. Could impressive AI initiatives be enough to bring shares back to life? Find out.