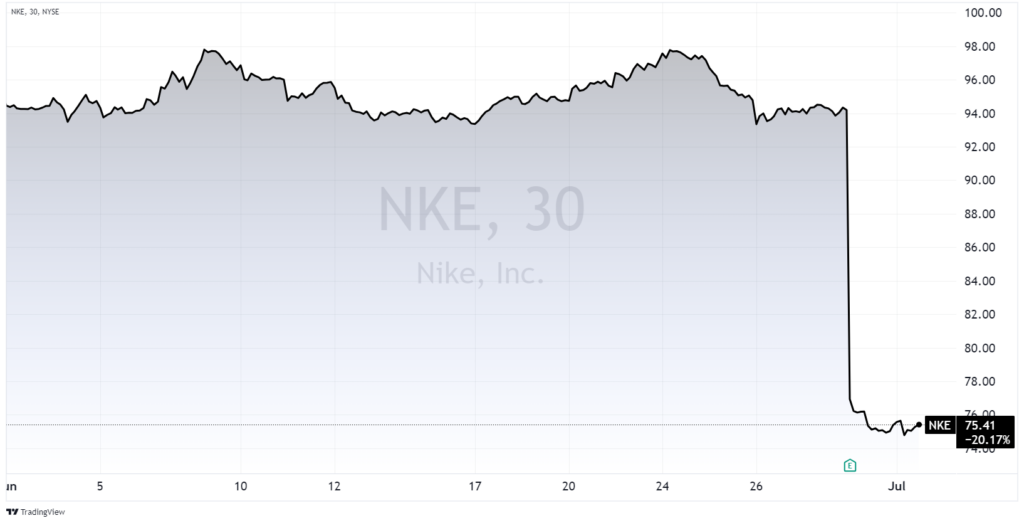

Nike’s (NKE) stock had its worst day on record Friday, plummeting nearly 20% on a troubling earnings report.

For the quarter ended May 31, 2024, revenue was down 2% year over year to $12.6 billion, direct-to-consumer sales dropped 8% to $5.1 billion, and execs warned of more losses to come.

During a dour earnings call, CEO John Donahoe called 2025 a “transition year,” forecasting a 10% revenue decline in the first fiscal quarter, along with a mid-single-digit revenue drop for 2025.

With its stock price in the dumps, I’m seeing a lot of “buy the dip” cries from folks eager to pounce on a leading name at low levels.

Before you do that, let me show you what’s going on with Nike. Because this LikeFolio data is enlightening, to say the least…

From “Just Do It” to Just… Don’t

Nike is showing signs of losing its cool, especially among its youth audience…

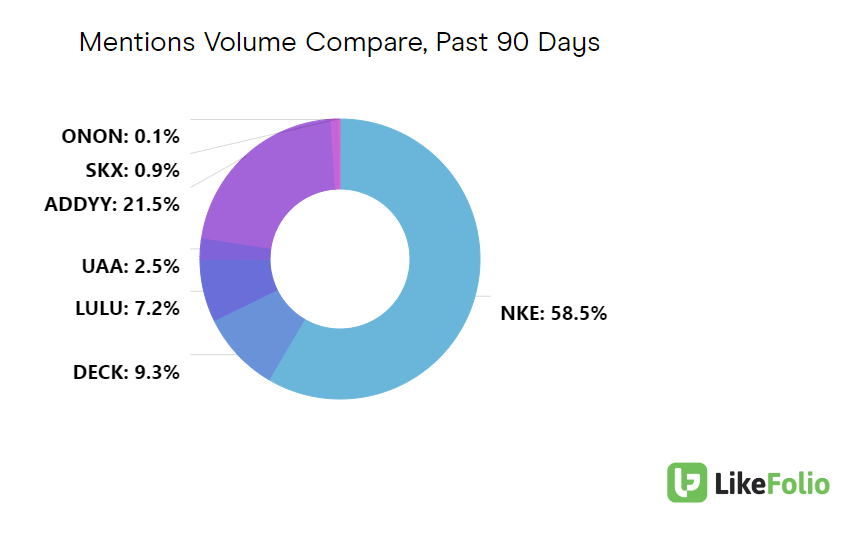

We can see this in the change in what we like to call consumer mindshare – or mention volume. While Nike is still the dominant force among apparel and footwear peers, its share of the “buzz” in this market has decreased by 14 points over the last two years, from 72% of mention buzz to 58% of mention buzz.

The latest Piper Sandler survey, which measures teen and Gen Z buying habits and brand loyalties, confirms LikeFolio’s findings.

