When you have a triple whammy of stubbornly-high inflation, $16.4 billion less refunded to taxpayers than last year, and consumers racking up record-high credit card debt, something was going to break.

And that something is travel demand…

LikeFolio social media analysis has previously shown consumers prioritizing experiences like travel over things like new clothes or decorations for the living room.

But the beauty of our system is that we’re always listening to what’s trending on Main Street, so we’re able to spot critical inflection points – or the point in time when things change – well before Wall Street catches wind.

And it looks like we’ve spotted one just in time to keep you ahead of the investing curve…

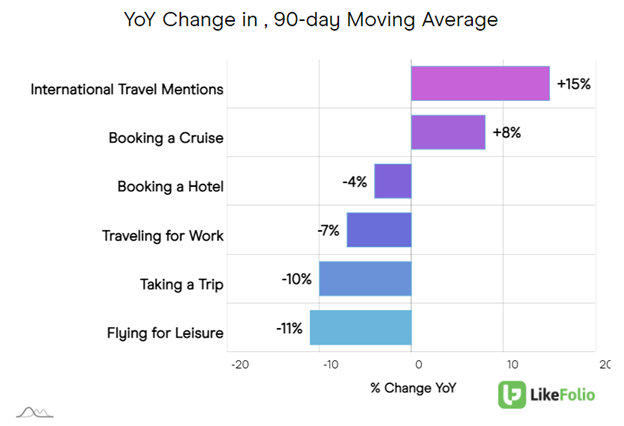

After a strong post-COVID rebound, forward-looking analysis suggests leisure travel momentum is now waning on a year-over-year basis:

These same leisure trends were pacing for double-digit growth last quarter: social media mentions of booking a hotel were up 21% and flying for leisure mentions were up 20% year-over-year.

Now, those same trends are reversing, down 4% and 11%, respectively.

Here’s what we know about this change in momentum and how it could impact market leaders like Booking Holdings (BKNG), Expedia (EXPE), and Airbnb (ABNB)…

Travel Inflection Point: What We Know

High-level industry reports mirror the emerging weakness in travel demand spotted in LikeFolio data.

The U.S. Travel Association recently reported that travel spending in March remained above 2019 levels but receded slightly from the month prior. In addition, air travel and hotel room demand dropped just below 2019 levels.

But you wouldn’t know it based on recent earnings announcements.

Last week, Booking and Expedia both boasted robust travel demand in their first-quarter numbers:

- Gross travel bookings through Bookings.com surged 44% from the same time last year, and its quarterly revenues reflected that demand, increasing 40% in the same time to $3.8 billion.

- For Expedia, gross lodging bookings reached a new record and pushed its quarterly revenue 18% higher to $2.7 billion, an all-time high Q1 record for the company.

BKNG shares have teetered near all-time highs in 2023, gaining nearly 30% year-to-date (YTD). EXPE shares shot from $89 the day of its report (May 4) to $97.80 the following day, despite a larger earnings miss (and a much lower bar to clear).

And Airbnb (ABNB) is set to report its first-quarter results after the market close today.

Thanks to LikeFolio’s predictive analysis, we already know what our data suggests: that the company will post solid results driven by a resurgence in urban travel.

What we’re more concerned with is what’s coming next for the travel industry and its leading companies, because that’s where our real edge lies.

