We’re officially in the Dog Days of Summer, folks – that sweltering 40-day span between July 3 and August 11 when the summer heat is at its peak… and when Sirius, the “Dog Star,” shines the brightest in the night sky. (Hence the name.)

This also happens to be a time when many of us get that itch to upgrade our digs: whether it’s prepping the backyard pool deck for the next summer party… giving the fence a fresh coat of paint… or calling the AC tech when you start sticking to your couch.

Long days make summer an ideal season for DIY home improvement projects and 2023 is no different.

A Home Improvement Research Institute survey found that as of May, 31% of homeowners planned to kick off a project within the next month, which was the highest reporting percentage of the year.

At the same time, we’ve seen home improvement stores Lowe’s (LOW) and Home Depot (HD) log significant gains in their stock prices. Since June 1, LOW shares are up 12% while HD shares are up 7%.

But just as the season is heating up for home reno stocks, LikeFolio data reveals a worrying consumer trend forming.

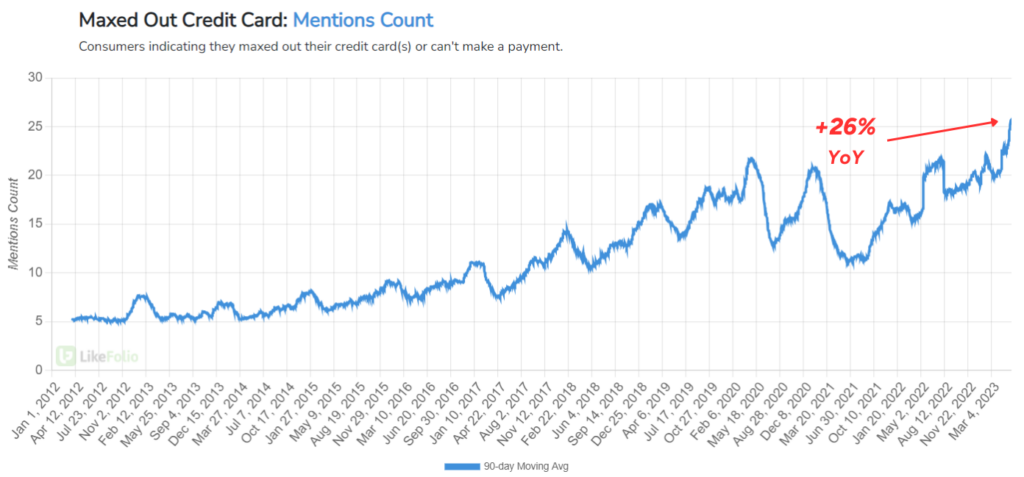

Buzz around maxed-out credit cards has skyrocketed over the past year, hitting record highs.

In fact, Americans have collectively piled up close to $1 trillion in credit card debt.

And that’s not all…

- Rising interest rates

- Persistent inflation

- Student loan payments resuming

- A cooling housing market

An economic storm is brewing that could hit home improvement retailers like LOW and HD where it hurts.

It’s a precarious position to be in right now, especially for a stock like this one that was already at risk of sinking…

A Perfect Storm

We already know the American economy is wrestling with high inflation and interest rates.

Now, add in the looming resumption of student loan payments taking hundreds of dollars out of pockets every month…

And we’re looking at a double-whammy for consumer spending.

There’s also that ticking time bomb of credit card debt I mentioned earlier: More than a third of U.S. adults carry around more credit card debt than emergency savings.

What’s more: The housing market, which was a beacon during the pandemic, is cooling. Experts are predicting a significant drop in home prices by the second or third quarter of 2023 in what could be the largest housing correction in the post-World War II era.

Needless to say, a cooling housing market paired with the financial strain of all that credit card debt could lead to a decrease in home improvement projects.

And while Home Depot is by no means “safe” from these risks, consumer data for Lowe’s looks particularly troubling under the surface.

