Pop Quiz: What is the number-one economic concern weighing on consumers’ minds right now?

Imagine you could poll 325 million consumers at once to find out the number-one thing weighing on their minds – and wallets.

Now, imagine you could do that all day, every day, to have a direct line on the consumer consciousness – to know at any given time what macroeconomic trends they’re concerned about, which brands they love (or hate), how and where they’re spending their money, and better yet, how it all impacts the publicly-traded companies you’re invested in.

That’s basically how our consumer insights database works.

Thanks to LikeFolio’s “preferred partner” status with Twitter, we have direct, real-time access to the firehose of social media data that gets created every minute of every day…

Our powerful machine analyzes thousands of posts per minute, sifts through every mention of every brand/product owned by a publicly traded company, and identifies the trends and shifts in the marketplace creating big opportunities for investors – long before the Wall Street pros see and position trades of their own.

It’s how we know the number-one trend weighing on consumers’ minds ahead of tomorrow’s critical inflation announcement, when the Federal Reserve will release the latest Consumer Price Index (CPI) report and inevitably send stock prices on a rollercoaster ride.

Whether that rollercoaster ride will induce glee or stomach-churning dread, we won’t know until tomorrow (April 12) around 8:30 a.m.

But thanks to our unique edge, we can tell you today what the consensus on Main Street is – and how it’s serving as a tailwind for the investable opportunity I’m about to show you…

Pop Quiz Answer: What is the number-one economic concern weighing on consumers’ minds right now?

A. Inflation

B. Rising interest rates ✔️

C. Food prices

D. Depleting savings accounts

E. Cost of healthcare

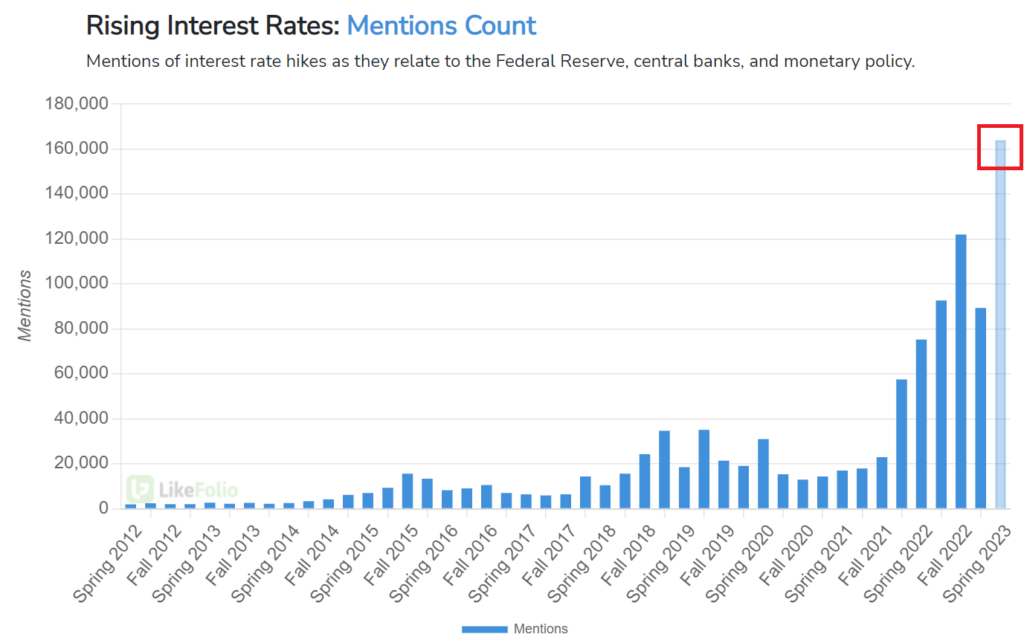

Of the nearly 1,000 consumer trends tracked by our database, rising interest rates are the number-one, top-of-mind concern – currently logging the single highest behavior “score” at +82.

💡 Did you know it’s possible to apply LikeFolio’s proprietary earnings signal calculations to consumer macro trends, too? By taking into account all of our consumer sentiment data, along with macro trends, this simple -100 to +100 score helps us understand how mentions are shifting so we can spot major shifts in momentum and know which topics matter most to the average Joe.