That’s where we’re seeing larger signs that trouble could be brewing…

Travel Inflection Point: What Comes Next

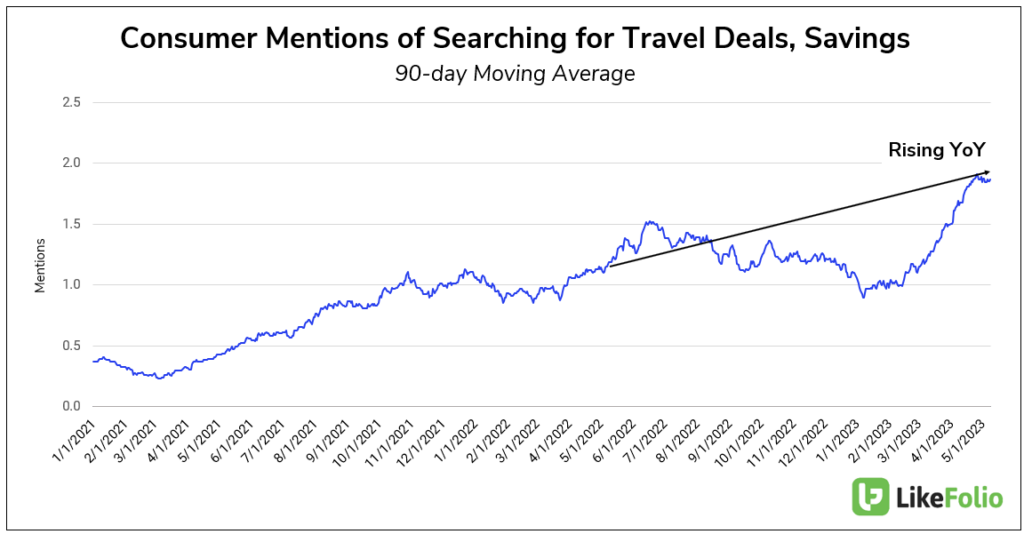

As consumers prioritize experiences, they’re still looking for ways to save.

And our forward-looking data shows that consumer mentions of searching for cheaper flights, hotels, and reservations are still rising on a year-over-year basis:

This type of sticky behavior is likely to benefit travel aggregators like Booking and Expedia, which allow consumers to compare costs for different airlines, hotels, and rental companies.

But it may not be so helpful for Airbnb.

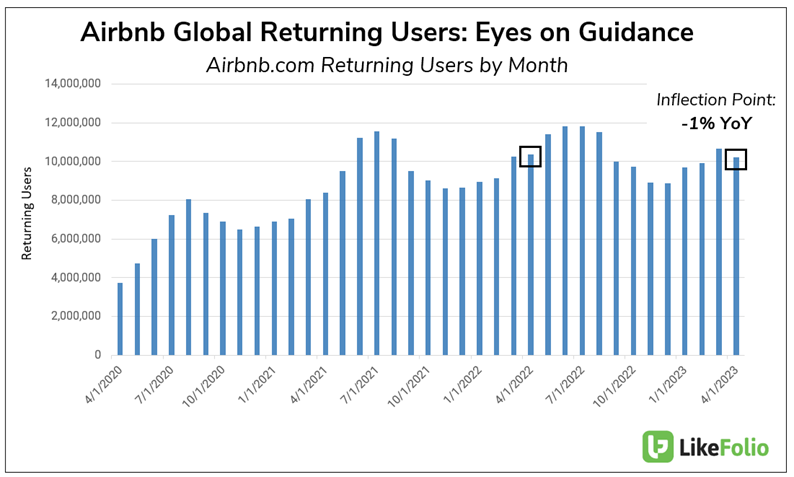

With our database, we’re able to get an x-ray view of how consumers are interacting with a website like airbnb.com.

And from what we can see, Airbnb may be in for trouble when it comes to forward-looking guidance.

Global returning users to airbnb.com, which is the most highly-correlated consumer metric for ABNB related to earnings, recorded solid growth in the quarter being reported, coming in 7% higher year-over-year.

But more recent data shows those users slipped by 1% in April:

