These days, you can’t talk about the stock market’s best performers without mentioning Meta Platforms (META). Its 138% gain in the first half of the year was second only to Nvidia’s (NVDA) dominant performance, which returned 190%.

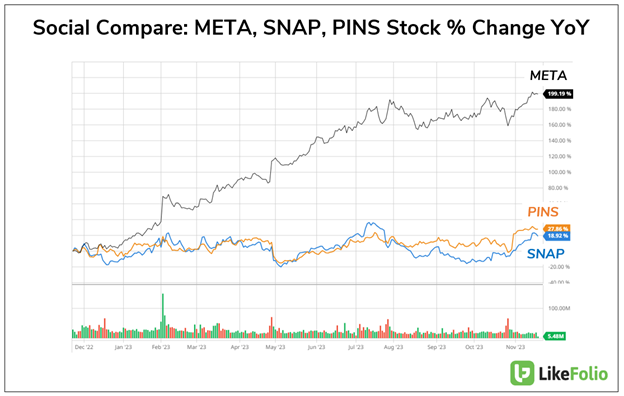

Year over year, Meta shares have soared nearly 200%, vastly outperforming publicly traded peers like Snap (SNAP) and Pinterest (PINS):

As META’s stock price climbed to impressive heights this year, MegaTrends subscribers watched as their gains rocketed higher… and higher… and higher.

And our September 2022 buy recommendation on META? The MegaTrends folks who followed it cashed out for an incredible 114% return last week. (Congratulations if you were one of them.)

But while Wall Street is still enamored with the Facebook parent company, we’re having second thoughts.

Its future growth plans are steeped in a buzzword that’s lost its shine with consumers: the metaverse.

And despite the stock’s run higher, the reality is – Meta’s metaverse bet has yet to pay off…

Meta’s Promising Potential

Meta has undergone a massive restructuring over the past few years as it realigns from social media player to global tech leader. Its high-level game plan and strategy encompasses several potentially high-growth opportunities, as you’ll see below.

- Development of Smart Glasses

Meta has developed smart glasses integrating AI, which can be paired with applications like Spotify (SPOT) or Instagram, potentially impacting markets like smart appliances and the metaverse.

- Investment in Virtual Reality (VR) and Augmented Reality (AR)

Meta’s investment in VR and AR, particularly through its Oculus portfolio, positions it strongly in these fields, with VR currently being a small but potentially significant part of its business.

- Potential Market Growth

The immersive reality market, encompassing VR and AR, is expected to grow to $1.2 trillion by 2035, indicating a significant opportunity for Meta.

- Shift Beyond Advertising

While advertising remains Meta’s primary revenue source, its ventures into VR, AR, artificial intelligence (AI), and the IoT (Internet of Things) signal a strategic shift toward diversified technology offerings.

Here’s the problem.

Meta’s investments in virtual reality (VR) and augmented reality (AR) through its Reality Labs division have resulted in nearly $40 billion in total losses since 2020.

Consumers Aren’t Buying It

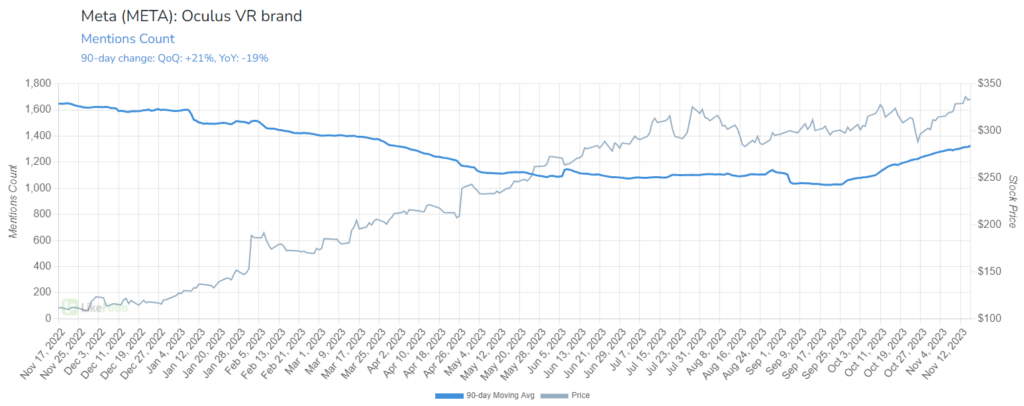

Meta launched its Quest 3 headset at the end of September (housed in the Oculus VR brand), and so far, it’s failed to generate any meaningful consumer buzz.

