As the top holding in the Standard & Poor’s (S&P) 500 Index – the benchmark financial analysts and investors have been relying on to gauge the health of our economy since the 1920s – Apple (AAPL) has some high standards to live up to.

When the stock gets a breakout to the upside as it did a few weeks ago, it signals a larger trend could be forming for the entire tech sector.

And when shares start to reverse course like they did earlier this week, alarm bells go off to tell us we need to dig into the data.

Here’s what happened…

📰 AAPL in Hot Water

After Apple shares got an added boost from suspected strong iPhone demand and production in Asia, the stock slipped back down to $160 on Monday on reports its global computer shipments fell by 40% from the same quarter a year ago.

Shares have stabilized to end the week around $165, but Wall Street can’t see what’s happening on Main Street like we can.

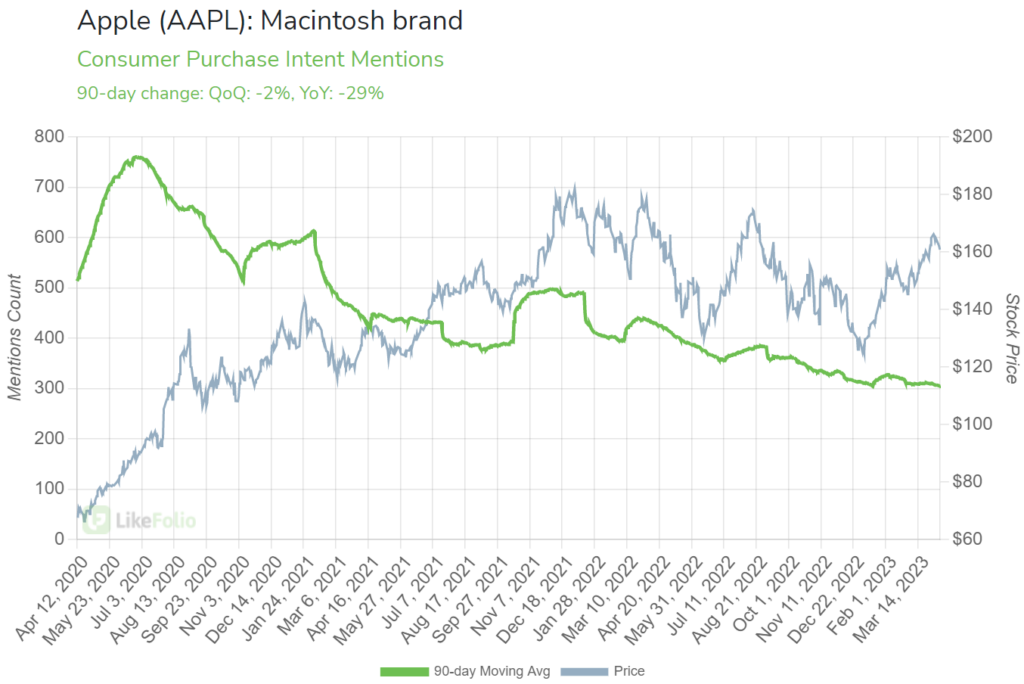

And a closer look at LikeFolio’s real-time data supports weakening demand for Apple’s Mac products.

Purchase Intent (PI) Mentions have dropped by 29% year-over-year (YoY), and shorter-term data suggests this weakness is only intensifying (demand has slipped by 34% YoY on a 30-day moving average).

Apple reports Q2 earnings on May 4 and early data points to hardware disappointment.

And it wasn’t the only company that found itself in hot water this week…

📰 BUD Controversy: Who’s Winning the Beer Wars Now?

We recently brought you fresh coverage on the booze sector as we see more and more cash-strapped consumers turn to affordable indulgences like beer. You may remember us noting a controversy that was just starting to swarm around Anheuser-Busch InBev (BUD), the maker of America’s favorite beer, Bud Light.

Politicized backlash over a new partnership with trans activist Dylan Mulvaney, which was designed primarily to boost Bud Light’s “Corporate Equality Index” score, was starting to take a toll on BUD’s Consumer Happiness.