Spring 2024 survey results show that Nike’s share in footwear decreased 190 basis points year over year and 230 basis points from the previous survey, while the up-and-comers On Holding (ONON) and Deckers Outdoor’s (DECK) Hoka gained popularity among higher-income teens.

In apparel, tastes are also shifting away from the traditional favorites like Nike and toward rising brands like Alo Yoga and Vuori. These athleisurewear brands have surged in popularity with the help of social media influencers and celebs such as Kendall Jenner.

Losing Ground in a “Competitive Battlefield”

Nike itself recognizes its precarious position, referring to the running market as a “competitive battlefield” on its last earnings call.

Performance runners are increasingly turning to names like Hoka and On when searching for their next pair of running shoes.

Mentions show many consumers calling out Nike for poor designs that cut into their skin and cheap glue that causes the sole to separate from the shoe within six months.

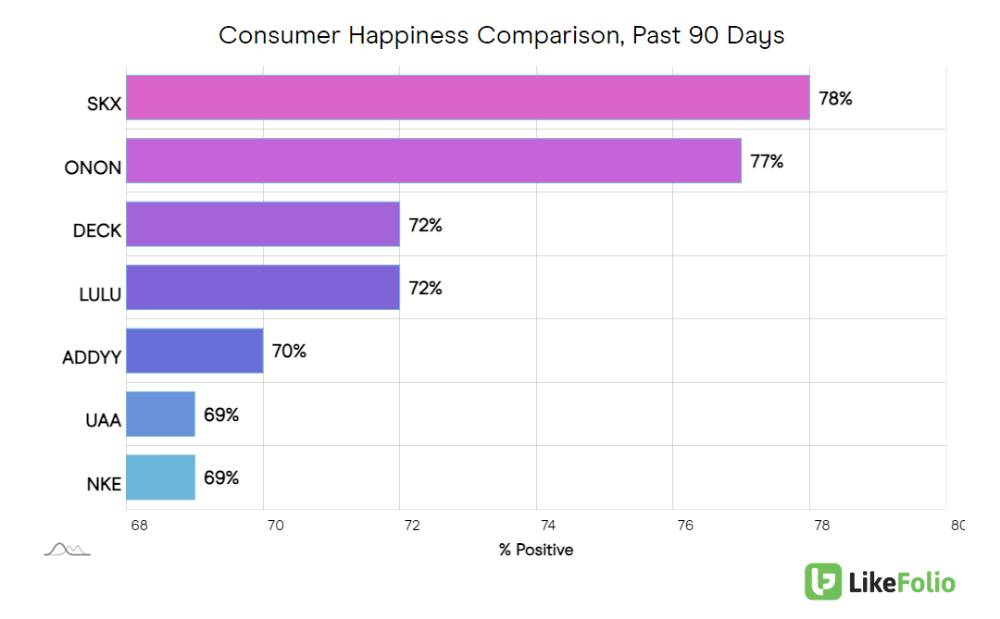

This commentary is also reflected in overall Consumer Happiness levels, where Nike now sits at the bottom of the pack:

It’s more than just a quality issue.

Nike is also suffering from being on the losing end of an increasingly faster trend cycle where smaller companies are proving more nimble and agile.

Bottom line: Nike is a MASSIVE company that has stagnated when it comes to innovation, quality, and understanding its core consumer base. A return to high standards and innovative designs would serve the company well. Don’t expect much until then.

Watch These Sneaker Stocks Instead

In the meantime, we see a handful of other strong growth candidates pulling ahead in key LikeFolio metrics.

DECK’s Hoka brand is recording a 44% year-over-year increase in web visits. We featured the company back in April as a rising “ugly shoe powerhouse,” and the stock has gained more than 10% in the months since – read that story here.

Skechers (SKX) boasts the strongest sentiment levels of the bunch (noted above), along with a growing direct-to-consumer (DTC) base. We alerted our LikeFolio Investor subscribers to SKX in November when our Data Engine detected buzz surging to two-year highs. That trade has delivered members a 40% win so far.

And our ONON trade? To date, LikeFolio Investor subscribers are up more than 83%. Nice work, folks.

Trading trends is our specialty – and if you’d like to unlock these kinds of profits with real-time alerts, there’s only one way to do it…

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Must-Watch Stock: This Firm Hunts Hackers with AI

$12.5 billion was lost to cybercrime in 2023 – but this $20 stock has the AI-powered solution…

Rivian Just Evolved into a True Tesla Competitor

Here’s how a $5 billion Volkswagen alliance will supercharge the EV competition…