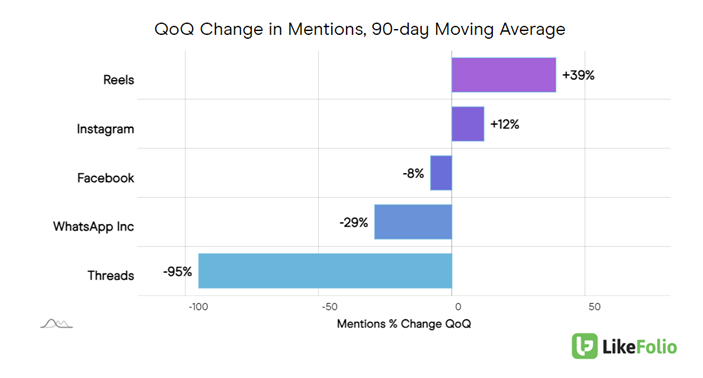

LikeFolio data also reveals tempering user data in several core platforms. See for yourself:

While Reels (+39%) and Instagram (+12%) are showing promise, its Facebook (-8%) and WhatsApp (-29%) platforms are losing some relevance.

And its attempt at launching an X (aka Twitter) alternative with Threads? It was a total flop.

Consumer mentions have tanked by 95% on a quarter-over-quarter basis.

Meta is going all in on the metaverse, but so far, it’s not moving the needle in the consumer psyche.

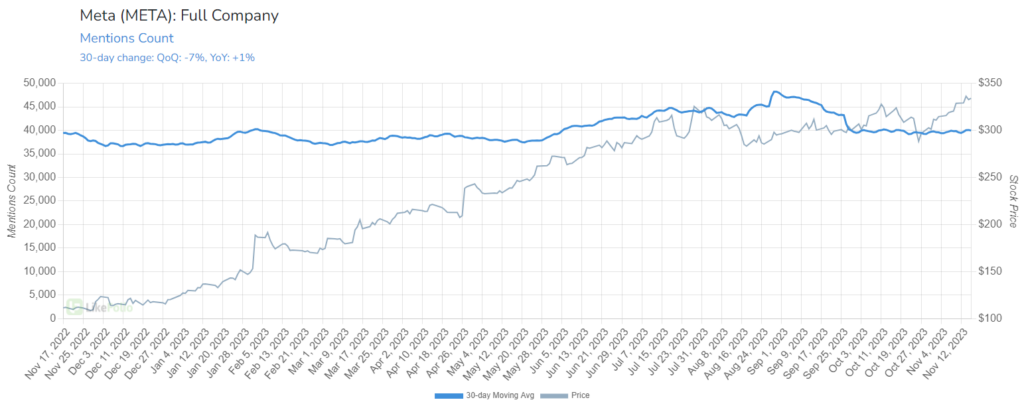

In addition, near-term stagnation in its family of platforms could be troublesome ahead of the holiday season. Meta mentions overall are registering flat:

Meta’s one saving grace could be the recovery in advertising we noted earlier this week.

In October, it proudly reported 23% year-over-year revenue growth for the third quarter, bolstered by ad revenue.

We’ll be keeping a close eye on social usage rates to better understand advertising efficacy and will be closely tracking product purchases – like its Quest headset – over the next few months.

If things don’t improve, META may shift into overbought territory.

So we’re taking our gains on mega-cap tech stocks like META and moving onto the smaller-cap plays with truly explosive growth potential… like this undercover AI gem that at just $3 makes a fantastic “moonshot” bet.

Until next time,

Andy Swan

Founder, LikeFolio

Now Available: 3 Stocks to Build Your Wealth in 2024

In this just-dropped report, we’re revealing the top picks on our radar for the new year…