Earnings season is our favorite time of year at LikeFolio.

It’s like a 40-day profit party for investors as publicly-traded companies report quarterly revenue numbers, shareholders react, and stock prices swing wildly – sometimes with moves up to 30x larger than you’d see on a typical trading day.

Our consumer insights data gives us a significant edge when it comes to predicting which stocks are set to move big on earnings and how far prices will swing…

And that’s especially true when it comes to lesser-known, small-cap names benefitting from macro consumer trend tailwinds that our social media machine picks up on before Wall Street catches wind.

Online consignment shop ThredUp (TDUP) is a perfect example of how we used that advantage to win big this season.

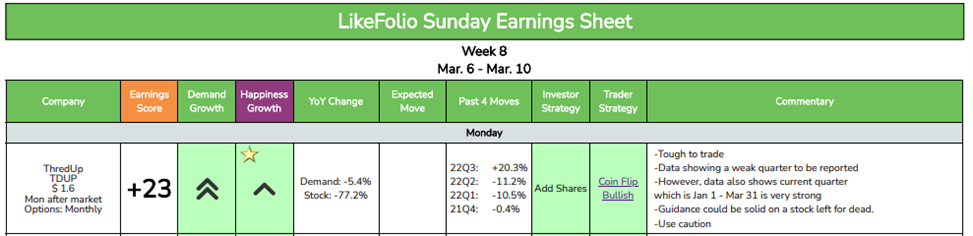

We gave our Earnings Season Pass members a heads up before ThredUp’s March 6 earnings announcement that although the quarterly data being reported on (Q4 2022) looked weak, our consumer data for the current quarter (Q1 2023) was very strong:

We noted that forward-looking guidance could be solid and recommended a bullish play on TDUP heading into the report.

ThredUp shares opened that day (March 6) at $1.59. Earnings were released after the market close, showing an expected 2% decline in quarterly revenue year-over-year (YoY), full-year revenue growth of 15%, and a forward-looking statement from CEO and co-founder James Reinhart:

“By investing in growth and rigorously managing expenses, we believe we’re well positioned to capture an apparel market recovery as the consumer continues to seek value in 2023.”

Right in line with our expectations.

And the very next day (March 7), TDUP shares soared to $2.89 for an 81% gain.

I’m not telling you this to toot my own horn.

I’m telling you this because even if you missed that earnings play, we still expect a lot of money to be made here.

Because just as our consumer insights data predicted – and ThredUp’s CEO confirmed in his statement – consumers are becoming strategic about spending, especially on apparel.

That’s a trend that could keep ThredUp’s share price riding higher all year long and help you make even more money when the next earnings season kicks off in a few short weeks…

Consumers Are Trading Down with ThredUp

One of the biggest investing themes we’re tracking in 2023 is the “trade-down effect:” Faced with pesky inflation, growing job cuts, rising debt levels, and eroding savings, consumers across the board are having to “trade down” to more affordable menu items or brands.

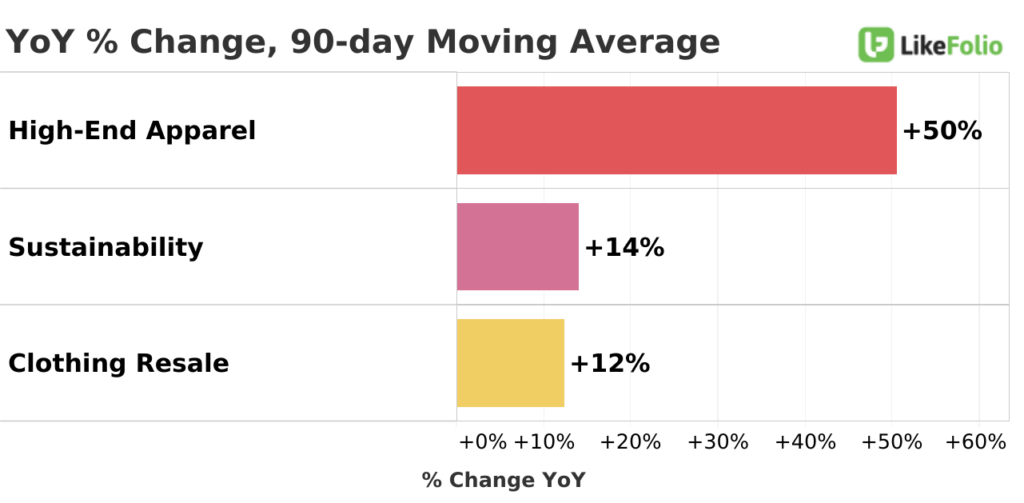

Our data also shows that even with tightening wallets, folks are still craving high-end apparel:

And ThredUp is in a perfect position to ride this wave as an online thrift shop where price-conscious consumers can find designer brands for cheap while stocking their closets in a sustainable way.

Thrifting might not sound glamorous but it’s a lasting trend that could keep ThredUp around for the long haul.

The EPA estimates 11.3 million tons of clothing items were chucked into landfills in 2018 alone. And as the popularity of fast-fashion retailers has increased (looking at you, Shein), so has awareness around the detrimental environmental impacts of the fashion industry:

“With new fashion trends emerging almost every month, more than 100 billion items of clothing are produced each year with no sustainable method of disposal,” reports climate researcher Marcus Ruggiero.

