🚨 Celsius Hits New All-Time High 🚨

Update from the Desk of Andy Swan – June 8, 2023

There’s nothing quite like that warm and fuzzy feeling I get when one of the stock picks we bring you here in Derby City Daily soars to a new high.

I’m talking about energy drink maker Celsius (CELH), whose stock flew to $147.90 on June 5.

This most recent jump came on the heels of a Piper Sandler analyst upping the price target on CELH from $130 to $165.

It was a vote of confidence, to be sure – but one that only came after the company impressed with record first-quarter earnings. Revenue came in 95% above last year’s numbers while earnings per share (EPS) got a 344% boost.

But if you followed our lead when we first filled you in on this high-energy “Trifecta” play in the February 28 Derby City Daily issue, you would’ve been sitting on a 62% gain as shares hit an all-time high this week.

Don’t worry if you missed out, though. We’re as bullish on CELH as we’ve ever been.

And if you keep following our lead, you’ll find there are plenty more winners where Celsius came from.

Here’s how we spotted Celsius early on, and how we’ll keep spotting under-the-radar investment opportunities well before Wall Street catches wind…

This story was initially published on May 20, 2023, and updated with the note above on June 8, 2023.

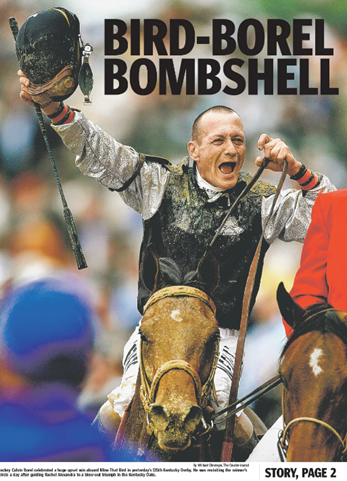

When Mage triumphed in the 149th running of the Kentucky Derby earlier this month, the three-year-old thoroughbred overcame 15-1 odds to do so.

15-1 odds.

A longshot.

That win – along with my family’s lifelong involvement in horse racing – has me thinking about longshots here of late.

A lot.

In the world of horse racing, one name that doesn’t quite have the same recognition as Seabiscuit or Secretariat, but stands as a testament to unexpected success, is Mine That Bird.

That gelding’s journey to victory in the 2009 Kentucky Derby stands as a valuable lesson in horse racing – and the factors that can predict “longshot” champions.

Mine That Bird was a longshot in every sense of the word.

Bred in Canada, he lacked the pedigree of many of his competitors. His sire was Birdstone, who had won the Belmont Stakes, but his dam was a relatively unknown mare.

Standing only 15.2 hands high, Mine That Bird was noticeably undersized compared to the typical thoroughbred. He was seen as a 50-1 Derby longshot. A rank outsider.

But there were signs of his upside – hints at what was to come.

For instance:

- He demonstrated significant speed and endurance – even if he hadn’t maintained that performance level.

- He was paired with an experienced jockey, Calvin Borel, who’d notched the Kentucky Derby win in 2007.

That brings me back to the 2009 Derby.

Race morning was ugly: The track was a rain-abused, sloppy mess.

And here’s where Mine That Bird’s real attributes began to shine through… where perceived negatives became positives.

His “smallness” meant he was more agile than the bigger horses he was racing against – especially on the sloppy track that day. Borel expertly guided his horse through the pack.

And then – in one of the most thrilling finishes in Derby history – Mine That Bird made a power move on the rail and pulled away to win by 6¾ lengths.

With the largest margin in more than 60 years, the horse so many “experts” had dismissed out of hand was now a Derby champion.

In hindsight, the signs were there.

As surprising as it seems, those “signs” can also be used to identify off-the-radar investment winners – like the energy drink maker we identified three years ago whose stock just hit an all-time high.

And that’s what I want to show you here today…

Finding the Next Longshot Winner

Past performance as a juvenile, an experienced jockey, and a resilience that lent itself well to the adverse track conditions on race day…

Mine That Bird’s story reminds us that in horse racing, it’s not always the obvious choice – or the biggest horse – that comes out on top.

This same is true of investing and trading.

When it comes to stocks, some of the biggest wins come from the smallest players – the lesser-known, off-the-radar names – that that are just starting to show signs of explosive growth.

Companies that seem to “come out of the pack” to win.

Longshots.

Among these “signs,” there are three that are key – our “Trifecta Box” secret sauce for unlocking “10-bagger” profit opportunities.

We’re talking about:

✔️ Strong Consumer Demand

✔️ High Consumer Happiness

✔️ Macro Trend Tailwinds

It’s a powerful system – and it works.

Among the companies we follow, healthy energy drink maker Celsius (CELH), a brand that’s rocketing in popularity among fitness nuts, checks off those boxes.

