Pinterest’s (PINS) journey from a humble digital mood board to a pandemic-era sensation has been nothing short of a rollercoaster ride.

Thriving as a haven for creativity and inspiration during lockdowns, it connected millions of isolated folks to a world of exciting ideas – just when they needed it most.

As Pinterest exploded in popularity, so did its stock price. LikeFolio Investor subscribers who followed our bullish recommendation at the time can tell you firsthand, as they’ve taken a 35% win on PINS along the way.

But as life resumed its usual pace, Pinterest faced a stark reality.

User interest faded away with our free time, and financial challenges followed…

And Pinterest shares plummeted from their 2021 highs above $80 to below $20 by 2022.

But with strategic investments in artificial intelligence (AI) and a new Amazon.com (AMZN) partnership this year, we see a new, transformative chapter unfolding for Pinterest.

We showed you why this misunderstood moneymaker could make a great long-term bet back in April.

Now, the stock is finally showing signs of life, gaining over 20% just since Monday following Pinterest’s “surprise” third-quarter earnings beat.

This long-term bet is paying off – and we believe these profits are only getting started.

Here’s what we’re seeing that has us so optimistic about Pinterest, now and in the future…

The Surprise Earnings Beat We Saw Coming

Before this week’s surge, PINS shares were down nearly 15% following the company’s last earnings report in August – which revealed expenses growing faster than revenue.

A key factor driving those expenses was Pinterest’s significant investment in AI, aimed at enhancing user experience and ad performance.

Fast forward to this week’s third-quarter earnings report, and Monday’s results reflected year-over-year growth across multiple key areas:

- Revenue was up 11% to $763.2 million

- Global monthly active users were up 8% to 482 million (a new record)

- And net income improved by 110%, coming in at $6.73 million – a drastic improvement from its $65.2 million loss the year prior.

It’s no wonder the tune around Pinterest has changed drastically on Wall Street in recent days.

But while the sudden turnaround caught many by surprise, we saw it coming, thanks to our real-time consumer insights.

Our Earnings Season Pass subscribers went into this week’s report knowing PINS could be in for a bullish surprise – and that call paid off big time for them.

Check out these metrics to see that momentum for yourself…

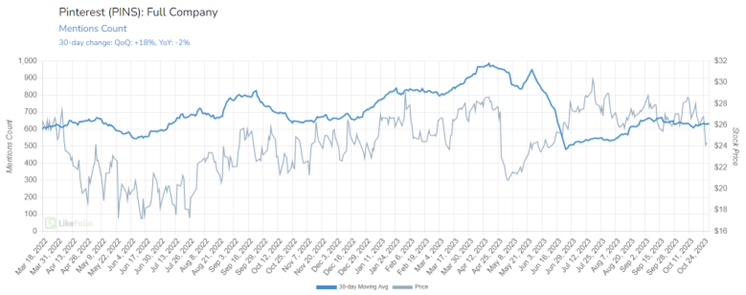

- Pinterest Buzz: +18% quarter-over-quarter

Even at 2% lower on a year-over-year basis, this shows a notable recovery from a 21% year-over-year drop last quarter.

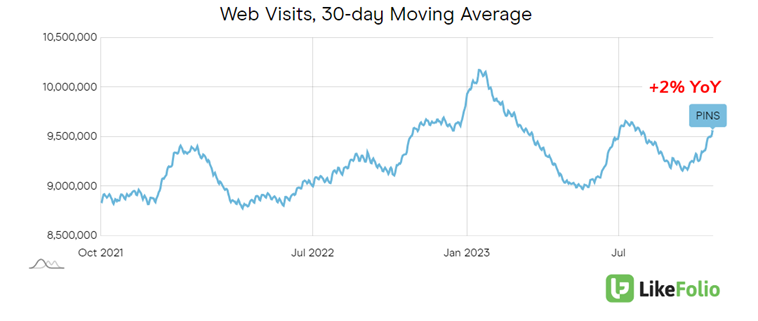

- U.S. Web Visits: +2% year-over-year (and +8% on a two-year stack)

Given the higher average revenue per user (ARPU) in the U.S. compared to global averages, this uptick was (and is) crucial.