You can see for yourself the swell in consumer buzz registering for Spring 2023 as consumers feel the ripple effects of persistent Fed rate increases brought on by pesky inflation:

The Fed has been terrorizing investors and consumers alike with its interest rate hike campaign ever since inflation hit its 40-year high in June (at 9.1%).

The Fed aims to squeeze demand by making it more expensive to borrow money — which ultimately brings prices down for everyone.

Inflation has cooled down to 6% since then, and the consensus on Wall Street is that tomorrow’s number for March will come in at 5.2%.

Still, the Fed has made it perfectly clear it intends to continue its campaign, even amid the recent banking sector collapses that were a direct result of said rate hikes.

The target range for the federal funds rate is now at its highest level since 2007.

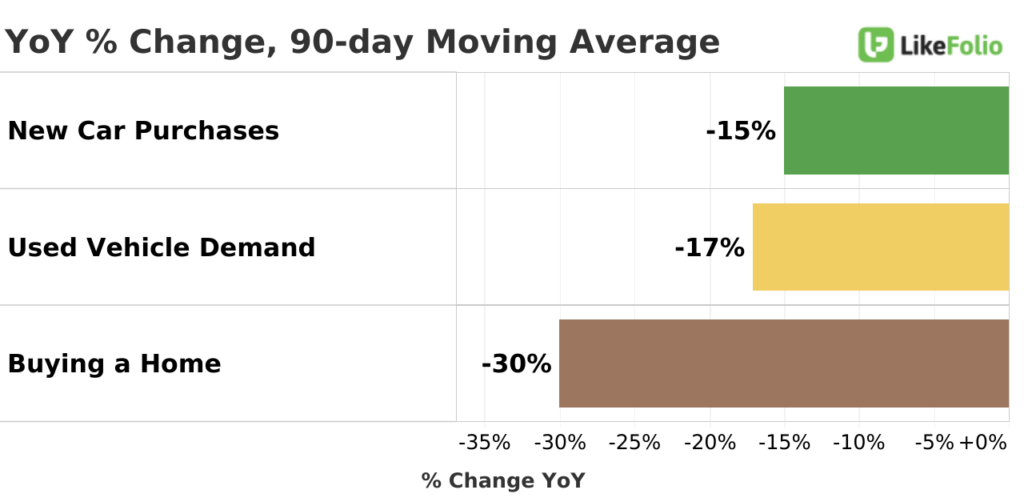

And you can see the effects in real-time in LikeFolio’s consumer data, with consumers talking about buying a new home or vehicle falling off in a big way:

We’ll be monitoring consumer demand for companies operating in each of these segments for potential investment opportunities to the upside and downside – especially during earnings season, which revs up next week.

In the meantime, there’s one investable opportunity that deserves your attention…

Investable Opportunity: Keep an Eye on Tesla (TSLA)

Sure, consumer chatter around buying a new car might be slipping…

But Tesla (TSLA) is bucking those macro trend pressures and sparking fresh consumer demand for its electric vehicles (EVs) through strategic price cuts.

Just last week, the company announced its fifth round of price reductions so far in 2023, slashing the Model 3 sedan by $1,000, Model Y by $2,000, and Models S and X by $5,000.

That brings the base price for the Model 3 down by 11% and the Model Y down by 20% this year alone.

With each price cut, consumer buzz around Tesla has ticked higher – currently pacing 7% above last year’s levels.

While some on Wall Street are concerned the discounts may hamper near-term profit margins, they also present an opportunity for TSLA to gain further market share in the EV and luxury vehicle space.

And so far, the affordability campaign seems to be working.

Consumer mentions of purchasing an EV are trending 80% higher year-over-year. TSLA shares are currently up 57% year-to-date (YTD).

And with Tesla expected to report its first-quarter earnings next week (April 19), you know we’re already lining up our earnings season trades as we speak.

If you’re serious about making money this earnings season – and every earnings season after that – you need to watch this right now.

Landon and I show you how to trade ahead of the earnings reports of Tesla and hundreds of other companies during the next 40 days of earnings season.

But you have to act fast – because the broadcast is only available until midnight tonight.

Watch it here before this video goes offline for good.

Until next time,

Andy Swan

Co-Founder