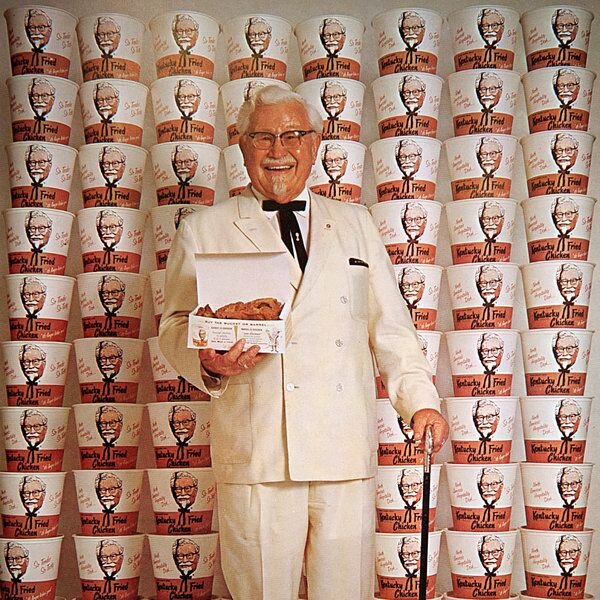

Just a few blocks down the street from where I am now in Louisville, Kentucky, in the midst of the Great Depression, Harland Sanders embarked on a culinary quest that would forever change the landscape of fast food.

After bouncing around the south picking up odd jobs – working as a fireman… practicing law… selling insurance… running gas stations, ferry companies, and motels – Sanders finalized his “Secret Recipe” for fried chicken…

Earned his Kentucky Colonel title…

And founded the iconic brand known today as Kentucky Fried Chicken (KFC).

Colonel Sanders once remarked, “I’ve only had two rules: Do all you can and do it the best you can. It’s the only way you ever get that feeling of accomplishing something.”

The Colonel’s accomplishment with KFC made him a living legend in his own day – and a rich one at that. He sold his empire in 1964 for $2 million or what would roughly be $19 million today.

But all these years later, that same Colonel Sanders ethos lives on in a new corporate parent, as it innovates and adapts in a changing market.

We were waiting for a “winner” to emerge among fast-food stocks because fortunes have been made in burger flipping… and selling buckets of chicken.

Now, fresh data out of LikeFolio suggests this one stock is serving up a mouthwatering opportunity…

How YUM Broke Away from the Pack

If you remember, we started this month largely neutral on fast-food stocks.

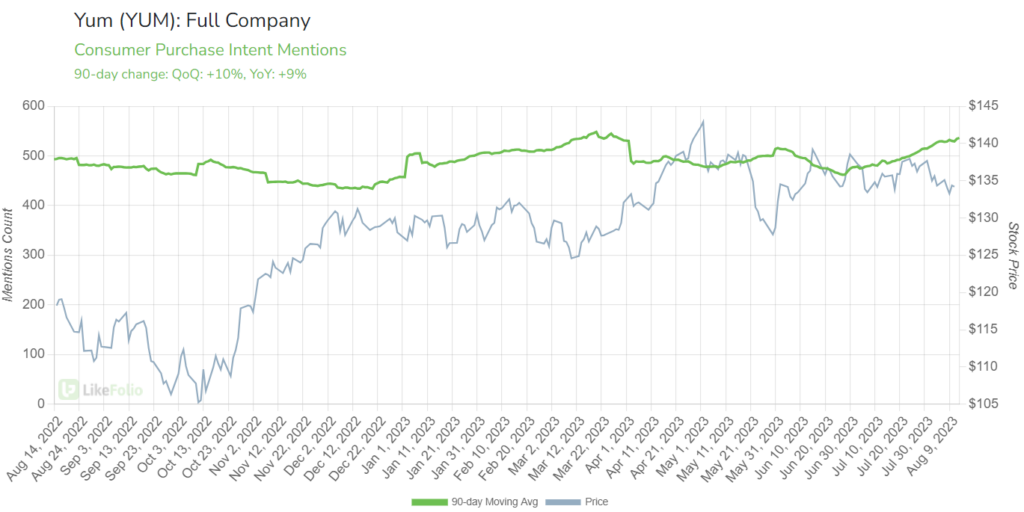

But YUM Brands (YUM), the $37.8 billion fast-food conglomerate that houses the KFC, Taco Bell, and Pizza Hut brands, is grabbing our attention.

YUM shares traded mostly flat following its August 2 earnings release, which was exactly what we predicted in our Week 3 Earnings Season Pass Scorecard.

But LikeFolio data says a new opportunity is emerging: Over the last week and some change, YUM’s Earnings Score has increased by a whopping 10 points to +23…

Putting YUM firmly in bullish territory.