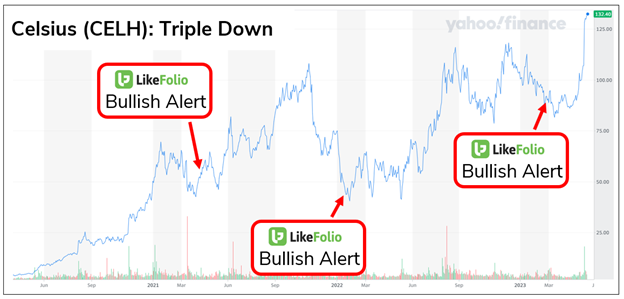

In fact, it’s checked our “winner” box at least three times in the last three years.

And Celsius has yet to disappoint…

Check out the gains logged since each recommendation to our Opportunity Alerts subscribers:

| ALERT | SEND DATE | GAINS AS OF MAY 17 |

|---|---|---|

| CELH Bullish Alert 1 | April 14, 2021 | +133% 📈 |

| CELH Bullish Alert 2 | January 24, 2022 | +201% 📈 |

| CELH Bullish Alert 3 | February 27, 2023 | +45% 📈 |

We also put out a special report on Celsius right here in Derby City Daily on February 28. And those of you who acted on that would be up 41%.

The common theme of each bullish signal?

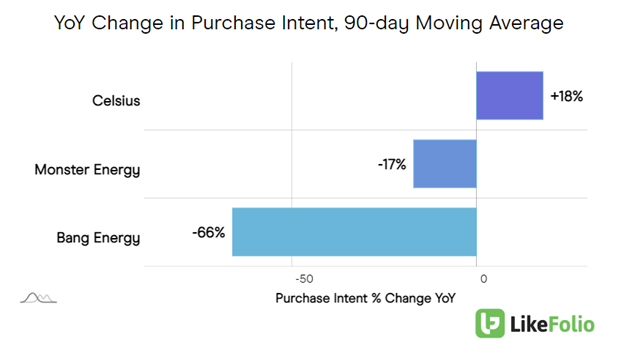

Celsius was outracing its peers in Consumer Happiness and Purchase Intent, hitting the mark on all three pieces of our “Trifecta” strategy with:

✔️ Surging demand for its beverages…

✔️ An army of hyper-enthusiastic consumers who are “casting votes” for its offerings…

✔️ And a wave of post-pandemic demand for “better-for-you” food and drink options propelling this company into a long-term winner.

When CELH shares hit an all-time high last week, we weren’t surprised.

This “thoroughbred” stock just keeps winning…

This “Thoroughbred” Stock’s Still Got It

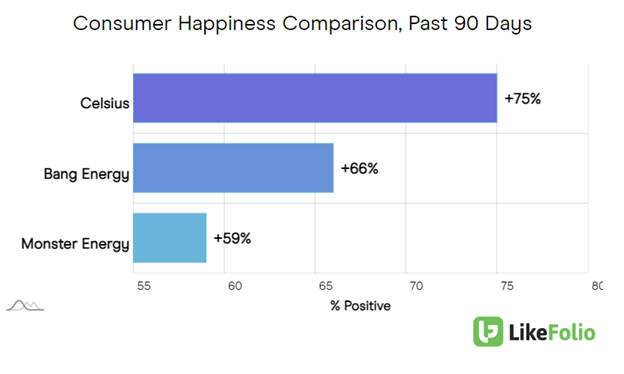

Compared with other, bigger peers like Monster Beverage (MNST), Celsius has the strongest level of consumer demand growth.

Purchase Intent mentions are pacing 18% higher year-over-year as of this writing.

Its beverages are healthier than its rival’s energy drinks, which tend to be sugary calorie adders.

And with a savvy distribution deal with PepsiCo putting its drinks in store coolers across the country, Celsius demand – and revenues – are soaring.

The company announced 95% year-over-year revenue growth for the first quarter of 2023; it also reported record net income for the quarter that topped what it made for the entire year of 2022.

Oh, and Celsius is doing all that while also maintaining the highest levels of Consumer Happiness (currently hovering around 75%).

When you couple this super-positive consumer data with a continuation of the macro trend – a focus on “good-for-you” food and drinks – you’ve checked all three of the boxes.

(LikeFolio data shows mentions from consumers avoiding sugar, or changing behavior to consume less, are trending 14% higher year-over-year in just one example).

Add in strong distribution partnerships (like PepsiCo), and you’re talking about a “bet” you can feel comfortable making in the immediate term.

We’ll continue to provide updates as data progresses and share other long-shot winners with members along the way.

In case you missed it the first time around, you can check out our initial Derby City Daily report on Celsius right here.

Until next time,

Andy Swan

Co-Founder