You might not be thinking about what gift you’re going to get for Aunt Karen this holiday season yet – but don’t worry. FedEx (FDX) and United Parcel Service (UPS) are already planning how they’ll get it to her by December 25, 2023.

For these shipping giants, the fourth quarter of the year is game time as hundreds of millions of packages move through their supply chains during the October to January holiday season.

UPS just announced it will add 100,000 seasonal workers to help with the rush.

But while FedEx and UPS share the same end goal – getting Santa’s presents under the tree by midnight – they take two drastically different paths to get there.

FedEx is renowned for its long-distance rapid delivery and dominates international air express shipping with a fleet size that’s double that of UPS.

UPS excels in domestic ground package delivery, boasting a larger fleet of ground vehicles while providing additional services, like supply chain management and customs brokerage, that cater to businesses venturing into international online sales.

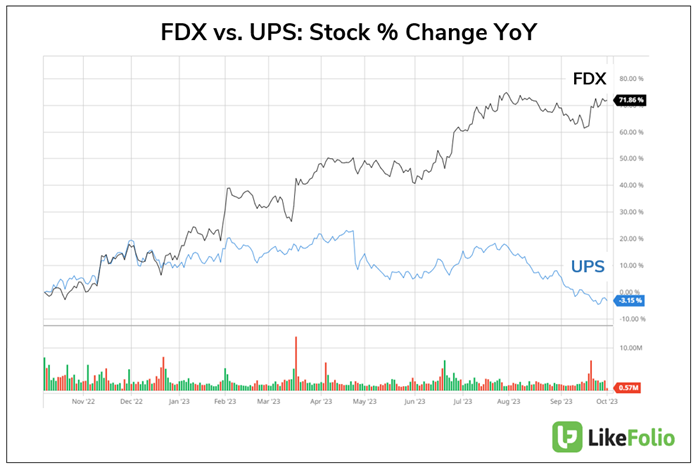

And their stocks have diverged here in 2023 as well…

Despite UPS being the reigning delivery champ with over $100 billion in revenue in 2022, FedEx has impressed investors with an ambitious roadmap to profitability.

To achieve its profit margin goal of 12% to 13%, the company will merge its delivery operations in a bold move to slash costs by a whopping $6 billion by 2027.

That has the market and analysts rallying behind FedEx, while UPS falls behind.

But one key LikeFolio metric suggests that Wall Street might be cheering for the underdog a tad prematurely…

FedEx: Closing the Gap

With the Federal Reserve tightening its grip to combat inflation, stocks are navigating choppy waters. Yet FedEx is emerging as a beacon of hope – a company whose fate is largely in its own hands, rather than being at the mercy of broader economic trends.

Its recent quarterly report was nothing short of impressive. A 32% surge in fiscal first-quarter adjusted earnings sent its shares soaring by 5%.

Strategic cost-cutting and a shift in clientele from rivals like UPS and Yellow played a pivotal role in this uptick. Despite some operational hiccups, FedEx is gearing up for a promising holiday season.

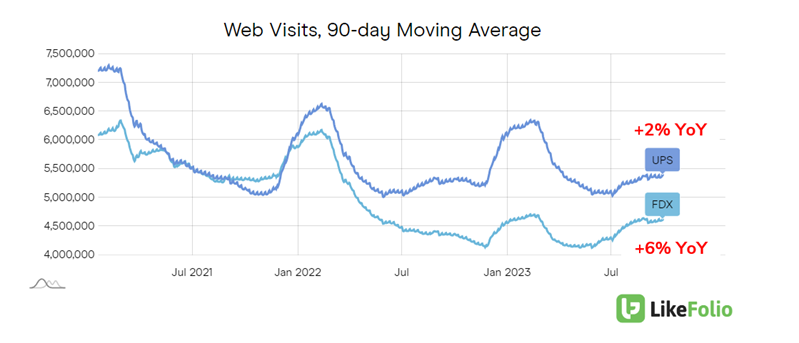

And we’re seeing that momentum shifting in LikeFolio data as FedEx slowly but surely catches up to UPS.

