[TIME-SENSITIVE] Earnings Season Kick-Off This Sunday 🎉

Well folks, it’s our favorite time of year. Over the next 10 weeks, stock prices will make some of the biggest moves we’ve seen all year as hundreds of publicly traded companies report their Q4 and full-year earnings. We’ll, of course, be trading it all with our AI-powered earnings predictor. Go here now so we can show you how it works before the profit party kicks off in earnest.

A warning from Walmart (WMT) put Wall Street on notice: According to CEO John Furner, Walmart customers are purchasing “less units, slightly less calories,” due to the soaring popularity of weight-loss drugs like Ozempic.

Reports that “Ozempic is making people buy less food” quickly took over the headlines.

Wall Street took it as a sure-fire sign that demand for junk food was on the outs and that snacking giants like PepsiCo (PEP) would be the next to see sales take a hit.

Pepsi owns the classic munchies you find in vending machines, kids’ lunch boxes, and gas stations – the kind that satisfy those late-night cravings.

Doritos, Cheetos, Tostitos, Fritos… you get the picture. If it’s got “eetos” in the name, Pepsi probably owns it.

Food accounts for a sizable 40% chunk of Pepsi’s revenue.

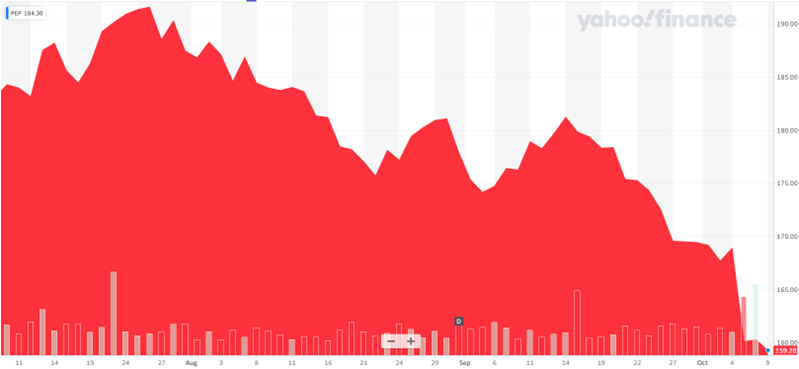

So the fallout from this single report was swift: Pepsi shares dropped nearly 6% in 24 hours.

But here at LikeFolio, we’ve never been ones to follow the crowd. Because we don’t have to.

We have our own edge: a powerful database that gives us a real-time read on what Main Street consumers actually want. Not what Wall Street wants you to believe.

And as fear swept the stock market, we put that LikeFolio edge to work to get the real story.

Turns out, Wall Street had this one all wrong.

Here’s what’s going on, and why at LikeFolio we think a bullish opportunity (or two) may be brewing…

Investor Fear Weighs on Snacking Stocks: The Real Story

Pepsi wasn’t the only stock caught in the crossfire.

The undisputed King of Fast Food, McDonald’s (MCD), along with other entities in the snacking and restaurant sectors, are facing pressure over these reports that weight-loss drugs could potentially decrease the demand for their products.

This, despite otherwise positive – and much more real – indicators to the contrary, like McDonald’s dividend increase, encouraging comments from analysts on Pepsi shares, and an earnings beat this week.

So here are the cold, hard facts.

Yes, consumer demand for weight loss drugs like Ozempic is off the charts – and not slowing down anytime soon. (You can get the full story on that here.)

But it’s not taking a toll on demand for our junk-food giants.

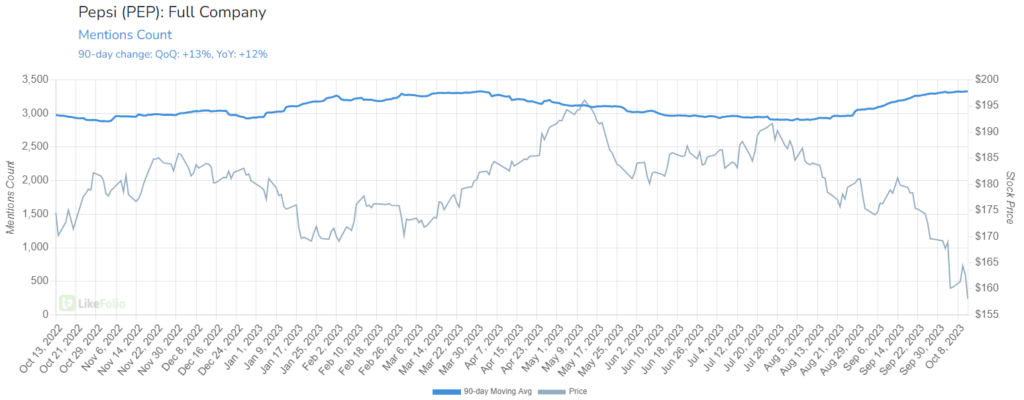

Consumer mentions of Pepsi products have increased by 12% year over year, and consumer sentiment has jumped by four points in the same time frame.