It’s safe to say a core section of Bud Light drinkers were really ticked off – with many boycotting the brand altogether.

According to Beer Business Daily, distributors are getting nervous about the heated reaction to the promo.

And our data reveals strong evidence that these fears are well justified.

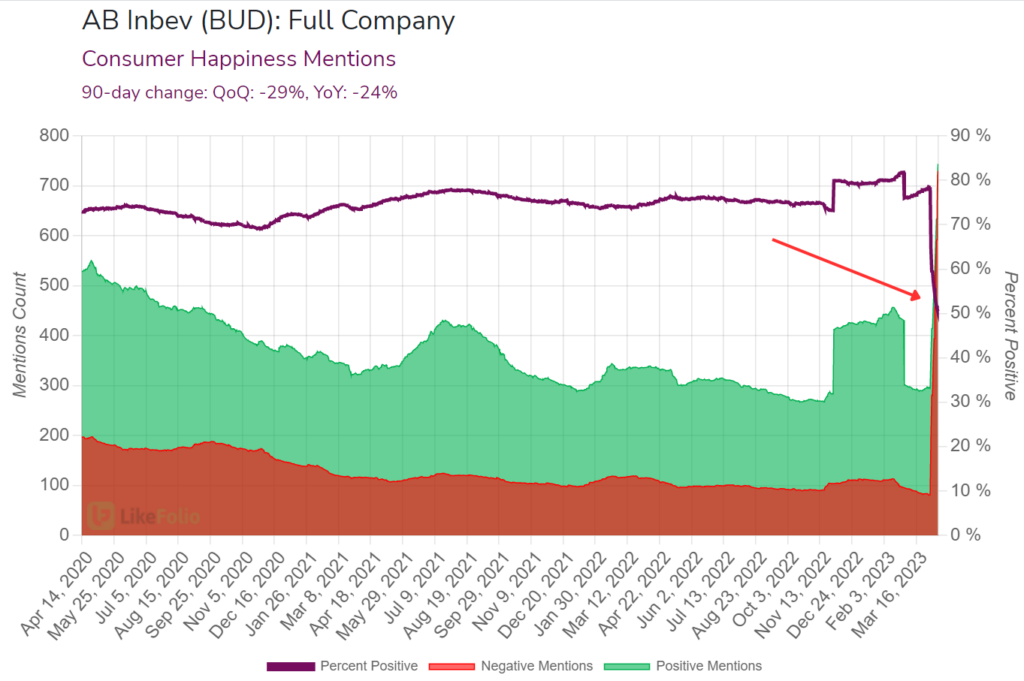

Consumer Happiness levels (purple line) for the company have plummeted to all-time lows, from nearly 80% positive prior to the promotion all the way down to just over 50% positive today:

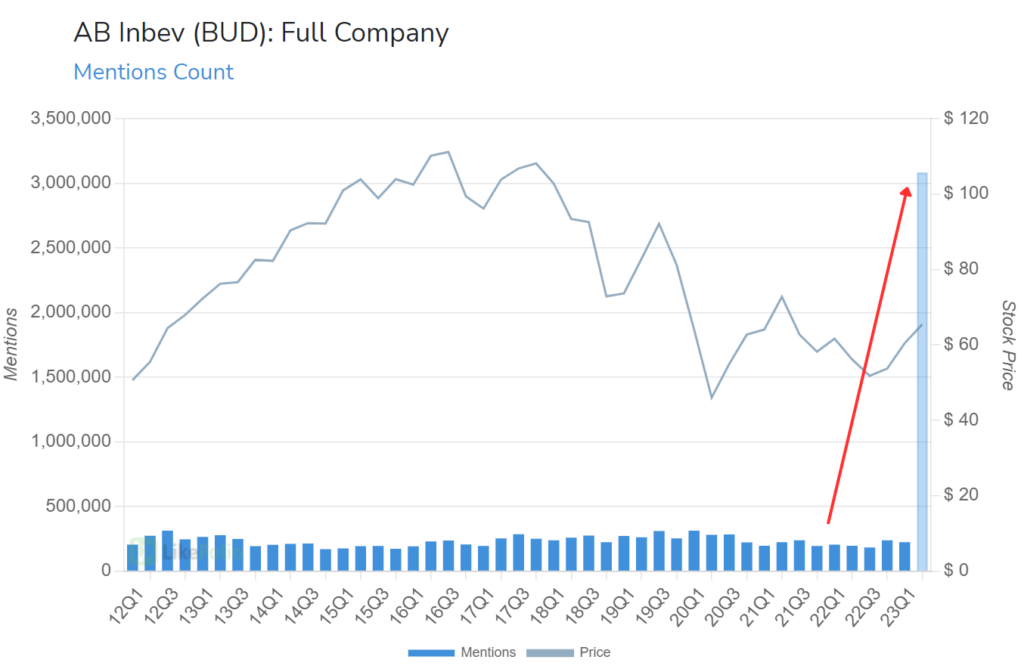

Making matters worse, this sentiment drop is happening as consumer buzz surges to levels 10x BUD’s normal volume levels:

And as of this writing, BUD has lost nearly $5 billion in market cap since the campaign went live on April 1.

In other words, the campaign has created an enormous – and overwhelmingly negative – backlash that’s had a very real impact on BUD’s value.

But a beer drinker’s gotta drink: So, which brand are they reaching for instead?

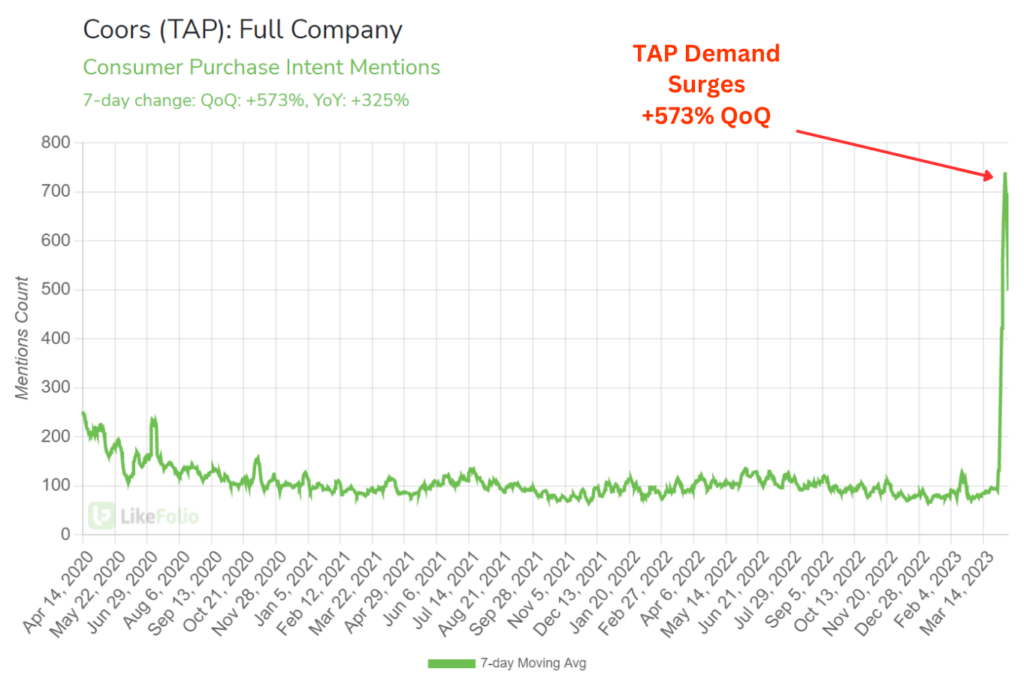

So far, it looks like Coors (TAP):

Purchase Intent (PI) Mentions of consumers spending their hard-earned cash on Coors skyrocketed in light of the Bud Light controversy, with some customers swearing they’ll never come back.

And as BUD lost value since the start of April, TAP shares have gained a solid 8%.

Here’s the thing: Politicized backlashes to ad campaigns are nothing new. And historically, we’ve rarely seen them have any real or lasting long-term impacts on overall brand happiness or revenues.

