Back in 2018, when there were just 400,000 electric vehicles (EVs) cruising the highways, spotting a Tesla (TSLA) “in the wild” was like finding a rare baseball card.

Yet folks were buzzing about getting their hands on one. So we leveraged our predictive insights for what they do best and made a bullish call on TSLA when shares were trading around $20.

Our stance may have seemed overly optimistic to some at the time. Fast-forward to today, though, and that data-driven foresight has paid off in spades.

TSLA stock is trading nearly 1,000% higher than it was five years ago.

But let’s be honest: The Tesla ride hasn’t exactly been smooth.

Just last month, a disappointing earnings report sparked a fresh wave of doom and gloom around the electric vehicle (EV) king.

Tesla reported a gross margin of 17.9% (still well above traditional automakers, just not enough to make Wall Street happy); earnings and revenue were lower than expected, too. And CEO Elon Musk’s “We dug our own grave with [the] Cybertruck” comment sealed the deal, sending shares tumbling more than 10%.

It wasn’t the outcome we expected.

But one positive did come out of that third-quarter call: We finally got a delivery date on the eagerly awaited Cybertruck.

November 30.

This Thursday.

Four years after its unveiling in 2019.

Ten lucky consumers will finally get the hyper-powerful, hyper-futuristic electric pickup they’ve been waiting for.

And with the recent bearish sentiment and media headlines giving us an eerie sense of déjà vu, we can’t help but wonder…

Is Tesla poised to beat market expectations yet again?

Here’s why we think so – and what investors should be watching ahead of Tesla’s big moment…

Tesla’s Big Moment Is Here

Tesla is set to deliver the first 10 Cybertrucks at an upcoming delivery event on November 30 in Austin, Texas, and the hype is real.

The Cybertruck Delivery Event will officially commemorate the electric pickup’s market debut, but the journey to customers is already underway, evidenced by the flood of Cybertruck sightings that have taken over social media feeds in recent days.

This initial small batch aligns with Tesla’s typical approach for product launches, as the company anticipates ramping up production to reach a target of 5,000 units per week by 2025.

From our view, Tesla’s market position is stronger than ever heading into this event.

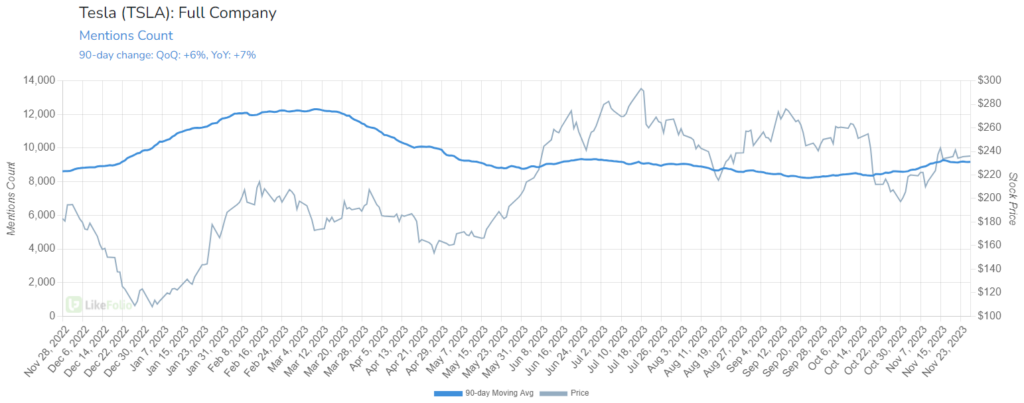

Tesla mentions have increased 7% year over year, primarily driven by the Model X, Model Y, and the surging interest in the Cybertruck.