With a 6% year-over-year increase in web visits compared to UPS’s 2%, FedEx is making its presence felt.

However, UPS still wears the crown in this domain. And it’s got FedEx beat in an all-important metric…

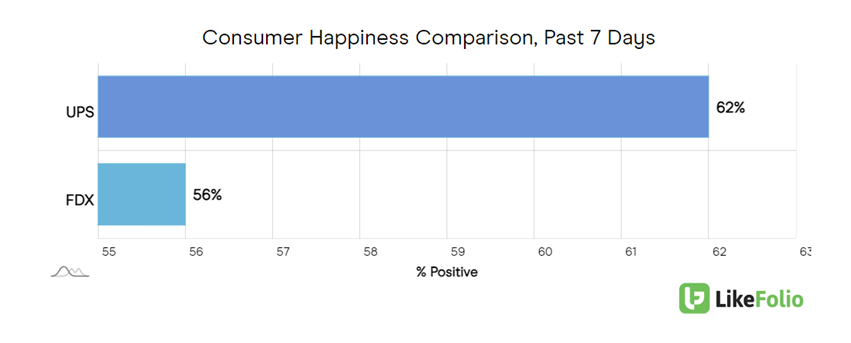

Consumer Happiness: The Achilles Heel

FedEx’s Consumer Happiness lags behind at 56% positive, while UPS boasts a healthier 62%. This metric is a telling sign: Given a choice, consumers seem to lean towards UPS.

This metric is often a precursor to long-term growth – and it’s flagged more than a few moneymakers for our paid-up members. (Like this sub-$5 stock that’s more than doubled since it first hit our radar in March, currently holding an elite 80%-plus Consumer Happiness level. More here.)

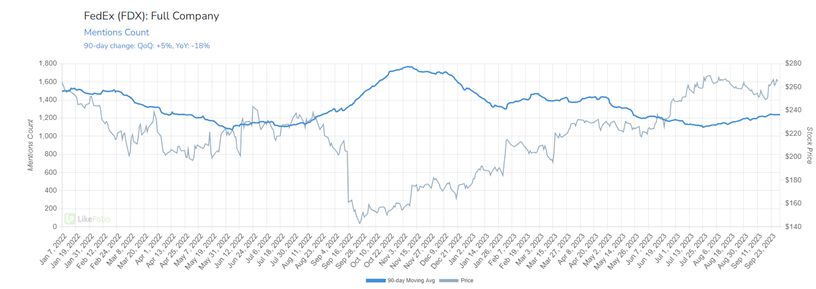

Another concerning trend? With the global e-commerce market’s growth rate expected to hover around 8% in the coming years, FedEx’s mentions have seen a dip.

The Verdict

While Wall Street’s current darling might be FedEx, LikeFolio data suggests that the consumer jury is still out. The upcoming holiday season will be the ultimate test.

Will FedEx sustain its impressive 72% year-over-year share price surge?

Or will UPS, with its superior Consumer Happiness metric and a 3% dip in share price over the same period, emerge as the dark horse?

Something tells us we may be betting on the dark horse.

Until next time,

Andy Swan

Founder, LikeFolio

More Main Street Favorites from Derby City Insights

Companies with a Consumer Happiness rating above 80% hold a special place in the LikeFolio universe – and these consumer favorites have proven to be moneymakers time and time again…

Elite Pick No. 1

Our system flagged this healthy energy drink maker as a buy in January 2022 with an 83% Consumer Happiness score. See how it led to a 327% profit opportunity…

Elite Pick No. 2

Positive sentiment around this running shoe was higher than most brands of its kind in October 2022 – and netted our paid-up members 50%-plus gains. Check it out…

Elite Pick No. 3

The latest stock to join this elite squad gives those favorites a run for their money… And you can grab it under $3 today if you act fast…