While the fast-food industry may not be as sexy as “AI tech stocks” or “flying cars,” believe me – fortunes have been made investing in burger-flipping operations.

An investment in McDonald’s (MCD) twenty years ago would’ve spooled up a 1,100% return today; ten years ago, it would’ve been a 200%-plus return; heck, even five years ago, you’d have made over 70% on shares of the iconic fast-food joint.

As earnings reports flood in for many of our favorite fast-food staples, you know we’ve been keeping close tabs on the data to see which drive-thrus are hot… and which are not.

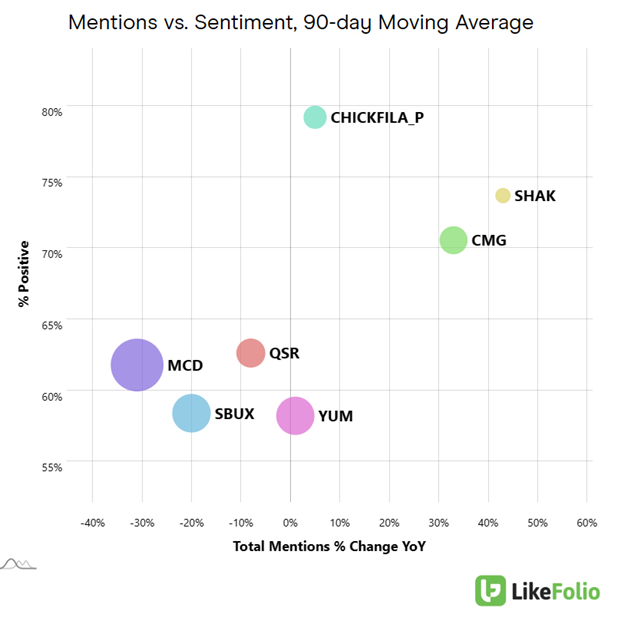

So, we put together an Outlier Grid of the fast-food realm to show you where the opportunities lie.

It’s a tool that sorts the winners from the losers in any given industry – and sums it up in one picture-perfect image.

And let’s just say, these results I’m about to show you are eye-opening.

Here’s what we found…

Just Released: Our Most Powerful Moneymaking Tool Yet… with an AI Upgrade

While the Outlier Grid can reveal the most bullish and bearish opportunities in any given sector, the Social Heat Score can tell you what to buy, what to short, and when to do it for maximum profit potential.

Landon and I engineered this special device using a fusion of artificial intelligence and data extraction to anticipate events before they happen.

Check out our strongest moneymaking tool yet – and the five stocks it’s targeting now for 1,000% growth potential – in this just-released report.

Fast-Food’s Winners and Losers Revealed

The Outlier Grid you see below plots two key LikeFolio metrics against each other – Purchase Intent (demand) growth on the x-axis and Consumer Happiness on the y-axis – to reveal which stocks could be ready for liftoff. Check it out:

Picture it like this: The higher up a company, the more its customers are singing its praises. The further to the right it is, the louder the chatter about its brands and products.

Companies that cozy up in the top-right corner are typically the ones we see shooting to stardom.

With this chart in hand, let’s unravel the fast-food saga as it currently stands.

First up, our trendsetters Shake Shack (SHAK) and Chipotle (CMG) are clearly leading this race, attracting both consumer attention and affection. SHAK Purchase Intent is up 41% year-over-year while CMG’s is up 22%, and 27% just this quarter.

What’s even more intriguing? Chipotle’s stock sprinted to near-record highs above $2,000 per share in July and is currently up over 40% year-to-date. But SHAK has those gains beat – logging 85% YTD returns as of this writing.

In the midst of this, Chick-fil-A, the ever-popular veteran, flaunts the happiest customer base by a considerable margin.

Truly setting the benchmark for what a beloved fast-food restaurant looks like, Chick-fil-A has ranked as America’s number-one fast-food favorite nine years in a row, according to the annual American Customer Satisfaction Index (ACSI) Restaurant Study.

Now let’s talk about the “old guard,” our seasoned veterans, McDonald’s (MCD), Starbucks (SBUX), Burger King (QSR), and Yum Brands (YUM).

They seem to be grappling with a mid-life crisis, struggling with dwindling customer attention and lackluster levels of Consumer Happiness.

But should one of these titans manage to break away towards the top right, it could ignite a tantalizing investment opportunity.

We’ll be watching this space for that kind of move – and our paid-up members will be the first to know when one of these names registers a Social Heat Score in buying territory.

But you don’t have to wait on the sidelines until then: Our Social Heat Score device just flagged five AI stocks with 1,000%+ growth potential over the next 12 months, which you can get the details on right here.

Until next time,

Andy Swan

Founder, LikeFolio