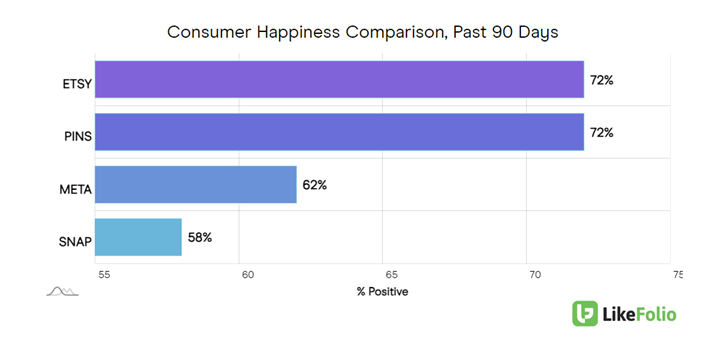

- User Happiness: +72% Positive

Pinterest’s high Consumer Happiness rating is comparable to platforms like Etsy (ETSY) and outperforms social media peers like Meta Platforms (META) and Snap Inc. (SNAP). This positive sentiment is crucial for attracting and retaining advertisers.

In a promising development for international interest, Google Trends data shows Pinterest’s global searches are climbing.

This wasn’t just a one-time bump for Pinterest, though. Remember – we started this as a long-term bet. And beyond these datapoints, there’s a larger bullish narrative worth following with Pinterest…

Reasons for Long-Term Optimism

- A CEO with a Vision

Let’s start at the top with Pinterest’s powerhouse CEO: Former Google executive Bill Ready.

Ready joined Pinterest as CEO in June 2022 and immediately got to work on increasing the amount of “shoppable” inventory, aka products that users can buy directly from the website.

With the help of artificial intelligence (AI), of course.

- AI Investments

Last year, Pinterest acquired AI-powered shopping platform THE YES, which lets users shop a personalized feed based on their input on brand, style, and size.

Now, anytime users interact with Pinterest, the app collects more and more data. And its recommendations – and the ads it pushes out – get smarter and smarter.

And the user experience? It just gets better and better.

Say you saved that olive-inspired necklace image you see below…

In Ready’s words: “Our AI recommendation engine builds off of the saved content from those boards to recommend additional pins that provide users with more points of inspiration, resulting in strong growth and saving on the platform.”

Pinterest’s strategic AI investments are paying off, with AI-powered search recommendation models now 100 times larger than before.

It’s not just about showing users “more of the same,” though. It’s about creating new inspiration – and monetizing it.

Pinterest is already a pro in this arena: A stunning 85% of weekly U.S. pinners have made a purchase from a pin they saw from a brand.

But a game-changing Amazon partnership will take Pinterest’s “shoppable” content to the next level.

- A Game-Changing Partnership

Pinterest is introducing third-party ads to its platform for the first time with Amazon – a move toward significantly boosting Pinterest’s ad inventory and potential revenue.

This collaboration, leveraging Amazon’s vast advertising segment, is expected to enhance Pinterest’s ad rates and relevance, while also improving profit margins by reducing sales and marketing expenses.

The success of this partnership could lead to further third-party ad collaborations, amplifying Pinterest’s long-term growth and profitability.

We’re excited to see how this one plays out.

Bottom line: LikeFolio metrics suggest Pinterest is on the path to recovery, enhancing user experience and re-engaging consumers. Looking ahead, Pinterest’s focus on leveraging AI to connect consumers with brands positions it as an attractive platform for advertisers, hinting at a bright future.

For another “undercover” AI play that could see a surprise earnings boost this week, check out this $2 stock – before it takes off.

Until next time,

Andy Swan

Founder, LikeFolio