Here’s what changed.

- Digital Sales Domination

Digital sales surged by almost 30% during YUM’s most recent quarter, making up nearly half of all orders and setting a new record of $7 billion. And KFC led the pack, with system sales growth of 19%.

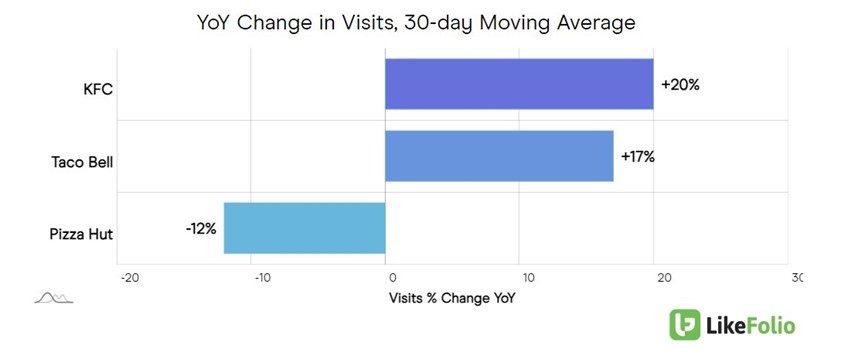

LikeFolio consumer insights support this, with web visits for KFC (+20%) and Taco Bell (+17%) increasing by double digits year-over-year; only Pizza Hut recorded a decline:

And consumer mentions of ordering KFC, Taco Bell, or Pizza Hut via third-party delivery apps have increased collectively by 5% year-over-year — impressive considering Pizza Hut’s relative weakness.

Overall Purchase Intent mentions – measuring demand across YUM’s umbrella of restaurants – are ticking higher as a result: gaining as much as 10% quarter-over-quarter.

- “Taco Tuesday” Victory

Another key factor in YUM’s more recent success? “Taco Tuesday.”

Seriously: Taco Bell won a legal battle for the phrase “Taco Tuesday” over the small chain that owned the trademark, Taco John’s.

Taco Bell’s battle to “liberate” Taco Tuesday for the masses generated more publicity for the brand than its own Mexican Pizza, according to company leadership.

To celebrate its victory, starting today, Taco Bell is offering free Doritos Locos tacos every Tuesday for a month.

Free tacos? That’s an easy way to get folks excited – and get them through the drive-thru line.

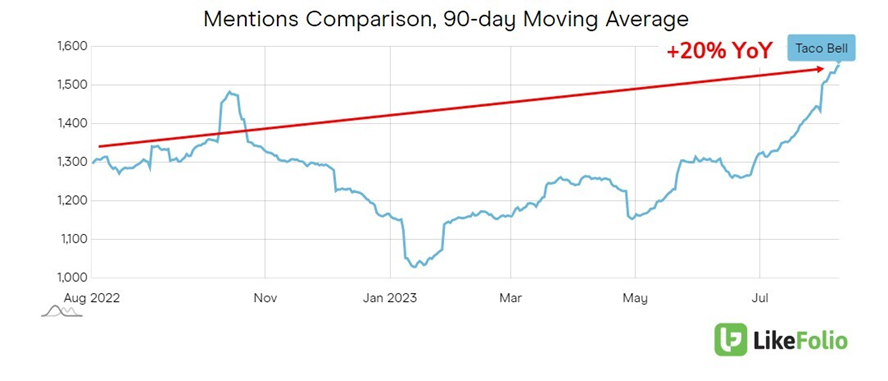

We can see the impact in Taco Bell buzz levels, with mentions trending 20% higher on a year-over-year basis, greatly outperforming YUM’s other brands KFC (+6%) and Pizza Hut (-31%).

- Consumers Ready to Splurge

One last piece of the puzzle: the big picture.

YUM executives mentioned during the company’s conference call that inflation has peaked in most developed markets and is starting to slow down.

Emerging markets continue to experience rising prices, sure. But this shift could bode well for consumers who are ready to splurge on fast food or upgrade menu options.

We believe YUM’s embrace of digital sales, strategic victories in legal battles, and insights into economic trends demonstrate an innovative and resilient approach to the industry.

It may not be the secret recipe that Colonel Sanders crafted all those decades ago.

But the strategic blend YUM employs today promises a rich taste of success for investors hungry for opportunity.

Until next time,

Andy Swan

Founder, LikeFolio

Hungry for More? Grab This AI Stock Today for Less Than $3 a Share: When our consumer insights machine helped us ID this “under the radar” AI player back in March, it was straight off the dollar menu – trading at just $1.20. Its stock price has already doubled since then. But we believe those gains are only just getting started. More here.