The discrepancy in Pepsi buzz and its stock price is crystal clear in the chart above.

But a deeper dive into Pepsi’s brands reveals another interesting takeaway.

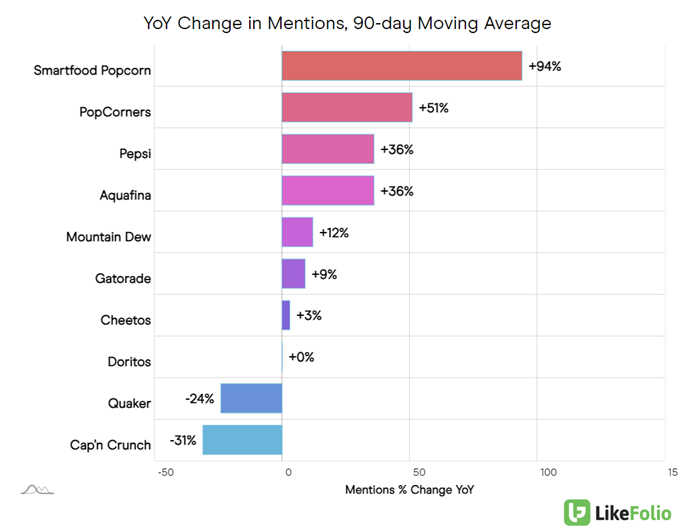

Pepsi isn’t tied to just its “eetos” brands.

It has other healthy alternatives that consumers can grab to snack on instead – like PopCorners, Smartfood Popcorn, and even Aquafina, all of which are experiencing growth in consumer interest.

McDonald’s is hanging in there, too.

Earlier this week, we even showed you why McDonald’s could prove to be the best long-term growth play in fast food right now, as consumers trade down and sentiment rises.

This isn’t not-so-good-for-you-food’s first rodeo.

McDonald’s and PepsiCo have weathered various diet trends and health movements. In the 1970s and 1980s, the low-fat craze prompted many to shun fast foods and sugary sodas, leading these companies to introduce healthier options and diet sodas.

The Atkins and low-carb movements of the early 2000s saw a shift away from bread and high-carb foods, yet both companies adapted by diversifying their product lines.

More recently, the rise of organic, non-GMO, and clean-eating trends have posed challenges, but McDonald’s and PepsiCo have demonstrated resilience by innovating and aligning with changing consumer preferences.

They’ve ensured their enduring presence in the global market.

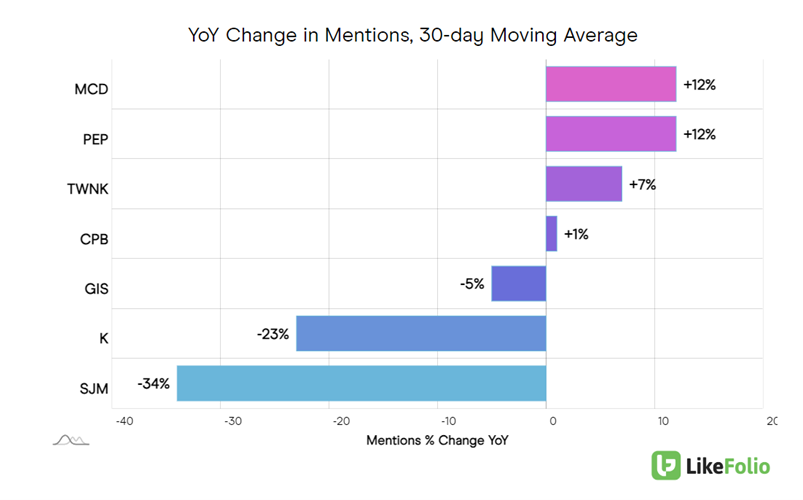

In fact, our insights suggest Pepsi and McDonald’s have been more responsive to changes in consumer behavior than peers like The J.M. Smucker Company (SJM), Kellogg’s (K), and General Mills (GIS).

You can see this playing out in the chart below, where MCD and PEP are seeing growth on Main Street while the others decline:

Long-term investors may take a second look at both of these consumer favorites – with shares trading down, negative news may already be baked in.

In 48 hours – on Sunday at 7:00 PM – the first Earnings Season Pass report of the season will hit member inboxes. And with plays on Netflix (NFLX), Tesla (TSLA), United Airlines (UAL), and more on deck, you won’t want to miss this.

The clock is ticking: Make sure you’re on the list by clicking here.

Until next time,

Andy Swan

Founder, LikeFolio