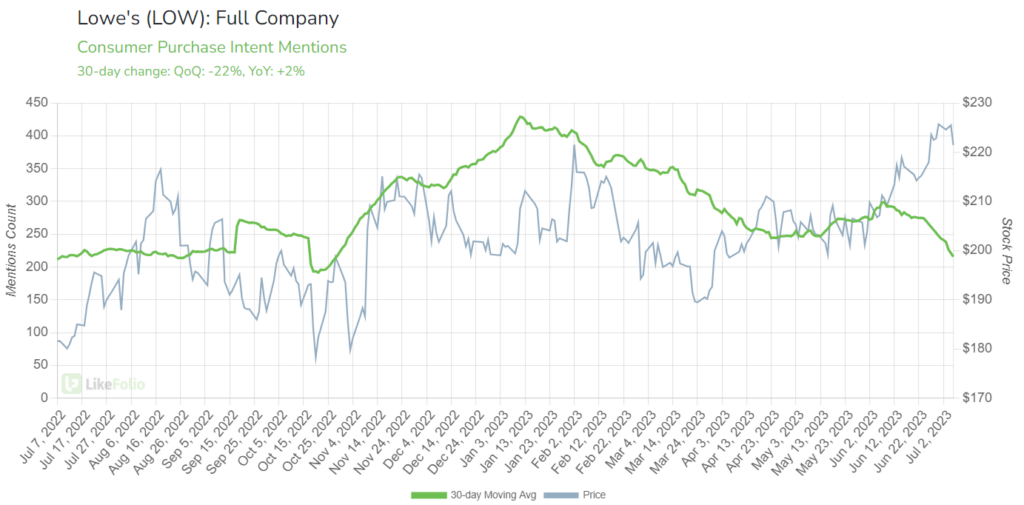

Looking at Purchase Intent mentions, Lowe’s demand has dropped by 22% quarter-over-quarter.

And with its stock price rising just as quickly, we’re seeing a divergence form that points clearly bearish.

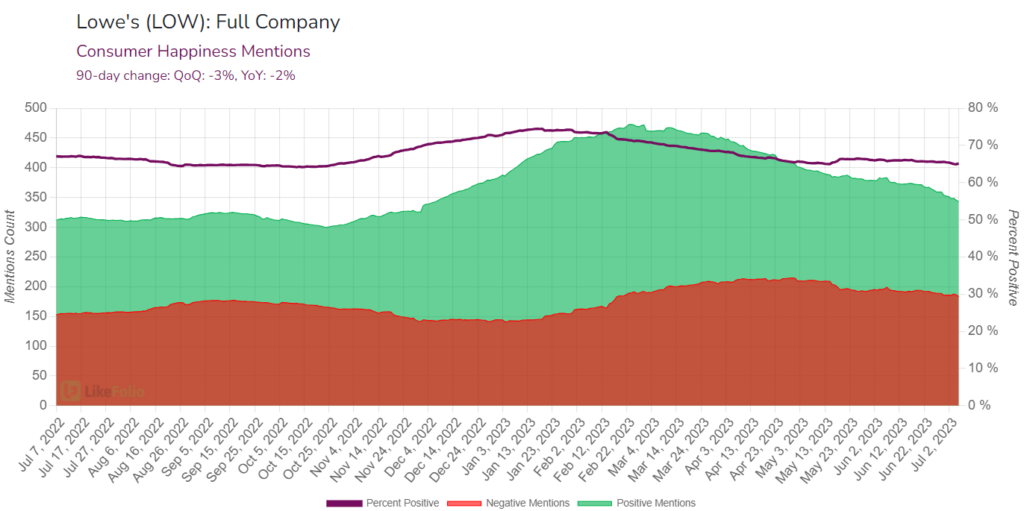

Positive sentiment around the Lowe’s brand has been falling in the background too, losing three points on a quarter-over-quarter basis to put Lowe’s Consumer Happiness at just 64%.

The guys over at TD Ameritrade brought me on for a live segment to share the latest data on Lowe’s, and you can check out that video clip below:

Bottom line: With weakening consumer data, the convergence of rising interest rates, a cooling housing market, and financially strained consumers could pose significant challenges for Lowe’s and its stock.

But while ending the pause on student loan payments could hurt retailers like Lowe’s, it spells opportunity for others – like this stock that’s ready for liftoff.

Until next time,

Andy Swan

Founder, LikeFolio