In the cruise industry, “Wave Season” is like a mash-up of Black Friday and the Apple Keynote for cruise liners, when prices are the lowest and consumers are most likely to hit that book button.

It runs from January through March each year and offers an extremely forward-looking snapshot of future consumer demand.

And if you caught my “cheat sheet” to winning earnings season earlier this week, you already know cruises are one of the bullish consumer trends we’ll be trading over the next 10 weeks – when stocks will make some of their biggest moves all year.

So, naturally, this is when we really dial in at LikeFolio to see where the biggest opportunities lie.

The formula is simple: Macro Trend + Company-Specific Demand = Investor Edge

- Macro Trend: Consumers tip their hands, indicating future cruise plans.

- Company-Specific Demand: We map these mentions up to the publicly-traded cruise parent to see which cruise lines are outperforming or underperforming.

- End Result: Investors get a consumer-driven edge.

Let’s break it down, just in time for the earnings season profit party kickoff event on Tuesday…

(Speaking of, have you RSVP’d yet?)

Macro Trend: Cruise Demand Continues to Swell

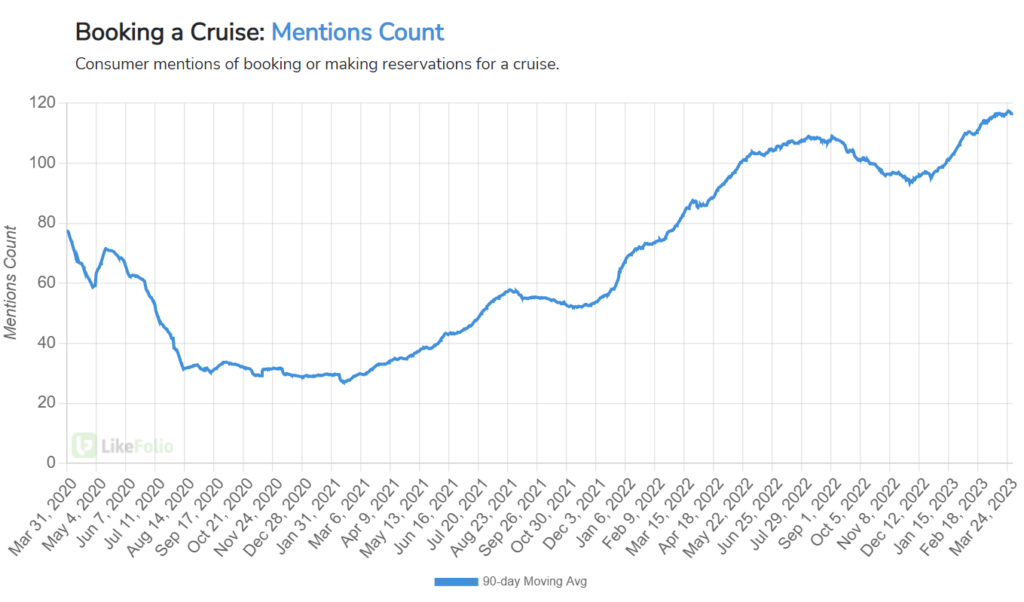

Consumer mentions of booking a cruise surged during Wave Season:

Social media buzz around cruises is still trending more than 30% higher than last year, even surpassing pre-COVID levels to signal a true cruise revival.

Cruise demand is hot heading out of peak booking season, and that’s a bullish sign for companies operating in this space that could last for several months to come.