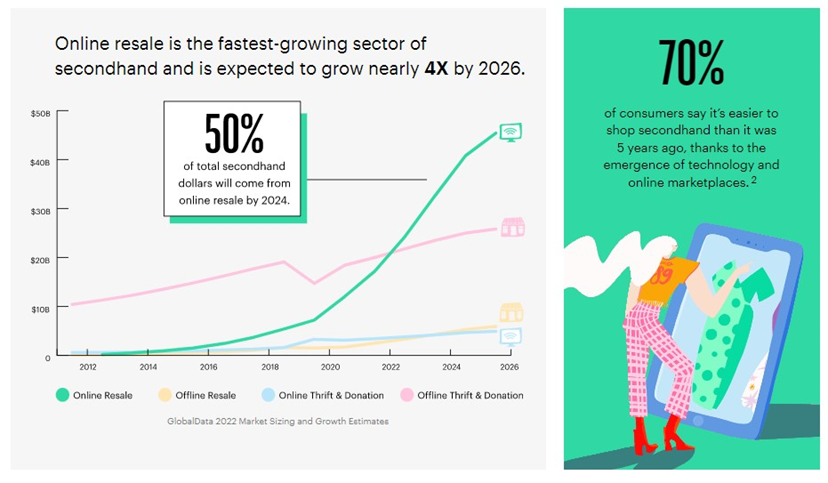

Sustainable-minded consumers have turned to thrifting as a solution to this problem and created a lucrative business in the process.

According to ThredUp’s 2022 Fashion Resale Market and Trend Report, the U.S. secondhand market is expected to more than double by 2026. And online resale marketplaces are driving that growth, on track to grow 4x as much during that timeframe:

Buying clothes second-hand to give garments a longer lifecycle is great. But sending clothes you no longer wear to a store like ThredUp in exchange for cash or store credit? Even better.

Consumers have realized that and they’re loving what ThredUp offers.

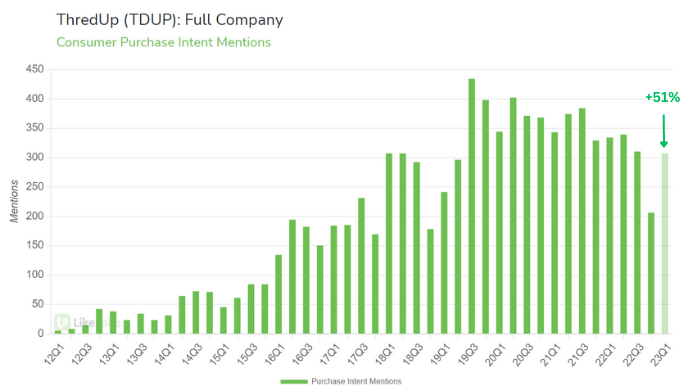

Demand is ticking way higher in 2023. Consumer mentions of purchasing items from ThredUp are currently on pace to finish the first quarter of the year 51% higher versus the first quarter of 2022:

And that positive outlook we were talking about earlier? You can see it playing out in real-time in the chart above, in the shaded 23Q1 bar on the far right.

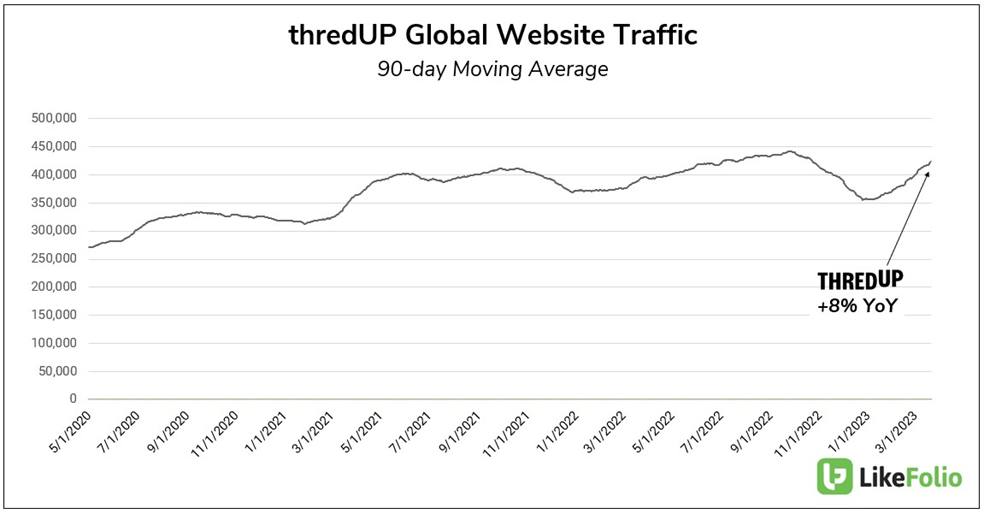

LikeFolio Global Website Traffic data further highlights the increased use of ThredUp’s online fashion resale site, marking an 8% improvement since last year:

In fact, ThredUp is doing so well that fast-fashion retailers want in on the profits: H&M launched its own resale site in collaboration with ThredUp just last week.

The secondhand retail space is growing exponentially as consumers make the conscious choice to trade down on apparel, and TDUP is an early winner that continues to gain steam.

Stay Tuned for the Next Round of Earnings Season Profits

The first earnings season of 2023 is coming to a close but in true LikeFolio style, we’ve already got our sights set on the next round starting in April.

And this one will be huge. It’s when companies will announce their first quarterly earnings numbers of 2023 and set the tone for the rest of the year.

Trading down, sustainability, and fashion are all trends that could have a big impact on this first round of 2023 earnings.

Stay tuned for more coverage to come as we prepare for the coming season because next week, we’ll show you how you can get in on the next 40 days of earnings season profits.

Until next time,

Andy Swan

Co-Founder

Must-Read: Cruise Demand Is Back in Full Force Just in Time for Spring (3 Stocks to Know About)

Carnival (CCL) becomes the latest cruise line to report 2022 earnings on Monday. Before then, catch up on how its competitors are performing now that spring is here and demand is booming. Click here for our complete cruise coverage.