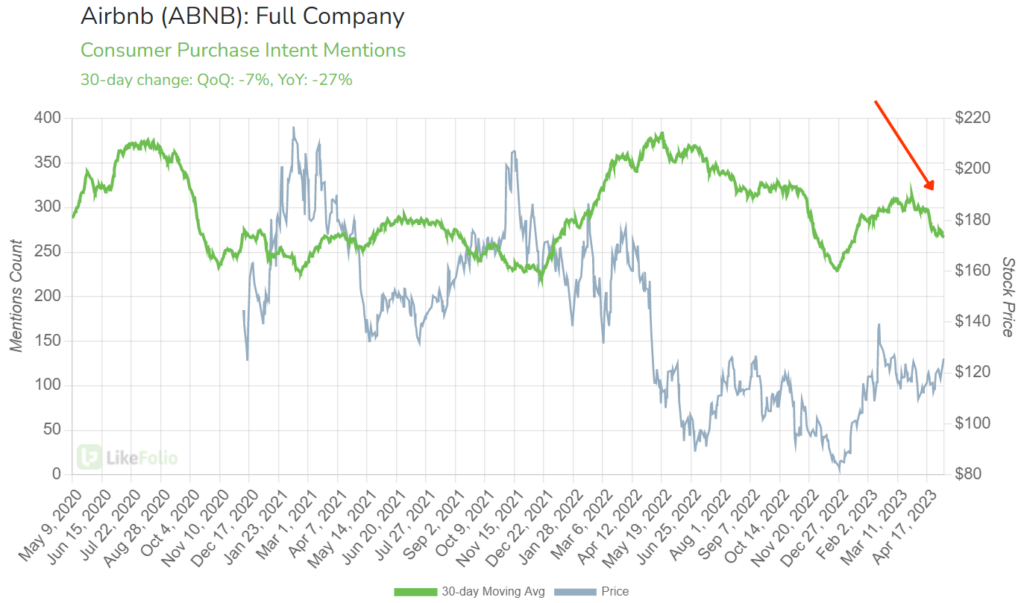

Similarly, LikeFolio ABNB Purchase Intent (PI) mentions are losing momentum.

Check out the decline in April logged on a 30-day moving average:

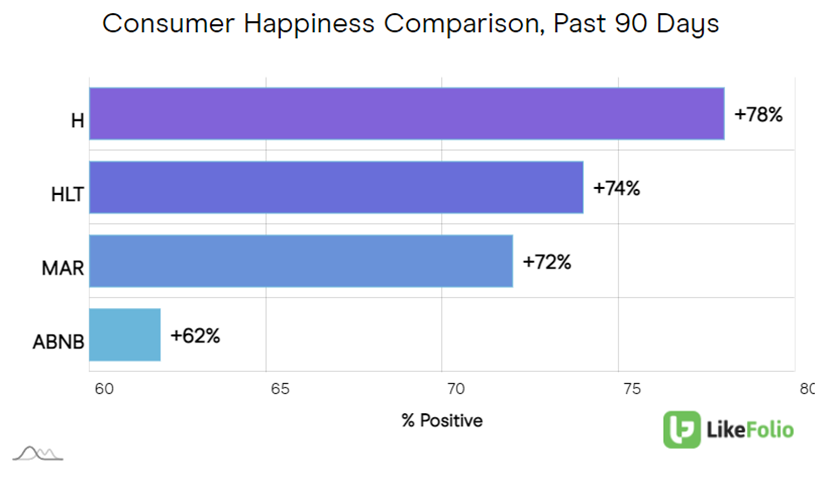

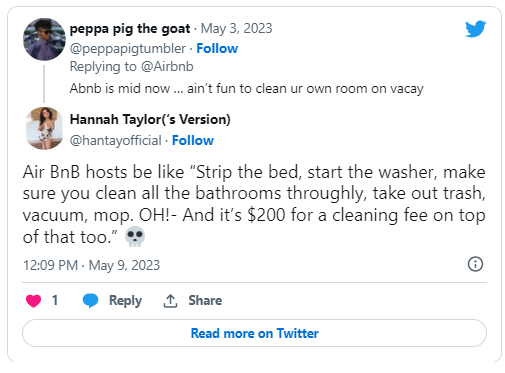

Airbnb is also trailing traditional hotels like Hyatt (H), Hilton (HLT), and Marriott (MAR) in Consumer Happiness at just 62%:

That’s after ABNB sentiment dropped by 3% year-over-year, which is never a good sign in terms of long-term success as folks start to turn against check-out fees, cleanup requirements, and other aspects of staying at an Airbnb.

And considering ABNB leads other travel competitors in gains over the last month, with a nearly 16% run in its stock price, forward-looking guidance may prove to be a headwind for bullish investors moving forward.

One bright spot we should note is in international travel demand, which currently leads all other travel trends in the LikeFolio universe with a 15% year-over-year increase.

We’ll continue to monitor this inflection point in travel demand.

In the meantime, check out my report on the state of the airline industry here for the latest on which companies are ruling the skies.

Until next time,

Andy Swan

Co-Founder