Company-Specific Demand: One Cruise Line Is Outperforming Peers

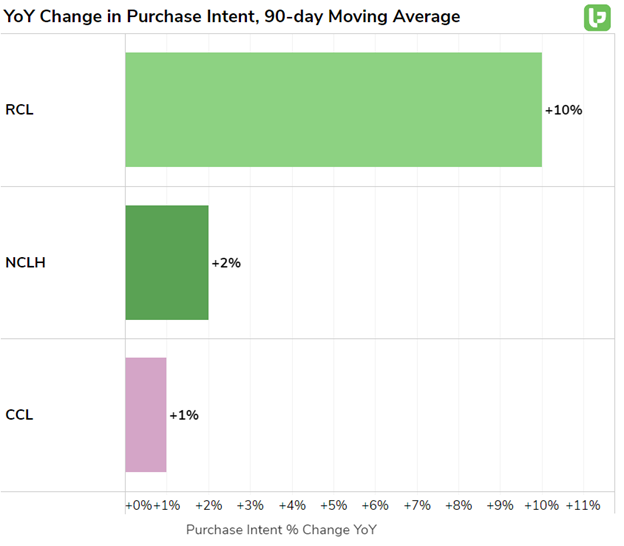

It’s evident when we look at company-specific demand that the rising macro trend toward cruises is lifting all boats in the space. All three major cruise lines are getting a demand boost but one is sailing further and faster than the rest:

Since we last covered the cruise industry, Royal Caribbean (RCL) has maintained its significant lead over competitors Norwegian Cruise Lines (NCLH) and Carnival (CCL).

If you ask consumers, they’d tell you Royal Caribbean’s destinations and on-ship experiences are far superior…

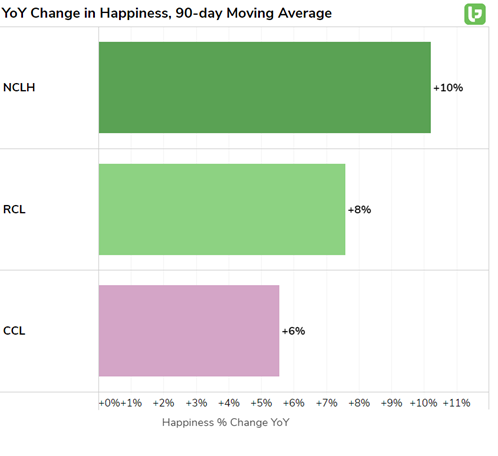

From a Consumer Happiness perspective – our most useful indicator when it comes to a company’s long-term success – every cruise line boasts a Consumer Happiness level of 80% positive or more (wow).

And not just that but all have recorded significant improvements in the past year as consumers return to the sea:

The combination of rising demand and increasingly happy customers is a positive long-term indicator for the industry at large, and why we’ll be watching this sector like a hawk for big-money trades during this earnings season.

Here’s how the opportunities shake out for investors…

End Result: Your Consumer-Driven Investing Edge

Let’s start with what Wall Street already knows, based on prior earnings reports:

- RCL: Royal Caribbean is doing a great job wrangling costs, posting narrower-than-expected losses alongside a strong booking outlook.

- CCL: Carnival posted a strong report earlier this week featuring improving ticket prices and growth in onboard revenue. But overall, booking recovery trailed that of RCL at five points below 2019’s pre-COVID levels.

- NCLH: Norwegian Cruise Line is struggling the most to rein in costs and combat debt weighing down its business, though expects improvements in the second quarter.

That’s all well and good.

But our real edge is in what Wall Street doesn’t know – the real-time consumer insights our database picks up on Main Street well before they hit the market, which tell us:

- Cruise demand is not waning: Consumers are continuing to prioritize experiences when deciding how to spend their money, and we expect this to serve as a tailwind for the next quarter.

- RCL leads the pack in booking recovery: Thanks to its superior experience and high-value, higher-cost ticketing model, we expect continued near-term outperformance on the consumer front.

- CCL looks to be priced about right: The company has room for improvement on the booking front but demand shows signs of continued recovery. The stock’s near-term price improvement is in line with consumer metrics.

- NCLH may be overlooked because of its execution: The cruise line touts the highest price point compared to competitors, and NCLH shares are seriously trailing peers on a six-month basis. But with affluent consumers possessing the most spending power in this inflationary economy… We believe that if management can implement cost-saving measures, NCLH could present the most significant opportunity for long-term investors on the back of strong demand and an even stronger consumer base.

Now, with just a day left before we go live with our earnings season broadcast, I want to personally make sure YOU are able to make it: Access your invitation here.

We’re expecting a heck of a turnout for this thing on Tuesday… I mean, who wouldn’t want to learn how to trade the most profitable 40 days of the year – when stock prices can make moves up to 30x greater than you’d see on a typical trading day? You’d be crazy to miss it.

Sign up here so we can kick off the April to June earnings season with a bang.

Until next time,

Andy Swan

Co-Founder