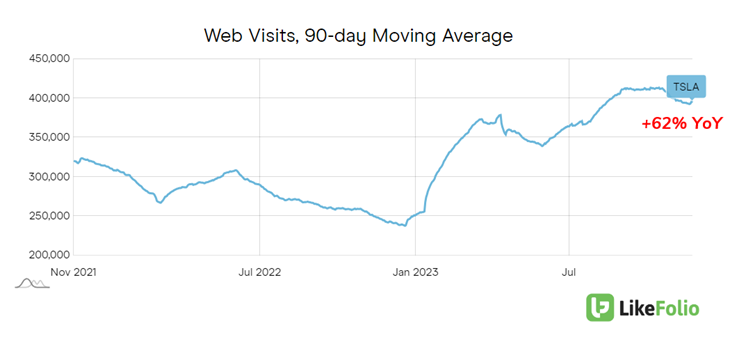

And Tesla’s digital footprint has expanded significantly. LikeFolio data reveals Tesla website visits have soared a staggering 62% year over year.

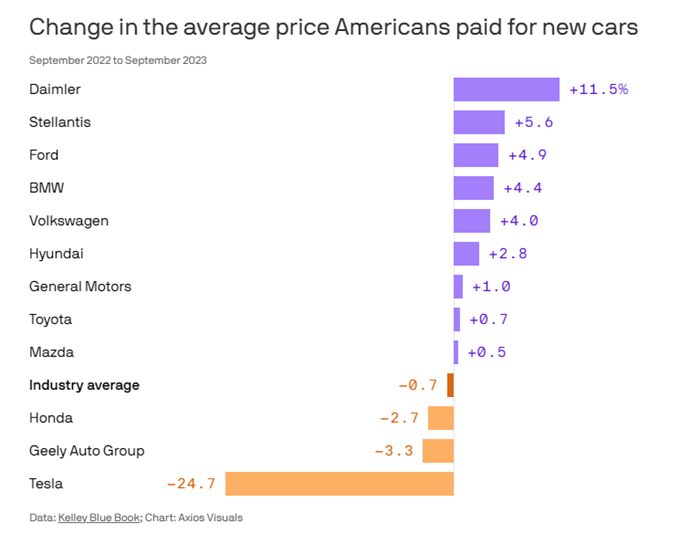

This growth goes hand-in-hand with Tesla’s dynamic pricing strategy.

Despite reducing prices by nearly 25% compared to September 2022, Tesla has managed to sustain a healthy 18% margin, showcasing the company’s ability to balance affordability and profitability.

Wall Street hasn’t always been convinced of this bold affordability strategy. We saw that after Tesla’s third-quarter earnings report.

But we’re standing strong in our bullish outlook on Tesla, which is anchored in three key areas.

The Three Pillars Driving Tesla’s Path Higher

- No. 1: EV Price Parity

Tesla’s strategic pricing adjustments have enabled its EVs to directly compete with traditional internal combustion engine vehicles in terms of affordability and appeal. The Model 3, priced at a competitive $28,000, is particularly noteworthy, offering an attractive option that rivals the cost of mainstream ICE models. (For context, the Model 3 is now in the same price range as a 2024 Toyota Corolla.)

- No. 2: Supercharger Network Expansion

Tesla’s Supercharger network, utilizing the North American Charging Standard (NACS), is a significant differentiator in the EV market. The adoption of NACS by other major automakers, slated for 2025, will further elevate Tesla’s charging infrastructure, enhancing its convenience and accessibility.

- No. 3: New Product Excitement

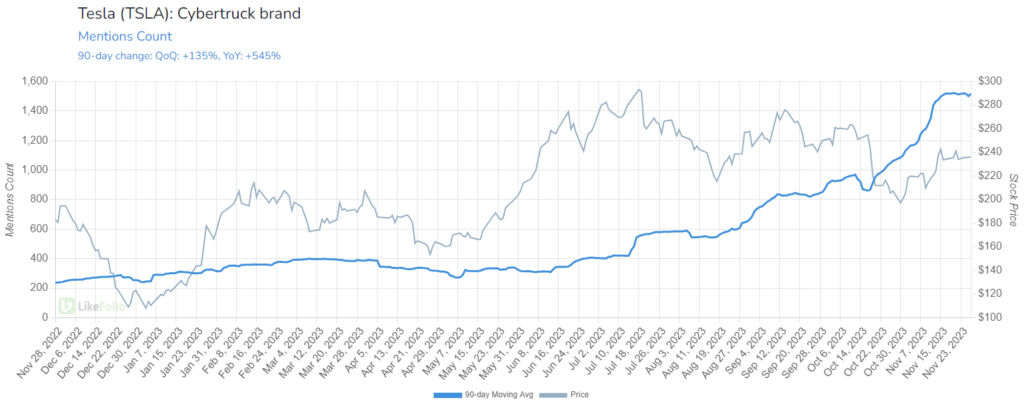

The Cybertruck has generated a wave of excitement, with mentions increasing by over 500% year over year. Check it out:

This enthusiasm points to a potential new growth avenue for Tesla, further solidifying its market position.

