Americans reached a bleak milestone in 2023, racking up more than $1 trillion in credit card debt for the first time.

A 2024 survey by Clever Real Estate put this into perspective, finding that three in five Americans are in credit card debt, holding an average balance of $5,875.

Yet consumers are more confident today than they have been in two years, according to January’s Consumer Confidence Index.

And their penchant for luxury products – and memorable experiences – remains unfazed.

This is all great news for one of our favorite long-term plays.

As the optimistic spending continues, our outlook on American Express (AXP) just gets better and better…

Record Earnings and Overperforming LikeFolio Metrics

We picked up on this credit card giant’s “best-of-breed” status last April, noting its success in winning over consumers by catering to high-value, high-quality experiences.

And no doubt, 2023 was a great year for American Express. Last week, the company reported record full-year revenue of $60.5 billion for 2023, a 14% jump. Increased card member spending, higher net interest from income, and rising annual fees all contributed to the windfall.

Amex distinguishes itself with its closed-loop payment system, a contrast to the models of Visa and Mastercard, which rely on banking partners for credit risk and extension. By acting as both the credit card issuer and payment network, American Express not only assumes default risk, but also retains most transaction revenue.

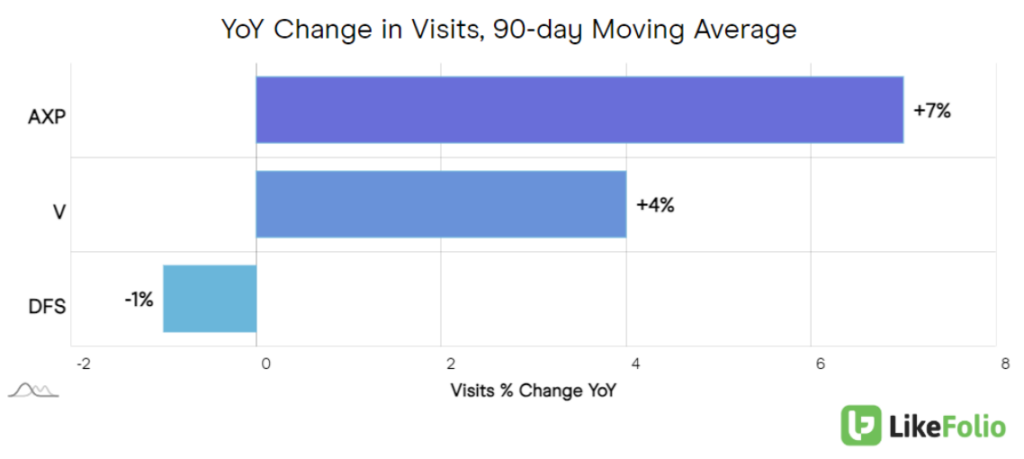

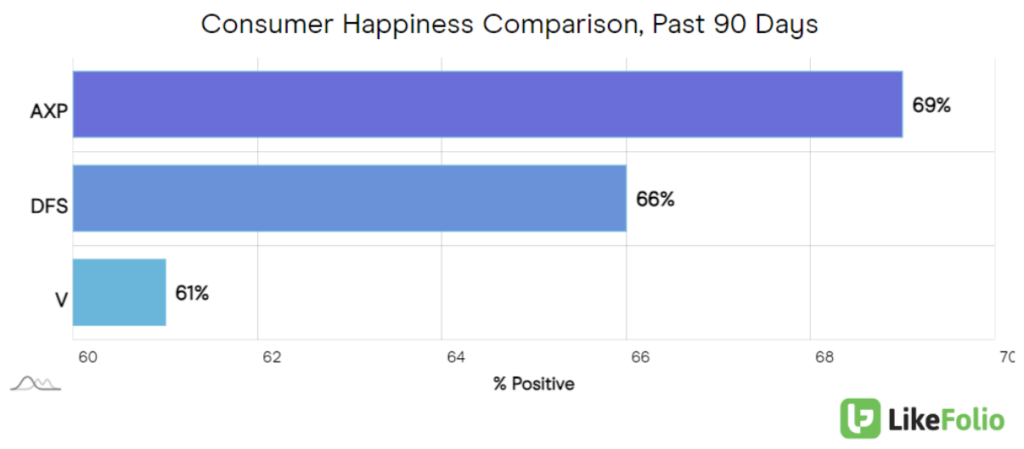

And LikeFolio data points to a clear overperformance compared to its peers. Notably, there’s been a 7% year-over-year increase in web visits…

While the company maintains an impressive 69% Consumer Happiness level, well ahead of peers like Discover Financial Services (DFS) and Visa (V).

Why Customers “Don’t Leave Home Without It”

Amex has consistently attracted a consumer base that values status, perks, and superior service.

It’s sought after by older consumers and younger cohorts alike, who are looking not only for a status-symbol card, but also one that provides the travel perks and experiences the wanderlust-afflicted younger generations crave.

The millennial and Gen Z crowd has been Amex’s fastest-growing cohort over the last year, accounting for an incredible 60% of American Express’s new customers in Q3.

While American Express is notorious for its high annual fees (up to $700 for platinum-level cards), the return on that investment proves valuable for many loyal customers, providing travel rewards that include everything from priority boarding and lounge access to free hotel stays. And simply signing up for Amex cards that offer perks like that can net some nice rewards, like travel miles and membership rewards points, which can be used for future purchases.

Its stock performance reflects this strength, with shares trading nearly 40% higher over the past three months, significantly outpacing competitors like Visa, which saw a 14% increase in the same period.

AXP for the Win

Looking ahead, LikeFolio remains bullish on Amex for the long haul. The company’s high Consumer Happiness levels among consumers indicate promising long-term growth prospects. And its robust growth among younger customers, with Millennials and Gen Z constituting its fastest-growing cohorts, will continue to boost the brand.

At LikeFolio, we’re tracking consumer favorites like AXP in real time to keep you ahead of the market.

But with LikeFolio Investor, we take that to the next level with real-time trade alerts – one of which delivered an 81% profit just this week.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Winners and Losers in the Future of Banking

With our real-time read on social media, we can show you the early winners – and losers – of the digital banking era…

Stanley’s Fall from Grace – and the Opportunity It Creates

A cult-brand meltdown is underway. This story is a testament to how consumers can make or break a brand…