Click here to jump straight to today’s video. ⬇️

During the last three months of 2008, in the midst of the worst financial crisis since the Great Depression, Americans purchased over 4.3 million iPhones and 2.5 million Macs to set a single-quarter revenue record for Apple (AAPL).

The unemployment rate was skyrocketing at the time, already at 7.2% by that December.

Yet amid the economic uncertainty, Apple stood out by offering high-quality products and superior user experiences with the iPhone and other devices.

Apple’s focus on design, innovation, and creating an ecosystem of products and services enabled it to gain and maintain a strong market position.

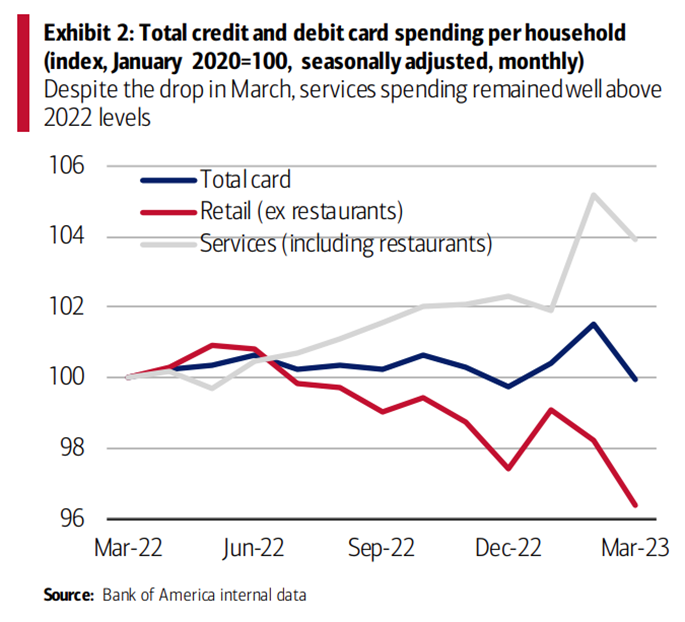

Some 14 years later, consumers are worried about rising interest rates brought on by persistent inflation and budgets are tightening once again.

Only this time, we’re in a post-COVID world where experiences are prioritized above all else when it comes to spending money:

And just like Apple in 2008, the companies focused on providing high value and high quality are the ones thriving in today’s challenging economic environment.

One company taking a page out of Apple’s book is American Express (AXP).

The company made a point of attracting younger generations in 2022, with millennials and Gen Z customers accounting for over 60% of card acquisitions that year.

Now, in 2023, it’s doing a fantastic job enabling high-value experiences that are winning over consumers.

LikeFolio data shows the credit card provider has separated itself from the pack in a key growth metric that sets it up for long-term market share capture.

Let me show you why that spells opportunity for investors like you – and what you can expect from the company ahead of its earnings report this week…

American Express: A Rising Status Symbol

During a time when Americans are looking for value, American Express is impressing consumers with an array of perks that cater to their desire for high-quality experiences.

Perks vary by membership level but typically range from cash back on everyday purchases like groceries to discounted hotel reservations, rental cars, plane tickets, and anything else the wanderlust-filled traveler may need.

Why book a room straight through the hotel’s website at full price with no ability to cancel when you could book the same room through AmEx’s travel portal at a lower price, use any points you’ve already accumulated to knock off a couple hundred bucks, and get cancellation protection from American Express?

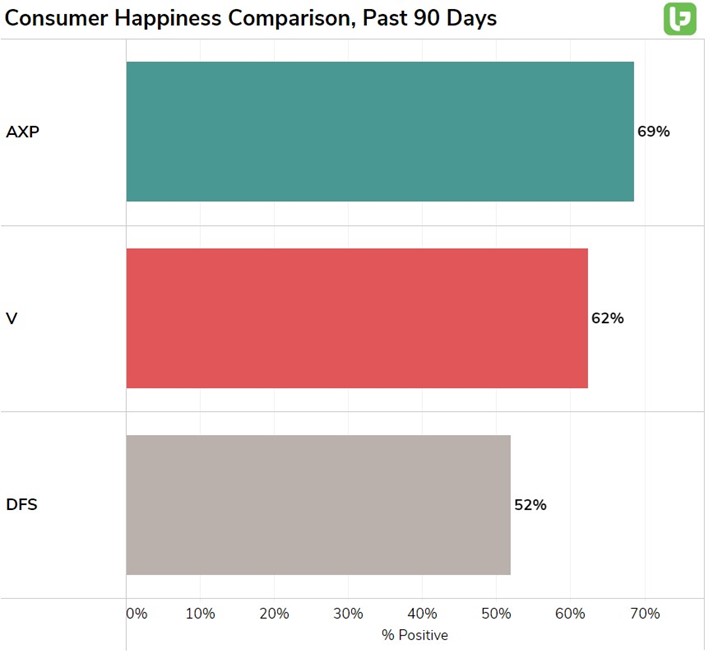

It’s an easy choice – and credit card peers like Visa (V) and Discover (DFS) simply can’t keep up when it comes to Consumer Happiness.

With positive sentiment at 69%, AmEx is already way ahead. But it’s not just about the score – it’s about how that score has grown.

Significant improvements in Consumer Happiness levels and outperformance versus peers are leading indicators of future success. And AmEx’s Consumer Happiness levels have risen by six points on a year-over-year basis.

Once Happiness levels start ticking up, demand tends to follow. And LikeFolio Purchase Intent (PI) Mentions for AmEx are currently trending 5% higher on a quarterly basis.

AmEx is looking like a great long-term opportunity.

But what about in the near term? What can investors expect from AXP as it heads into its first earnings report of 2023 on Thursday?

I’ll break it down for you right now…

Get my earnings outlook on AXP before it reports numbers to Wall Street this Thursday in this just-released video segment.

Watch here:

Until next time,

Andy Swan

Co-Founder

Up Next: This Week’s Earnings Headliners: NFLX, UAL, and TSLA (What to Know)

With first-quarter earnings reports rolling in for Netflix (NFLX), United Air (UAL), and Tesla (TSLA) this week, we’ll fill you in on what Wall Street is watching – and what Main Street is saying about these Week 1 headliners. Complete coverage here.