United Airlines (UAL) invoked the wrath of conservatives in 2021 when it announced its goal for half of the spots in its pilot training program to be filled by women and/or people of color.

The “controversy” that felt so heated at the time ultimately bounced off the business, with United beating Wall Street expectations in Q4 2022 revenues. Today, it’s all but forgotten.

I actually did a review of the U.S. airline industry earlier this week, which I encourage you to check out here.

The social media outrage machine moves fast, and it’s likely that consumers will find something new to ruffle their feathers before BUD suffers any long-term damage.

Now, for some encouraging news…

📰 Bitcoin (BTC) Breaks $30K

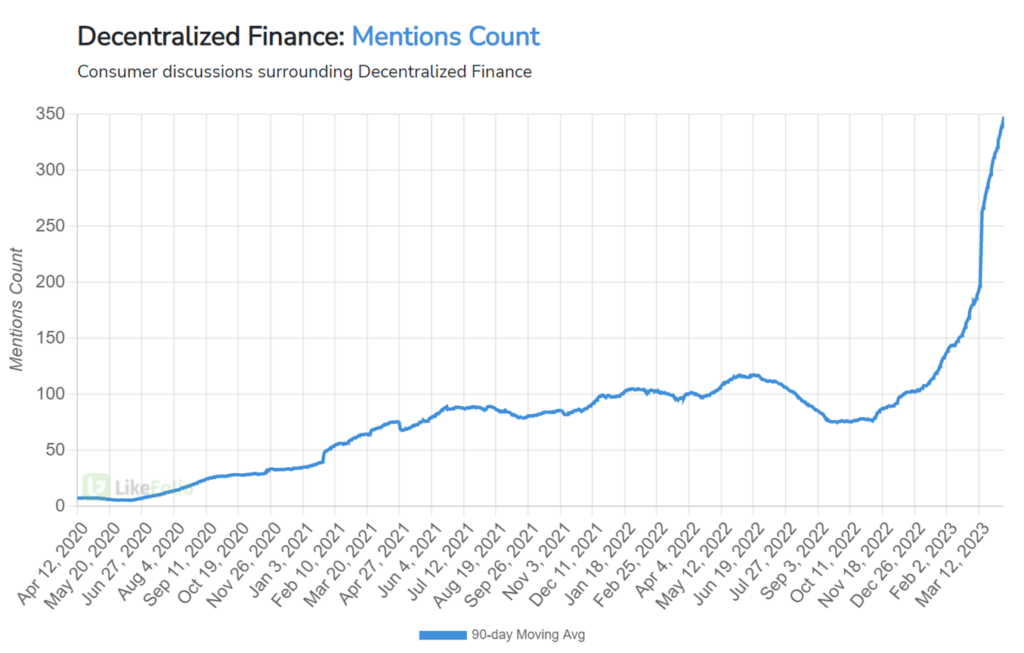

Decentralized finance (DeFi), aka cryptocurrency, is one of the hottest trends we’re tracking right now in Derby City Daily.

And interest is likely to continue to grow, thanks to Bitcoin (BTC) breaking the $30,000 price level this week – a level it hasn’t crested since last June’s crypto crash.

The breakout has triggered an influx of cash across the crypto ecosystem as investors scramble to get in on the action. Ethereum (ETH), another major coin, is also on the rise, reaching its highest price since last May.

The media may love to hate on BTC and other cryptos, but that negative narrative headwind doesn’t seem to be impeding the crypto market’s ascent.

If you’re skeptical as to whether Bitcoin will continue on its bullish path, consider this: The next Bitcoin halving is just over a year away.

This event, which occurs roughly every four years, reduces the reward for mining new bitcoins – meaning less is released into the supply.

Supply tightens, demand increases, and the price of BTC surges. It’s happened every four years since the first halving in 2012.

So, if history is any indication, BTC will continue ticking higher from here.

Bitcoin is one of Landon’s favorite plays for 2023 – I’ll let him tell you why here.

Until next time,

Andy Swan

Co-Founder