Even with all the convenience of online shopping at my fingertips, the “Home Depot run” to the store still manages to be a routine around our house. Especially this time of year, when I find myself needing to leave mid-project to peruse the cavernous concrete halls of the local Home Depot (HD) looking for that last tool that will get the job done…

The outdoor light goes out but any standard 60-watt A19 won’t cut it. I need the BR30 dimmable. “Honey, I’m running out to Home Depot!”

I’m prepping the deck for summer and realize the kinds used my last good paintbrush on their science fair project. Next thing I know, “I’m just gonna pop out for a Home Depot run!”

As your average DIY-guy, it doesn’t make much difference which home improvement store I end up at. Home Depot happens to be more convenient but I could just as easily find what I need at Lowe’s (LOW).

If I ask my contractor buddy, though, he’d send me to Home Depot every time.

With a Volume Pricing Program that offers steep discounts on bulk orders and members-only benefits for pros – plus a strategic $1.2 billion investment in its supply chain infrastructure to keep those orders filled – Home Depot is the hands-down favorite of professionals, who account for nearly half the company’s revenue (despite making up just 5% of its customers).

In contrast, Lowe’s generates most of its sales – about 75% – from do-it-yourselfers like me.

That preference from contractors has historically given Home Depot the upper hand. While the average homeowner might spend a few hundred bucks on a project, the professionals rack up a significantly bigger bill buying in bulk.

And we’ve seen that advantage play out in real time on earnings day: In August 2022, just as LikeFolio data was picking up an uptick in social media buzz around “hiring a contractor” and a slowdown in DIY projects, Home Depot reported 6.5% sales growth for the quarter… While Lowe’s saw sales drop 0.3% during the same period.

But in February, something changed that put HD investors on alert: For the first time since 2019, Home Depot missed expectations on its Q4 earnings report and shares quickly tumbled by 7%.

The company attributed the miss to declining lumber costs. And a few weeks later, Lowe’s jumped on board with a similar sentiment when its own Q4 report fell short.

Both companies weaved a tale of long-term confidence in the power of needed upgrades as housing inventory ages, but should investors be concerned about these companies after not meeting expectations?

Also, does Home Depot still have an edge over Lowe’s?

We don’t have to rely on anecdotal evidence and assumptions when we have forward-looking data straight from the mouths of consumers.

Take a look at what LikeFolio data reveals about the outlook for home improvement stores in 2023 – and whether Home Depot can maintain its telltale advantage…

Marco Level View: The Professional Segment Remains Strong

After a lapse in contractor activity mentions over the holiday season, our consumer trend data shows contractor activity ramping up again in February – with mentions currently pacing 10% higher year-over-year (YoY):

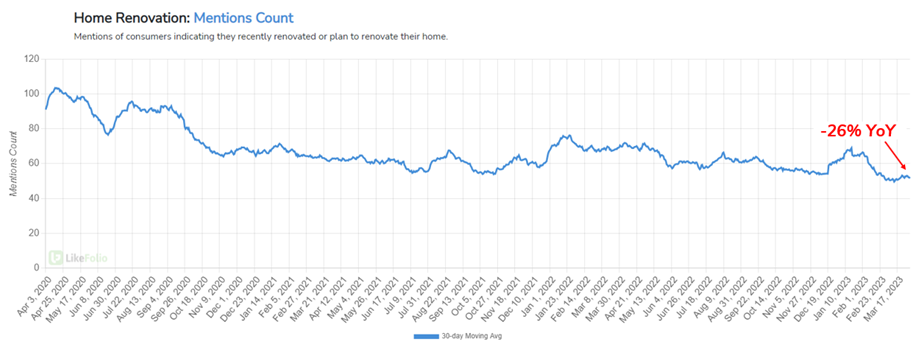

That’s in stark contrast to what we’re seeing from DIY home renovation mentions, which have dropped by 26% in the same time frame:

A pullback in DIY home renovations will impact both HD and LOW – and you can already see the effects in our forward-looking consumer data.

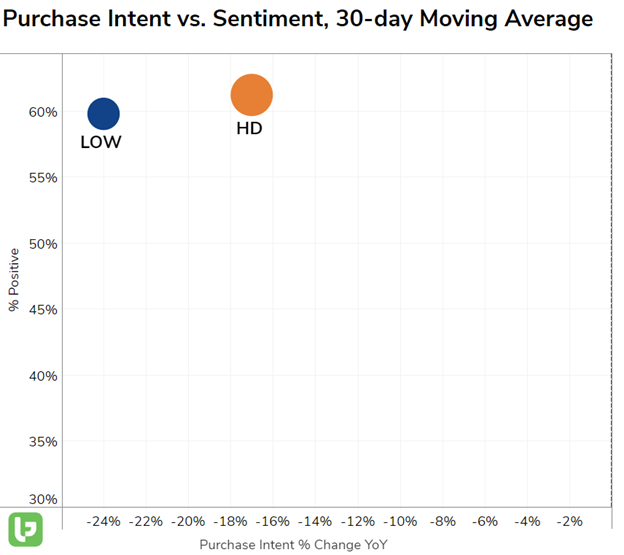

Check out the Outlier Grid below, which displays a double-digit drop in demand for both retailers:

(Need a refresher on how to read a LikeFolio Outlier Grid? Here’s an explainer.)

However, you can also see that Home Depot’s demand has dropped off much less (-17%) compared to Lowe’s (-24%) on a YoY basis. Plus, the contractor-favored HD boasts higher levels of Consumer Happiness.

Any decline in demand poses a serious headwind for these companies looking ahead. But considering Home Depot’s revenue is more balanced with professional clients AND it’s seeing less of a decline, even in the DIY audience, we’re giving HD the advantage here.

🏡 DIY Advantage: Home Depot

But Can Home Depot Defend Its Pro Advantage?

As DIY home renovations mentions stall, Home Depot’s robust professional customer base should help insulate the company more than Lowe’s, right?

Yes – if Home Depot can defend its market share.

Lowe’s made strides in capturing more of the professional sales market: The company noted Pro U.S. growth of 10% YoY, enhanced professional product assortment, and a professional-confirmed backlog booked out the same or more compared to 2022.

“One example of enhancing our Pro product assortment is the exciting news that Klein Tools will be coming back to Lowe’s. We know that our Pros are fiercely loyal to certain national brands and Klein is the number one hand tool brand among electrical and HVAC professionals. This creates immediate credibility across trades,” said Marvin Ellison, President and CEO.

But Home Depot’s management noted that Pro sales growth outpaced DIY in its fourth quarter as well, touting a backlog that remained elevated from historical averages.

We’ll acknowledge that Lowe’s is gaining traction here but Home Depot still claims the lead.

💼 Professional Advantage: Still Home Depot

Looking Ahead: HD vs. LOW

While both Home Depot and Lowe’s appear vulnerable to weakening consumer demand for home improvement projects, HD is holding onto it its advantage.

Consumer Happiness levels suggest Home Depot is strengthening its value proposition to consumers.

And considering HD shares have underperformed LOW over the last three months – trading 6% lower versus LOW shares trading 2% higher – long-term investors may view this as an ideal entry point.

Landon and I will meet you right here for our earnings season kickoff event tonight at 8:00 p.m.

See you soon,

Andy Swan

Co-Founder