Navigating Challenges: Recognizing Opportunities Amidst the “Noise”

Despite these growth engines, Tesla and its leader, Musk, have been in the headlines recently for different reasons.

- Legal Action in Sweden

Tesla recently filed a lawsuit against the Swedish Transport Agency in response to logistical challenges and labor disputes in Sweden.

- Labor Dispute

That ongoing labor dispute involving Tesla mechanics in Sweden revolves around a collective bargaining agreement affecting around 130 employees across seven facilities.

This situation demands careful management to ensure continued operational efficiency.

- X Drama and Musk’s Visibility

Elon Musk’s recent visit to Israel and the ensuing controversy underscore the challenges of managing public perception, especially given Musk’s high visibility and his association with Tesla.

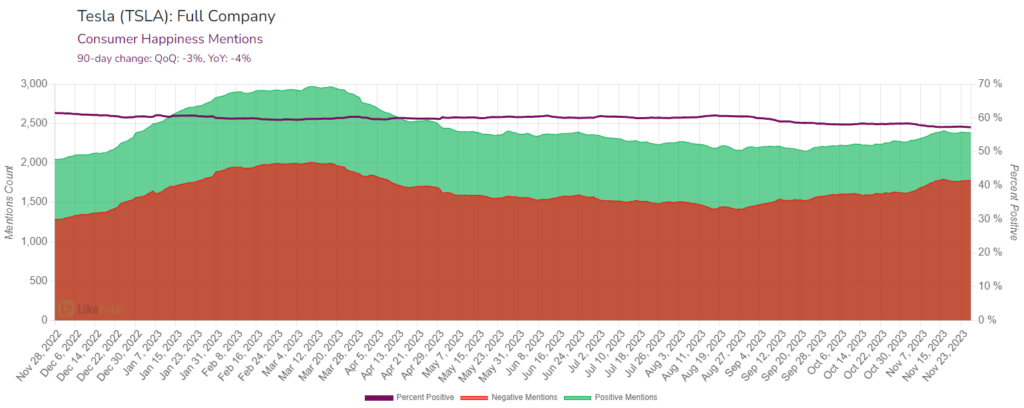

This situation has a nuanced impact on Tesla’s brand sentiment, which we’re seeing in LikeFolio data: Tesla Consumer Happiness is currently registering at 57% positive, representing a 4% drop year over year.

However, this contrasts with the actual user sentiment ratings for the Model 3 and Model Y, at 66% and 67%, respectively.

For long-term investors who believe in Musk’s vision, any negative backlash for headlines like these could serve as opportunities to pick up TSLA on dips.

Bottom Line

Tesla has faced its fair share of challenges over the years, but ultimately, it’s always come out on top. That 1,000% return I mentioned earlier is proof. As it continues to navigate market dynamics, transforming them into opportunities for sustained growth and innovation, Tesla makes a compelling case for investors and industry watchers alike.

Our 2024 Tesla Outlook: Bullish.

For more 2024 stock market predictions, check this out.

It’s a special presentation where Landon and I reveal our biggest predictions for investors in the new year – including one tiny $6 player about to dominate a massive $300 billion industry.

Until next time,

Andy Swan

Founder, LikeFolio

More from Derby City Insights: The Ultimate Holiday Stock Watchlist

3 Companies Leveraging AI to Boost Holiday Profits

Add these names to your moneymaking watchlist this season…

2 Beauty Brands Soaring on Holiday Skincare Demand

Discover the top picks driving Gen Alpha’s obsession with skincare…

One Rising Star Stock to Watch This Holiday

This 250-year-old brand is on the cusp of its next growth spurt – and you can own a piece today…